Preparing for the CFA Exam requires a comprehensive understanding of "Capital Market Expectations, Part 2: Forecasting Asset Class Returns," a crucial aspect of portfolio management. Mastery of forecasting techniques, return estimation methods, and risk analysis is essential. This knowledge provides insights into strategic asset allocation, enhancing investment decision-making and portfolio performance, critical for achieving a high CFA score.

Learning Objective

In studying "Capital Market Expectations, Part 2: Forecasting Asset Class Returns" for the CFA Exam, you should learn to understand the various approaches used to forecast expected returns across asset classes, including equities, fixed income, real estate, and alternative investments. Analyze different models and methods such as historical averages, forward-looking metrics, and risk premium approaches. Evaluate factors influencing return forecasts, including economic indicators, market valuations, and macroeconomic trends. Additionally, explore how to incorporate these forecasts into strategic asset allocation and portfolio construction. Apply this understanding to create robust, diversified investment strategies and assess portfolio risk-adjusted performance.

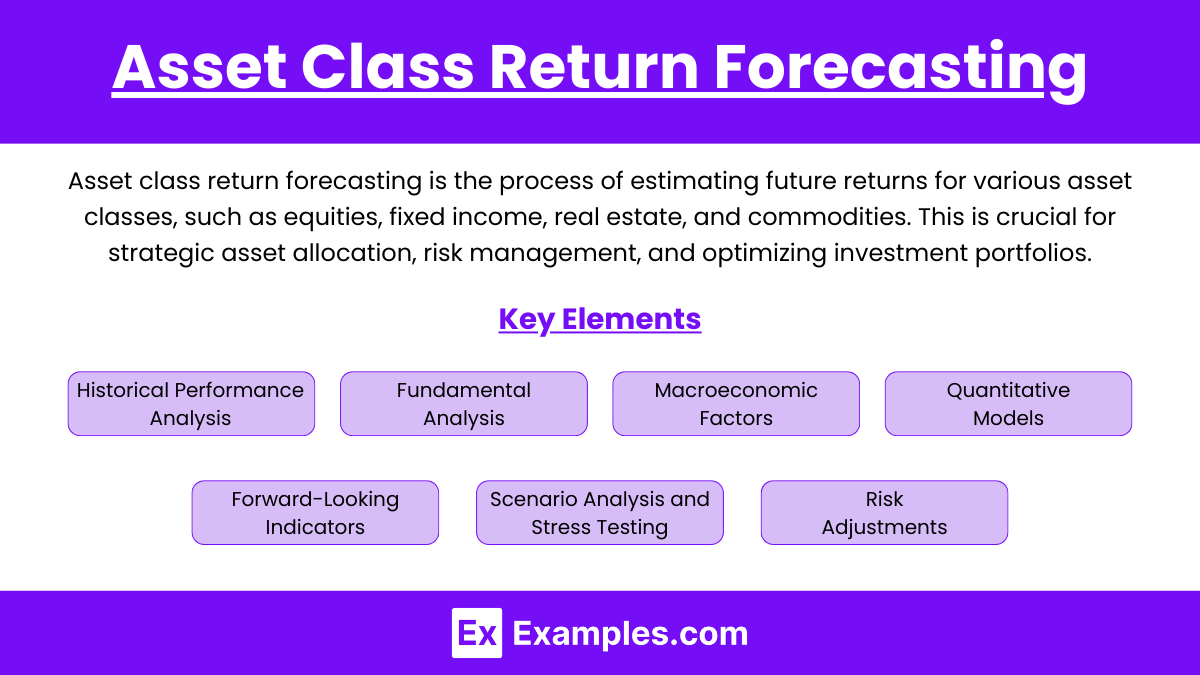

Understanding Asset Class Return Forecasting

Asset class return forecasting is the process of estimating future returns for various asset classes, such as equities, fixed income, real estate, and commodities. This is crucial for strategic asset allocation, risk management, and optimizing investment portfolios. Here’s an overview of the key elements involved in understanding and developing asset class return forecasts:

Historical Performance Analysis

Uses past returns and volatility as a baseline.

Limitation: Past results may not reflect future trends.

Fundamental Analysis

Equities: Earnings growth, dividend yields, P/E ratios.

Fixed Income: Current yields, rate changes, credit spreads.

Real Estate: Rental income and property trends.

Commodities: Supply-demand dynamics and geopolitical impacts.

