Capital Flows and the FX Market are essential components of international finance, impacting global economies and investment strategies. This topic explores the drivers of capital flows, including interest rate differentials, economic growth, and geopolitical factors, as well as the structure and functioning of the foreign exchange (FX) market. Key concepts include exchange rate mechanisms, currency risk, and the influence of central bank policies. Understanding capital flows and FX market dynamics is crucial for analyzing currency trends and making informed financial decisions within the global investment landscape.

Learning Objectives

In studying “Capital Flows and the FX Market” for the CFA, you should learn to understand the dynamics of international capital flows and their impact on foreign exchange (FX) rates. Analyze how economic factors, such as interest rates, inflation, and economic growth, influence capital movements across borders. Examine the role of central banks and government policies in managing FX rates and how they affect global capital flows. Assess the implications of capital flow volatility on currency stability and financial markets. Additionally, gain proficiency in interpreting currency exchange rate mechanisms, including spot, forward, and swap markets, and understand how investors and companies use these tools to hedge or speculate in the FX market.

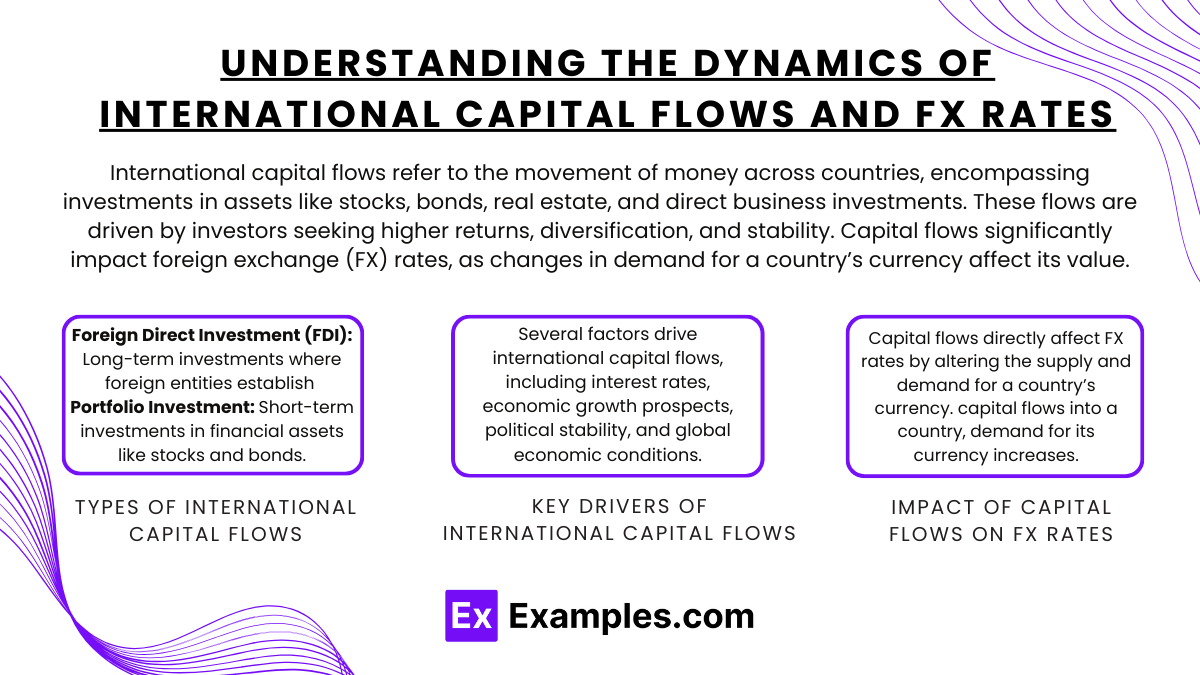

Understanding the Dynamics of International Capital Flows and FX Rates

International capital flows refer to the movement of money across countries, encompassing investments in assets like stocks, bonds, real estate, and direct business investments. These flows are driven by investors seeking higher returns, diversification, and stability. Capital flows significantly impact foreign exchange (FX) rates, as changes in demand for a country’s currency affect its value. Let’s explore the main drivers, impacts, and interdependencies between international capital flows and FX rates.

