Capital Structure is a fundamental concept in finance, encompassing the mix of debt and equity that a company uses to fund its operations and growth. This topic examines how various financing choices impact a company’s cost of capital, risk profile, and overall value. Key elements include the trade-offs between debt and equity financing, leverage implications, and the influence of capital structure on shareholder returns. A solid understanding of these factors is essential for evaluating a company’s financial health and strategic decisions, forming a critical part of corporate finance and investment analysis.

Learning Objectives

In studying “Capital Structure” for the CFA, you should learn to understand the composition of a firm’s capital structure, including the mix of debt and equity financing. Analyze the impact of different capital structures on a firm’s cost of capital and overall valuation. Evaluate the trade-offs between debt and equity, considering factors like tax benefits, financial distress costs, and agency costs. Understand key theories of capital structure, such as the Modigliani-Miller theorem, trade-off theory, and pecking order theory, and how they apply in real-world scenarios. Additionally, assess how a firm’s business risk and market conditions influence capital structure decisions, and develop skills to analyze and recommend optimal capital structures to enhance shareholder value.

Understanding the Composition of a Firm’s Capital Structure

A firm’s capital structure is the mix of debt, equity, and hybrid securities it uses to finance its operations and growth. The right combination of these components is crucial, as it influences the firm’s risk, cost of capital, financial flexibility, and overall value. Here’s an in-depth look at the key components of a firm’s capital structure and how they impact financial decision-making:

Key Components of Capital Structure

a. Equity

Equity represents ownership in the company and consists of funds raised through issuing shares to investors. It is often considered a permanent source of capital, as it doesn’t have a maturity date or fixed repayment obligation.

- Common Stock: Represents ownership shares in the company and provides shareholders with voting rights. Common stockholders have a residual claim on the firm’s assets after all debts and obligations are met.

- Preferred Stock: Combines characteristics of both equity and debt. Preferred shareholders receive fixed dividends and have a higher claim on assets than common shareholders, but they usually lack voting rights.

Advantages of Equity:

- No fixed repayment obligations, providing financial flexibility.

- Lower financial risk than debt, as dividends are only paid when profits are available.

- Access to additional funding through subsequent equity offerings.

Disadvantages of Equity:

- More expensive than debt, as equity investors expect higher returns due to higher risk.

- Dilution of ownership, reducing control for existing shareholders.

- Dividends are not tax-deductible, unlike interest payments.

Example: A tech startup may rely heavily on equity financing to avoid the burden of debt repayments, which can limit cash flow flexibility in its early stages.

b. Debt

Debt is a fixed obligation where the firm borrows funds with the agreement to repay the principal amount along with interest over time. Debt financing includes various instruments like loans, bonds, and notes.

- Long-Term Debt: Bonds or term loans with maturities typically greater than one year. Long-term debt is suitable for funding capital-intensive projects with predictable cash flows.

- Short-Term Debt: Loans, credit lines, or commercial paper with maturities of less than one year, used for working capital or short-term financing needs.

Advantages of Debt:

- Interest payments are tax-deductible, reducing the effective cost of debt.

- Debt holders do not have voting rights, allowing original owners to retain control.

- Lower cost than equity, as debt holders have a priority claim on assets, resulting in lower required returns.

Disadvantages of Debt:

- Fixed obligations increase financial risk, as the firm must make payments regardless of profitability.

- High debt levels can lead to financial distress or insolvency if cash flows are insufficient.

- Restrictive covenants on debt agreements may limit operational flexibility.

Example: A utility company with stable cash flows may use a high proportion of long-term debt in its capital structure to benefit from tax savings and lower financing costs.

c. Hybrid Securities

Hybrid securities are financial instruments that combine characteristics of both debt and equity, providing firms with financing flexibility.

- Convertible Bonds: Bonds that can be converted into a predetermined number of common shares. This allows companies to raise debt with the option for future equity conversion, often at a lower interest rate.

