Preparing for the CFA Exam requires a solid grasp of Backtesting and Simulation, essential tools for evaluating the effectiveness of trading strategies and risk models. Mastery of these techniques helps assess model performance, forecast potential outcomes, and refine investment strategies, enhancing risk management capabilities and optimizing portfolio performance for CFA success.

Learning Objective

In studying “Backtesting and Simulation” for the CFA Exam, you should learn to evaluate the performance and reliability of trading strategies and risk models. Understand the process of comparing historical data against model predictions to assess accuracy and identify weaknesses. Analyze the use of simulation techniques, such as Monte Carlo simulation, to predict potential outcomes and stress test strategies under varying market conditions. Evaluate key principles of backtesting methodologies, including data integrity, sample selection, and statistical robustness. Additionally, explore applications of these tools for improving risk management, portfolio optimization, and investment decision-making in both real-world and theoretical contexts.

Introduction to Backtesting

Backtesting is a critical process used to evaluate the effectiveness of trading strategies and risk models by comparing their predictions or decisions against historical market data. The goal of backtesting is to assess how well a strategy or model would have performed in the past, providing insights into its reliability and potential for future success. By simulating historical scenarios, financial professionals can identify strengths and weaknesses, optimize strategies, and improve risk management practices.

- Purpose and Importance of Backtesting: Backtesting allows financial institutions and investors to validate predictive accuracy and assess the reliability of trading strategies, ensuring they align with market dynamics and regulatory requirements.

- Common Backtesting Approaches: Techniques like walk-forward testing and dividing data into in-sample and out-of-sample sets are used to evaluate strategy performance without overfitting.

- Limitations and Challenges: Issues such as data overfitting, data-snooping bias, and ensuring data integrity can hinder the reliability of backtesting results, requiring careful consideration.

- Walk-Forward Testing: This approach involves testing strategies on a rolling basis to ensure that the model adapts to changing market conditions over time.

- In-Sample vs. Out-of-Sample Data: Models are trained on in-sample data and validated on out-of-sample data to reduce biases and evaluate their robustness.

- Overfitting Concerns: When a model is too closely fitted to past data, it may fail to generalize to future conditions, leading to poor real-world performance.

Simulation Techniques

Simulation techniques are used to model and analyze potential future outcomes of financial strategies by creating various scenarios that represent different market conditions. These techniques allow for a more comprehensive assessment of risk and performance by incorporating randomness, stress-testing portfolios, and predicting distributions of returns. Simulations help financial professionals and institutions understand how portfolios or strategies may perform under a range of possible market scenarios, enhancing their ability to manage risk and make informed decisions.

- Monte Carlo Simulation: This technique generates thousands of random outcomes based on statistical distributions to model potential future returns. Monte Carlo simulations help estimate the probability of various portfolio performance scenarios, making it a powerful tool for risk assessment.

- Scenario Analysis: This approach involves creating hypothetical scenarios, such as market crashes or rapid interest rate changes, to evaluate how portfolios would perform under these conditions. It provides valuable insights into vulnerabilities and potential impacts.

- Stress Testing: Stress tests simulate extreme or adverse market events, such as financial crises, to measure a portfolio’s resilience. This helps identify potential weaknesses and prepares financial institutions for market shocks.

- Stochastic Modeling: These models incorporate randomness and varying inputs to simulate real-world financial behavior. They are used to predict the probability distributions of outcomes, accounting for market uncertainty.

- Risk Management Applications: Simulations are widely used in portfolio risk management to assess the likelihood of different outcomes, optimize asset allocation, and refine hedging strategies.

- Historical vs. Hypothetical Scenarios: Simulations can be based on historical market data or hypothetical scenarios, providing flexibility in assessing a wide range of potential risks and outcomes.

