Easily change gram calories to electronvolts and vice versa with Examples.com. Input your data for instant, precise conversions.

cal to eV

Formula: Energy in Electronvolts (eV) = Energy in Gram Calories (cal) x 2.6114e+19

Gram Calorie :

Electronvolt :

| Gram Calories | Electronvolts |

|---|---|

| 1 | 26114000000000000000 |

eV to Cal

Formula: Energy in Gram Calories (cal) = Energy in Electronvolts (eV) ∕ 2.6114e+19

Electronvolt :

Gram Calorie :

| Electronvolts | Gram Calories |

|---|---|

| 1 | 3.829363559776365e-20 |

Energy Converters to Gram Calorie

Energy Converters to Electronvolt

Conversion Factors:

- Gram Calories to Electronvolts: 1 gram calorie = 2.6114e+19 electronvolts

- Electronvolts to Gram Calories: 1 electronvolt = 3.8267e-20 gram calories

How to Convert Gram Calories to Electronvolts:

To convert gram calories to electronvolts, multiply the number of gram calories by 2.6114e+19.

Electronvolts=Gram Calories×2.6114e+19

Example: Convert 2 gram calories to electronvolts.

Electronvolts=2×2.6114e+19=5.2228e+19 eV

How to Convert Electronvolts to Gram Calories:

To convert electronvolts (eV) to gram calories (cal), you need to use the conversion factor between these two units. The conversion factor is:

Gram Calories=Electronvolts/2.6114e+19

Example: Convert 1e+20 electronvolts to gram calories.