Macroeconomic Factors

Economic Indicators: GDP growth, inflation, interest rates.

Monetary Policy: Central bank actions' impact on asset returns.

Quantitative Models

CAPM: Estimates equity returns using risk-free rates and beta.

Multi-Factor Models: Include factors like size and momentum.

Yield Curve Analysis: Predicts fixed income performance.

Forward-Looking Indicators

Market Sentiment: Investor surveys and VIX for market outlook.

Valuation Metrics: CAPE ratio to adjust forecasts based on current valuations.

Scenario Analysis and Stress Testing

Create varying economic scenarios and conduct stress tests for extreme conditions.

Risk Adjustments

Include risk premiums for credit and liquidity risks.

Factor in geopolitical and economic uncertainties.

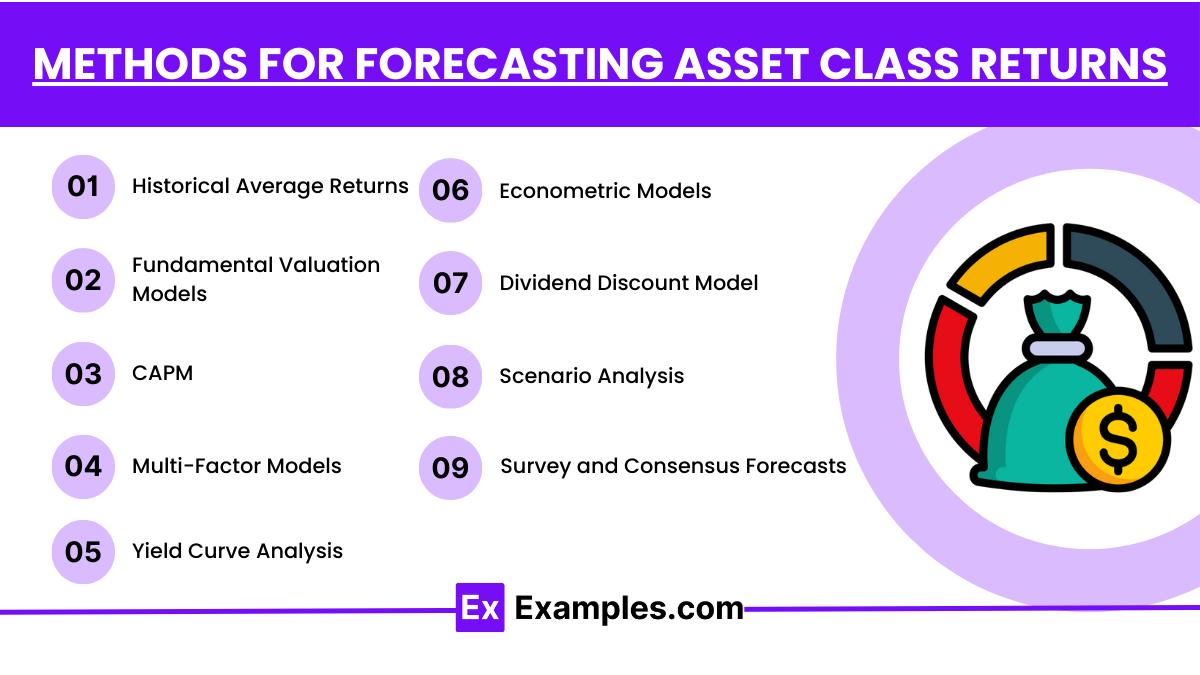

Methods for Forecasting Asset Class Returns

Forecasting asset class returns involves a mix of quantitative and qualitative methods to provide accurate and reliable predictions. Here are the primary methods used:

Historical Average Returns

Method: Uses past average returns as future expectations.

Strengths: Simple and data-driven.

Limitations: May not reflect changing market conditions.

Fundamental Valuation Models

Equities: Earnings growth, P/E ratios.

Fixed Income: Current yields, interest rate changes.

Strengths: Reflects intrinsic value.

Limitations: Requires up-to-date data.

CAPM (Capital Asset Pricing Model)

Method: Risk-free rate + beta × market risk premium.

Strengths: Risk-adjusted returns.

Limitations: Simplifies reality with one-factor reliance.

Multi-Factor Models

Method: Includes size, value, momentum factors.

Strengths: Captures more return drivers.

Limitations: Data-intensive.