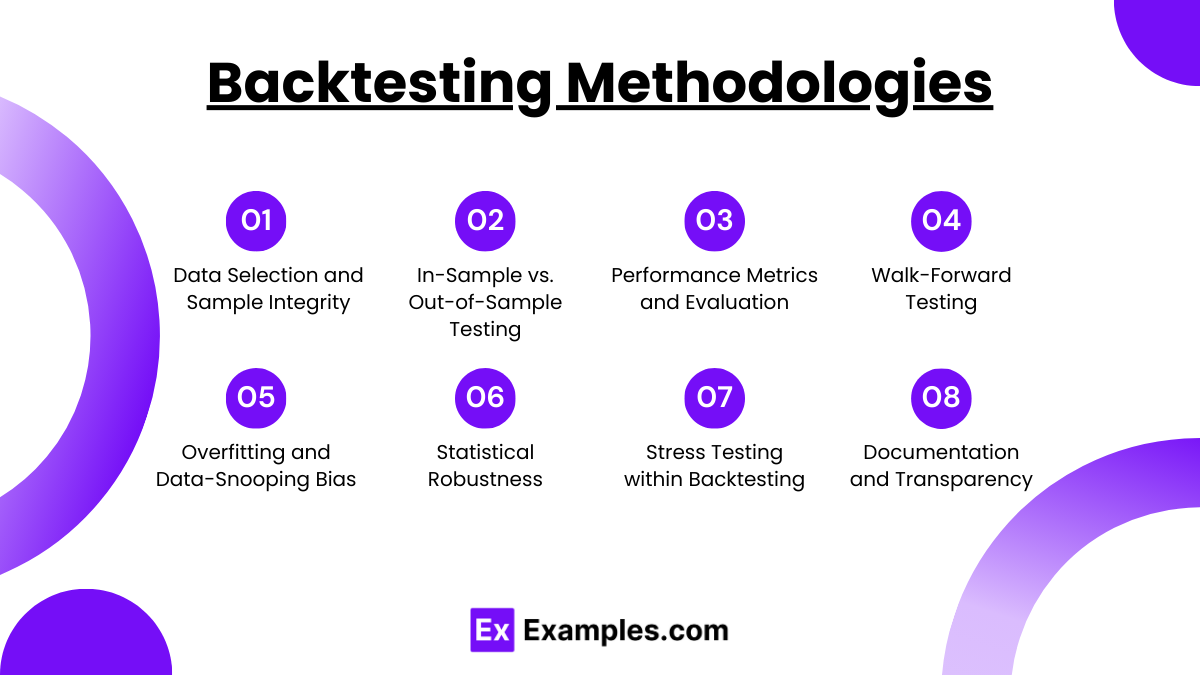

Backtesting Methodologies

Backtesting methodologies are essential for evaluating the effectiveness of financial models and strategies by applying them to historical data. The goal is to determine how well a model would have performed in the past to predict its future success. Effective backtesting requires careful data selection, evaluation metrics, and statistical robustness to ensure reliable results, helping financial professionals refine strategies and improve risk management practices.

- Data Selection and Sample Integrity: High-quality and relevant data sets are critical for accurate backtesting. Splitting data into in-sample (for model training) and out-of-sample (for validation) helps prevent overfitting and ensures unbiased performance evaluation.

- In-Sample vs. Out-of-Sample Testing: Models are typically trained using in-sample data and then tested on out-of-sample data to validate their predictive power and robustness. This approach minimizes the risk of overfitting.

- Performance Metrics and Evaluation: Various metrics are used to assess model performance, including accuracy, precision, risk-adjusted returns, drawdowns, and volatility. These metrics provide insights into the model’s effectiveness and risk profile.

- Walk-Forward Testing: This technique tests strategies on a rolling basis using updated data to adapt to changing market conditions. It ensures that models remain relevant and effective over time.

- Overfitting and Data-Snooping Bias: Overfitting occurs when a model is too closely fitted to historical data, leading to poor performance in future scenarios. Data-snooping bias arises when excessive testing on the same data set results in artificially inflated performance metrics.

- Statistical Robustness: Ensuring statistical robustness in backtesting requires careful validation of results, addressing biases, and evaluating statistical significance. This helps build confidence in model performance.

- Stress Testing within Backtesting: Incorporating stress tests during backtesting can help assess how a model performs under extreme conditions, providing an additional layer of risk evaluation.

- Documentation and Transparency: Clear documentation of the backtesting methodology, data sources, assumptions, and limitations is critical for reproducibility and transparency, enhancing credibility and compliance with regulatory standards.

Applications and Practical Considerations

The applications and practical considerations of backtesting and simulation extend beyond mere model validation to encompass real-world portfolio optimization, risk management enhancements, and regulatory compliance. By applying these methodologies, financial institutions and investors can optimize their decision-making processes, mitigate risk exposure, and meet regulatory standards. Practical considerations ensure that backtesting and simulations are executed effectively and meaningfully.

- Risk Management Enhancements: Backtesting helps refine models to minimize market risk exposure, identify weaknesses in strategies, and implement appropriate mitigation techniques to better withstand adverse market movements.

- Portfolio Optimization: By analyzing historical and simulated data, portfolio managers can identify optimal asset allocation strategies, improving overall portfolio performance and achieving a balance between risk and return.