Types of International Capital Flows

International capital flows are categorized into two main types, each with unique implications for FX rates and economic stability.

- Foreign Direct Investment (FDI): Long-term investments where foreign entities establish or expand operations in a foreign country. FDI tends to be stable and creates jobs, contributing to economic growth.

- Portfolio Investment: Short-term investments in financial assets like stocks and bonds. Portfolio investments are more volatile, as investors can quickly withdraw funds in response to changing economic conditions.

Example: A U.S.-based company opening a manufacturing plant in India represents FDI, while buying shares in an Indian company constitutes a portfolio investment.

Key Drivers of International Capital Flows

Several factors drive international capital flows, including interest rates, economic growth prospects, political stability, and global economic conditions.

- Interest Rate Differentials: Higher interest rates in a country attract foreign capital seeking better returns. When rates rise in one country relative to others, it attracts foreign investors, increasing demand for the country’s currency.

- Economic Growth: Countries with strong economic growth prospects attract foreign investment, as higher growth can translate to higher corporate profits and better asset performance.

- Political and Economic Stability: Stable political environments and sound economic policies make a country more attractive for investors, reducing risks associated with capital outflows.

- Global Economic Conditions: During global recessions, capital often flows toward “safe-haven” countries with stable economies and currencies, like the U.S. and Switzerland.

Example: During the 2008 financial crisis, investors sought safe-haven assets like U.S. Treasury bonds, leading to capital inflows into the U.S. and appreciating the U.S. dollar.

Impact of Capital Flows on FX Rates

Capital flows directly affect FX rates by altering the supply and demand for a country’s currency. When capital flows into a country, demand for its currency increases, leading to appreciation. Conversely, capital outflows reduce demand, leading to depreciation.

- Capital Inflows and Currency Appreciation: Inflows of foreign capital increase demand for the local currency, leading to appreciation. Currency appreciation can make exports more expensive, affecting trade balances.

- Capital Outflows and Currency Depreciation: When investors pull capital out of a country, demand for the currency decreases, causing depreciation. Depreciation can make exports cheaper, potentially benefiting the trade balance but also increasing the cost of imports.

Example: In the early 2000s, high foreign investment in U.S. tech stocks led to capital inflows, increasing demand for the U.S. dollar and resulting in currency appreciation.

Role of Central Banks in Managing Capital Flows and FX Rates

Central banks play a critical role in managing capital flows and FX rates through monetary policy and foreign exchange interventions.

- Monetary Policy Adjustments: Central banks can influence capital flows by adjusting interest rates. Higher interest rates attract foreign capital, supporting currency appreciation, while lower rates can lead to depreciation and capital outflows.

- Foreign Exchange Interventions: Central banks may intervene in the FX market by buying or selling their currency to stabilize exchange rates. These interventions are common in countries with fixed or pegged exchange rates to prevent excessive volatility.

- Capital Controls: Some countries implement capital controls to limit inflows or outflows of foreign capital, aiming to maintain financial stability and prevent rapid currency fluctuations.

Example: To stabilize the yen, the Bank of Japan frequently intervenes in the FX market by selling yen and buying foreign currencies, preventing excessive appreciation that could harm Japanese exports.

Economic Factors Influencing Capital Movements

Capital movements, or the flow of investments across borders, are primarily influenced by various economic factors that affect the perceived risks and returns of investments in different countries. These movements include both inflows (investments entering a country) and outflows (capital leaving a country). The key economic factors influencing these movements include interest rates, economic growth, inflation, exchange rates, and market stability. Let’s explore each of these factors and their impact on capital flows.

1. Interest Rate Differentials

Interest rate levels in different countries are one of the primary drivers of capital flows. When a country offers higher interest rates compared to others, it attracts capital, as investors seek to maximize their returns.