Yield Curve Analysis

Method: Analyzes the yield curve for fixed income forecasts.

Strengths: Effective for bonds.

Limitations: Prone to short-term distortions.

Econometric Models

Method: Regression analysis with economic indicators.

Strengths: Includes macroeconomic variables.

Limitations: Complex and data-heavy.

Dividend Discount Model (DDM)

Method: Expected dividends + growth rate.

Strengths: Suitable for dividend stocks.

Limitations: Not for non-dividend payers.

Scenario Analysis

Method: Tests returns under multiple scenarios.

Strengths: Prepares for different conditions.

Limitations: Assumptions may be subjective.

Survey and Consensus Forecasts

Method: Expert opinions and consensus data.

Strengths: Broad insights.

Limitations: Potential bias.

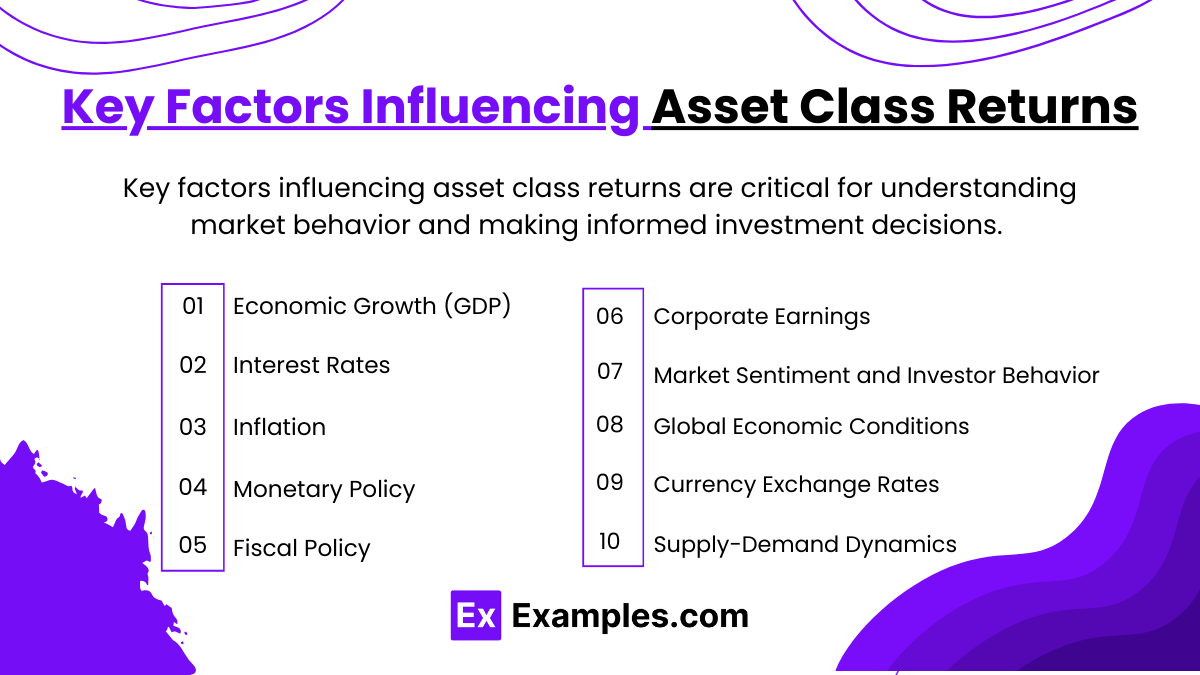

Key Factors Influencing Asset Class Returns

Key factors influencing asset class returns are critical for understanding market behavior and making informed investment decisions. Here are the main factors:

1. Economic Growth (GDP)

Strong economic growth typically boosts corporate earnings, driving equity returns. Slower growth can negatively affect stocks and favor bonds.

Asset Classes Affected: Equities, real estate, and commodities.

2. Interest Rates

Rising interest rates can lead to higher yields on bonds but may reduce equity valuations. Lower rates often boost stock and real estate prices by lowering borrowing costs.

Asset Classes Affected: Fixed income, equities, and real estate.

3. Inflation

Moderate inflation can support economic growth, but high inflation erodes purchasing power and impacts fixed-income returns negatively. Commodities and real assets like real estate often act as inflation hedges.

Asset Classes Affected: Fixed income, commodities, real estate, and equities.