- Preferred Stock: Shares that pay fixed dividends and have priority over common stock in asset claims, but are treated as equity for accounting purposes. Preferred stockholders may have limited or no voting rights.

- Warrants: Derivative securities giving holders the right to purchase company stock at a specific price within a certain period. Warrants are often issued with bonds to attract investors by offering potential future equity.

Advantages of Hybrid Securities:

- Offer flexibility by combining benefits of both debt and equity.

- Convertible bonds and warrants may have lower initial interest costs, as they carry equity conversion potential.

- Preferred stock dividends are fixed, providing predictability in cash flows.

Disadvantages of Hybrid Securities:

- Complex structuring can lead to dilution of ownership if converted to equity.

- Convertible bonds add interest payment obligations initially, increasing leverage until conversion.

- Some hybrid securities do not provide tax benefits, unlike conventional debt.

Example: A biotechnology company may issue convertible bonds to raise funds, offering a lower interest rate while giving investors the option to convert to equity if the company performs well.

Evaluating Trade-Offs Between Debt and Equity

The decision between debt and equity financing is one of the most fundamental choices a firm faces. Each financing option has distinct advantages and disadvantages, impacting a company’s cost of capital, financial flexibility, risk profile, and control. Striking the right balance between debt and equity is essential for maintaining financial health and maximizing shareholder value. Here’s a comprehensive look at the trade-offs between debt and equity:

Key Components

1. Cost of Capital

The cost of capital is the rate of return required by investors. The mix of debt and equity affects the firm’s overall cost of capital, impacting profitability and valuation.

Debt Financing

- Lower Cost Due to Tax Shield: Interest payments on debt are tax-deductible, reducing the effective cost of debt and making it generally cheaper than equity.

- Fixed Cost: Debt typically has a lower required rate of return, as it’s less risky for lenders due to priority claims on assets in case of liquidation.

Equity Financing

- Higher Cost Due to Higher Risk: Equity investors bear more risk since they are last in line to receive payments. Consequently, they demand a higher rate of return.

- No Tax Benefits: Dividends paid to equity holders are not tax-deductible, making equity more costly in terms of after-tax returns.

Trade-Off: Debt financing can reduce the overall cost of capital, especially if the firm benefits from tax savings. However, over-relying on debt increases financial risk, potentially negating these benefits.

Example: A profitable manufacturing firm may prefer debt for a new factory expansion to take advantage of tax savings, lowering its cost of capital.

2. Financial Risk and Leverage

The amount of debt influences the financial leverage and risk exposure of the firm. High levels of debt can amplify both returns and losses.

Debt Financing

- Increased Financial Leverage: Debt increases the firm’s fixed obligations, which can magnify returns when the business performs well. However, it also increases the risk of financial distress if cash flows are insufficient.

- Higher Default Risk: Excessive debt heightens the risk of default, especially in economic downturns or periods of low revenue.

Equity Financing

- Lower Financial Risk: Equity does not require fixed repayments, which provides a cushion during economic fluctuations. This flexibility reduces financial distress risk.

- Dilution of Ownership: Issuing more equity may dilute ownership for existing shareholders, potentially reducing their control over the company’s direction.

Trade-Off: Debt financing can enhance returns but increases the risk of financial distress, while equity financing provides greater stability but dilutes ownership and control.

Example: A technology company with volatile cash flows might prioritize equity to avoid the risk of debt repayments, ensuring flexibility during slower periods.

3. Control and Ownership

Control over decision-making and ownership structure is a crucial consideration, especially for closely-held companies or family-owned businesses.

Debt Financing

- Preserves Ownership: Debt does not dilute ownership, allowing original shareholders to retain full control over the company’s strategic decisions.

- Covenant Restrictions: While debt preserves ownership, lenders may impose restrictive covenants, limiting certain business activities to safeguard their investments.

Equity Financing

- Dilution of Control: Issuing new shares dilutes ownership, which may dilute control, especially if new equity holders gain voting rights.