- Higher Interest Rates: Higher interest rates increase the return on investments, such as bonds and deposits, attracting foreign investors. This leads to capital inflows, strengthening the local currency.

- Lower Interest Rates: Lower interest rates reduce the attractiveness of a country for foreign investment, leading to potential capital outflows as investors look for better returns elsewhere.

Example: If the U.S. raises interest rates while rates remain low in Europe, investors may move capital from Europe to the U.S. to take advantage of the higher returns, leading to dollar appreciation.

2. Economic Growth Prospects

Economic growth is a critical factor influencing capital movements, as investors are drawn to economies with strong growth potential, which is often linked to higher profitability for businesses.

- High Growth Potential: Countries with high GDP growth rates attract foreign direct investment (FDI) and portfolio investment, as investors seek opportunities in booming economies.

- Low Growth Potential: Economies experiencing slow growth or recession are less attractive for investment, leading to capital outflows as investors seek more dynamic markets.

Example: Emerging markets like India and Vietnam attract capital due to their high growth potential, while stagnating economies may see capital flight.

3. Inflation Rates

Inflation affects capital flows by impacting the real return on investments. High inflation erodes purchasing power, reducing the real returns that investors receive, while low and stable inflation is often more attractive.

- Low and Stable Inflation: Countries with low and stable inflation rates tend to attract capital, as the purchasing power of returns remains steady, and there is less risk of value erosion.

- High Inflation: High inflation deters investment, as it erodes real returns and creates economic uncertainty. Investors are more likely to withdraw capital from high-inflation countries to preserve their purchasing power.

Example: Hyperinflation in Venezuela has led to capital flight, as investors seek safer and more stable returns elsewhere.

4. Exchange Rate Expectations

Expected changes in exchange rates significantly influence capital flows. Investors consider both current returns and potential gains or losses from currency movements when making cross-border investments.

- Currency Appreciation Expectations: If investors expect a currency to appreciate, they are more likely to invest in that country, as they can gain both from the investment returns and currency appreciation.

- Currency Depreciation Expectations: If a currency is expected to depreciate, it may deter foreign investment, as potential returns could be offset by exchange rate losses.

Example: If investors anticipate that the Japanese yen will appreciate, they may invest in Japanese assets, expecting to benefit from both asset returns and currency gains.

5. Political and Economic Stability

Political and economic stability make a country more attractive to investors, reducing the risk of unexpected losses. Countries with stable governments and sound economic policies are perceived as safer investment destinations.

- Stable Environments: Stable political and economic conditions attract capital, as they reduce risks associated with changes in policies, expropriation, or social unrest.

- Unstable Environments: Political instability, economic mismanagement, or high levels of corruption deter investment and can lead to capital outflows as investors seek safer havens.

Example: Switzerland’s political and economic stability make it a magnet for international capital, even offering lower returns, as investors seek safety.

6. Tax Policies

Tax policies, such as corporate tax rates, capital gains taxes, and tax incentives, directly affect the attractiveness of a country for foreign investment. Competitive tax policies encourage capital inflows, while high tax burdens can drive capital outflows.

- Low or Favorable Tax Rates: Countries with low corporate tax rates or favorable tax incentives attract multinational companies and investors looking to reduce tax liabilities.

- High Tax Rates: High taxes on corporate profits, dividends, or capital gains can discourage investment, leading investors to move capital to countries with more favorable tax conditions.

Example: Ireland’s low corporate tax rate has attracted significant foreign investment, especially from U.S. tech firms, which seek to optimize their tax obligations.

7. Trade and Capital Account Liberalization

Countries with open capital accounts and free trade policies are more likely to attract foreign capital, as investors face fewer restrictions on the movement of funds.

- Liberalized Trade and Capital Accounts: Countries with open markets, fewer capital controls, and free trade agreements attract more capital, as foreign investors have easier access to invest and repatriate earnings.

