Preparing for the CFA Exam requires a comprehensive understanding of “Application of the Code and Standards: Level II,” a crucial component of ethical investment practices. Mastery of ethical decision-making processes, compliance, and professional standards is essential. This knowledge provides insights into responsible conduct, safeguarding market integrity, and ensuring client trust, critical for achieving a high CFA score.

Learning Objective

In studying “Application of the Code and Standards: Level II” for the CFA Exam, you should learn to understand and apply the CFA Institute’s Code of Ethics and Standards of Professional Conduct in complex scenarios and practical cases. Analyze how these standards guide ethical behavior and decision-making in the investment profession. Evaluate real-world applications of ethical principles in areas such as disclosure to clients, duty to employer, and analysis of conflicts of interest. Additionally, explore how adherence to these standards enhances professional credibility and client trust. Apply this knowledge to case studies that simulate ethical dilemmas and compliance challenges faced by finance professionals.

Introduction to Ethics and Professionalism

Ethics and professionalism are foundational concepts that guide behavior and decision-making in various fields, particularly in business and finance. Upholding these principles ensures trust, integrity, and accountability among professionals and within organizations.

Key Concepts of Ethics and Professionalism

- Ethics:

- A set of moral principles that dictate right and wrong behavior.

- Purpose: Promotes fairness, honesty, and respect for others in professional settings.

- Application: Guides decision-making to avoid conflicts of interest, fraud, and unethical practices.

- Professionalism:

- A standard of conduct that emphasizes competence, reliability, and respect in the workplace.

- Purpose: Builds a reputation of trustworthiness and credibility, fostering strong professional relationships.

- Application: Demonstrated through punctuality, quality work, adherence to industry standards, and continuous professional development.

Standards of Professional Conduct

Standards of Professional Conduct outline the principles and behaviors expected of professionals to maintain integrity, trust, and competence in their field. These standards ensure that professionals adhere to ethical guidelines and maintain high levels of performance, fostering a culture of trust and respect.

Key Standards of Professional Conductp:

- Integrity and Honesty

- Professionals must act with honesty, avoiding any actions that could compromise integrity.

- Application: Ensures truthful communication and ethical behavior in all professional interactions.

- Objectivity

- Professionals should make decisions based on unbiased and impartial judgment.

- Application: Avoid conflicts of interest and ensure that personal or external pressures do not affect professional duties.

- Diligence and Competence

- Professionals must carry out their duties with skill, care, and thoroughness.

- Application: Continuously enhance skills and knowledge to remain competent and deliver high-quality work.

- Confidentiality

- Safeguard client or employer information and only use it for appropriate and agreed-upon purposes.

- Application: Avoid unauthorized disclosure or misuse of confidential data.

- Fairness and Respect

- Treat all clients, colleagues, and stakeholders equally and with dignity.

- Application: Ensure that decisions and actions do not discriminate or show favoritism.

- Compliance with Laws and Regulations

- Adhere to all applicable laws, rules, and standards governing professional conduct.

- Application: Maintain awareness of relevant regulations and ensure full compliance in practice.

- Disclosure of Conflicts of Interest

- Identify and disclose any potential or actual conflicts of interest to affected parties.

- Application: Take measures to mitigate conflicts to preserve objectivity and trust.

- Professional Accountability

- Accept responsibility for actions and decisions in the course of professional work.

- Application: Respond transparently to mistakes or errors and make efforts to correct them.

