Preparing for the CFA Exam requires a comprehensive understanding of “Analysis of Dividends and Share Repurchases,” a crucial component of corporate finance. Mastery of dividend policies, types of share repurchases, and their impact on shareholder value is essential. This knowledge provides insights into company strategy, financial health, and investor returns, critical for achieving a high CFA score.

Learning Objective

In studying “Analysis of Dividends and Share Repurchases” for the CFA Exam, you should learn to understand the principles behind corporate payout policies, including cash dividends and share repurchase programs. Analyze the impact of dividends and share buybacks on shareholder value, earnings per share (EPS), and a company’s capital structure. Evaluate the reasons why companies choose different payout methods, such as signaling effects and tax implications. Additionally, explore how changes in dividend policy can reflect a company’s financial health and strategic goals. Apply this knowledge to assess company strategies and make informed investment decisions in CFA exam practice scenarios.

Overview of Dividends and Share Repurchases

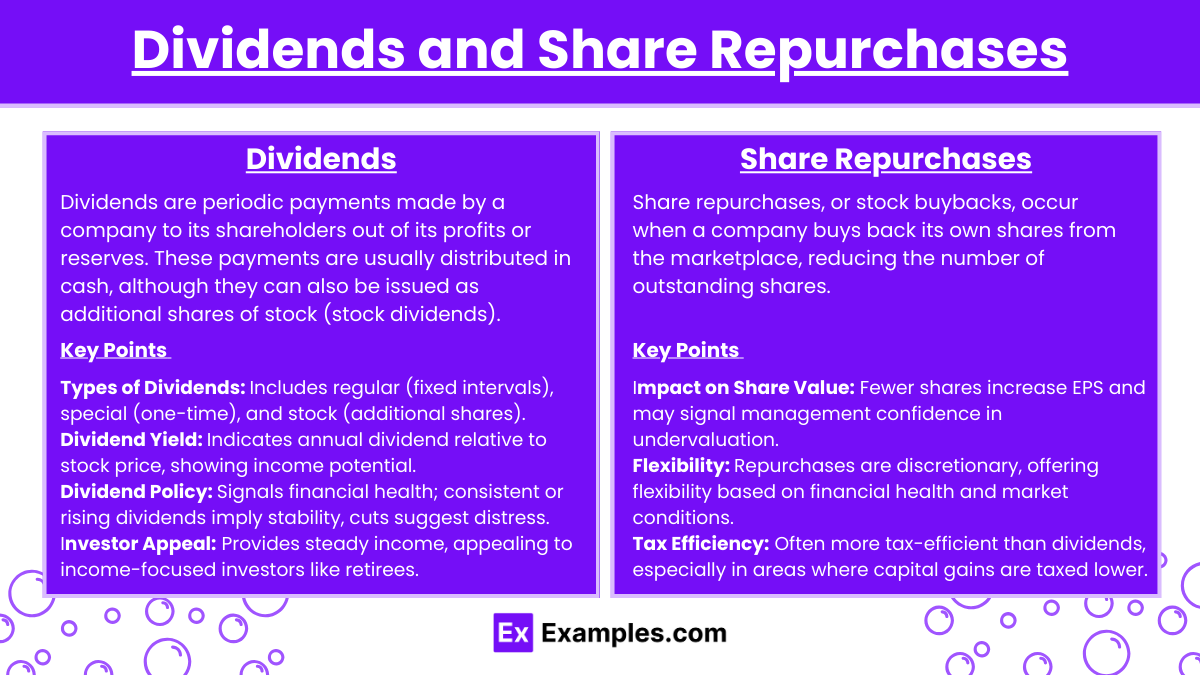

Dividends and share repurchases are two common ways companies return value to their shareholders. Both approaches have their benefits and strategic purposes, influencing how investors perceive and value a company. Here’s an introduction to dividends and share repurchases:

Dividends

Dividends are periodic payments made by a company to its shareholders out of its profits or reserves. These payments are usually distributed in cash, although they can also be issued as additional shares of stock (stock dividends).