- Restrictive Trade and Capital Controls: Restrictions on capital movements or trade can discourage foreign investment, as they create barriers and risks for investors who may struggle to repatriate profits.

Example: China’s gradual liberalization of its capital account has increased foreign investment, though remaining restrictions still limit some capital flows.

8. Global Economic Conditions and Risk Sentiment

Global economic conditions and investor sentiment play a role in capital flows, as shifts in risk appetite influence where investors allocate funds.

- Risk-On Sentiment: In periods of economic optimism, investors are more likely to invest in higher-risk emerging markets, seeking higher returns.

- Risk-Off Sentiment: During global economic downturns or crises, investors tend to move capital to safer assets, often in developed countries with stable currencies, like the U.S. dollar or Swiss franc.

Example: During the 2020 COVID-19 pandemic, a risk-off sentiment led to capital flows into safe-haven assets and currencies, strengthening the U.S. dollar and Swiss franc.

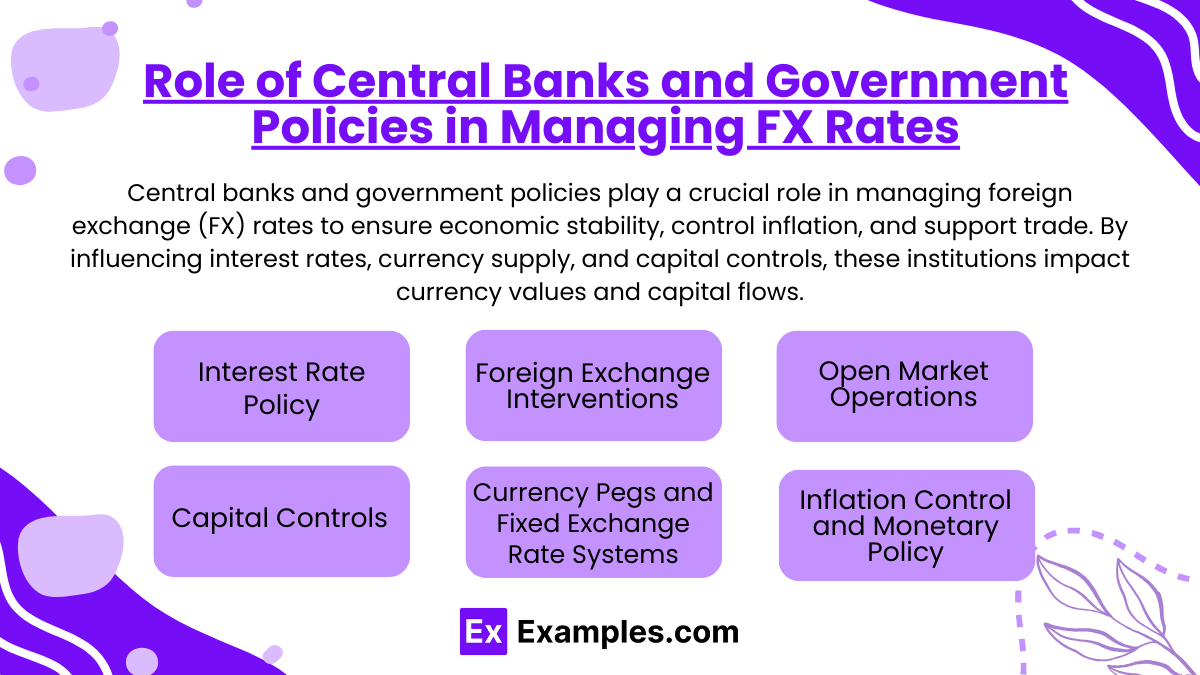

Role of Central Banks and Government Policies in Managing FX Rates

Central banks and government policies play a crucial role in managing foreign exchange (FX) rates to ensure economic stability, control inflation, and support trade. By influencing interest rates, currency supply, and capital controls, these institutions impact currency values and capital flows. Here’s an in-depth look at the tools and strategies used by central banks and governments to manage FX rates and their effects on the economy.