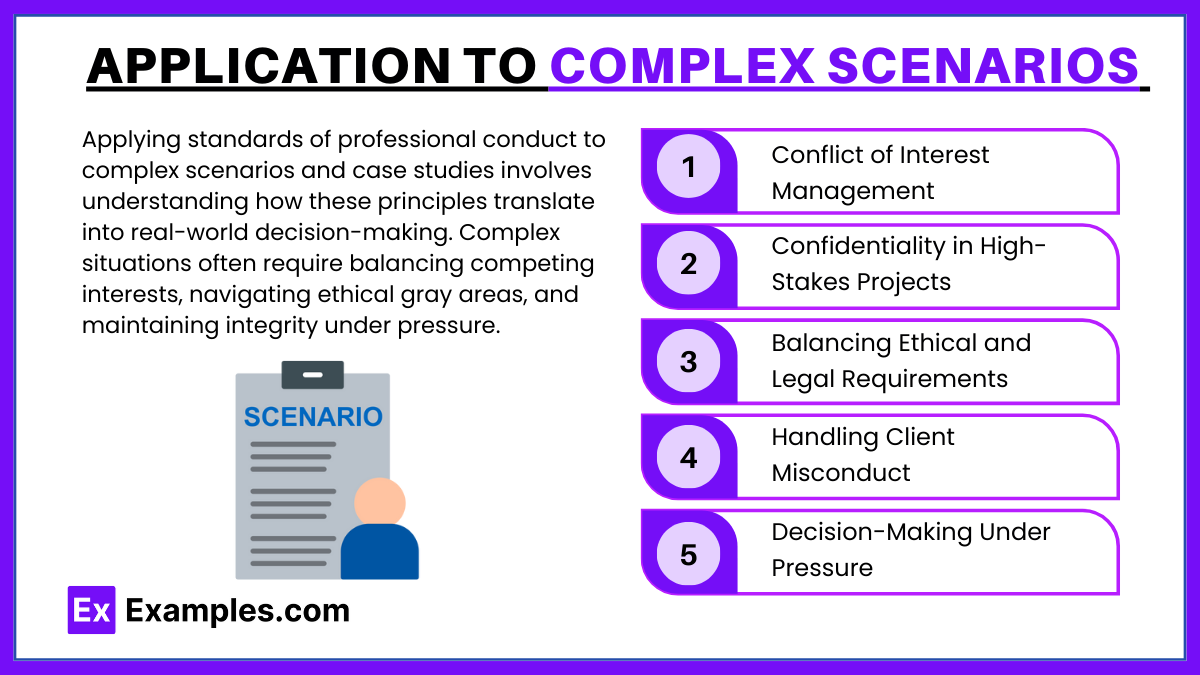

Application to Complex Scenarios

Applying standards of professional conduct to complex scenarios and case studies involves understanding how these principles translate into real-world decision-making. Complex situations often require balancing competing interests, navigating ethical gray areas, and maintaining integrity under pressure. Here’s how professional conduct standards can be applied:

Key Applications in Complex Scenarios

- Conflict of Interest Management

- Scenario: A financial advisor is asked to recommend a new investment product that offers higher commissions.

- Application: The advisor must disclose any potential conflicts of interest and ensure that recommendations prioritize the client’s best interests, maintaining objectivity and transparency.

- Confidentiality in High-Stakes Projects

- Scenario: An executive working on a merger receives insider information about stock price implications.

- Application: The executive must protect this information, avoid using it for personal gain, and ensure that no unauthorized disclosure occurs, following strict confidentiality standards.

- Balancing Ethical and Legal Requirements

- Scenario: A company is under pressure to meet aggressive revenue targets, leading to potential shortcuts or aggressive interpretations of financial regulations.

- Application: Professionals must ensure compliance with both legal and ethical standards, resisting pressure to act in ways that compromise integrity or violate regulations.

- Handling Client Misconduct

- Scenario: A client requests an action that is legal but potentially unethical, such as exploiting a tax loophole.

- Application: The professional must consider the broader ethical implications, advise against actions that compromise ethical conduct, and act in alignment with the values of fairness and integrity.

- Decision-Making Under Pressure

- Scenario: A manager faces pressure to cut costs, which could involve unethical workforce reductions or misrepresentations of company performance.

- Application: The manager should act with diligence, fairness, and respect, ensuring transparent communication with employees and stakeholders while maintaining compliance with ethical standards.

Compliance and Regulatory Considerations

Compliance and regulatory considerations are essential components of maintaining ethical and professional conduct in any industry. Adhering to regulations ensures that organizations operate within legal boundaries, protect stakeholders’ interests, and foster trust in their business practices.

