Preparing for the CFA Exam requires a comprehensive understanding of “Case Study in Risk Management: Private Wealth,” a crucial component of wealth management. Mastery of risk assessment strategies, personalized investment solutions, and client-specific financial planning is essential. This knowledge provides insights into protecting and growing private wealth, critical for achieving a high CFA score.

Learning Objective

In studying “Case Study in Risk Management: Private Wealth” for the CFA Exam, you should learn to understand the comprehensive strategies used in managing risks for private wealth clients. Analyze how diverse financial instruments and investment portfolios are tailored to mitigate specific risks such as market volatility, inflation, and interest rate changes. Evaluate the principles behind asset allocation, diversification, and hedging as they apply to individual wealth management. Additionally, explore how these risk management techniques are integrated into broader wealth planning processes including estate planning, tax strategies, and retirement planning. Apply this knowledge to real-world scenarios to develop effective risk mitigation strategies that align with clients’ long-term financial goals.

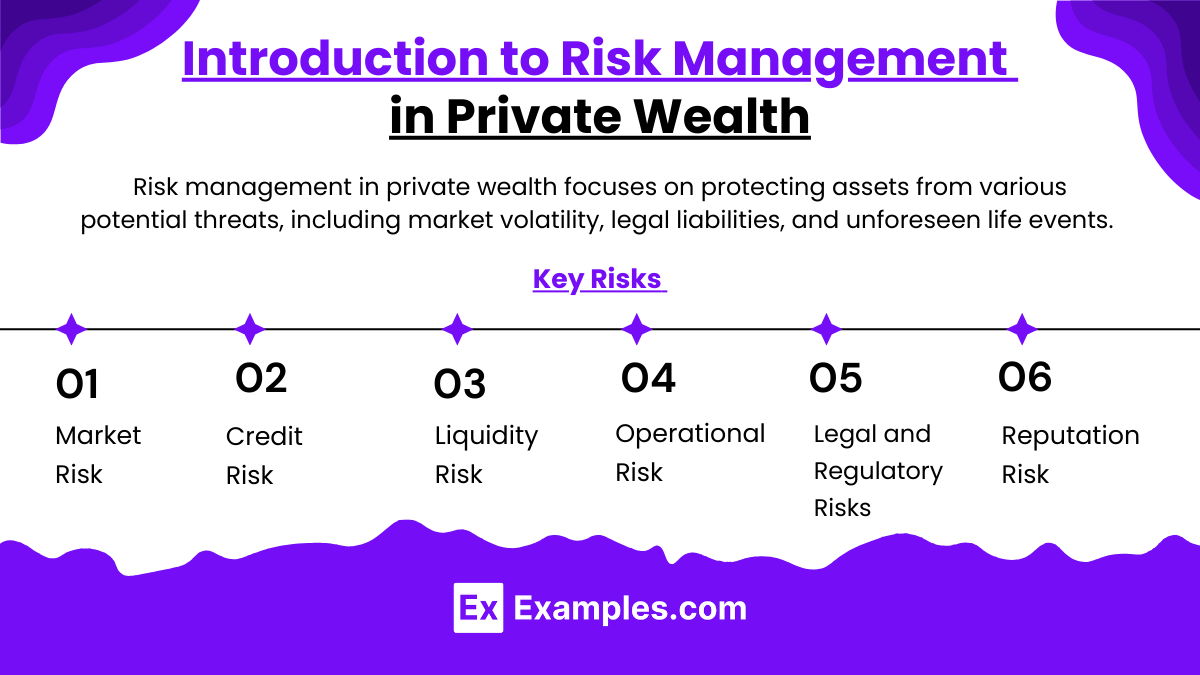

Introduction to Risk Management in Private Wealth

Risk management in private wealth focuses on protecting assets from various potential threats, including market volatility, legal liabilities, and unforeseen life events. The goal is to create a resilient financial strategy that supports long-term objectives while mitigating financial risks.