Gram Calories=1e+20 eV/2.6114e+19=3.8267 cal

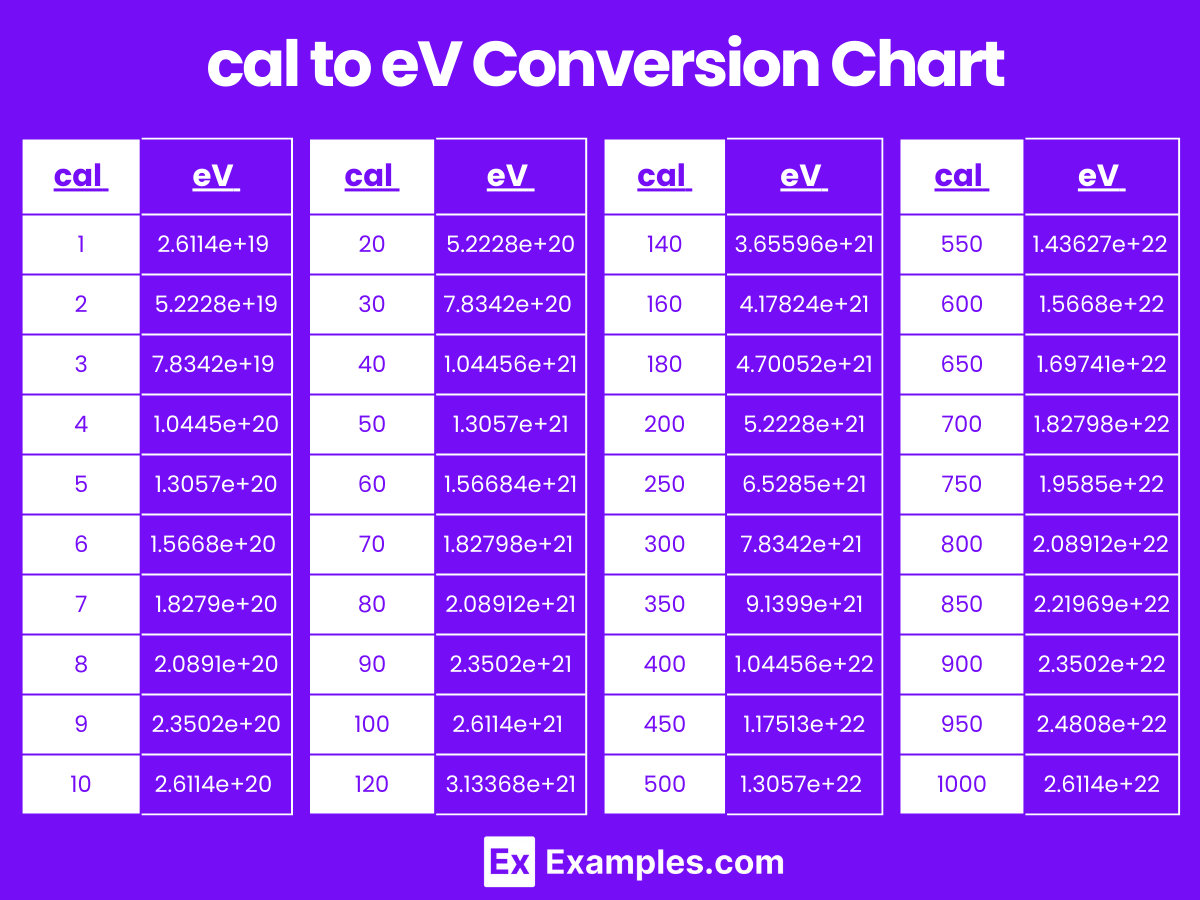

Gram Calorie to Electronvolt Conversion Table

| Gram Calories (cal) | Electronvolts (eV) |

|---|---|

| 1 cal | 2.6114e+19 eV |

| 2 cal | 5.2228e+19 eV |

| 3 cal | 7.8342e+19 eV |

| 4 cal | 1.0445e+20 eV |

| 5 cal | 1.3057e+20 eV |

| 6 cal | 1.5668e+20 eV |

| 7 cal | 1.8279e+20 eV |

| 8 cal | 2.0891e+20 eV |

| 9 cal | 2.3502e+20 eV |

| 10 cal | 2.6114e+20 eV |

| 20 cal | 5.2228e+20 eV |

| 30 cal | 7.8342e+20 eV |

| 40 cal | 1.04456e+21 eV |

| 50 cal | 1.3057e+21 eV |

| 60 cal | 1.56684e+21 eV |

| 70 cal | 1.82798e+21 eV |

| 80 cal | 2.08912e+21 eV |

| 90 cal | 2.3502e+21 eV |

| 100 cal | 2.6114e+21 eV |

cal to eV Conversion Chart

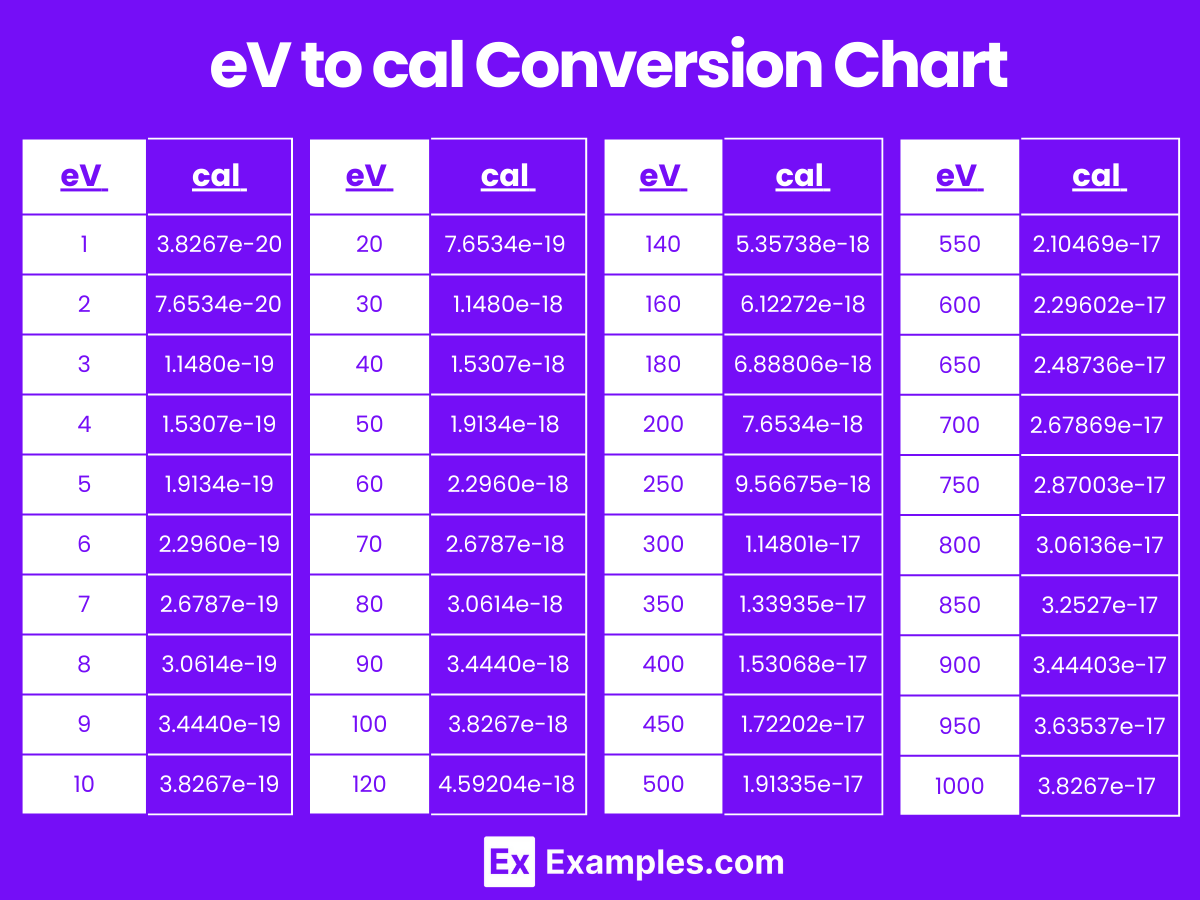

Electronvolt to Gram Calorie Conversion Table

| Electronvolts (eV) | Gram Calories (cal) |

|---|---|

| 1 eV | 3.8267e-20 cal |

| 2 eV | 7.6534e-20 cal |

| 3 eV | 1.1480e-19 cal |

| 4 eV | 1.5307e-19 cal |