Key Concepts in Compliance and Regulation:

- Compliance:

- Compliance refers to following laws, regulations, and internal policies relevant to an organization’s operations.

- Purpose: Ensures that businesses and professionals adhere to industry standards, mitigating legal and reputational risks.

- Regulatory Considerations:

- Regulatory Bodies: Organizations must comply with rules set by governmental or industry-specific agencies (e.g., SEC, FCA).

- Standards and Codes: Compliance often involves adhering to established codes of conduct and ethical guidelines set by professional organizations.

Examples

Example 1: Conflict of Interest

An investment advisor owns a significant amount of shares in a company that he is also recommending to his clients. The ethical approach requires full disclosure of his holdings to the clients and his employer to manage any potential conflicts of interest.

Example 2: Material Nonpublic Information

A financial analyst receives confidential information that a publicly traded company is about to be acquired. Using this information to trade or making recommendations based on this information would violate the CFA Institute’s standards regarding integrity of capital markets.

Example 3: Duty to Employer

An employee in an asset management firm is planning to leave and start her own firm. Ethically, she must continue to act in her employer’s best interests until her departure and must not solicit her current firm’s clients before leaving, as per her duty of loyalty to her employer.

Example 4: Fair Dealing

A portfolio manager must allocate trades fairly and equitably among clients when a limited investment opportunity arises. Favoring one client over others without a justifiable reason could breach the standard of fair dealing.

Example 5: Professional Misconduct

A CFA charterholder is convicted of driving under the influence of alcohol. While this is a personal legal issue, it could still reflect poorly on the professional’s judgment and integrity, potentially leading to disciplinary action by the CFA Institute if it is deemed to reflect adversely on their professional activities.

Practice Questions

Question 1

Which of the following actions is most likely to be considered a violation of the CFA Institute’s Code of Ethics?

A. Using publicly available earnings data to analyze a stock.

B. Sharing portfolio performance data with a client, excluding the relevant benchmark.

C. Trading securities based on a tip from an unidentified source claiming nonpublic information.

D. Declining a gift from a client that exceeds the normal standards of hospitality.

Answer:

C. Trading securities based on a tip from an unidentified source claiming nonpublic information.

Explanation:

Trading on material nonpublic information or even on a tip that claims to be nonpublic violates the CFA Institute’s Code of Ethics, which demands integrity of capital markets and fair and diligent treatment of all participants. Such actions can undermine trust in the financial markets and the integrity of the investment profession.

Question 2

An investment professional regularly purchases small, non-material amounts of stock for personal accounts shortly before including them in client portfolios. This is likely to:

A. Enhance the investment professional’s credibility by aligning interests with the client.

B. Be permitted if the amounts are not material and disclosed to the employer.

C. Be considered a violation of the duty of loyalty to clients.

D. Have no ethical implications under the CFA Standards.

Answer:

C. Be considered a violation of the duty of loyalty to clients.

Explanation:

This practice, known as “front-running,” is unethical and violates the duty of loyalty to clients. It prioritizes the investment professional’s interests ahead of the clients’ and potentially affects the prices at which clients can execute trades. It is prohibited regardless of the materiality of the amounts involved.

Question 3

A CFA charterholder writes an investment newsletter. In an issue, the charterholder uses performance data from previous years that have not been independently verified but believes to be accurate. According to the CFA Institute’s Standards of Professional Conduct, the charterholder should:

A. Avoid using unverified data under any circumstances.

B. Disclose that the data has not been verified.

C. Use the data as long as it does not differ significantly from verified data.

D. Verify the data before publication to ensure its accuracy and reliability.

Answer:

D. Verify the data before publication to ensure its accuracy and reliability.

Explanation:

The CFA Standards require that members and candidates exercise diligence and thoroughness in making investment recommendations or taking investment actions. Using unverified data can lead to misinformation and potentially harm clients and the integrity of investment decisions. Therefore, it is imperative to verify all data before using it in any client communication or publication, according to the Standard V(A) – Diligence and Reasonable Basis.