Preparing for the CFA Exam requires a comprehensive understanding of “Alternative Investment Performance and Returns,” a critical aspect of portfolio management. Mastery of performance metrics, return drivers, and risk factors specific to alternative investments is essential. This knowledge provides insights into evaluating non-traditional assets, enhancing portfolio diversification, and achieving financial goals, crucial for a high CFA score.

Learning Objective

In studying “Alternative Investment Performance and Returns” for the CFA Exam, you should aim to understand the unique characteristics of performance measurement and return generation in alternative investments, including hedge funds, private equity, real estate, and commodities. Analyze performance metrics such as internal rate of return (IRR), net asset value (NAV), and hurdle rates, and evaluate their relevance in assessing alternative asset performance. Explore the primary drivers of returns, such as leverage, market timing, and asset-specific factors, along with associated risks like illiquidity and volatility. Apply this knowledge to evaluate alternative investments in a portfolio context, preparing for practical analysis on the CFA Exam.

Overview of Alternative Investments and Performance Measurement

Alternative investments encompass a wide array of assets that operate outside of traditional stock and bond markets, offering unique opportunities for diversification, return enhancement, and risk management in a portfolio. Here’s an overview of alternative investments along with insights into how their performance is typically measured:

Types of Alternative Investments:

- Real Estate: Investments might be in residential, commercial, or industrial properties, or through real estate investment trusts (REITs).

- Private Equity: Includes venture capital, buyouts, and direct investments in private companies.

- Hedge Funds: Utilize a variety of strategies to achieve returns, such as long-short equities, arbitrage, macro trends, and derivatives trading.

- Commodities: Direct investment in physical goods like oil, precious metals, and agricultural products.

- Collectibles: Art, antiques, rare wines, and other valuable physical assets.

- Infrastructure: Investment in large-scale public systems, facilities, and services.

- Cryptocurrencies and Digital Assets: Emerging assets like Bitcoin and Ethereum, including tokens and blockchain technology investments.

