Easily convert between centimeters and inches & inches to centimeters with Examples.com’s accurate and instant measurement unit length conversion tool. Input your value for swift, precise results.

CM to Inch

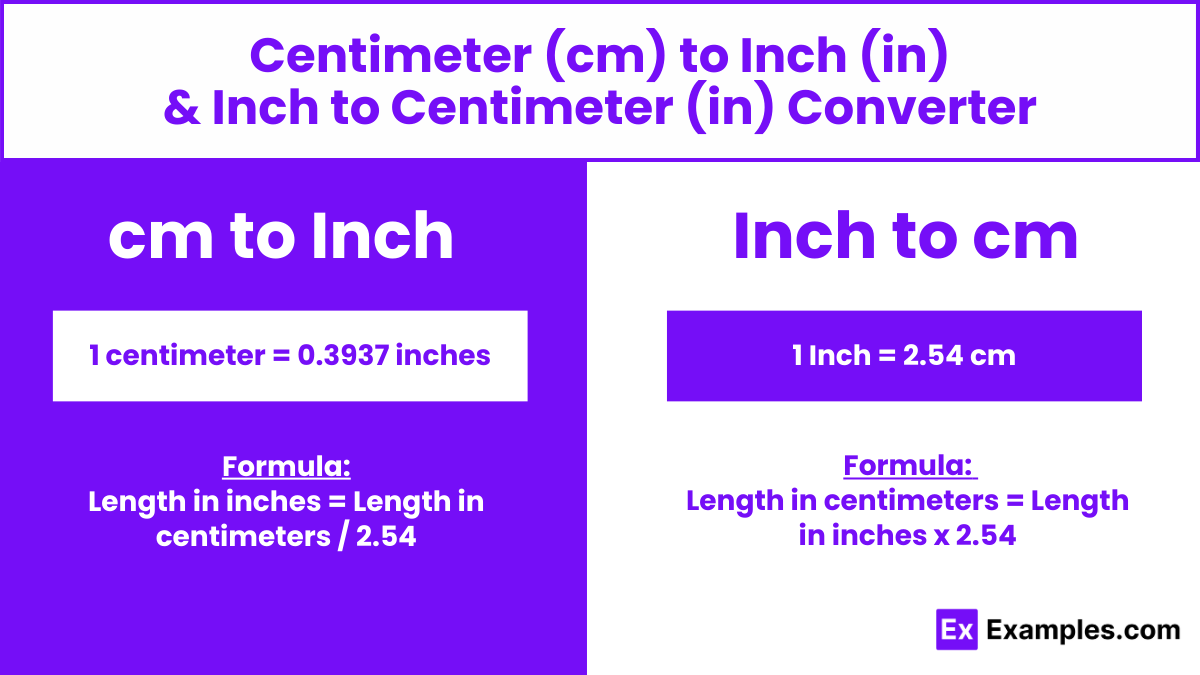

Formula: Length in inches = Length in centimeters / 2.54

CM :

Inch :

| Centimeters | Inches |

|---|---|

| 1 | 0.39370078740157477 |

Inch to CM

Formula: Length in centimeters = Length in inches x 2.54

Inch :

CM :

| Inches | Centimeters |

|---|---|

| 1 | 2.54 |

Length Converters to Centimeter (cm)

Length Converters to Inch (in)

| Kilometer to Inch | Meter to Inch | Centimeter to Inch |

| Millimeter to Inch | Micrometer to Inch | Nanometer to Inch |

| Mile to Inch | Yard to Inch | Feet to Inch |

| Nautical Mile to Inch |

How to Convert Centimeters to Inches

centimeter = 0.393701 inches

Start with Your Number in Centimeters

Think of a number of centimeters you want to convert.

1 cm = 0.3937007874 in

1 in = 2.54 cm

Example: convert 6 cm to in:

6 cm = 6 × 0.3937007874 in = 2.3622047244 in

How to Convert Inches to Centimeters

1 inch (1 “) = 2.54 centimeters

Start with Your Number in Inches

1 in = 2.54 cm

1 cm = 0.3937007874 in

Example: convert 6 inches to cm:

6 inches = 6 × 2.54 cm = 15.24 cm

Centimeters to Inches Conversion Table

| Centimeters (cm) | Inches (“) (decimal) | Inches (“) (fraction) |

|---|---|---|

| 0.01 cm | 0.0039 in | 0 in |

| 0.1 cm | 0.0394 in | 3/64 in |

| 1 cm | 0.3937 in | 25/64 in |

| 2 cm | 0.7874 in | 25/32 in |

| 3 cm | 1.1811 in | 1 3/16 in |

| 4 cm | 1.5748 in | 1 37/64 in |

| 5 cm | 1.9685 in | 1 31/32 in |

| 6 cm | 2.3622 in | 2 23/64 in |

| 7 cm | 2.7559 in | 2 3/4 in |

| 8 cm | 3.1496 in | 3 5/32 in |

| 9 cm | 3.5433 in | 3 35/64 in |

| 10 cm | 3.9370 in | 3 15/16 in |

| 20 cm | 7.8740 in | 7 7/8 in |

| 30 cm | 11.8110 in | 11 13/16 in |

| 40 cm | 15.7480 in | 15 3/4 in |

| 50 cm | 19.6850 in | 19 11/16 in |

| 60 cm | 23.6220 in | 23 5/8 in |

| 70 cm | 27.5591 in | 27 9/16 in |

| 80 cm | 31.4961 in | 31 1/2 in |

| 90 cm | 35.4331 in | 35 7/16 in |

| 100 cm | 39.3701 in | 39 3/8 in |

Inches to Centimeters Convertion Table

| Inches (in) | Centimeters (cm) |

|---|---|

| 1/8 in | 0.3175 cm |

| 1/4 in | 0.635 cm |

| 1/2 in | 1.27 cm |

| 3/4 in | 1.905 cm |

| 1 in | 2.54 cm |

| 2 in | 5.08 cm |

| 3 in | 7.62 cm |

| 4 in | 10.16 cm |

| 5 in | 12.7 cm |

| 6 in | 15.24 cm |

| 7 in | 17.78 cm |

| 8 in | 20.32 cm |

| 9 in | 22.86 cm |

| 10 in | 25.4 cm |

| 11 in | 27.94 cm |

| 12 in | 30.48 cm |

Differences Between Centimeter and Inch

| Aspect | Centimeter (cm) | Inch (in) |

|---|---|---|

| Equivalent | One centimeter is equal to 0.39 inches. | One inch is equal to 2.54 centimeters. |

| Part of | One centimeter is 1/100th of a meter. | One inch is 1/12th of a foot or 1/36 of a yard. |

| Geographical Use | Centimeter is more common in Europe. | Inch is more utilized in the US and UK. |

| Measurement System | Belongs to the metric system. | Belongs to the Imperial system of Measurement. |

| Adoption | Adopted by the French Revolutionary Assembly in 1795. | Adopted by King Edward II of England during the 14th century. |

Solved Examples on Centimeters to Inches and Inches to Centimeters Conversion

1. Converting Centimeters to Inches

- Example 1: Convert 10 cm to inches. 10 cm=10×0.3937007874 in≈3.937007874 in10 cm=10×0.3937007874 in≈3.937007874 in

- Example 2: Convert 25 cm to inches. 25 cm=25×0.3937007874 in≈9.842519685 in25 cm=25×0.3937007874 in≈9.842519685 in

- Example 3: Convert 50 cm to inches. 50 cm=50×0.3937007874 in≈19.68503937 in50 cm=50×0.3937007874 in≈19.68503937 in

2. Converting Inches to Centimeters

- Example 1: Convert 5 inches to centimeters. 5 in=5×2.54 cm=12.7 cm5 in=5×2.54 cm=12.7 cm

- Example 2: Convert 12 inches to centimeters. 12 in=12×2.54 cm=30.48 cm12 in=12×2.54 cm=30.48 cm

- Example 3: Convert 20 inches to centimeters. 20 in=20×2.54 cm=50.8 cm20 in=20×2.54 cm=50.8 cm

1. Why do we need to convert inches to centimeters and vice versa?

Sometimes, we encounter measurements in inches, while at other times, it’s all about centimeters. Converting between the two helps us understand and communicate measurements more effectively, whether we’re building, crafting, or simply trying to figure out the length of something.

2. How do I convert inches to centimeters?

To convert inches to centimeters, you can use a simple formula: multiply the number of inches by 2.54. For example, if you have 5 inches, you would multiply 5 by 2.54 to get 12.7 centimeters.

3. What about converting centimeters to inches?

Converting centimeters to inches is just as straightforward. You divide the number of centimeters by 2.54. So, if you have 20 centimeters, divide 20 by 2.54 to get approximately 7.87 inches.

4. Why is it important to know both units of measurement?

Understanding units of measurements for both inches and centimeters gives you flexibility. While inches are commonly used in some countries like the United States, centimeters are more prevalent in others. Being able to convert between the two allows for seamless communication and collaboration, no matter where you are in the world.

5. Can I use online converters for accurate conversions

Absolutely! There are numerous online tools and apps available that can quickly and accurately convert inches to centimeters and vice versa. These tools can be especially handy for precise measurements in fields like engineering, architecture, and design.

6. Are there any common objects I can use to visualize inches and centimeters?

Yes, many everyday objects can help you visualize these measurements. For example, a standard sheet of paper is usually about 21 by 29.7 centimeters (or 8.27 by 11.69 inches). Knowing this can provide a tangible reference point for understanding lengths in both units.

7. What if I need to convert fractions of an inch or centimeter?

Converting fractions can be a bit trickier, but it follows the same principles. You simply apply the conversion factor to each part of the measurement. For example, if you have 3 ½ inches, you would convert 3 inches to centimeters, then add the converted value of ½ inch.