Preparing for the CFA Exam requires a thorough understanding of “Analyzing Statements of Cash Flows I,” a fundamental aspect of financial analysis. Mastery of cash flow classification, assessment of operating, investing, and financing activities, and understanding cash flow implications is essential. This knowledge provides insights into a company’s liquidity, operational efficiency, and financial health, which are crucial for a high CFA score.

Learning Objectives

In studying “Analyzing Statements of Cash Flows I” for the CFA, you should aim to understand the components and purpose of cash flow statements, focusing on their role in financial analysis. Learn how cash flows from operating, investing, and financing activities provide insights into a company’s financial health. Explore the impact of non-cash adjustments, such as depreciation and amortization, on operating cash flow, and examine how changes in working capital reflect operational efficiency. Analyze the importance of cash flow trends in assessing liquidity and solvency. Additionally, assess how cash flow analysis informs investment strategies, credit decisions, and the overall evaluation of a company’s financial sustainability in a competitive market.

Components of Analyzing Statements of Cash Flows I

Analyzing statements of cash flows is essential for understanding a company’s financial health and operations. This analysis provides insight into cash movements across three key areas:

1. Operating Activities

- Represents cash flows directly related to the core business operations.

- Includes cash generated from customer sales, payments to suppliers, and employee wages.

- Key indicators include Net Cash Provided by Operating Activities and Adjustments for Non-Cash Items (depreciation, amortization).

2. Investing Activities

- Covers cash flows from the purchase and sale of long-term assets like equipment and real estate.

- Investing activities can indicate expansion, divestment, or restructuring.

- Critical analysis includes Net Cash Used in Investing Activities and Free Cash Flow (Operating Cash Flow – Capital Expenditures).

3. Financing Activities

- Details cash flows related to financing the company, such as debt issuance, stock repurchase, and dividends.

- Key metrics include Net Cash Used in Financing Activities, Debt Repayment, and Equity Financing.

- Positive cash flow from financing activities can provide the necessary capital for growth initiatives, while consistent dividend payments can enhance shareholder satisfaction and attract investors.

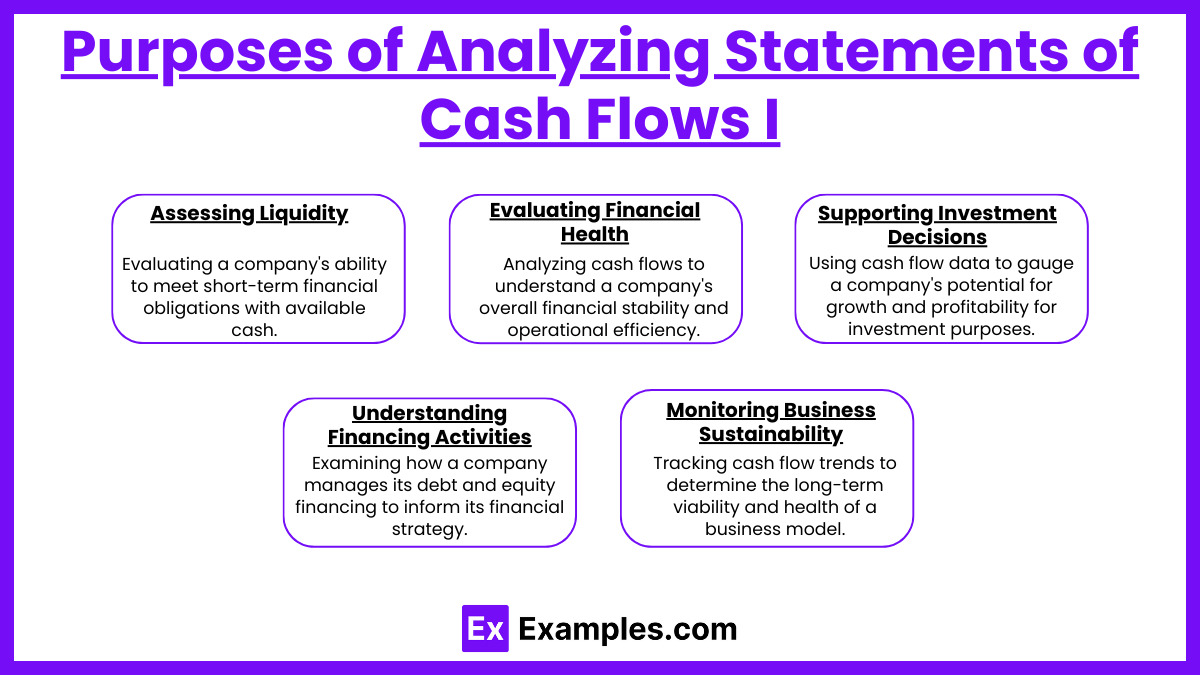

Purposes of Analyzing Statements of Cash Flows I

- Assessing Liquidity

Cash flow analysis helps determine if a company has enough cash to cover its short-term obligations, ensuring it can meet financial commitments. - Evaluating Financial Health