4. Monetary Policy

Central bank actions, such as adjusting interest rates or implementing quantitative easing, influence liquidity and asset prices.

Asset Classes Affected: Equities, bonds, and currency markets.

5. Fiscal Policy

Government spending and tax policies can stimulate or slow down the economy, impacting corporate profits and consumer spending.

Asset Classes Affected: Equities and fixed income.

6. Corporate Earnings

Strong earnings growth supports higher equity prices. Declining earnings can lead to market corrections.

Asset Classes Affected: Equities.

7. Market Sentiment and Investor Behavior

Investor confidence and behavioral biases can drive asset prices up or down, often independent of fundamentals.

Asset Classes Affected: Equities and real estate.

8. Global Economic Conditions

International trade dynamics, global growth, and geopolitical events can affect asset class performance, especially in commodities and foreign investments.

Asset Classes Affected: Equities, fixed income, and commodities.

9. Currency Exchange Rates

Currency fluctuations can affect the returns on foreign investments and companies with significant international revenue.

Asset Classes Affected: Equities, fixed income, and commodities.

10. Supply-Demand Dynamics

Changes in the supply-demand balance impact prices, especially for commodities and real estate.

Asset Classes Affected: Commodities and real estate.

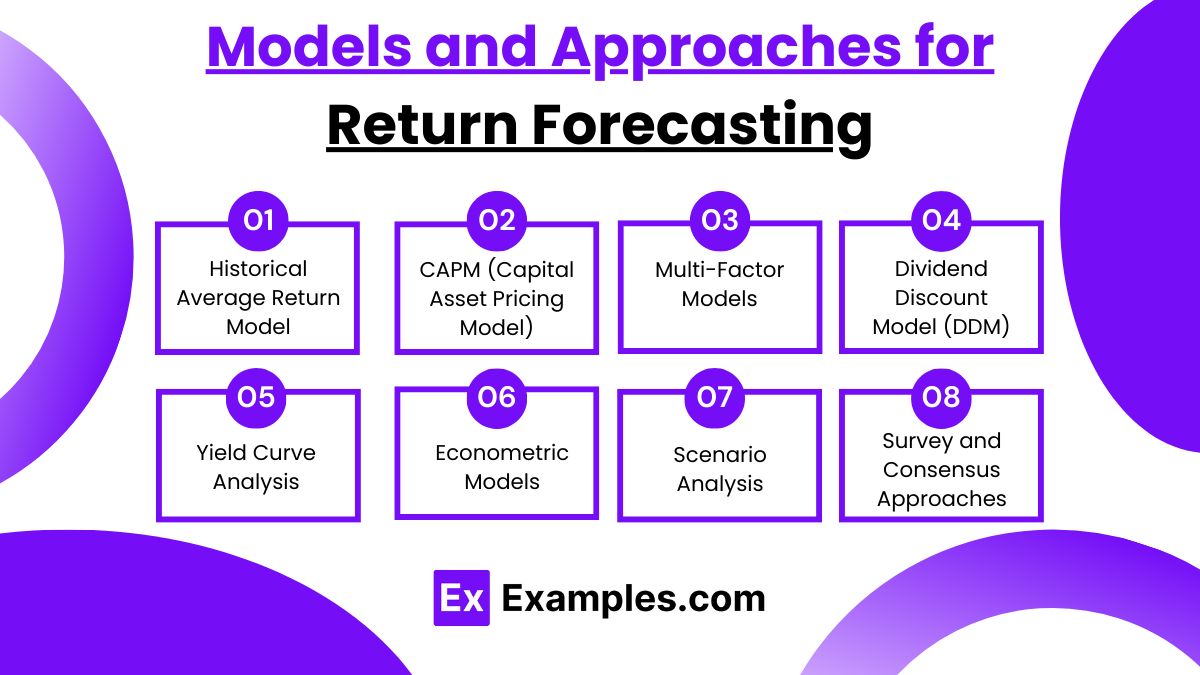

Models and Approaches for Return Forecasting

Models and approaches for return forecasting are essential tools for predicting future asset class performance and guiding investment strategies. Here are the primary models and approaches used:

Historical Average Return Model

Method: Uses past average returns for future forecasts.

Strengths: Simple and data-driven.

Limitations: Assumes trends continue, which may not be true.

CAPM (Capital Asset Pricing Model)

Method: Risk-free rate + beta × market risk premium.