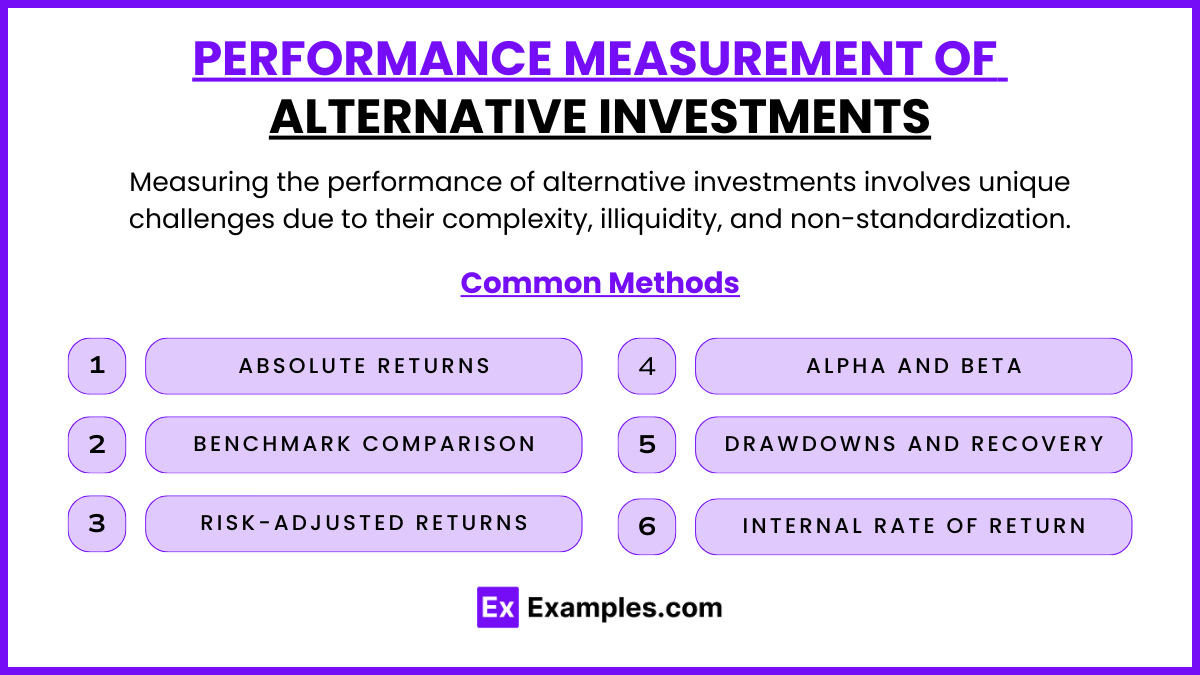

Performance Measurement of Alternative Investments

Measuring the performance of alternative investments involves unique challenges due to their complexity, illiquidity, and non-standardization. Here are common methods used:

- Absolute Returns: Evaluating performance based on the total return over a period, regardless of the market environment.

- Benchmark Comparison:

- Private Equity and Venture Capital: Often benchmarked against similar funds or market indices adjusted for risk.

- Real Estate: Compared to real estate indices such as the NCREIF Property Index.

- Hedge Funds: Benchmarked against strategies like the HFRX Global Hedge Fund Index or specific strategy benchmarks that reflect the fund’s investment style.

- Risk-Adjusted Returns:

- Sharpe Ratio: Measures excess return per unit of risk (volatility), giving investors a sense of the return earned per unit of risk taken.

- Sortino Ratio: Similar to the Sharpe ratio but only considers downside volatility, which is more relevant for strategies expecting positive returns.

- Alpha and Beta:

- Alpha: Measures the active return on an investment compared to a benchmark index, representing the value added by the manager’s investment decisions.

- Beta: Measures the volatility of an investment compared to the market as a whole, indicating the level of systematic risk.

- Drawdowns and Recovery:

- Measures the peak-to-trough decline during a specific period for an investment, providing insight into potential losses and the time needed to recover to peak levels.

- Internal Rate of Return (IRR):

- Commonly used for private equity, real estate, and other illiquid investments. IRR considers the time value of money and the cash flow profile of the investment.