Key Risks in Private Wealth:

- Market Risk: The risk of losses due to movements in market prices. It includes equity risk, interest rate risk, and currency risk.

- Credit Risk: The possibility that a borrower or counterparty will fail to meet the obligations in accordance with agreed terms.

- Liquidity Risk: The risk of being unable to sell an asset without causing a significant movement in its price and potentially incurring substantial losses.

- Operational Risk: Risks arising from failures in internal processes, people, and systems or from external events (including legal risks).

- Legal and Regulatory Risks: These include the risk of litigation or adverse regulatory actions which can affect financial planning and asset protection strategies.

- Reputation Risk: The potential loss that can occur from a damaging loss in confidence by stakeholders.

Risk Identification and Assessment

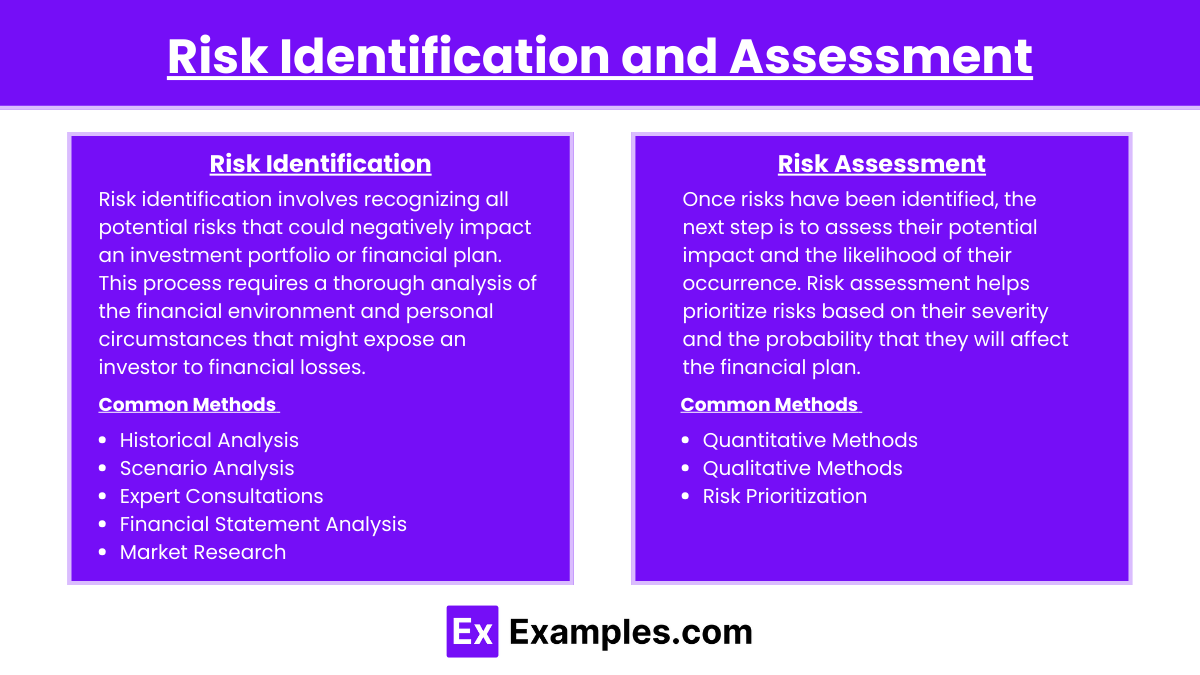

Risk identification and assessment form the foundational steps in the risk management process, especially in the context of financial planning and investment management. These steps are crucial for understanding potential threats to an investor’s assets and developing strategies to mitigate those threats effectively. Here’s a detailed overview of risk identification and assessment:

Risk Identification

Risk identification involves recognizing all potential risks that could negatively impact an investment portfolio or financial plan. This process requires a thorough analysis of the financial environment and personal circumstances that might expose an investor to financial losses. Here are some common methods used in risk identification:

- Historical Analysis: Reviewing past market behavior and personal investment performance to identify patterns and potential risk factors.

