Preparing for the CFA Exam requires an understanding of “Analysis of Active Portfolio Management,” a crucial concept in investment strategies. Active portfolio management involves making specific investments with the goal of outperforming a benchmark index. Understanding this approach helps candidates evaluate performance, manage risk, and adapt to market changes effectively. Mastery of this concept supports a high CFA score by enhancing insights into sophisticated investment techniques and portfolio optimization.

Learning Objectives

In studying “Analysis of Active Portfolio Management” for the CFA, you should aim to understand the essential strategies and techniques involved in actively managing investment portfolios. This includes learning how active managers make investment decisions to outperform benchmarks, effectively navigating market volatility. Analyzing the performance metrics and risk factors that influence portfolio outcomes, along with understanding their impact on overall investment strategies, is central to mastering this topic. Understanding active portfolio management enables you to evaluate investment opportunities across various asset classes, from equities to fixed income. Mastery in this area allows you to develop robust investment strategies, enhance portfolio performance, and optimize financial decision-making in managing investment assets.

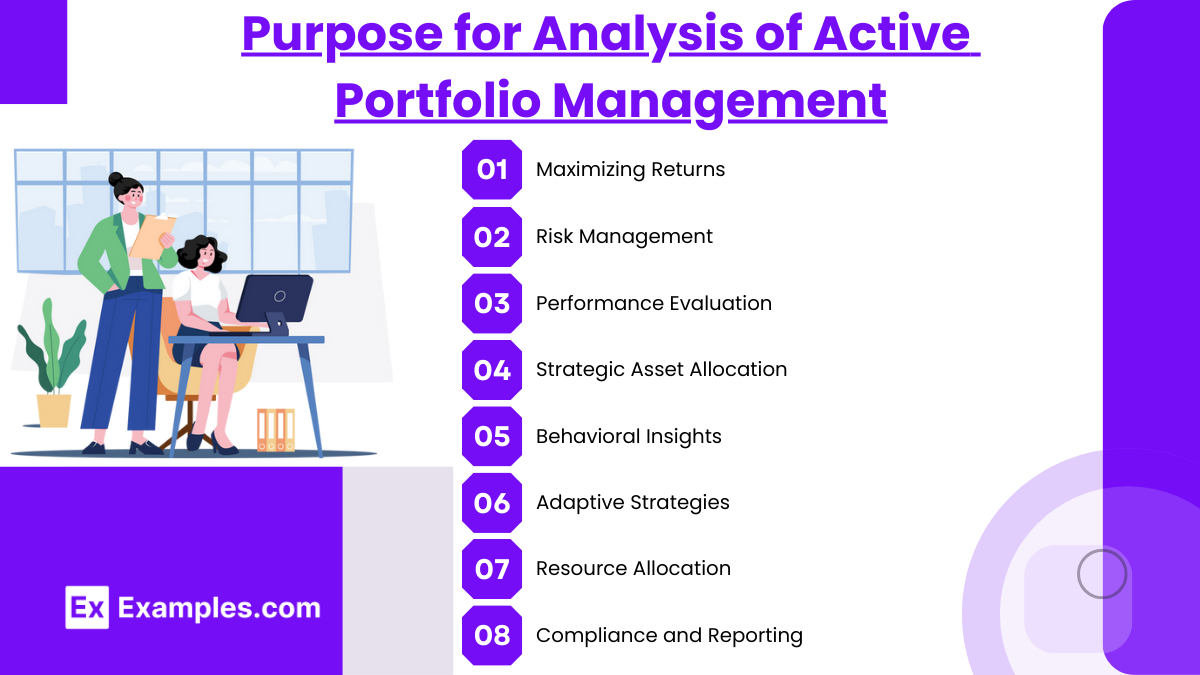

Purpose for Analysis of Active Portfolio Management

Active portfolio management involves continuously monitoring and adjusting a portfolio to achieve specific investment objectives. Here are several key purposes for analyzing active portfolio management:

1. Maximizing Returns

The primary goal of active portfolio management is to outperform the market benchmarks. Analyzing active strategies helps in identifying opportunities for superior returns through market timing, sector rotation, and security selection.

2. Risk Management

Active portfolio managers must assess the risks associated with their investment strategies. Analysis helps to evaluate exposure to different risk factors, allowing managers to implement strategies that mitigate potential losses and align with the investor’s risk tolerance.

3. Performance Evaluation

Regular analysis provides insights into the performance of individual assets and the portfolio as a whole. This includes comparing returns against benchmarks and peers, which helps in assessing the effectiveness of the active management strategies employed.

