Preparing for the CFA Exam requires an understanding of the Asset Manager Code of Professional Conduct, a fundamental framework for maintaining ethical and professional standards in asset management. This code highlights key principles, including loyalty to clients, adherence to legal requirements, diligence, and transparency in investment practices. By following these guidelines, asset managers can prioritize client interests, uphold fiduciary responsibilities, and foster trust in the investment process. Understanding this code helps candidates develop ethical decision-making skills, ensure compliance with industry standards, and strengthen their professional credibility.

Learning Objectives

In studying the Asset Manager Code of Professional Conduct for the CFA, you should aim to understand the fundamental principles and ethical guidelines that govern asset management practices. This framework emphasizes loyalty to clients, compliance with laws, diligence in investment management, and the integrity of reporting and disclosures. Familiarity with these standards ensures that asset managers prioritize client interests, act with transparency, and maintain trust in professional relationships. Grasping these concepts enables you to apply ethical decision-making in diverse scenarios, enhancing your ability to align asset management practices with global industry standards and foster long-term client confidence.

What is Asset Manager Code of Professional Conduct?

The Asset Manager Code of Professional Conduct is a framework of ethical principles for asset managers. It ensures that client interests are placed above all else in investment decisions. The code mandates integrity and fairness in dealing with clients and other stakeholders. Transparency in communication and reporting is a key requirement. Asset managers are expected to act with professionalism and competence at all times. It also includes guidelines for managing conflicts of interest responsibly. Accountability in managing clients’ assets is emphasized to build trust. By following the code, asset managers contribute to a more ethical and responsible financial industry.

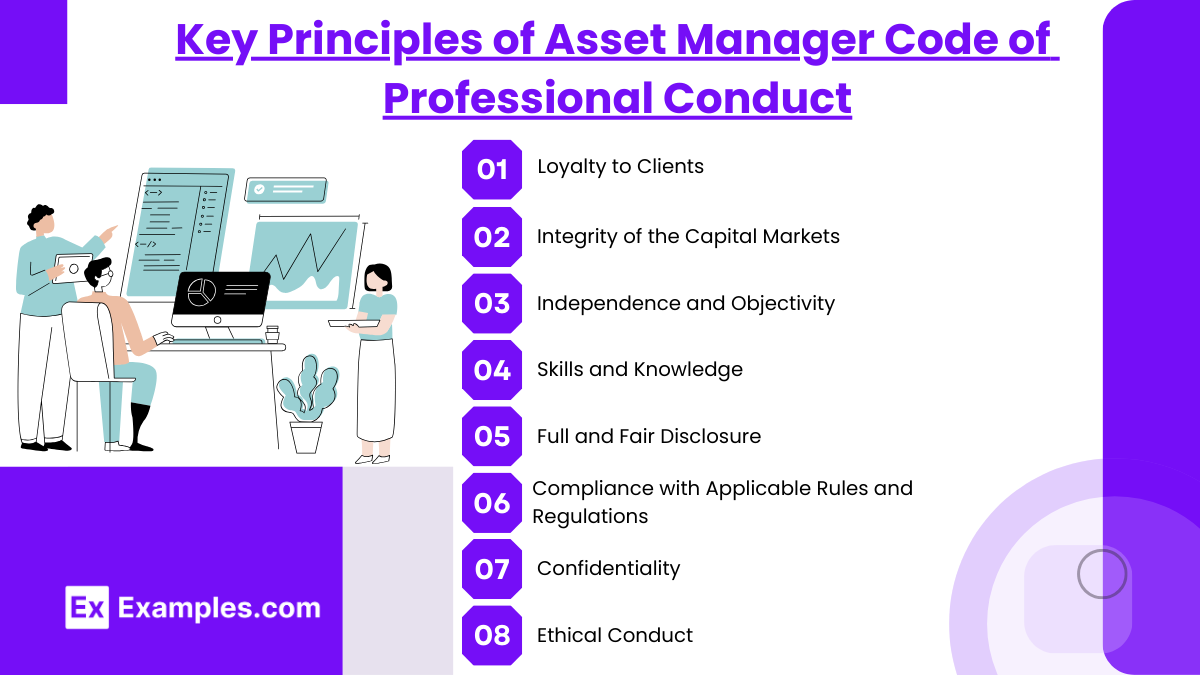

Key Principles of Asset Manager Code of Professional Conduct

The Asset Manager Code of Professional Conduct (AMC) establishes ethical standards for investment professionals and organizations managing client assets. Here are the key principles outlined in the code:

- 1. Loyalty to Clients

Asset managers must prioritize the interests of their clients above their own. This includes acting in good faith, avoiding conflicts of interest, and making decisions solely in the best interest of clients. - 2. Integrity of the Capital Markets

Managers should work to maintain the fairness, transparency, and efficiency of the capital markets. This involves avoiding market manipulation and ensuring accurate dissemination of information. - 3. Independence and Objectivity

Asset managers must make decisions based on objective analysis and judgment, free from outside influences. This entails resisting pressures from clients, employers, or third parties that might compromise decision-making and avoiding conflicts arising from gifts or compensation. - 4. Skills and Knowledge

Managers are expected to maintain and improve their professional skills and knowledge to serve clients effectively. Key practices include staying informed about industry changes and developments and training and mentoring junior professionals. - 5. Full and Fair Disclosure

Transparency is crucial. Asset managers must disclose all relevant information to clients, including investment processes and risks, conflicts of interest, and fees and costs associated with managing assets. - 6. Compliance with Applicable Rules and Regulations

Adhering to legal and regulatory requirements in the jurisdictions where they operate is mandatory. Asset managers must understand and comply with all applicable laws and establish policies to monitor compliance. - 7. Confidentiality

Managers must protect client information and use it solely for the intended purpose. This means avoiding disclosure of sensitive data unless required by law and ensuring internal processes safeguard client confidentiality. - 8. Ethical Conduct

Managers should uphold the highest standards of honesty, fairness, and integrity. This principle encompasses avoiding any deceptive or unethical practices and acting as role models for ethical behavior within their organizations.

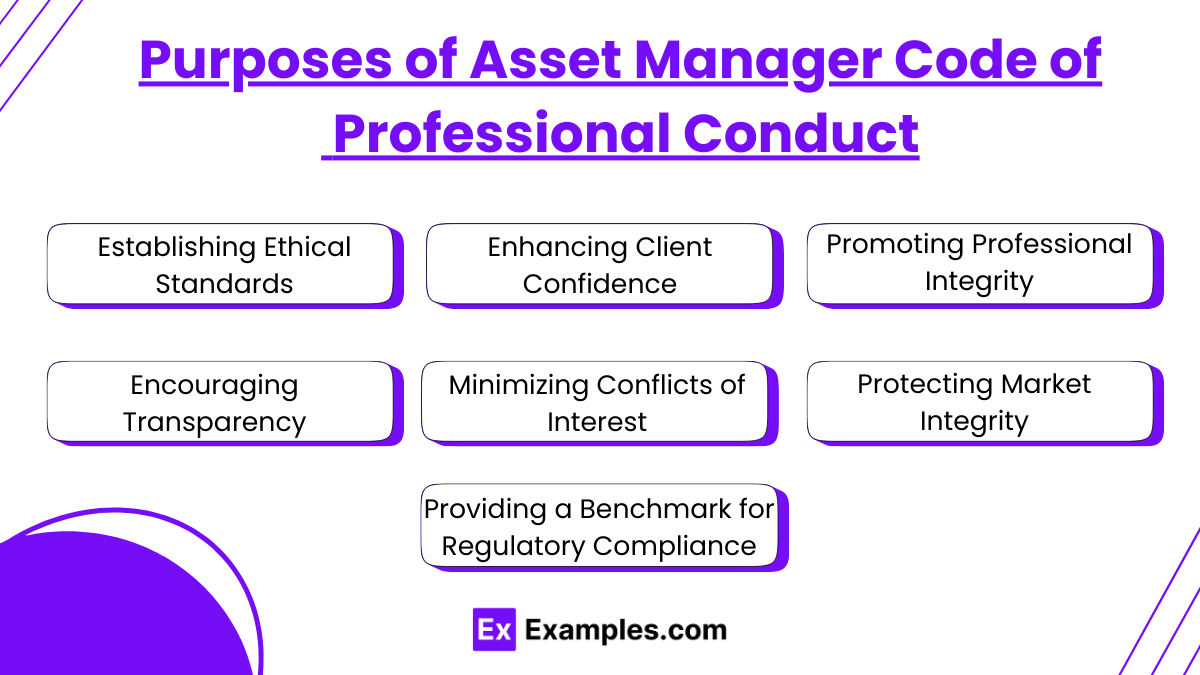

Purposes of Asset Manager Code of Professional Conduct

The Asset Manager Code of Professional Conduct serves several critical purposes aimed at promoting ethical behavior and ensuring the integrity of asset management practices. Here are the key purposes:

1. Establishing Ethical Standards

- Provides a globally recognized framework of ethical principles for asset managers.