| 5 eV | 1.9134e-19 cal |

| 6 eV | 2.2960e-19 cal |

| 7 eV | 2.6787e-19 cal |

| 8 eV | 3.0614e-19 cal |

| 9 eV | 3.4440e-19 cal |

| 10 eV | 3.8267e-19 cal |

| 20 eV | 7.6534e-19 cal |

| 30 eV | 1.1480e-18 cal |

| 40 eV | 1.5307e-18 cal |

| 50 eV | 1.9134e-18 cal |

| 60 eV | 2.2960e-18 cal |

| 70 eV | 2.6787e-18 cal |

| 80 eV | 3.0614e-18 cal |

| 90 eV | 3.4440e-18 cal |

| 100 eV | 3.8267e-18 cal |

eV to cal Conversion Chart

Difference Between Gram Calorie to Electronvolt

| Aspect | Gram Calorie (cal) | Electronvolt (eV) |

|---|---|---|

| Definition | A gram calorie is the amount of energy needed to raise the temperature of 1 gram of water by 1°C. | An electronvolt is the amount of kinetic energy gained or lost by an electron when it is accelerated through an electric potential difference of 1 volt. |

| Symbol | Represented by “cal”. | Represented by “eV”. |

| Conversion Factor | 1 gram calorie = 2.6114e+19 electronvolts. | 1 electronvolt = 3.8267e-20 gram calories. |