4. Strategic Asset Allocation

Active portfolio management requires ongoing adjustments to asset allocation based on market conditions and economic forecasts. Analysis helps determine the optimal mix of asset classes that aligns with investment goals and market expectations.

5. Behavioral Insights

Understanding investor behavior and market sentiment is crucial for active portfolio management. Analyzing trends and patterns can provide insights into how market psychology may impact asset prices, allowing managers to make informed decisions.

6. Adaptive Strategies

Market conditions can change rapidly, making it essential for active portfolio managers to adapt their strategies accordingly. Analysis enables managers to evaluate the current market environment and adjust their approaches to capitalize on new opportunities.

7. Resource Allocation

Analyzing active portfolio management helps in determining how resources (capital and time) should be allocated among various strategies or assets. This ensures that the most promising opportunities receive the necessary focus and investment.

8. Compliance and Reporting

Active portfolio managers need to ensure compliance with regulations and investment policies. Regular analysis assists in tracking adherence to guidelines and provides necessary documentation for reporting purposes.

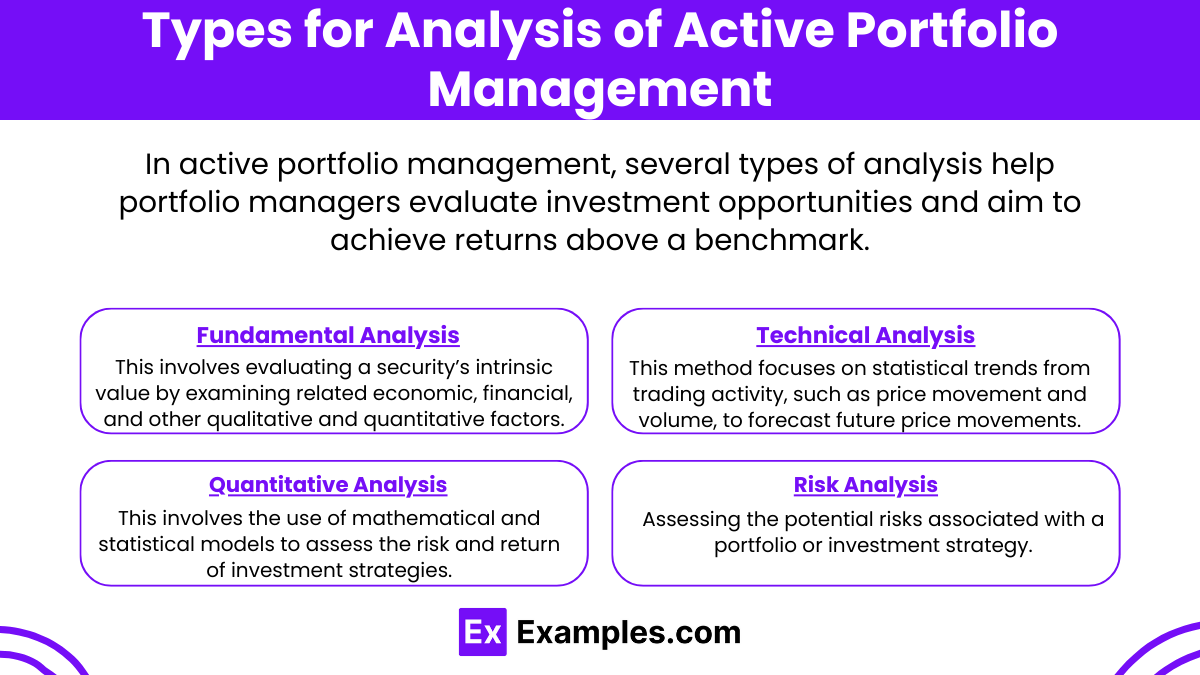

Types for Analysis of Active Portfolio Management

In active portfolio management, several types of analysis help portfolio managers evaluate investment opportunities and aim to achieve returns above a benchmark.

1. Fundamental Analysis

- Definition: This involves evaluating a security’s intrinsic value by examining related economic, financial, and other qualitative and quantitative factors.

- Purpose: To determine whether the stock is overvalued or undervalued based on its fundamentals, such as earnings, revenue growth, and market conditions.

- Methods:

- Earnings Reports: Analyzing quarterly and annual earnings.

- Industry Analysis: Understanding the sector dynamics and competitive landscape.

2. Technical Analysis

- Definition: This method focuses on statistical trends from trading activity, such as price movement and volume, to forecast future price movements.

- Purpose: To identify trading opportunities based on patterns and signals in price charts.

- Tools:

- Charts: Using line, bar, and candlestick charts to visualize data.