- Encourages trust between asset managers and their clients through adherence to high ethical standards.

2. Enhancing Client Confidence

- Ensures clients that their interests are prioritized over the asset manager’s own interests.

- Builds confidence in the fairness and transparency of investment management practices.

3. Promoting Professional Integrity

- Sets expectations for professionalism and integrity in managing assets.

- Encourages asset managers to act with diligence, competence, and respect for the law.

4. Encouraging Transparency

- Requires full and fair disclosure of fees, risks, and conflicts of interest.

- Ensures that clients are well-informed about the management of their assets.

5. Minimizing Conflicts of Interest

- Guides asset managers in identifying and managing potential conflicts of interest.

- Reinforces fiduciary responsibilities and accountability.

6. Protecting Market Integrity

- Promotes fair competition and ethical practices within the asset management industry.

- Reduces the likelihood of fraudulent or manipulative activities.

7. Providing a Benchmark for Regulatory Compliance

- Serves as a reference point for regulators and industry stakeholders.

- Assists firms in aligning their internal policies with recognized ethical standards.

Examples

Example 1. Establishing Ethical Guidelines

Asset management firms implement the Asset Manager Code of Professional Conduct to define a robust framework of ethical behavior for their employees. By adhering to this code, firms ensure that all professionals act with integrity, transparency, and fairness while handling client funds, building a reputation for trustworthiness in the industry.

Example 2. Promoting Client Interest

The code emphasizes placing client interests above personal or organizational gains. Asset managers use these principles to ensure all decisions, from investment selection to portfolio management, are aligned with the financial goals and risk tolerances of their clients, fostering long-term relationships and loyalty.

Example 3. Ensuring Compliance and Transparency

By using the Asset Manager Code of Professional Conduct, firms establish policies that comply with legal and regulatory standards. This includes clear reporting practices and full disclosure of fees, conflicts of interest, and investment risks, helping clients make informed decisions.

Example 4. Enhancing Governance

The code provides a foundation for robust governance structures within asset management firms. It is used to outline responsibilities for oversight, ensure accountability at all organizational levels, and manage risks effectively, which contributes to sustainable business practices and client confidence.

Example 5. Building Industry Credibility

Asset management firms adopt the Asset Manager Code of Professional Conduct to showcase their commitment to professional standards. This adherence enhances their credibility in the marketplace, attracting investors and stakeholders who value ethical and responsible financial practices.

Practice Questions

Question 1

Which of the following is a primary goal of the Asset Manager Code of Professional Conduct?

A. Maximizing profits for the asset management firm

B. Protecting the interests of clients above all else

C. Promoting aggressive marketing practices

D. Reducing competition within the financial industry

Correct Answer: B. Protecting the interests of clients above all else

Explanation:

The Asset Manager Code of Professional Conduct emphasizes placing the interests of clients above the firm’s or the manager’s personal interests. This ensures ethical practices, transparency, and trust between asset managers and their clients, which are foundational principles of the code. It is not about profit maximization or reducing competition, which are contrary to its ethical focus.

Question 2

What is the most critical element of the disclosure requirements outlined in the Asset Manager Code of Professional Conduct?

A. Concealing conflicts of interest

B. Providing clear and accurate information about fees and risks

C. Hiding poor performance to maintain client trust

D. Avoiding discussions about legal compliance

Correct Answer: B. Providing clear and accurate information about fees and risks

Explanation:

The code requires asset managers to fully disclose all relevant information, including fees, risks, and potential conflicts of interest. Transparency allows clients to make informed decisions and trust the asset manager’s practices. Concealing or avoiding key information would violate the ethical and professional standards of the code.

Question 3

How does the Asset Manager Code of Professional Conduct promote compliance with legal and regulatory standards?

A. By allowing firms to interpret laws subjectively

B. By requiring managers to follow a code that exceeds minimum legal requirements

C. By focusing solely on ethical guidelines without addressing legal compliance

D. By reducing the importance of governance structures

Correct Answer: B. By requiring managers to follow a code that exceeds minimum legal requirements

Explanation:

The Asset Manager Code of Professional Conduct is designed to encourage firms to not only comply with legal and regulatory standards but also to adopt practices that exceed these minimum requirements. This proactive approach ensures better governance, accountability, and ethical conduct in the asset management industry. It does not suggest a reduction in governance or subjective interpretation of laws.