Key Points about Dividends:

- Types of Dividends: Common types include regular dividends (recurring payments at fixed intervals), special dividends (one-time payments often resulting from exceptional profits), and stock dividends (distribution of additional shares).

- Dividend Yield: This metric shows how much a company pays in dividends each year relative to its stock price, helping investors assess the income potential of their investments.

- Dividend Policy: A company’s approach to paying dividends can signal its financial health and future prospects. A consistent or increasing dividend often indicates financial stability, while a cut in dividends may suggest financial distress.

- Investor Appeal: Dividends provide regular income to shareholders and are particularly attractive to income-focused investors, such as retirees or those seeking steady cash flow.

Share Repurchases

Share repurchases, or stock buybacks, occur when a company buys back its own shares from the marketplace, reducing the number of outstanding shares.

Key Points about Share Repurchases:

- Mechanism: Companies repurchase shares either through open market operations or tender offers where shareholders can sell shares back to the company at a predetermined price.

- Impact on Share Value: Reducing the number of outstanding shares can increase earnings per share (EPS) and, consequently, the value of remaining shares. This can signal confidence from management that the stock is undervalued.

- Flexibility: Unlike dividends, share repurchases offer companies more flexibility as they are discretionary and can be adapted based on financial health and market conditions.

- Tax Efficiency: Share repurchases can be more tax-efficient for shareholders compared to dividends, especially in regions where dividend income is taxed at a higher rate than capital gains.

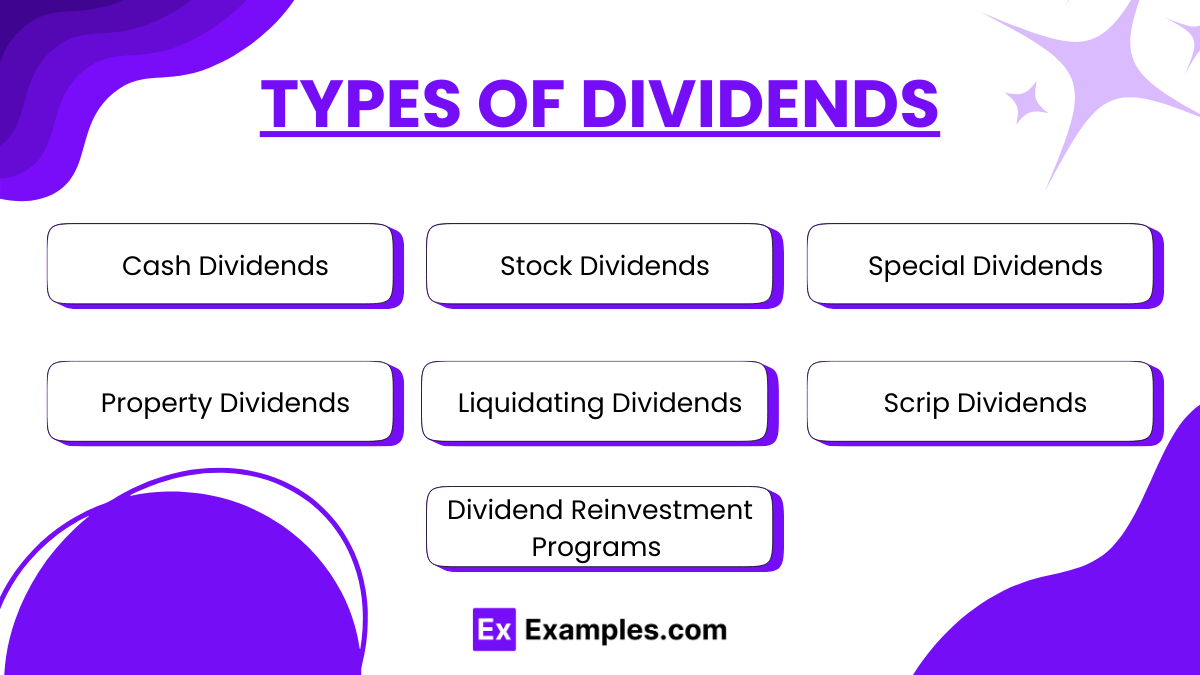

Types of Dividends

Dividends can be distributed in various forms, each with its own implications for the company and its shareholders. Here’s an overview of the main types of dividends:

1. Cash Dividends

- The most common type of dividend, where a company pays shareholders a portion of its earnings in cash.

- Usually distributed on a regular schedule, such as quarterly or annually.

- Provides direct income, making them attractive to income-focused investors.

- Reduces the company’s cash reserves and signals financial stability when paid consistently.

2. Stock Dividends

- Payments made in the form of additional shares of stock instead of cash.

- Typically declared periodically, similar to cash dividends.

- Increases the number of shares owned by each shareholder, potentially diluting the value per share but retaining overall ownership proportion.

- Allows the company to conserve cash while still rewarding shareholders.

3. Special Dividends

- One-time payments made when a company has excess cash or profits that it wants to distribute to shareholders.

- Not regular; declared in extraordinary situations, such as the sale of a large asset or an exceptional profit year.

- Provides a significant, unexpected income boost.

- Reduces cash reserves temporarily but does not signal an ongoing commitment to higher payouts.

4. Property Dividends

- Dividends paid in the form of physical assets or other property instead of cash or stock.

- ompanies may distribute shares of a subsidiary or physical assets.

- Can be complex to manage due to the nature of the distributed assets.

- Useful for distributing non-cash assets and reducing inventory or ownership in another entity.

5. Liquidating Dividends

- Dividends paid out of the company’s capital base, typically when the company is partially or fully liquidating its assets.

- Occurs during the liquidation process or when the company winds down operations.

- Returns part of the invested capital, often signaling that the company is ceasing operations or restructuring.

- Indicates a return of capital, reducing the company’s total asset base and often signaling significant changes in business strategy.

6. Scrip Dividends

- Dividends issued in the form of promissory notes, allowing the company to pay at a later date instead of immediately in cash.

- Offers a form of deferred payment, which can be useful for shareholders who can wait for cash.

- Preserves cash flow in the short term while still honoring a commitment to dividends.

7. Dividend Reinvestment Programs (DRIPs)

- Although not a direct type of dividend, these programs allow shareholders to reinvest their cash dividends back into additional shares of the company, often at a discount.

- Provides an automatic method for compounding investment and increasing shareholding without direct action.

- Retains cash within the company while giving shareholders a way to reinvest profits.