- Greater Flexibility: Equity generally lacks restrictive covenants, allowing management to operate with fewer limitations and more flexibility in pursuing business strategies.

Trade-Off: Debt is suitable for companies that want to preserve ownership and control, while equity may be preferable if flexibility in operations and decision-making is more critical.

Example: A family-owned business expanding to new markets may use debt to maintain ownership and control, while a growing startup may issue equity to attract venture capital without cash flow constraints.

4. Cash Flow and Liquidity

Cash flow stability is essential in determining the right financing mix, as debt requires consistent payments, while equity provides more cash flow flexibility.

Debt Financing

- Fixed Payments: Debt requires regular interest payments and principal repayment, which can strain cash flow, especially if earnings are unpredictable.

- Pressure on Liquidity: High debt obligations reduce cash flow available for reinvestment, dividends, or covering unexpected expenses.

Equity Financing

- No Fixed Obligations: Equity financing doesn’t require regular repayments, preserving cash flow for operations, reinvestment, and flexibility during slower periods.

- Investor Expectations: Although equity has no repayment obligation, shareholders often expect dividends or capital gains, impacting cash flow and reinvestment decisions.

Trade-Off: Debt financing is better suited for companies with steady cash flows that can handle fixed payments, while equity financing is preferable when cash flow stability is uncertain.

Example: A seasonal retail business may prefer equity financing to avoid the strain of fixed payments during off-peak months.

5. Impact on Earnings and Return on Equity (ROE)

Financing choices affect key profitability metrics, including earnings per share (EPS) and return on equity (ROE). Debt can enhance ROE by leveraging returns, but it also increases risk.

Debt Financing

- Earnings Per Share (EPS): Debt can improve EPS by lowering financing costs (due to tax deductions). However, if debt is high, interest costs can erode net income, reducing EPS.

- Return on Equity (ROE): Debt financing can enhance ROE by allowing more assets to be funded with a smaller equity base. This “leveraging effect” increases returns for shareholders but also increases risk.

Equity Financing

- Dilution of EPS: Issuing new equity can dilute EPS, as profits are spread across a larger number of shares. However, it avoids interest expenses, which can support a stable EPS.

- Stable ROE: Equity avoids the leveraging effect of debt, leading to a more stable ROE that isn’t as sensitive to fluctuations in net income.

Trade-Off: Debt can improve EPS and ROE if the firm performs well, but equity provides a stable EPS and ROE without additional financial risk.

Example: A company expecting consistent profit growth may use debt to boost ROE, while a company in a volatile industry may favor equity to protect EPS.

6. Tax Considerations

Tax policies and the tax environment can heavily influence the choice between debt and equity.

Debt Financing

- Interest Deductibility: Interest payments are tax-deductible, which reduces taxable income and the effective cost of debt, making it a tax-efficient choice.

- Attractive in High Tax Environments: In jurisdictions with high corporate tax rates, debt financing can offer significant tax savings, as interest deductions lower the overall tax burden.

Equity Financing

- No Tax Benefits on Dividends: Dividends paid to shareholders are not tax-deductible, leading to double taxation (once at the corporate level and again at the individual level for shareholders).

- Preferable in Low Tax Environments: In low-tax environments, the benefits of debt financing are reduced, making equity financing relatively more attractive.

Trade-Off: Debt is often preferable for companies seeking to reduce tax liabilities, while equity may be a better choice in low-tax environments or for companies with limited tax liabilities.

Example: A mature company in a high-tax country may favor debt to maximize tax benefits, while a new company with initial losses may prefer equity, as it has no immediate tax benefits from debt.