- Improving Strategy Robustness: Through the use of backtesting and simulation, investors can evaluate how strategies perform under different market conditions, including downturns, providing greater confidence in their robustness and adaptability.

- Compliance with Regulatory Standards: Accurate and transparent backtesting methodologies help ensure adherence to industry and regulatory standards, such as those set forth by Basel and other financial oversight bodies, enhancing market stability.

- Transparent Reporting and Documentation: Clearly documenting the results, assumptions, and limitations of backtesting exercises improves the credibility of models and strategies, making them more defensible to stakeholders and regulators.

- Hedging Strategy Evaluation: Simulations allow for testing different hedging strategies under varied market conditions, ensuring they effectively reduce exposure to undesirable risks without excessive costs.

- Identifying Data Limitations: Practical considerations include recognizing data quality, availability, and relevance, as these directly impact the reliability and accuracy of backtesting results.

- Cost and Resource Management: Implementing robust backtesting and simulations requires significant computational resources and expertise. Ensuring cost-effective deployment while maintaining methodological rigor is a critical practical consideration for institutions.

Examples

Example 1: Backtesting a Trading Strategy

A quantitative trader develops a trading algorithm based on moving average crossovers. To validate its effectiveness, the strategy is backtested against historical market data for the past five years. This evaluation reveals periods of profitability, drawdowns, and overall performance, helping the trader refine or discard the strategy based on its historical results.

Example 2: Monte Carlo Simulation for Portfolio Risk

A portfolio manager uses Monte Carlo simulation to model a portfolio’s potential future performance by generating thousands of random outcomes based on asset returns’ historical volatility and correlations. This approach helps estimate the probability distribution of returns, assess potential risks, and optimize portfolio allocation strategies.

Example 3: Stress Testing a Bank’s Loan Portfolio

A bank conducts stress tests on its loan portfolio to simulate the impact of severe economic downturns, such as a sharp rise in unemployment or a significant drop in real estate values. These tests identify vulnerabilities in the bank’s balance sheet, enabling proactive risk mitigation strategies to ensure financial stability.

Example 4: Scenario Analysis for Interest Rate Risk

A fixed-income manager uses scenario analysis to assess how changes in interest rates (e.g., a 2% increase) could impact bond holdings. By modeling the effects of different interest rate movements, the manager identifies potential risks and makes adjustments, such as hedging with interest rate swaps, to mitigate exposure.

Example 5: Validating a Risk Model for Regulatory Compliance

A financial institution uses backtesting to validate its internal risk model, which predicts potential losses. By comparing predicted results with actual historical data, the institution demonstrates the model’s accuracy and robustness to regulatory authorities, ensuring compliance with Basel framework requirements and enhancing trust with stakeholders.

Practice Questions

Question 1

Which of the following best describes the purpose of backtesting in financial modeling?

A. To determine the future profitability of a model.

B. To evaluate a model’s performance using historical data.

C. To increase the risk associated with a trading strategy.

D. To simulate future market scenarios.

Answer: B. To evaluate a model’s performance using historical data.

Explanation:

Backtesting involves testing a model or trading strategy against historical data to assess its performance. This process helps determine how well a strategy would have worked in the past and gives insights into its potential effectiveness. It does not predict future profitability but helps improve the model by identifying past weaknesses.

Question 2

Which simulation technique involves generating a wide range of possible outcomes based on random sampling from historical data?

A. Scenario Analysis

B. Sensitivity Analysis

C. Monte Carlo Simulation

D. Backtesting

Answer: C. Monte Carlo Simulation

Explanation:

Monte Carlo Simulation generates multiple outcomes by repeatedly sampling from statistical distributions, allowing for the modeling of a wide range of potential future results. This technique is widely used to assess portfolio risk and predict the probability of various scenarios. Unlike backtesting, it focuses on forecasting based on random sampling.

Question 3

In backtesting, which of the following is a common approach to avoid overfitting?

A. Using the entire dataset without any division.

B. Splitting the dataset into in-sample and out-of-sample segments.

C. Relying only on hypothetical data.

D. Ignoring model assumptions.

Answer: B. Splitting the dataset into in-sample and out-of-sample segments.

Explanation:

Splitting data into in-sample (for model training) and out-of-sample (for testing) helps prevent overfitting by ensuring the model isn’t overly tailored to historical data. This approach provides a realistic evaluation of the model’s ability to perform in unseen scenarios, making it a critical step in backtesting methodologies.