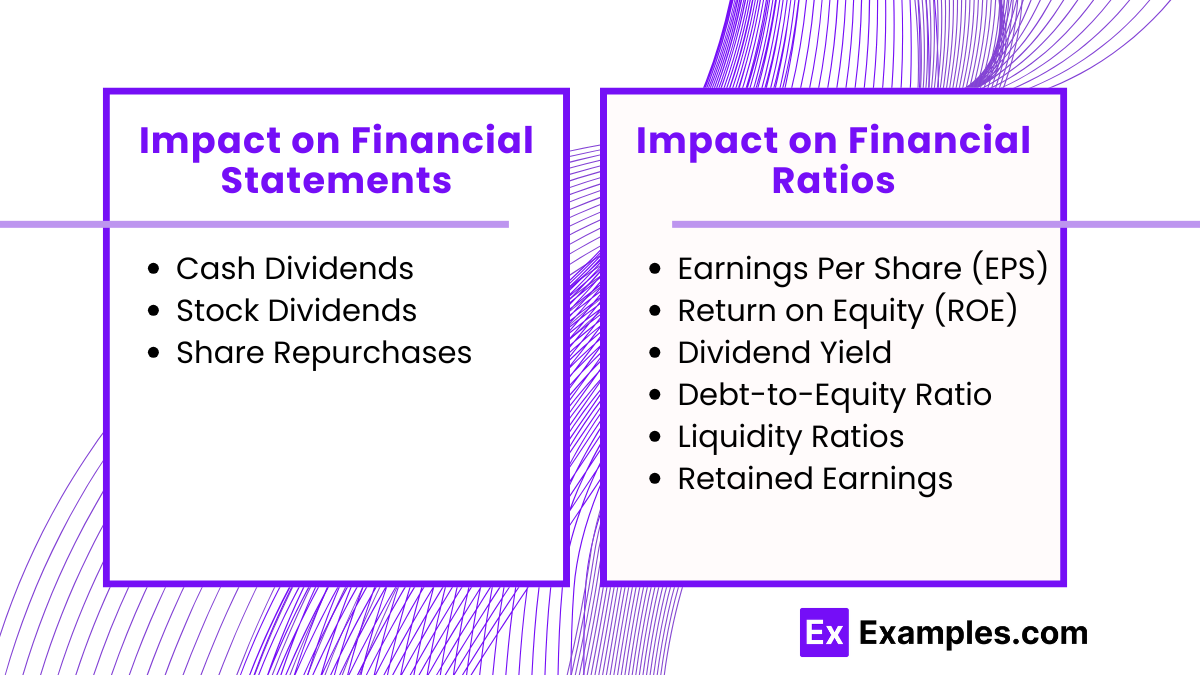

Impact on Financial Statements and Ratios

Dividends and share repurchases have significant impacts on a company’s financial statements and financial ratios, influencing how investors and analysts assess the company’s financial health and performance. Here’s an overview of their effects:

Impact on Financial Statements

- Cash Dividends

- Balance Sheet: Decrease in cash and retained earnings, as the company distributes profits to shareholders. Total equity is reduced by the dividend amount.

- Income Statement: Dividends do not appear on the income statement, as they are not considered an expense.

- Cash Flow Statement: Appear as an outflow in the financing section, reflecting cash paid to shareholders.

- Stock Dividends

- Balance Sheet: Transfer from retained earnings to common stock and additional paid-in capital, without changing total equity.

- Income Statement: No impact, as stock dividends are not expenses.

- Cash Flow Statement: No cash outflow, so stock dividends do not affect cash flow.

- Share Repurchases

- Balance Sheet: Reduction in cash and treasury stock recorded, leading to a decrease in shareholders’ equity.

- Income Statement: No direct impact, as repurchases are not considered expenses.

- Cash Flow Statement: Recorded as a cash outflow in the financing section, indicating cash used to buy back shares.

Impact on Financial Ratios

- Earnings Per Share (EPS)

- Share Repurchases: Reduces the number of outstanding shares, increasing EPS if net income remains constant, potentially improving perceived profitability.

- Dividends: No direct impact on EPS, but cash dividends reduce retained earnings.

- Return on Equity (ROE)

- Share Repurchases: Decreases shareholders’ equity, potentially increasing ROE if net income stays the same, signaling higher efficiency in generating returns.

- Dividends: Reduces equity (retained earnings), which can also boost ROE if net income is unaffected.

- Dividend Yield

- Cash Dividends: Directly impacts the dividend yield ratio by increasing the payout relative to the stock price, appealing to income-focused investors.

- Debt-to-Equity Ratio

- Share Repurchases: Lowers equity, potentially increasing the debt-to-equity ratio, making the company appear more leveraged.

- Dividends: Reducing equity with cash dividends can also slightly affect the debt-to-equity ratio.

- Liquidity Ratios

- Cash Dividends and Share Repurchases: Both reduce cash holdings, which can affect liquidity ratios such as the current ratio and quick ratio, signaling a reduced ability to meet short-term obligations.