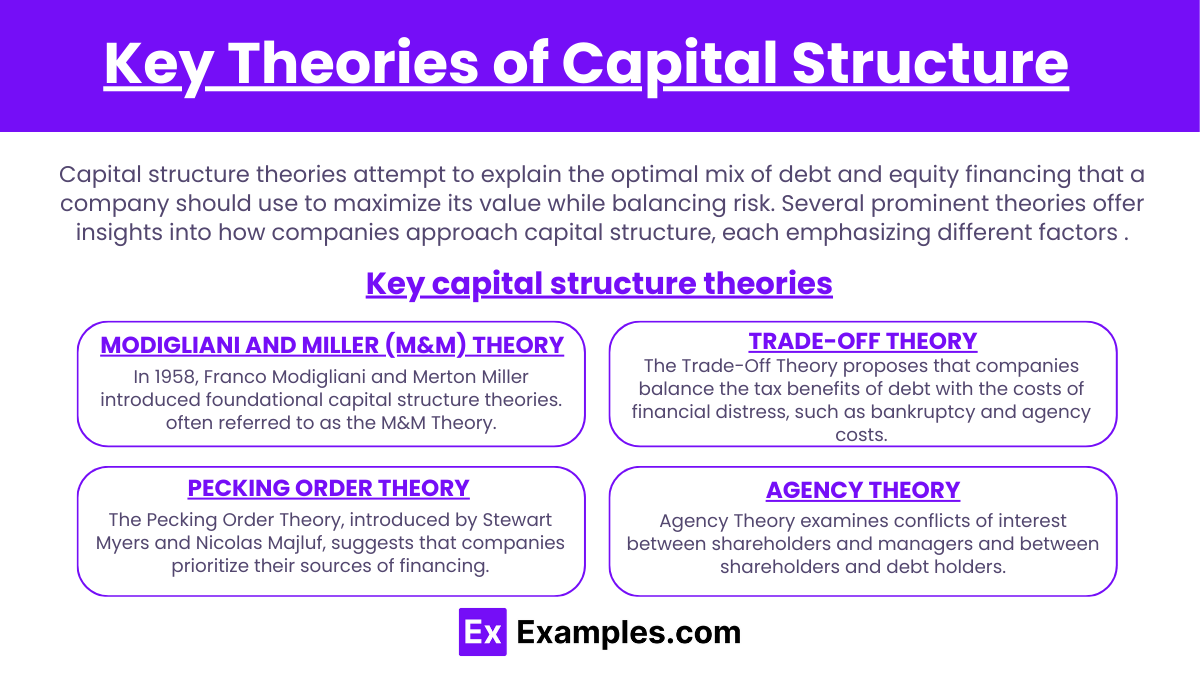

Key Theories of Capital Structure

Capital structure theories attempt to explain the optimal mix of debt and equity financing that a company should use to maximize its value while balancing risk. Several prominent theories offer insights into how companies approach capital structure, each emphasizing different factors like taxes, bankruptcy costs, agency issues, and market conditions. Here’s an overview of the key capital structure theories:

1. Modigliani and Miller (M&M) Theory

In 1958, Franco Modigliani and Merton Miller introduced foundational capital structure theories. Their propositions, often referred to as the M&M Theory, focus on the impact of capital structure on a firm’s value under different conditions.

Assumptions

The original M&M model is based on idealized assumptions, including:

- No taxes

- No transaction or bankruptcy costs

- Perfect information

- No agency costs

- Investors can borrow and lend at the same rate as companies

Propositions

- M&M Proposition I (Without Taxes): In a world with no taxes, the value of a firm is independent of its capital structure. This implies that whether a company is financed through debt or equity, its value remains the same.

- Implication: Since debt financing does not affect the firm’s value, there is no “optimal” capital structure, and companies can freely choose any debt-equity mix without impacting their overall value.

- M&M Proposition II (Without Taxes): The cost of equity increases as the company takes on more debt, reflecting the higher risk equity holders face. However, the weighted average cost of capital (WACC) remains constant.

- M&M with Taxes (1963): When taxes are introduced, debt financing becomes more attractive due to the tax shield on interest payments, as interest is tax-deductible. This suggests that a firm’s value increases with more debt in its capital structure.