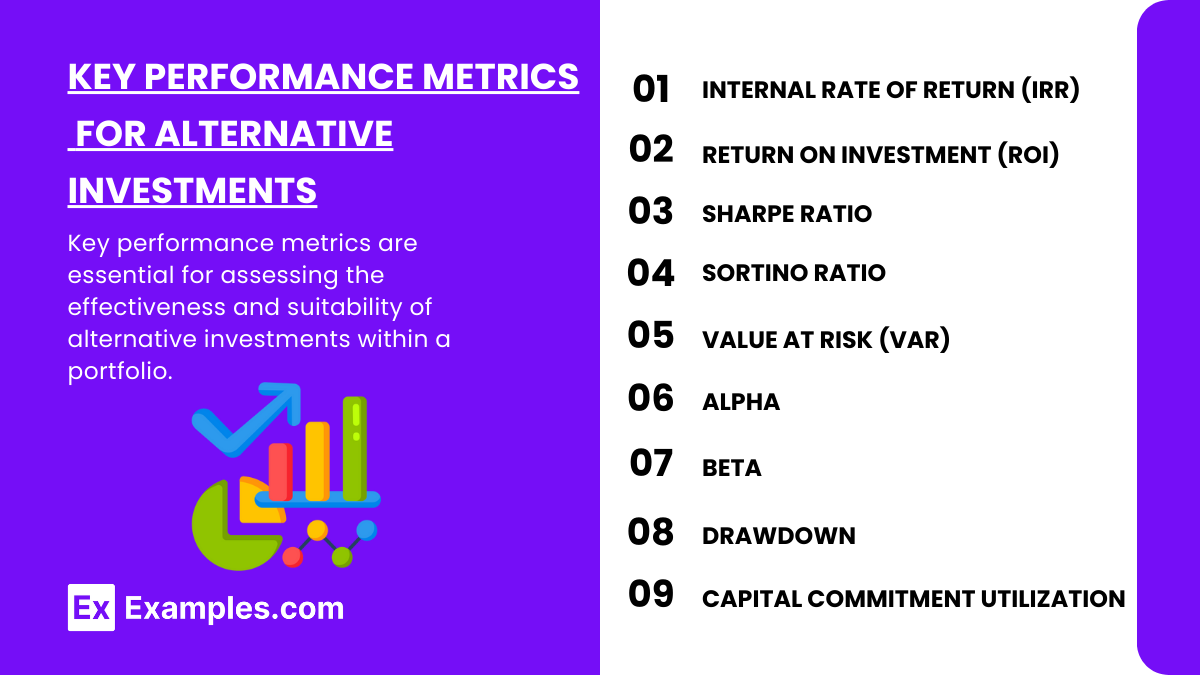

Key Performance Metrics for Alternative Investments

Key performance metrics are essential for assessing the effectiveness and suitability of alternative investments within a portfolio. Here’s a detailed look at the primary metrics used to measure the performance of alternative investments:

- Internal Rate of Return (IRR): Estimates the profitability of investments by setting the net present value (NPV) of all cash flows to zero.

- Return on Investment (ROI): Measures the profitability of an investment relative to its cost.

- Sharpe Ratio: Assesses risk-adjusted returns by calculating extra returns per unit of risk.

- Sortino Ratio: Focuses on downside risk, differentiating harmful volatility from total volatility.

- Value at Risk (VaR): Provides a probabilistic estimate of potential losses in an investment portfolio.

- Alpha: Indicates the manager’s ability to generate returns exceeding the benchmark’s returns.

- Beta: Measures the investment’s volatility relative to the overall market.

- Drawdown: Tracks the peak-to-trough decline during a specific period, indicating potential risk and volatility.

- Capital Commitment Utilization: Evaluates how efficiently invested capital is used to generate returns.

Return Drivers in Alternative Investments

Alternative investments offer unique return drivers that can differ significantly from those of traditional asset classes like stocks and bonds. These drivers are critical for understanding how alternative investments can enhance portfolio returns and provide diversification. Here’s an overview of the primary return drivers in various categories of alternative investments:

- Real Estate:

- Rental Income: Steady cash flows from leases.

- Appreciation: Value increase due to market conditions and property improvements.

- Development Opportunities: Profits from developing and enhancing properties.

- Private Equity:

- Operational Improvements: Boosting profitability through efficiency gains.

- Market Expansion: Growing business presence organically or via acquisitions.

- Financial Engineering: Using leverage to optimize capital structure.

- Hedge Funds:

- Market Mispricings: Capitalizing on temporary price inefficiencies.

- Leverage: Amplifying returns using borrowed funds.

- Short Selling: Profiting from the decline in stock prices.

- Commodities:

- Supply and Demand Shifts: Returns influenced by market supply and demand changes.

- Geopolitical Events: Impacts from global political developments.

- Inflation Hedging: Protecting against inflation as commodity prices typically rise.

- Infrastructure:

- Regulated Returns: Stable returns from investments in regulated sectors.

- Economic Growth: Benefits from broader economic expansion.

- Government Contracts: Steady cash flows from long-term government agreements.

- Venture Capital:

- Technological Breakthroughs: High returns from disruptive innovations.

- IPOs and Acquisitions: Large profits from public offerings or company sales.

- Scaling Small Businesses: Transforming startups into larger, profitable companies.

- Cryptocurrencies:

- Market Adoption: Increasing use in mainstream finance drives returns.

- Regulatory Changes: Impacts from evolving crypto regulations.

- Technological Developments: Enhancements in blockchain technology boosting value.