By examining cash flows, stakeholders can identify trends in cash management, understanding if the company generates sufficient cash from its core operations. - Supporting Investment Decisions

Investors use cash flow data to assess a company’s potential for growth and profitability, determining if it is a worthwhile investment. - Understanding Financing Activities

Analyzing financing cash flows reveals how a company manages its debt and equity financing, shedding light on financial strategy and risk. - Monitoring Business Sustainability

Positive cash flow trends suggest a sustainable business model, whereas negative trends may indicate financial stress or the need for improved cash management.

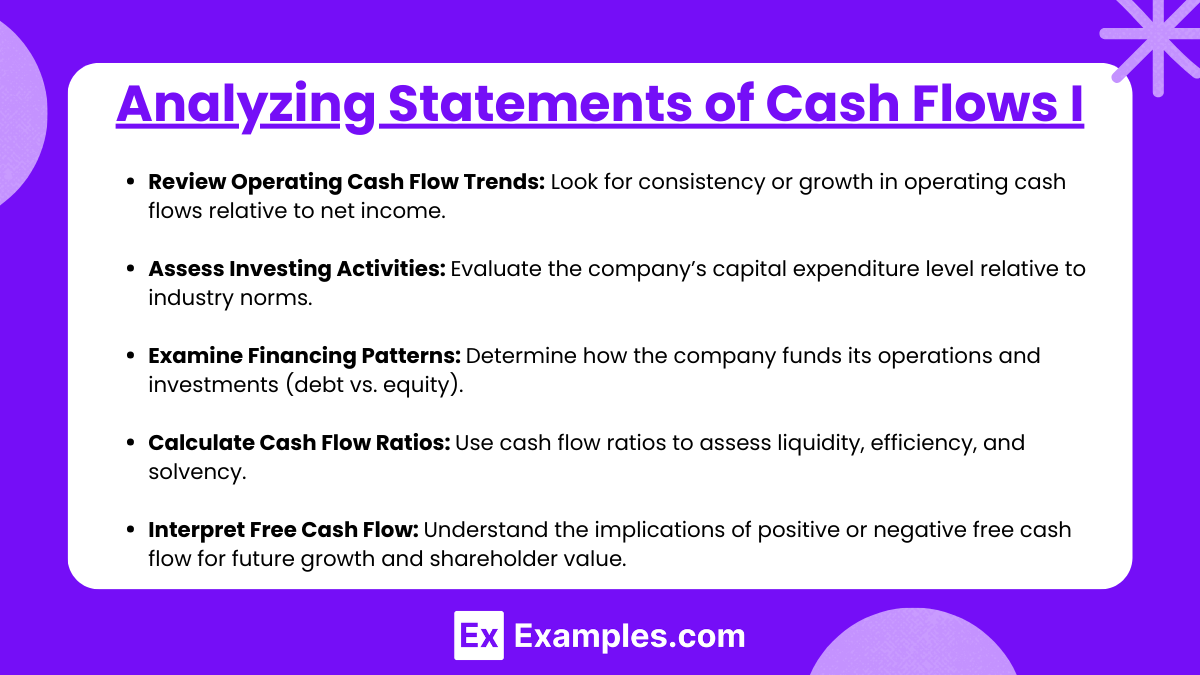

Analyzing Statements of Cash Flows I

- Review Operating Cash Flow Trends: Look for consistency or growth in operating cash flows relative to net income.

- Assess Investing Activities: Evaluate the company’s capital expenditure level relative to industry norms.

- Examine Financing Patterns: Determine how the company funds its operations and investments (debt vs. equity).

- Calculate Cash Flow Ratios: Use cash flow ratios to assess liquidity, efficiency, and solvency.

- Interpret Free Cash Flow: Understand the implications of positive or negative free cash flow for future growth and shareholder value.

Examples

Example 1. Evaluating a Company’s Liquidity Position

One of the primary uses of cash flow analysis is to assess a company’s liquidity. By examining the cash flow from operating activities, analysts can determine whether a company generates enough cash to cover its short-term obligations. For instance, a company with positive and consistent cash flow from operations likely has strong liquidity, suggesting it can meet its immediate expenses, pay salaries, and handle unexpected costs. This assessment is critical for investors and creditors who are interested in the company’s ability to sustain daily operations without relying on additional debt.