- Retained Earnings

- Dividends: Direct reduction in retained earnings, showing the distribution of profits to shareholders.

- Stock Dividends: Reallocation within equity without decreasing total retained earnings significantly.

Reasons for Choosing Dividends vs. Share Repurchases

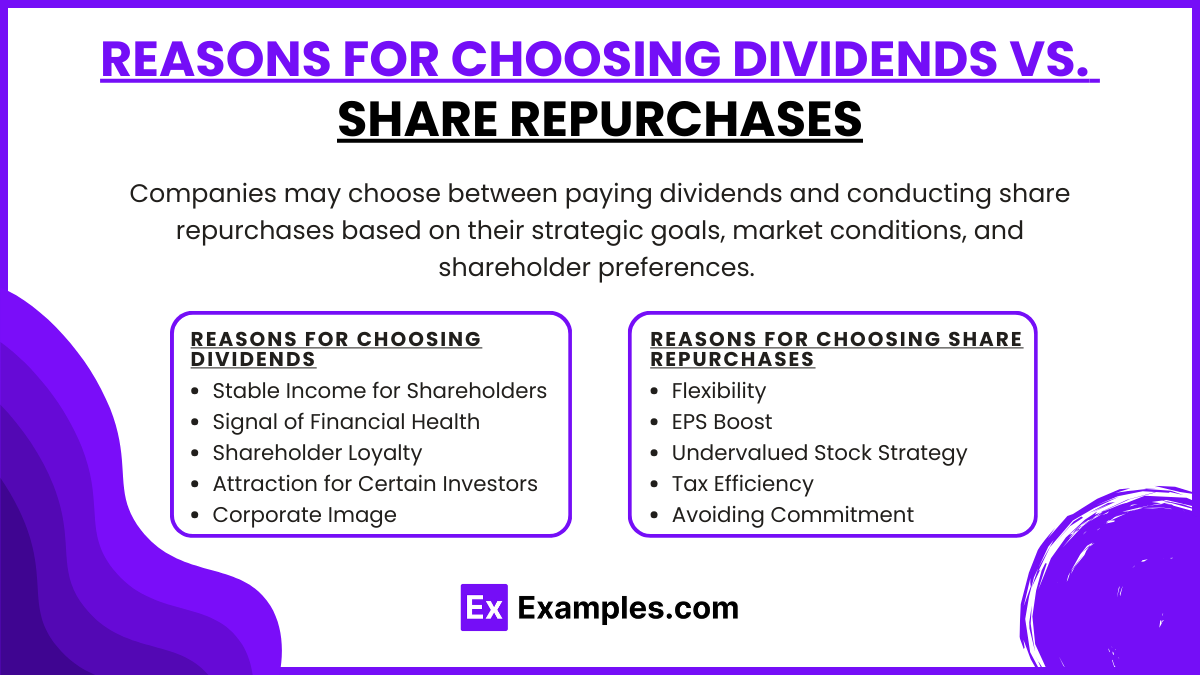

Companies may choose between paying dividends and conducting share repurchases based on their strategic goals, market conditions, and shareholder preferences. Here are the main reasons for choosing one approach over the other:

Reasons for Choosing Dividends

- Stable Income for Shareholders

- Dividends provide regular, predictable income, appealing to income-focused investors such as retirees who rely on cash flow from their investments.

- Signal of Financial Health

- A consistent or increasing dividend payout signals that a company is financially healthy and confident in its long-term profitability. This can attract and retain long-term investors.

- Shareholder Loyalty

- Regular dividends build trust and loyalty among shareholders, as they demonstrate a commitment to sharing profits directly.

- Attraction for Certain Investor Profiles

- Dividends attract investors who prefer stability and reliable income streams, such as those who prioritize low-risk investments.

- Corporate Image

- Paying dividends helps maintain a reputation as a stable company, which can enhance market perception and investor confidence.