Strengths: Provides risk-adjusted forecasts.

Limitations: Single-factor model, oversimplified.

Multi-Factor Models

Method: Includes factors like size, value, and momentum.

Strengths: More comprehensive.

Limitations: Data-intensive and complex.

Dividend Discount Model (DDM)

Method: Expected dividend/price + growth rate.

Strengths: Good for dividend stocks.

Limitations: Not for non-dividend stocks.

Yield Curve Analysis

Method: Uses yield curve for bond forecasts.

Strengths: Insightful for fixed income.

Limitations: Affected by short-term distortions.

Econometric Models

Method: Uses macroeconomic data and regression analysis.

Strengths: Incorporates economic variables.

Limitations: Data-intensive.

Scenario Analysis

Method: Tests forecasts under different economic conditions.

Strengths: Prepares for various outcomes.

Limitations: Subjective assumptions.

Survey and Consensus Approaches

Method: Combines expert forecasts.

Strengths: Diverse insights.

Limitations: May reflect biases.

Examples

Example 1: Equity Return Forecast Using the Dividend Discount Model (DDM)

Example of using the DDM to forecast expected returns for the S&P 500 by applying current dividend yield, projected dividend growth rate, and price-to-dividend ratios. Discuss how this forecast can guide long-term equity allocation decisions.

Example 2: Estimating Bond Returns with Yield to Maturity (YTM)

Illustrate how YTM can be used to project future bond returns, factoring in the current coupon rate and expected inflation adjustments. Use a real-world example of a government bond portfolio to show how this method helps in fixed-income planning.

Example 3: Scenario Analysis for Portfolio Diversification

Example of constructing different economic scenarios, such as a high-growth scenario with rising inflation versus a recessionary scenario, and estimating how different asset classes (equities, bonds, and commodities) would perform under these conditions. Explain how this analysis helps in asset allocation and risk management.

Example 4: Calculating Equity Risk Premium (ERP) for a Developed Market

Provide an example of estimating the ERP for a developed market like the U.S. by using historical data, forward-looking growth estimates, and surveys. Discuss the implications of ERP projections for equity investors and strategic asset allocation.

Example 5: Impact of Central Bank Policy on Forecasted Returns

Example of analyzing how anticipated changes in central bank interest rates influence expected returns on both equities and fixed income. Discuss how lower rates might lead to higher equity valuations and the subsequent effect on portfolio allocation strategies.

Practice Questions

Question 1

Which of the following methods is most commonly used to estimate the expected return for equity investments?

A. Yield to Maturity (YTM)

B. Dividend Discount Model (DDM)

C. Mean-Variance Optimization

D. Price-to-Book Ratio

Answer:

B. Dividend Discount Model (DDM)

Explanation:

The Dividend Discount Model (DDM) is commonly used to estimate the expected return for equity investments by projecting dividend payments and their growth over time. It calculates the present value of future dividends and helps in forecasting equity returns. YTM is more relevant for bonds, while mean-variance optimization is used for portfolio allocation, and the price-to-book ratio is an indicator of valuation, not a direct method for return forecasting.

Question 2

In forecasting future bond returns, why is it important to adjust for expected inflation?

A. It helps in estimating nominal returns

B. It ensures that real returns are higher than nominal returns

C. It allows for calculating real returns, which reflect purchasing power

D. It reduces the volatility of bond prices

Answer:

C. It allows for calculating real returns, which reflect purchasing power

Explanation:

Adjusting for expected inflation is essential to determine real returns, which represent the actual purchasing power an investor will have after accounting for the inflation rate. Real returns provide a more accurate picture of an investment’s value over time, while nominal returns do not account for inflation's eroding effect.

Question 3

When using the equity risk premium (ERP) approach to forecast expected equity returns, which of the following factors is typically included?

A. Current dividend yield only

B. The spread between long-term and short-term interest rates

C. Historical average returns, survey estimates, and future growth projections

D. Credit ratings of corporate bonds

Answer:

C. Historical average returns, survey estimates, and future growth projections

Explanation:

The equity risk premium (ERP) approach includes historical average returns, survey-based estimates, and future growth projections to forecast expected equity returns. These factors help in estimating the premium investors expect over the risk-free rate for taking on equity risk. Other options like the dividend yield and credit ratings pertain to specific asset classes but do not form the basis of ERP estimation.