Preparing for the CFA Exam requires a comprehensive understanding of “Basics of Portfolio Planning & Construction,” a foundational element of investment management. Mastery of portfolio objectives, asset allocation, and diversification strategies is essential. This knowledge enables informed portfolio construction that aligns with client goals and risk tolerance, critical for achieving a high CFA score.

Learning Objective

In studying “Basics of Portfolio Planning & Construction” for the CFA Exam, you should aim to understand the foundational principles of building investment portfolios. Analyze how to establish client objectives, including return expectations, risk tolerance, and investment constraints, through a structured process. Evaluate core concepts such as asset allocation, diversification, and the importance of aligning portfolios with client goals. Additionally, explore the role of investment policy statements (IPS) in guiding portfolio decisions and maintaining consistency. Apply this knowledge to construct well-balanced portfolios that meet varied client needs and adapt to changing market conditions, enhancing your proficiency for the CFA Exam.

Introduction to Portfolio Planning & Construction

Portfolio planning and construction is the process of creating an investment portfolio tailored to an investor’s financial goals, risk tolerance, and time horizon. It involves strategic decisions to optimize returns and manage risk while staying aligned with the investor’s unique objectives. Here’s an overview of the key components:

- Understanding Investor Goals: The first step is identifying the investor’s financial goals, such as capital growth, income generation, or wealth preservation, to guide the portfolio’s design.

- Assessing Risk Tolerance: Evaluating how much risk the investor is willing and able to take, considering their financial situation, investment experience, and personal comfort with market fluctuations.

- Defining Asset Allocation: Deciding the proportion of investments across asset classes (e.g., stocks, bonds, real estate) based on the investor’s objectives and risk tolerance, which is a critical driver of portfolio performance.

- Diversification: Selecting a mix of assets within each asset class to reduce risk, ensuring the portfolio isn’t overly dependent on any single investment or sector.

- Security Selection: Choosing individual securities (stocks, bonds, funds) based on analysis and expected performance, aligning with the broader asset allocation strategy.

- Regular Monitoring and Rebalancing: Periodically reviewing the portfolio to ensure it remains aligned with goals, and adjusting as necessary to respond to market changes or shifts in the investor’s financial situation.

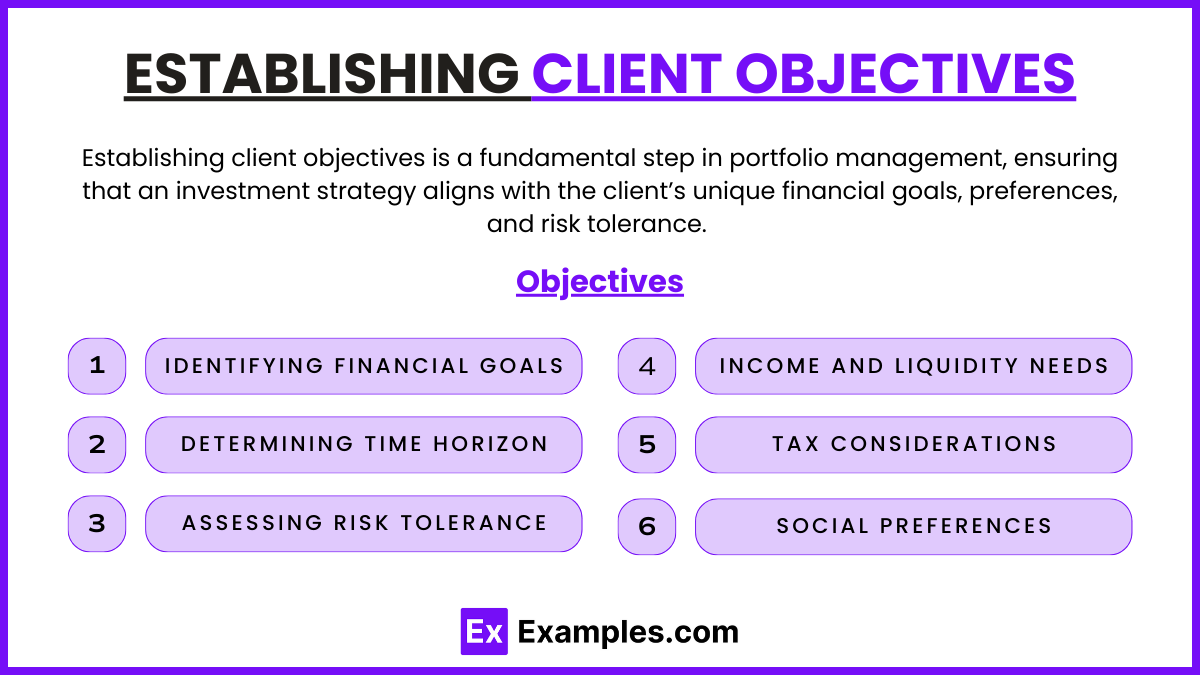

Establishing Client Objectives

Establishing client objectives is a fundamental step in portfolio management, ensuring that an investment strategy aligns with the client’s unique financial goals, preferences, and risk tolerance. Here’s a structured approach:

- Identifying Financial Goals:

- Clarify what the client aims to achieve, such as retirement savings, wealth preservation, income generation, or funding major life events.

- Define specific, measurable goals to guide the investment strategy effectively.

- Determining Time Horizon:

- Assess the client’s investment timeline, distinguishing between short-term (1-3 years), medium-term (3-10 years), and long-term (10+ years) goals.

- The time horizon influences asset allocation decisions, with longer horizons often supporting more growth-oriented investments.

- Assessing Risk Tolerance:

- Understand the client’s willingness and capacity to accept risk, which varies based on financial situation, investment experience, and personal comfort with market fluctuations.

- Use risk assessments or questionnaires to objectively gauge risk tolerance.

- Income and Liquidity Needs:

- Determine if the client requires regular income from their portfolio or needs liquidity for unexpected expenses.

- Income needs can shape the choice of income-generating assets like bonds or dividend stocks.

- Tax Considerations:

- Understand the client’s tax situation to select tax-efficient investments, especially for high-net-worth individuals where tax impact is significant.

- Use strategies like tax-loss harvesting or placing tax-efficient assets in taxable accounts.

- Ethical or Social Preferences:

- Discuss any preferences for socially responsible or ESG (Environmental, Social, Governance) investing if the client wishes to align their investments with personal values.

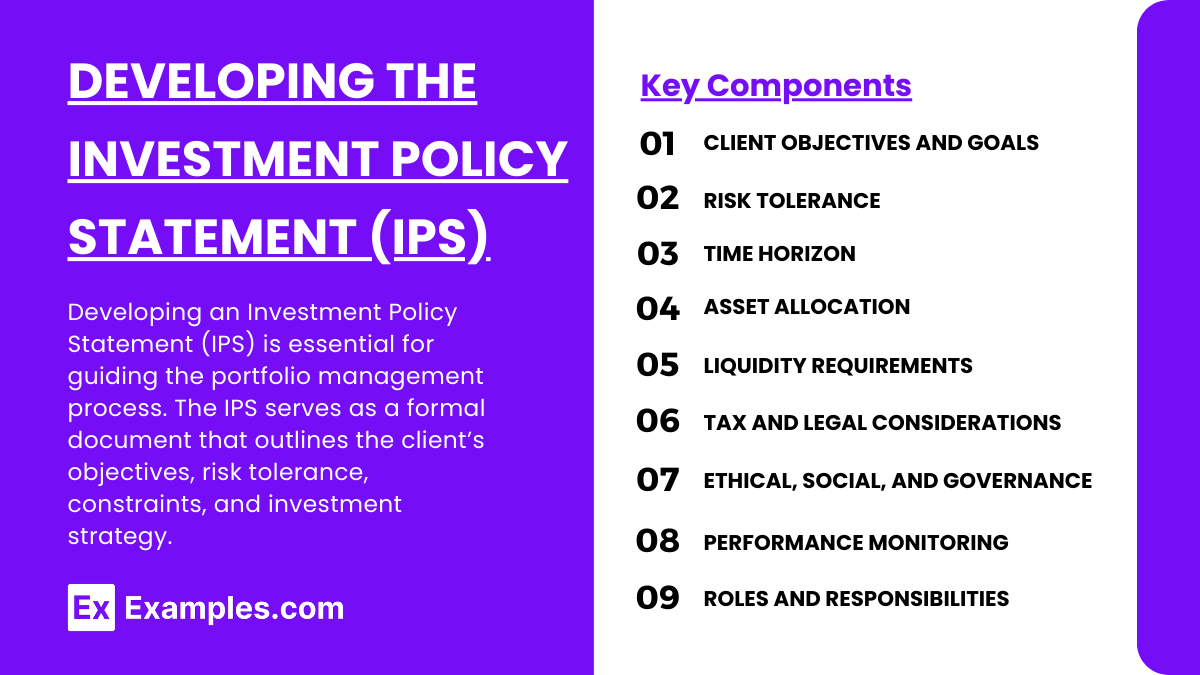

Developing the Investment Policy Statement (IPS)

Developing an Investment Policy Statement (IPS) is essential for guiding the portfolio management process. The IPS serves as a formal document that outlines the client’s objectives, risk tolerance, constraints, and investment strategy. Here are the key components of an IPS:

- Client Objectives and Goals:

- Clearly state the client’s financial goals, such as capital growth, income generation, or wealth preservation.