Reasons for Choosing Share Repurchases

- Flexibility

- Share repurchases offer more flexibility compared to regular dividend payments. Companies can decide when and how much to buy back, without committing to an ongoing obligation.

- EPS Boost

- Reducing the number of outstanding shares through repurchases increases earnings per share (EPS), which can enhance the company’s valuation and appeal to investors focused on growth metrics.

- Undervalued Stock Strategy

- When a company believes its stock is undervalued, share repurchases signal confidence in the stock’s future prospects and can support share price appreciation.

- Tax Efficiency

- Share repurchases can be more tax-efficient for shareholders in certain jurisdictions, where capital gains taxes on stock price appreciation are lower than taxes on dividend income.

- Avoiding Commitment

- Unlike dividends, which signal a regular income expectation, share repurchases do not set a precedent for recurring payouts. This allows companies to manage cash flow more dynamically.

Examples

Example 1: Case Study: Apple Inc.’s Share Repurchase Program

Analyze how Apple’s significant share repurchase program impacted its earnings per share (EPS) and stock price over time. Discuss the rationale behind the program and the market’s perception of Apple’s financial health and growth prospects.

Example 2: Dividend Policy Shift at General Electric (GE)

Review GE’s decision to cut its dividend during financial difficulties and the market reaction to this move. Discuss how dividend cuts can signal financial challenges and impact investor confidence, as well as the subsequent recovery strategies employed by the company.

Example 3: Comparison of Dividend Yields in Utility vs. Technology Sectors

Examine why utility companies, known for stable cash flows, often have high dividend yields compared to technology companies, which may prefer reinvesting earnings for growth or using share repurchases. Discuss how these sectoral differences reflect company strategies and investor expectations.

Example 4: The Signaling Effect of Microsoft’s Special Dividend

Explore Microsoft’s 2004 decision to issue a special dividend of $32 billion. Analyze the reasons behind this extraordinary payout and how it affected shareholder perception and company valuation.

Example 5: Evaluating the Effect of Share Buybacks on Financial Ratios

Study a scenario where a company repurchased shares and its impact on key financial ratios such as EPS, return on equity (ROE), and debt-to-equity ratio. Discuss how these changes can influence investor assessments of the company’s performance and capital structure.

Practice Questions

Question 1

What is one common reason companies engage in share repurchase programs?

A. To increase the total number of outstanding shares

B. To reduce earnings per share (EPS)

C. To signal that management believes the stock is undervalued

D. To increase retained earnings

Answer:

C. To signal that management believes the stock is undervalued

Explanation:

Companies often engage in share repurchase programs as a signal that management believes the stock is undervalued. By repurchasing shares, the company reduces the number of shares outstanding, potentially increasing the earnings per share (EPS) and boosting investor confidence in the company’s valuation.

Question 2

Which of the following is an advantage of paying regular cash dividends to shareholders?

A. It provides the company with increased financial flexibility

B. It enhances shareholder confidence and provides steady income

C. It decreases the tax burden on shareholders

D. It helps reduce share price volatility

Answer:

B. It enhances shareholder confidence and provides steady income

Explanation:

Regular cash dividends are attractive to income-focused investors and can enhance shareholder confidence by signaling that the company has stable cash flows. However, paying regular dividends can reduce a company’s financial flexibility, as it requires a commitment to consistent cash outflows.

Question 3

What is a potential disadvantage of a company conducting significant share repurchases?

A. It reduces the number of shares outstanding, increasing EPS

B. It signals that the company has strong growth opportunities

C. It can lead to a perception that the company lacks profitable reinvestment opportunities

D. It avoids tax implications for shareholders

Answer:

C. It can lead to a perception that the company lacks profitable reinvestment opportunities

Explanation:

One potential disadvantage of share repurchases is that they may signal to the market that the company does not have sufficient profitable projects or growth opportunities to reinvest its capital. This perception can impact investor sentiment, even if EPS is increased due to fewer outstanding shares.