- Implication: In a world with taxes, the optimal capital structure would be 100% debt, as maximizing debt maximizes the value of the firm. However, practical limitations like bankruptcy risk prevent companies from following this extreme.

Example: An established utility company may use high levels of debt to benefit from the tax shield, supporting M&M’s theory in a taxed environment.

2. Trade-Off Theory

The Trade-Off Theory proposes that companies balance the tax benefits of debt with the costs of financial distress, such as bankruptcy and agency costs, to reach an optimal capital structure. According to this theory, there is an optimal level of debt where the benefits of the tax shield are maximized without incurring excessive financial distress costs.

Key Components

- Tax Shield Benefits: Interest on debt is tax-deductible, which reduces the company’s taxable income, making debt financing attractive.

- Bankruptcy Costs: Higher debt levels increase the likelihood of financial distress, which carries direct costs (legal fees) and indirect costs (reduced employee morale, damaged reputation).

- Agency Costs: High debt levels can lead to conflicts between shareholders and creditors, as shareholders may be incentivized to pursue high-risk projects that benefit them but increase creditors’ risk.

Implications

- The trade-off between tax benefits and financial distress costs means companies will increase debt up to a point where the marginal tax benefit equals the marginal cost of financial distress.

- Firms with stable cash flows and low business risk (e.g., utilities) are likely to use more debt, while high-risk firms (e.g., technology startups) may rely more on equity.

Example: A mature manufacturing firm with steady revenue may increase its debt level until the tax benefits are offset by the risk of bankruptcy.

3. Pecking Order Theory

The Pecking Order Theory, introduced by Stewart Myers and Nicolas Majluf, suggests that companies prioritize their sources of financing based on the principle of least resistance, starting with internal financing (retained earnings), then debt, and finally issuing new equity. This order arises due to information asymmetry, where management has more information about the company’s value than external investors.

Key Components

- Information Asymmetry: Managers know more about the company’s true value than external investors. Issuing new equity can signal that managers believe the firm’s stock is overvalued, potentially driving down the stock price.

- Financing Hierarchy:

- Internal Financing: First preference, as it incurs no issuance costs and avoids signaling effects.

- Debt Financing: Next preferred, as debt is less sensitive to information asymmetry and typically cheaper than equity.

- Equity Financing: Least preferred, as issuing new shares can dilute ownership and may indicate that the company’s stock is overvalued.

Implications

- Companies with abundant internal cash flow will avoid external financing, while companies needing more funds may issue debt before considering equity.

- The theory suggests that there is no target debt-equity ratio; instead, capital structure evolves based on financing needs and the availability of internal funds.

Example: A profitable retail company may rely on retained earnings to fund expansion, only considering debt if internal funds are insufficient, and using equity as a last resort.

4. Agency Theory

Agency Theory examines conflicts of interest between shareholders (principals) and managers (agents) and between shareholders and debt holders, which can influence a company’s capital structure.

Key Components

- Shareholder-Manager Conflict: Managers may not always act in the best interests of shareholders, potentially preferring low-risk projects to secure their positions rather than pursuing high-risk, high-reward projects.

- Shareholder-Debtholder Conflict: Debt holders may be concerned that shareholders will take on high-risk projects after debt is issued, as shareholders benefit from the upside, while debt holders bear the downside risk.

Implications

- Debt as a Disciplinary Mechanism: Taking on debt can reduce agency costs by creating financial obligations that force managers to be more disciplined in cash flow management, reducing the likelihood of investing in low-value projects.

- Equity Financing: Equity dilutes ownership and may reduce the risk-taking incentives of shareholders but also provides flexibility in managing the business.

Example: A family-owned business may use debt to fund growth rather than issuing equity, using debt payments to discipline managers and align with shareholders’ desire for growth and profitability.