- Interest Rate Policy: Interest rates are one of the primary tools central banks use to influence FX rates. By raising or lowering rates, central banks can affect the flow of capital and demand for the domestic currency.

- Foreign Exchange Interventions: Central banks sometimes directly intervene in the FX market by buying or selling their own currency to stabilize or influence its value. This is especially common in countries with managed exchange rate systems.

- Open Market Operations (OMOs): Open market operations, which involve buying and selling government securities, indirectly influence FX rates by affecting interest rates and liquidity in the economy.

- Capital Controls: Capital controls are regulatory measures that restrict or limit the movement of foreign capital in and out of a country. These are used by governments to manage FX rates, prevent capital flight, and protect the economy from volatility.

- Currency Pegs and Fixed Exchange Rate Systems: Some countries manage their FX rates by pegging their currency to another major currency, like the U.S. dollar, or by maintaining a fixed exchange rate system. This approach provides stability and predictability, particularly for smaller economies that rely on trade with larger economies.

- Inflation Control and Monetary Policy: Central banks use monetary policy to control inflation, indirectly affecting FX rates. Inflation erodes purchasing power and devalues currency, so managing inflation is key to maintaining a stable currency.

Currency Exchange Rate Mechanisms: Spot, Forward, and Swap Markets

Currency exchange rate mechanisms play a crucial role in global finance, enabling international trade, investment, and risk management. Three primary mechanisms exist for currency exchange: the spot market, forward market, and swap market. Each serves different purposes and caters to the specific needs of individuals, businesses, and financial institutions.

1. Spot Market

The spot market is where currencies are traded for immediate delivery. It’s the simplest and most commonly used mechanism for currency exchange, with rates known as spot rates.

- Spot Rate: The current exchange rate at which a currency pair can be bought or sold. Spot rates fluctuate continuously based on supply and demand in the market.

- Settlement: Spot transactions are typically settled within two business days (T+2), although some currencies may settle within one day (T+1).

- Uses: The spot market is widely used by businesses and individuals for immediate currency needs, such as paying for imported goods, remittances, or converting foreign income.

Example: A U.S. company needs euros to pay a German supplier and converts dollars to euros in the spot market at the current EUR/USD rate.

2. Forward Market

The forward market is where contracts are made to exchange currencies at a future date at a predetermined rate, known as the forward rate. Unlike the spot market, the forward market is used for hedging and managing future currency risk.

- Forward Rate: The agreed-upon exchange rate for a transaction that will occur on a future date. Forward rates are influenced by the interest rate differentials between the two currencies.

- Customizable Terms: Forward contracts can be customized to meet specific needs, including the amount, currency pair, and settlement date. Contracts can range from one month to several years.

- Uses: The forward market is commonly used by businesses to hedge against currency risk, ensuring that they know the exact exchange rate for a future transaction. It helps protect against unfavorable currency movements.

Example: A U.S. exporter who expects to receive euros in six months can enter a forward contract to sell euros and buy dollars at a predetermined rate, ensuring they lock in their revenue value regardless of currency fluctuations.

3. Swap Market

The currency swap market involves the simultaneous buying and selling of currencies, combining elements of both spot and forward transactions. Currency swaps are typically used by financial institutions and large corporations to manage cash flows and exposure to different currencies.

- Structure of a Currency Swap: A currency swap involves two legs:

- Spot Leg: One currency is exchanged for another at the current spot rate.

- Forward Leg: A reverse transaction occurs at a specified future date, using a predetermined rate.

- Types of Swaps:

- Simple Currency Swaps: A straightforward exchange of currencies with a later re-exchange at a predetermined rate.

- Cross-Currency Swaps: Involves exchanging principal and interest payments in different currencies, often used for long-term loans or bonds in foreign currency.