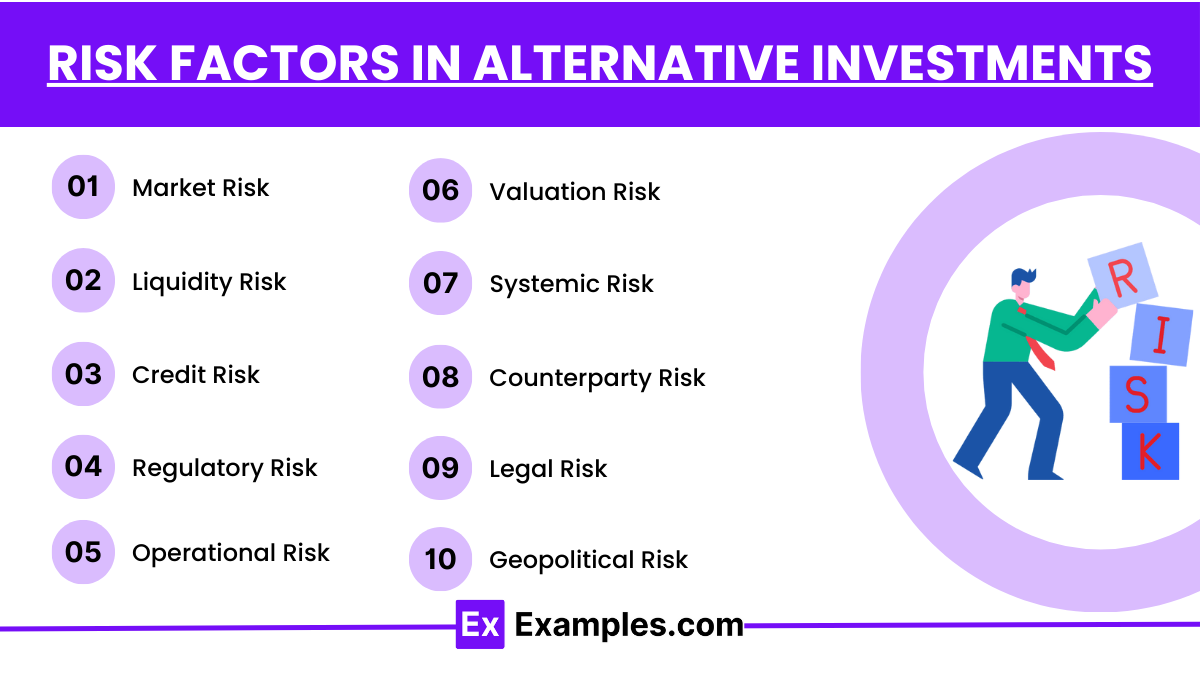

Risk Factors in Alternative Investments

Alternative investments carry unique risk factors that differentiate them from traditional asset classes like stocks and bonds. Investors need to understand these risks to manage them effectively. Here are the primary risk factors associated with alternative investments:

- Market Risk: The value of investments can decline due to economic shifts or market sentiment changes. Alternative investments may be highly volatile and sensitive to specialized market conditions.

- Liquidity Risk: Many alternative investments, such as real estate, private equity, and collectibles, are not readily sellable at a market price in a timely manner. This can make it difficult to exit positions without incurring significant losses.

- Credit Risk: Especially relevant in private debt investments, credit risk involves the possibility that a borrower will default, impacting the performance of the investment.

- Regulatory Risk: Changes in regulations can significantly affect alternative investments, particularly with assets like hedge funds, cryptocurrencies, and private equity, where oversight might increase or new compliance requirements might be introduced.

- Operational Risk: Failures in internal processes, people, or systems, or from external events, can lead to unexpected losses. This is particularly relevant in complex strategies employed by hedge funds.

- Valuation Risk: The unusual nature or rarity of some alternative assets, like art or antiquities, can make valuation difficult, potentially leading to pricing inaccuracies.