- Define specific, measurable objectives with target returns that align with the client’s time horizon and risk profile.

- Risk Tolerance:

- Describe the client’s risk tolerance, combining both willingness (personal comfort) and capacity (financial ability) to accept risk.

- Include any agreed-upon limits for volatility or maximum loss to clarify acceptable levels of risk.

- Time Horizon:

- Specify the investment time horizon(s), such as short-term, medium-term, or long-term, as it impacts asset allocation and investment strategy.

- For multiple objectives with different horizons, define separate strategies if needed.

- Asset Allocation and Diversification Strategy:

- Outline the target asset allocation across various asset classes (e.g., stocks, bonds, real estate) based on risk tolerance and goals.

- Include guidelines on rebalancing frequency and thresholds to maintain the desired allocation over time.

- Liquidity Requirements:

- Detail any liquidity needs, such as cash flow for income or emergency reserves, and consider these requirements in the asset selection process.

- Tax and Legal Considerations:

- Address any tax-efficient strategies or legal constraints, especially relevant for high-net-worth clients or specific account types (e.g., retirement accounts).

- Define approaches for minimizing tax impacts, like tax-loss harvesting or holding certain assets in tax-advantaged accounts.

- Ethical, Social, and Governance (ESG) Preferences:

- Note any ESG or socially responsible investing preferences if the client wishes to avoid certain industries or prioritize sustainable investments.

- Performance Monitoring and Review:

- Establish criteria for evaluating portfolio performance against benchmarks and review frequency (e.g., quarterly, annually).

- Outline when adjustments should be made, such as in response to changes in market conditions or client circumstances.

- Roles and Responsibilities:

- Clarify the roles of the client, portfolio manager, and any other involved parties, specifying who is responsible for decision-making and communication.

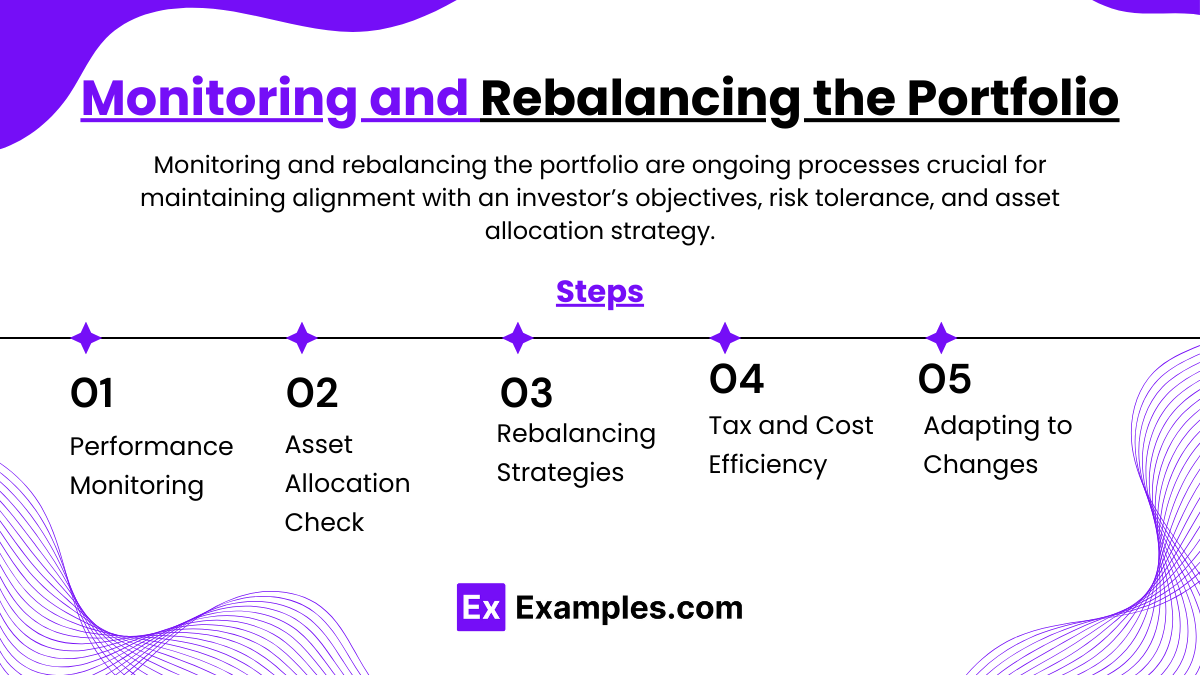

Monitoring and Rebalancing the Portfolio

Monitoring and rebalancing the portfolio are ongoing processes crucial for maintaining alignment with an investor’s objectives, risk tolerance, and asset allocation strategy. Here’s a breakdown of these steps:

- Performance Monitoring: Regularly track returns and compare against benchmarks to assess performance and ensure risk levels remain acceptable.

- Asset Allocation Check: Identify deviations from the target allocation, monitoring thresholds to determine when adjustments are needed.

- Rebalancing Strategies:

- Calendar-Based: Rebalance at set intervals (e.g., annually).

- Threshold-Based: Adjust only when asset weights exceed specified limits.

- Hybrid Approach: Review regularly but rebalance only if significant deviations occur.

- Tax and Cost Efficiency: Minimize tax impacts by rebalancing within tax-advantaged accounts and managing transaction costs.

- Adapting to Changes: Adjust for client life changes (e.g., retirement) or market conditions to keep the portfolio aligned with goals.

Examples

Example 1: Creating an Investment Policy Statement (IPS) for a High-Net-Worth Individual

- Develop an IPS for a high-net-worth individual focused on capital growth and tax efficiency. Outline specific return goals, risk tolerance, and investment constraints, illustrating how the IPS guides the portfolio’s asset allocation and risk management.

Example 2: Strategic Asset Allocation for a Long-Term Growth Portfolio

- Design a strategic asset allocation for a young investor with a high risk tolerance and long investment horizon. Explain the choice of equities, alternative investments, and low fixed-income exposure, considering the client’s goal for long-term capital appreciation.

Example 3: Diversifying a Portfolio to Reduce Unsystematic Risk

- Explore how to build a diversified portfolio across various asset classes, including stocks, bonds, real estate, and commodities. Analyze the role of correlation in selecting non-correlated assets, demonstrating how diversification can lower unsystematic risk and enhance portfolio stability.

Example 4: Implementing a Core-Satellite Portfolio for a Moderate-Risk Investor

- Construct a core-satellite portfolio for a moderate-risk investor by creating a stable core of index funds and adding satellite positions in sectors with high growth potential. Discuss how this approach balances stability with opportunities for enhanced returns.

Example 5: Rebalancing a Portfolio in Response to Market Conditions

- Demonstrate the process of rebalancing a portfolio after a market rally that caused equities to exceed target allocation. Explain different rebalancing techniques, such as selling a portion of the over-weighted asset class and reinvesting in under-weighted ones, to maintain alignment with the IPS.

Practice Questions

Question 1

What is the primary purpose of an Investment Policy Statement (IPS) in portfolio management?

A. To outline the economic outlook and market predictions

B. To document the portfolio manager’s investment preferences

C. To formalize the client’s investment goals, risk tolerance, and constraints

D. To set specific short-term trading strategies

Answer:

C. To formalize the client’s investment goals, risk tolerance, and constraints

Explanation:

An Investment Policy Statement (IPS) serves as a guiding document for portfolio management by formalizing the client’s objectives, risk tolerance, and constraints. This ensures that the portfolio is managed consistently with the client’s financial goals and provides a reference for decision-making and performance evaluation.

Question 2

Which asset allocation strategy involves adjusting the mix of assets based on short-term market conditions?

A. Strategic asset allocation

B. Dynamic asset allocation

C. Tactical asset allocation

D. Core-satellite allocation

Answer:

C. Tactical asset allocation

Explanation:

Tactical asset allocation is a strategy that involves short-term adjustments to the asset mix to capitalize on expected market trends or temporary mispricings. This differs from strategic asset allocation, which focuses on a long-term target mix based on the client’s risk and return objectives.

Question 3

Which portfolio construction technique aims to balance a stable core of low-cost investments with smaller, active positions?

A. Strategic asset allocation

B. Core-satellite approach

C. Factor-based investing

D. Risk-parity allocation

Answer:

B. Core-satellite approach

Explanation:

The core-satellite approach combines a stable core of low-cost, passive investments with smaller active positions (satellites) that seek to outperform or enhance returns. This strategy aims to achieve stability through the core while adding value through active management in select areas.