- Indicators: Employing moving averages, RSI, and MACD for trend analysis.

3. Quantitative Analysis

- Definition: This involves the use of mathematical and statistical models to assess the risk and return of investment strategies.

- Purpose: To develop algorithmic trading strategies and risk management techniques.

- Techniques:

- Statistical Models: Creating models for risk-adjusted returns.

- Backtesting: Testing strategies on historical data to validate effectiveness.

4. Risk Analysis

- Definition: Assessing the potential risks associated with a portfolio or investment strategy.

- Purpose: To identify, measure, and mitigate risks that could adversely affect investment performance.

- Components:

- Value at Risk (VaR): Estimating the potential loss in value of a portfolio.

- Stress Testing: Simulating extreme market conditions to assess potential impacts.

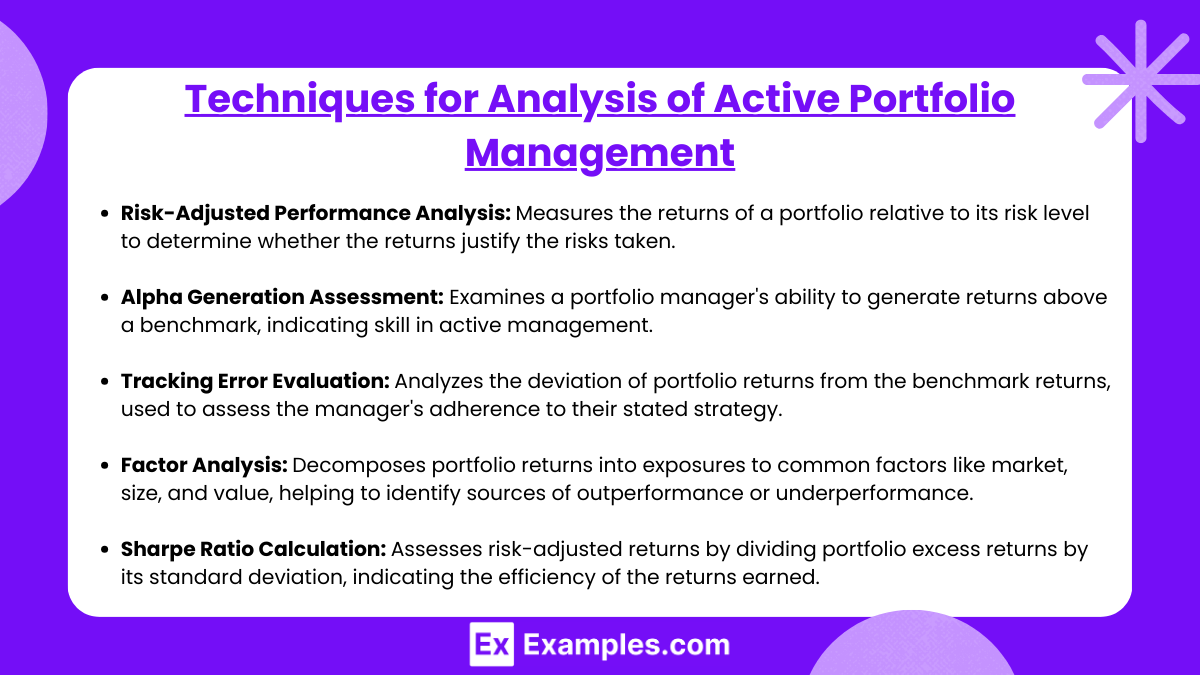

Techniques for Analysis of Active Portfolio Management

Here are some techniques commonly used in the analysis of active portfolio management, each presented in a clear, concise sentence:

- Risk-Adjusted Performance Analysis: Measures the returns of a portfolio relative to its risk level to determine whether the returns justify the risks taken.

- Alpha Generation Assessment: Examines a portfolio manager’s ability to generate returns above a benchmark, indicating skill in active management.

- Tracking Error Evaluation: Analyzes the deviation of portfolio returns from the benchmark returns, used to assess the manager’s adherence to their stated strategy.

- Factor Analysis: Decomposes portfolio returns into exposures to common factors like market, size, and value, helping to identify sources of outperformance or underperformance.

- Sharpe Ratio Calculation: Assesses risk-adjusted returns by dividing portfolio excess returns by its standard deviation, indicating the efficiency of the returns earned.

- Information Ratio: Measures the consistency of active returns by dividing the portfolio’s excess return by its tracking error, used to evaluate a manager’s skill.