Influence of Business Risk and Market Conditions on Capital Structure Decisions

Business risk and market conditions are key factors influencing a company’s capital structure decisions. Business risk affects the stability of a company’s cash flows, while market conditions impact the cost and availability of debt and equity financing. Together, they shape how a company balances debt and equity in its capital structure to achieve an optimal mix that supports growth while managing risk. Here’s a closer look at how these factors influence capital structure decisions:

1. Influence of Business Risk on Capital Structure

Business risk is the risk associated with a company’s operations, independent of its financing decisions. High business risk can make a company’s cash flows volatile, affecting its ability to service debt. Consequently, companies with high business risk often favor a more conservative capital structure, while those with low business risk may take on more debt to benefit from tax savings and lower capital costs.

Key Factors of Business Risk

- Industry Characteristics: Some industries, such as technology or biotechnology, have inherently high business risk due to rapid innovation and uncertain cash flows, while others, like utilities, experience stable and predictable cash flows.

- Revenue Stability: Companies with steady, predictable revenues (e.g., utilities) are more likely to handle fixed debt obligations and thus can sustain a higher debt ratio. Conversely, companies with fluctuating revenues tend to rely on equity to avoid the financial pressure of regular debt payments.

- Operating Leverage: High operating leverage (high fixed costs relative to variable costs) amplifies business risk, as a small change in revenue can significantly impact profitability. Companies with high operating leverage often avoid high debt levels to reduce the risk of financial distress.

Implications of Business Risk on Capital Structure

- High Business Risk (Low Debt Capacity):Companies with high business risk (e.g., high-growth tech firms) are more vulnerable to the pressures of fixed debt payments and the risk of financial distress.These companies are likely to adopt an equity-heavy capital structure to preserve cash flow flexibility and avoid bankruptcy risk.

- Low Business Risk (High Debt Capacity):Companies with stable, predictable cash flows (e.g., utilities) can afford to use more debt due to their low business risk.These firms benefit from a debt-heavy capital structure to take advantage of tax-deductible interest payments, which reduces their cost of capital.

2. Influence of Market Conditions on Capital Structure

Market conditions refer to the state of financial markets, including interest rates, investor sentiment, and overall economic health. These conditions affect the cost and availability of debt and equity financing, often driving companies to adjust their capital structure in response to the economic environment.

Key Market Conditions

- Interest Rates: The cost of debt financing is directly impacted by prevailing interest rates. When interest rates are low, debt becomes a more attractive option, as companies can borrow at lower costs. Conversely, high interest rates make debt more expensive, pushing firms to favor equity.

- Equity Market Conditions: A strong stock market with high valuations makes equity financing more appealing, as companies can raise funds at favorable terms. During bearish or volatile market periods, however, issuing equity may be difficult or result in dilution at unattractive valuations.

- Economic Cycles: During economic expansions, companies may be more willing to take on debt, as business prospects improve, and cash flows are expected to grow. In contrast, during recessions or downturns, firms tend to reduce debt levels to minimize financial risk and preserve liquidity.

Implications of Market Conditions on Capital Structure

- Low Interest Rate Environment (Favors Debt Financing):

- Low interest rates reduce the cost of borrowing, encouraging companies to issue debt instead of equity to finance new projects or expansions.

- Debt financing becomes more attractive as companies can lock in lower rates and benefit from the tax shield on interest payments.

- High Interest Rate Environment (Favors Equity Financing):

- High interest rates increase borrowing costs, making debt less attractive, as the company’s cost of capital rises.

- Companies may turn to equity financing to avoid the burden of high-interest payments and to protect cash flow stability.

- Strong Equity Markets (Favors Equity Financing):

- When equity markets are strong, companies may issue shares at higher valuations, minimizing the dilution effect and raising significant capital.

- Equity financing is more attractive in these conditions, especially for high-growth companies looking to fund expansion without increasing leverage.

- Economic Expansion (Favors Debt Financing):

- During periods of economic growth, companies may take on more debt to finance expansion, acquisitions, or other capital-intensive projects, expecting that cash flows will be sufficient to cover debt obligations.

- Higher leverage is sustainable in growth cycles, as revenue generation is typically stronger, supporting debt repayment.