| System of Units | Part of the Centimeter-Gram-Second (CGS) system. | Part of the International System of Units (SI) derived units. |

| Common Usage | Used primarily in chemistry and nutrition. | Used mainly in physics, particularly in the study of atomic and particle physics. |

| Magnitude | A gram calorie is a much larger unit of energy compared to an electronvolt. | An electronvolt is a much smaller unit of energy compared to a gram calorie. |

| Measurement Context | Often used to measure food energy and heat energy in small-scale experiments. | Used to measure the energy of particles, such as electrons, in scientific research. |

| Practical Applications | Useful for nutritional labeling and calorimetry. | Essential for understanding and calculating particle behavior and interactions in physics. |

1. Solved Examples on Converting Gram Calorie to Electronvolt

Example 1

Problem: Convert 1 gram calorie to electronvolts.

Solution: Electronvolts=1 cal×2.6114e+19=2.6114e+19 eV

So, 1 gram calorie is approximately 2.6114e+19 electronvolts.

Example 2

Problem: Convert 3 gram calories to electronvolts.

Solution: Electronvolts=3 cal×2.6114e+19=7.8342e+19 eV

Thus, 3 gram calories is approximately 7.8342e+19 electronvolts.

Example 3

Problem: Convert 5 gram calories to electronvolts.

**Solution: Electronvolts=5 cal×2.6114e+19≈1.3057e+20 eV

Therefore, 5 gram calories is approximately 1.3057e+20 electronvolts.

Example 4

Problem: Convert 10 gram calories to electronvolts.

Solution: Electronvolts=10 cal×2.6114e+19≈2.6114e+20 eV

Hence, 10 gram calories is approximately 2.6114e+20 electronvolts.

Example 5

Problem: Convert 0.5 gram calories to electronvolts.

Solution: Electronvolts=0.5 cal×2.6114e+19≈1.3057e+19 eV

So, 0.5 gram calories is approximately 1.3057e+19 electronvolts.

2. Solved Examples on Converting Electronvolt to Gram Calorie

Example 1

Problem: Convert 5e+19 electronvolts to gram calories.

Solution: Gram Calories=5e+19 eV/2.6114e+19=1.914 cal

Example 2

Problem: Convert 1e+20 electronvolts to gram calories.

Solution: Gram Calories=1e+20 eV/2.6114e+19=3.827 cal

Example 3

Problem: Convert 3e+19 electronvolts to gram calories.

Solution: Gram Calories=3e+19 eV/2.6114e+19≈1.149 cal

Example 4

Problem: Convert 2e+20 electronvolts to gram calories.

Solution: Gram Calories=2e+20 eV/2.6114e+19=7.653 cal

Example 5

Problem: Convert 5e+18 electronvolts to gram calories.

Solution: Gram Calories=5e+18 eV/2.6114e+19=0.192 cal

Is there a quick way to estimate gram calories to electronvolts conversion?

A quick way to estimate gram calories to electronvolts conversion is to remember that 1 gram calorie is equal to approximately 2.61e+19 electronvolts, though the exact conversion factor is 2.6114e+19.

Why is it important to convert gram calories to electronvolts?

Converting gram calories to electronvolts is important in physics and chemistry, especially when dealing with atomic and particle energies, as electronvolts are a more convenient unit for measuring small amounts of energy.

Can I use a calculator to convert gram calories to electronvolts?

Yes, you can use a calculator to convert gram calories to electronvolts. Simply multiply the number of gram calories by 2.6114e+19 using the calculator.

Can I use gram calories and electronvolts interchangeably?

No, gram calories and electronvolts cannot be used interchangeably because they are units of energy used in different contexts. Gram calories are often used in chemistry and nutrition, while electronvolts are used in physics.

Are gram calories and electronvolts used in different fields?

Yes, gram calories are commonly used in chemistry and nutrition to measure energy content, while electronvolts are used in physics to measure the energy of particles at the atomic and subatomic level.