Examples

Example 1. Understanding Performance Metrics

“Analysis of Active Portfolio Management” emphasizes the need to evaluate performance metrics to gauge the success of an actively managed portfolio. Through performance analysis, investors and portfolio managers can identify which decisions led to higher returns and understand the impact of those choices on overall portfolio performance. This metric-based approach provides a foundation for informed decision-making, helping managers continuously improve strategies based on past performance data.

Example 2. Risk Management Strategies

By studying “Analysis of Active Portfolio Management,” investors gain insight into risk management practices essential for actively managed portfolios. This analysis provides techniques to balance the desire for high returns with the need to mitigate risks, examining how portfolio managers can employ tools such as diversification and hedging. It also explores how to adjust strategies based on changing market conditions, enabling managers to protect assets while aiming for optimal growth.

Example 3. Asset Allocation Decisions

Asset allocation is a crucial topic within “Analysis of Active Portfolio Management,” as it determines the balance between different asset classes within a portfolio. Effective analysis helps managers decide on the right mix of equities, bonds, and alternative investments, tailoring allocations to align with the portfolio’s objectives and the investor’s risk tolerance. This approach emphasizes a strategic framework for adjusting asset allocations to maximize returns and minimize potential losses.

Example 4. Measuring Alpha and Benchmarking

One of the key areas in “Analysis of Active Portfolio Management” is understanding alpha—the excess return above a benchmark index—and how it reflects a portfolio manager’s skill. The analysis explains methods to benchmark performance accurately, providing insights into whether the returns achieved justify the costs associated with active management. This allows investors to determine if their manager’s strategy is adding value beyond what could be achieved through a passive approach.

Example 5. Evaluating Market Timing Skills

“Analysis of Active Portfolio Management” also examines the role of market timing in generating additional returns. By studying market trends and analyzing economic indicators, managers attempt to buy and sell assets at opportune moments. This aspect of active management requires a deep understanding of market movements, as successful market timing can substantially improve returns, while poor timing may lead to significant losses. This evaluation helps investors and managers alike to refine their market timing strategies.

Practice Questions

Question 1

What is the primary goal of active portfolio management?

A) To match the returns of a benchmark index

B) To outperform a benchmark index through strategic asset selection and market timing

C) To minimize trading costs and fees

D) To achieve stable, risk-free returns over time

Answer: B) To outperform a benchmark index through strategic asset selection and market timing

Explanation:

The primary goal of active portfolio management is to generate returns that exceed those of a benchmark index, such as the S&P 500 or another relevant market index. Active managers achieve this by carefully selecting assets they believe will perform better than the market average and by timing their entry and exit points based on market conditions. Unlike passive management, which aims to replicate the benchmark, active management involves strategic decisions aimed at achieving higher returns, albeit with potentially higher fees and risks. The focus on outperforming a benchmark distinguishes active management from other investment strategies, which may prioritize cost reduction or risk minimization over returns.

Question 2

Which of the following best describes “alpha” in the context of active portfolio management?

A) Alpha represents the portfolio’s total risk

B) Alpha is the excess return of a portfolio relative to its benchmark, attributed to the manager’s skill

C) Alpha is a measure of market volatility

D) Alpha represents the average returns of all portfolios managed by a firm

Answer: B) Alpha is the excess return of a portfolio relative to its benchmark, attributed to the manager’s skill

Explanation:

In active portfolio management, “alpha” refers to the additional return a portfolio achieves over its benchmark due to the portfolio manager’s skill and strategy. It is a key measure used to assess the success of active management. If a portfolio achieves a higher return than its benchmark, it has a positive alpha, suggesting that the manager’s decisions added value beyond what could be achieved through passive investing. Conversely, a negative alpha indicates underperformance relative to the benchmark. Alpha is essential in evaluating the effectiveness of active management because it quantifies the benefit (or detriment) provided by the manager’s expertise and investment strategy.

Question 3

In the context of active portfolio management, which risk management strategy is commonly used to reduce exposure to specific market risks?

A) Concentrating investments in a single asset class

B) Leveraging funds to maximize potential returns

C) Diversifying across multiple asset classes and sectors

D) Timing the market to buy only in bull markets

Answer: C) Diversifying across multiple asset classes and sectors

Explanation:

Diversification is a fundamental risk management strategy in active portfolio management. By spreading investments across various asset classes, sectors, and geographical regions, managers can reduce the impact of a downturn in any single asset or sector. This approach helps to balance the portfolio’s risk profile, protecting it from significant losses that might arise from concentration in a particular area. Although other strategies, such as market timing, may play a role in active management, diversification is one of the most reliable methods for managing market risk over the long term. Active managers often use diversification alongside other techniques to enhance returns while controlling for risk.