- Scenario Analysis: Considering various possible future events and their potential impacts on the investor’s assets.

- Expert Consultations: Engaging with financial advisors, economists, and other experts who can provide insights on emerging risks and their potential implications.

- Financial Statement Analysis: Scrutinizing personal or business financial statements to uncover areas of vulnerability, such as high debt levels or insufficient liquidity.

- Market Research: Staying informed about global economic trends, market developments, and regulatory changes that could pose risks.

Risk Assessment

Once risks have been identified, the next step is to assess their potential impact and the likelihood of their occurrence. Risk assessment helps prioritize risks based on their severity and the probability that they will affect the financial plan. Effective risk assessment typically involves:

- Quantitative Methods:

- Probability Analysis: Estimating the likelihood of each risk occurring using statistical models and historical data.

- Impact Quantification: Assessing the potential financial impact of each risk event. This can include estimating potential losses in terms of monetary value.

- Qualitative Methods:

- Risk Grading: Assigning a qualitative grade to each risk based on expert opinion and industry standards, which helps in understanding the severity of the risk.

- Risk Mapping: Creating a visual representation of risks to understand their relative magnitude and interconnections.

- Risk Prioritization:

- Risk Matrix: Developing a risk matrix that plots the likelihood of each risk against its potential impact, aiding in the prioritization of risk management efforts.

- Sensitivity Analysis: Examining how sensitive the financial outcomes are to changes in risk factors, which helps in understanding which risks have the most significant effect on financial goals.

Risk Management Strategies

Risk management strategies in finance are essential for mitigating potential losses and optimizing the performance of investment portfolios. These strategies involve a combination of techniques and tools designed to identify, assess, and manage financial risks effectively. Here’s an overview of key risk management strategies:

- Diversification: Spread investments across various asset classes and sectors to minimize the impact of losses in any single area.

- Asset Allocation: Strategically distribute assets to align with risk tolerance and investment goals, balancing between growth-oriented and safer investments.

- Hedging: Use financial instruments like options and futures to protect against potential market downturns.

- Risk Transfer: Employ insurance and other contracts to shift potential financial losses to another party.

- Stop-Loss Orders: Set automatic sell orders to limit losses on any investment.

- Regular Monitoring and Rebalancing: Periodically adjust the portfolio to maintain desired asset allocation and risk levels.

- Credit Risk Management: Conduct thorough credit analysis and diversify exposure to mitigate losses from defaults.

- Liquidity Management: Ensure sufficient liquidity to cover short-term needs and emergencies without needing to sell assets at a loss.

Implementing Risk Management Solutions

Implementing risk management solutions involves a systematic approach to integrating risk control measures into your investment strategies or business operations. The goal is to minimize potential losses while maximizing the effectiveness of your risk management plan. Here’s a detailed guide on how to implement these solutions effectively:

Key Steps for Implementing Risk Management Solutions:

- Establish a Risk Management Framework

- Identify Risks: Conduct thorough risk assessments to identify potential threats.

- Evaluate and Prioritize Risks: Assess and rank risks based on their likelihood and potential impact.

- Develop Risk Management Policies

- Formulate Policies: Create detailed policies that define strategies for managing identified risks.

- Define Roles: Clearly outline responsibilities for risk management across the organization.

- Select Appropriate Risk Management Strategies

- Diversification: Use asset allocation to minimize financial risk.

- Hedging: Implement derivatives strategies to protect investments.

- Insurance: Secure insurance to cover operational and financial risks.

- Risk Transfer: Shift risks through contracts or outsourcing.

- Implement Risk Control Measures

- Deploy Controls: Put necessary risk controls into practice.