Example 2. Assessing Earnings Quality and Stability

Cash flow analysis is also essential for evaluating the quality of a company’s earnings. If operating cash flow aligns closely with net income, it indicates that the company’s earnings are primarily cash-based and less dependent on non-cash items like depreciation or accounting adjustments. This alignment suggests more stable and sustainable earnings, which is appealing to long-term investors. Conversely, a large discrepancy between net income and cash flow may raise questions about the company’s accounting practices or reliance on credit sales, signaling potential financial management issues.

Example 3. Analyzing Capital Expenditure and Growth Plans

Investors use cash flow statements to understand a company’s approach to growth and capital investments. Cash flows from investing activities reveal whether a company is investing in new equipment, technology, or facilities. For example, a company with significant outflows in capital expenditures may be focused on expansion and long-term growth, an attractive sign for growth-oriented investors. Conversely, if a company is generating cash through asset sales, it may indicate restructuring efforts or cash flow constraints, impacting the company’s future growth potential.

Example 4. Understanding Financing Strategies and Debt Management

Financing activities within the cash flow statement provide insight into how a company funds its operations and growth. By analyzing cash inflows and outflows related to debt, equity, and dividends, analysts can assess the company’s financing strategy. For example, a company with large cash inflows from borrowing may be leveraging debt to support operations, which could introduce risk if the debt levels become unsustainable. Alternatively, a company paying significant dividends or repurchasing stock may indicate financial stability and confidence in its cash flow, which can be a positive signal for shareholders.

Example 5. Calculating Free Cash Flow I for Valuation

Free cash flow (FCF), calculated by subtracting capital expenditures from operating cash flow, is a crucial metric for valuation and investment analysis. This figure represents the cash available for reinvestment, debt repayment, or shareholder distributions. For example, positive and growing free cash flow over time is an encouraging sign, showing that the company generates sufficient cash after funding its operations and investments. This information is valuable for analysts when determining a company’s intrinsic value or assessing its ability to support dividends and growth initiatives, helping investors make informed decisions.

Practice Questions

Question 1

Which of the following activities is typically classified under “Operating Activities” in a cash flow I statement?

A. Purchasing new equipment

B. Paying dividends to shareholders

C. Receiving interest income

D. Issuing new shares of stock

Answer: C. Receiving interest income

Explanation: The cash flow I statement is divided into three main categories: Operating, Investing, and Financing activities. Operating activities involve the day-to-day operations that determine net income. This includes cash inflows and outflows from regular business activities like sales revenue, payments to suppliers, and employee wages. Interest income is also considered part of operating activities because it’s linked to the core operational cash flow and affects net income. On the other hand, purchasing new equipment falls under “Investing Activities” (since it involves acquiring long-term assets), while paying dividends and issuing new shares of stock are “Financing Activities.”

Question 2

If a company reports a large positive cash flow I from operating activities but a net loss on its income statement, what might this indicate?

A. The company has high non-cash expenses such as depreciation

B. The company is relying heavily on external financing

C. The company is selling long-term assets to raise cash

D. The company’s dividends exceed its net income

Answer: A. The company has high non-cash expenses such as depreciation

Explanation: A large positive cash flow I from operating activities with a net loss on the income statement often suggests significant non-cash expenses. Depreciation is a non-cash charge that reduces net income on the income statement but does not reduce actual cash. In cash flow analysis, depreciation is added back to net income within operating activities, which can result in a positive cash flow despite a net loss. Options B, C, and D relate to financing and investing cash flows rather than core operational performance and are therefore incorrect.

Question 3

Which of the following would most likely result in a cash outflow in the “Investing Activities” section of a cash flow I statement?

A. Repurchasing shares of the company’s own stock

B. Collecting receivables from customers

C. Purchasing machinery and equipment

D. Paying interest on a loan

Answer: C. Purchasing machinery and equipment

Explanation: “Investing Activities” in the cash flow I statement generally involve transactions for acquiring or selling long-term assets. Purchasing machinery and equipment requires a cash outflow and is classified under investing activities. Repurchasing shares (option A) and paying interest on a loan (option D) are financing activities, as they involve managing the company’s capital structure and servicing debt. Collecting receivables (option B) is an operating activity, as it pertains to the company’s core operations and daily cash management. Thus, only option C is correct as it relates directly to investment in long-term assets.