- Systemic Risk: Economic disruptions or the failure of a significant player within a sector (like a major bank or financial institution) can lead to broader market impacts, affecting even diversely held alternative investments.

- Counterparty Risk: The risk that the other party in an investment or a trading contract will not fulfill their obligations. This is a common risk in derivative transactions and private contracts.

- Legal Risk: Legal uncertainties including tax implications, ownership disputes, and changes in property rights can impact the returns and viability of alternative investments.

- Geopolitical Risk: Investments in global markets, especially in commodities and real estate, can be affected by changes in political stability, government policies, and international relations.

Examples

Examples 1: Evaluating Private Equity Fund Performance Using IRR

Analyze the performance of a private equity fund by calculating the internal rate of return (IRR) over the investment period. Discuss the impact of cash flow timing on IRR, the relevance of IRR as a metric for private equity, and the limitations of using IRR alone to evaluate performance.

Examples 2: Benchmarking Hedge Fund Returns Against Peer Groups

Compare a hedge fund’s returns to a peer group to assess relative performance. Explore how the Sharpe Ratio can be used alongside benchmarking to evaluate risk-adjusted returns, highlighting the challenges of finding appropriate benchmarks in the alternative investment space.

Examples 3: Assessing Real Estate Investment Trust (REIT) Performance with NAV

Use net asset value (NAV) to evaluate the performance of a REIT, examining factors that drive NAV, such as property appreciation, income generation, and changes in market valuation. Discuss how NAV growth reflects the performance of underlying real estate assets and investor returns.

Examples 4: Commodities as a Hedge Against Inflation

Examine the role of commodities, such as gold and oil, in protecting against inflation. Analyze historical data to demonstrate how commodities perform during inflationary periods, highlighting both the potential return enhancement and the volatility associated with commodity investments.

Examples 5: Impact of Fee Structures on Hedge Fund Returns

Explore how the “2 and 20” fee structure (2% management fee and 20% performance fee) affects the net returns of a hedge fund. Discuss how high-water marks and hurdle rates can align manager and investor interests, ensuring fees are only charged for consistent performance.

Practice Questions

Question 1

Which performance metric is commonly used in private equity to assess the profitability of an investment over its entire holding period?

A. Net Asset Value (NAV)

B. Internal Rate of Return (IRR)

C. Sharpe Ratio

D. Time-Weighted Return (TWR)

Answer:

B. Internal Rate of Return (IRR)

Explanation:

The Internal Rate of Return (IRR) is a key metric for private equity, as it reflects the annualized rate of return over the investment’s holding period, taking into account the timing of cash flows. NAV and TWR are used in other contexts, and the Sharpe Ratio focuses on risk-adjusted returns, which is less relevant for private equity’s cash-flow-oriented analysis.

Question 2

Why is benchmarking challenging for alternative investments like hedge funds?

A. Hedge funds only invest in fixed-income assets

B. Alternative investments lack standard indices and have diverse strategies

C. Hedge funds have low correlation with equity markets

D. Hedge funds do not charge management fees

Answer:

B. Alternative investments lack standard indices and have diverse strategies

Explanation:

Benchmarking is difficult for hedge funds and other alternative investments because these assets employ a wide variety of strategies that do not align with traditional market indices. The unique approaches and low correlation with traditional markets make it challenging to find standardized benchmarks that accurately reflect performance.

Question 3

What is the primary reason commodities are included in a portfolio as an alternative investment?

A. To generate regular dividend income

B. To provide liquidity in volatile markets

C. To act as a hedge against inflation

D. To reduce management fees

Answer:

C. To act as a hedge against inflation

Explanation:

Commodities, such as gold and oil, are commonly included in portfolios to protect against inflation. Their prices often rise during inflationary periods, helping to preserve purchasing power. Commodities are not typically chosen for regular income or liquidity, and they may have higher management fees compared to traditional assets.