- Training and Communication: Educate and inform all involved parties about risk procedures and their importance.

- Monitor and Review

- Continuous Monitoring: Regularly monitor the effectiveness of risk controls and strategies.

- Regular Reviews: Periodically reassess and update risk management frameworks and policies.

- Reporting and Feedback

- Reporting System: Establish a system for reporting risk-related data.

- Feedback Mechanism: Use experiences to refine risk management strategies continually.

Examples

Example 1: Tailored Asset Allocation for High-Net-Worth Individual (HNWI)

A private wealth manager develops a customized asset allocation for an HNWI with a low risk tolerance. The portfolio includes a higher proportion of fixed-income securities and real estate investments to provide stable income and reduce volatility, while maintaining a smaller allocation to equities and alternative investments for growth potential.

Example 2: Use of Hedging in Estate Planning

To protect the value of a large stock portfolio against market downturns, a wealth manager uses equity options to hedge the risk. This strategy ensures that the client’s estate value is preserved, even if stock prices fall, facilitating smoother wealth transfer to heirs according to the estate plan.

Example 3: Diversification Across Global Markets

To mitigate the risk of domestic market fluctuations impacting the entire investment portfolio, a wealth manager diversifies a client’s assets globally. Investments are spread across developed and emerging markets in different asset classes, including international equities, bonds, and commodities.

Example 4: Implementing Tax-Efficient Investment Strategies

A wealth manager structures a client’s investments to take advantage of tax-efficient vehicles like municipal bonds for a U.S.-based client. This approach minimizes the tax liability on investment returns, enhancing the net impact of gains on the client’s wealth accumulation.

Example 5: Insurance Products for Risk Management

For a client concerned about the long-term care costs affecting their family wealth, the wealth manager recommends long-term care insurance. This insurance product helps manage the potential financial risk of high medical and care costs in old age without depleting the family estate.

Practice Questions

Question 1

Which of the following is a crucial ethical consideration when implementing risk management strategies for private wealth clients?

A. Maximizing returns at all costs

B. Tailoring risk management to the specific risk tolerance of the client

C. Frequently changing risk strategies to take advantage of market trends

D. Using complex financial instruments that clients may not fully understand

Answer:

B. Tailoring risk management to the specific risk tolerance of the client

Explanation:

Ethically, it is essential to tailor risk management strategies to align with the specific risk tolerance and financial goals of the client. This approach respects the client’s preferences and circumstances, ensuring that financial advice and management practices are both appropriate and personalized, which upholds the fiduciary responsibility to act in the client’s best interests.

Question 2

A wealth manager is considering the use of derivatives to hedge a client’s large concentrated stock position. What must the manager ensure to comply with ethical standards?

A. The client fully understands the risks associated with using derivatives.

B. The derivatives provide a guaranteed increase in portfolio value.

C. The client’s other investments are similarly hedged.

D. The derivatives are only used if they are profitable within a short term.

Answer:

A. The client fully understands the risks associated with using derivatives.

Explanation:

It is ethically imperative that the client fully understands the risks and mechanics of using derivatives before they are implemented in the portfolio. This transparency ensures informed consent and supports the ethical obligation to provide fair, accurate, and thorough advice.

Question 3

When managing a private wealth client’s portfolio, the duty of loyalty requires a wealth manager to:

A. Prioritize the wealth manager’s own investment beliefs over the client’s instructions

B. Focus solely on financial returns, disregarding other client-specific concerns

C. Place the interests of the client above their own or the firm’s

D. Share potential conflicts of interest only if they result in financial loss

Answer:

C. Place the interests of the client above their own or the firm’s

Explanation:

The duty of loyalty is a fundamental ethical principle requiring that the wealth manager places the client’s interests above their own or their firm’s interests. This principle is crucial for maintaining trust and integrity in the advisor-client relationship and ensures that all decisions made are with the client’s best interests in mind, free from personal or organizational conflicts.