- Economic Downturn (Favors Equity or Conservative Debt Levels):

- In economic downturns, companies may limit debt issuance to avoid financial strain, given the uncertain revenue environment.

- Firms may turn to equity or hybrid financing to support operations without adding to debt burdens, protecting themselves from financial distress.

Examples

Example 1: Equity Financing in Startups

Many startups rely heavily on equity financing to fund their operations and growth. Founders often give up a percentage of ownership in exchange for capital from angel investors or venture capitalists. This approach allows them to raise funds without taking on debt, but it also dilutes ownership and control over the business.

Example 2: Debt Financing for Expansion

Established companies often use debt financing to fund expansion projects, such as acquiring new equipment or entering new markets. For example, a manufacturing firm may issue corporate bonds to raise capital, taking advantage of lower interest rates. This method allows the company to maintain ownership while benefiting from tax-deductible interest payments.

Example 3: Mixed Capital Structure in Corporations

A well-balanced capital structure typically includes both equity and debt. For instance, a large corporation might maintain a capital structure of 60% equity and 40% debt. This mix allows the company to leverage debt for growth while reducing the cost of capital and managing financial risk through the use of retained earnings and stock issuance.

Example 4: Impact of Capital Structure on Risk

The capital structure of a firm can influence its overall risk profile. For example, a company with a high proportion of debt relative to equity may experience higher financial risk during economic downturns, as it must meet interest obligations regardless of its revenue. Conversely, companies with lower debt levels may be more resilient to financial stress but may also experience slower growth.

Example 5: Use of Preferred Stock

Some companies incorporate preferred stock into their capital structure as a hybrid financing option. Preferred stockholders typically receive fixed dividends before common shareholders and have a higher claim on assets in the event of liquidation. For example, a utility company might issue preferred shares to raise capital while providing investors with relatively stable returns, balancing the needs of both equity and debt holders.

Practice Questions

Question 1

Which of the following components primarily make up a company’s capital structure?

A) Revenue and expenses

B) Assets and liabilities

C) Debt and equity

D) Dividends and retained earnings

Correct Answer: C) Debt and equity.

Explanation: A company’s capital structure refers to the mix of debt (borrowed funds) and equity (owner’s funds) used to finance its operations and growth. Debt may include loans and bonds, while equity includes common and preferred stock. Understanding the capital structure is crucial for assessing the company’s financial health and risk profile. Options A and B relate to financial statements, while option D mentions specific financial metrics rather than the overall structure.

Question 2

What is one advantage of using debt in a company’s capital structure?

A) It does not require repayment.

B) It may provide tax benefits due to interest deductions.

C) It increases ownership control for shareholders.

D) It has no impact on the company’s financial risk.

Correct Answer: B) It may provide tax benefits due to interest deductions.

Explanation: One significant advantage of using debt in a capital structure is that the interest payments on debt are typically tax-deductible, which can lower the overall tax burden for the company. This tax shield can make debt an attractive financing option compared to equity, which does not offer such tax benefits. Options A and C are incorrect; debt does require repayment, and using debt can dilute ownership control, while option D is misleading since increased debt can raise financial risk.

Question 3

How does a company’s capital structure affect its overall risk?

A) A higher proportion of equity always reduces risk.

B) Increased debt in the capital structure generally increases financial risk.

C) Capital structure has no impact on risk.

D) The capital structure solely affects the company’s operational risk.

Correct Answer: B) Increased debt in the capital structure generally increases financial risk.

Explanation: A company’s capital structure significantly influences its overall financial risk. When a company takes on more debt, it increases its financial obligations and vulnerability to changes in interest rates and cash flow fluctuations. While equity financing can dilute ownership, it typically does not impose fixed obligations like debt does. Therefore, a higher level of debt increases the company’s financial risk, particularly in challenging economic conditions. Options A and C misrepresent the relationship between equity and risk, while option D inaccurately limits the impact of capital structure on risk.