- Uses: Currency swaps help businesses and financial institutions manage currency exposure, reduce borrowing costs, and access different currency markets.

Example: A U.S. company with a loan in euros might enter a currency swap with a European company with a loan in dollars. They swap interest payments and principal in their respective currencies, reducing currency risk and potentially lowering borrowing costs.

Examples

Example 1: Foreign Direct Investment (FDI)

When multinational corporations invest in production facilities or operations in another country, it represents a significant capital flow. For example, a U.S. company establishing a manufacturing plant in Vietnam not only brings capital into Vietnam but also increases the demand for the Vietnamese dong. This influx can lead to appreciation of the dong in the FX market as foreign investors need to exchange their currency to invest.

Example 2: Portfolio Investment

Investors may choose to buy stocks and bonds in foreign markets, leading to capital flows. For instance, if European investors purchase U.S. Treasury bonds, they must exchange euros for U.S. dollars. This demand for dollars can strengthen the dollar against the euro in the foreign exchange market. Such portfolio investments are influenced by interest rates and economic conditions in both the home and host countries.

Example 3: Remittances

Money sent home by expatriates working abroad can also influence capital flows and the FX market. For example, if a large number of migrant workers in the United States send money back to their families in Mexico, this results in significant capital inflows to Mexico. The increased demand for pesos to facilitate these transactions can lead to a strengthening of the Mexican peso against other currencies.

Example 4: Speculative Capital Flows

Traders in the FX market often engage in speculation, buying and selling currencies based on expected changes in interest rates, economic data, or geopolitical events. For instance, if traders anticipate that a country will raise interest rates, they may buy that country’s currency in expectation of appreciation. This speculative activity can lead to significant capital flows and volatility in the FX market.

Example 5: Central Bank Interventions

Central banks may influence capital flows and currency values through direct interventions in the FX market. For example, if the Japanese yen is weakening against the U.S. dollar, the Bank of Japan might sell U.S. dollars and buy yen to stabilize its currency. This intervention alters capital flows by affecting supply and demand dynamics in the foreign exchange market, influencing investor behavior and currency valuation.

Practice Questions

Question 1

What is a primary factor that influences capital flows between countries?

A) Political stability and economic conditions

B) Weather patterns

C) Historical trade agreements

D) Cultural preferences

Correct Answer: A) Political stability and economic conditions.

Explanation: Capital flows between countries are significantly influenced by political stability and economic conditions. Investors are more likely to invest in countries with stable political environments and strong economic performance because these factors reduce risk and enhance the potential for returns. While weather patterns, historical trade agreements, and cultural preferences may have some influence, they do not have the same direct impact on capital movement as political and economic stability.

Question 2

What effect does an increase in foreign direct investment (FDI) have on the foreign exchange (FX) market?

A) It typically leads to an appreciation of the domestic currency.

B) It results in a depreciation of the domestic currency.

C) It has no impact on the FX market.

D) It creates volatility in the currency markets.

Correct Answer: A) It typically leads to an appreciation of the domestic currency.

Explanation: An increase in foreign direct investment (FDI) means that foreign investors are buying domestic assets, which increases demand for the domestic currency to facilitate those investments. As demand for the domestic currency rises, it typically leads to an appreciation of that currency in the FX market. This process illustrates the connection between capital flows and currency valuation.

Question 3

How do interest rate differentials between countries impact capital flows?

A) Higher interest rates in a country attract capital inflows.

B) Lower interest rates in a country attract capital inflows.

C) Interest rates have no impact on capital flows.

D) Interest rate differentials only affect short-term capital, not long-term investments.

Correct Answer: A) Higher interest rates in a country attract capital inflows.

Explanation: Higher interest rates offer better returns on investments, which attracts foreign capital inflows as investors seek to take advantage of these favorable conditions. Conversely, lower interest rates may lead to capital outflows as investors look for better opportunities elsewhere. This dynamic highlights the importance of interest rates in influencing capital movement and, subsequently, the FX market.