Preparing for the CFA Exam requires a comprehensive understanding of “Corporate Restructuring,” a vital topic in corporate finance. Mastery of mergers, acquisitions, divestitures, and reorganization strategies is essential. This knowledge provides insights into enhancing shareholder value, improving financial performance, and managing strategic growth and risk, crucial for achieving a high CFA score.

Learning Objective

In studying “Corporate Restructuring” for the CFA Exam, you should learn to understand the various forms of restructuring, including mergers and acquisitions (M&A), divestitures, spin-offs, and leveraged buyouts (LBOs). Analyze how these strategies can unlock shareholder value, improve operational efficiency, and achieve strategic business objectives. Evaluate the financial, legal, and strategic considerations involved in restructuring, including valuation methods, due diligence, and integration challenges. Additionally, explore the impact of restructuring on financial statements, debt structures, and equity valuation. Apply this knowledge to assess the risks and opportunities associated with corporate restructuring in practical investment scenarios and case studies.

Understanding Corporate Restructuring

Corporate restructuring refers to the comprehensive process of reorganizing a company’s structure, operations, or financial setup to increase profitability, improve efficiency, and better align with long-term strategic goals. It can involve changes in ownership, business units, financial arrangements, or management structures.

Reasons for Corporate Restructuring

- Financial Distress: To prevent bankruptcy or manage insolvency by reorganizing debt and assets.

- Improving Efficiency: To reduce operational costs and improve profitability.

- Strategic Refocus: To realign the business with its core strengths and long-term goals.

- Unlocking Value: To release value from underperforming assets or divisions.

- Regulatory Compliance: To meet regulatory requirements or restructure following legal directives.

- Tax Benefits: To take advantage of tax breaks or optimize tax structures.

Types of Corporate Restructuring

Corporate restructuring involves different types of changes aimed at improving a company’s financial stability, operational efficiency, and strategic focus. Here’s an overview of the main types of corporate restructuring:

- Financial Restructuring

- Adjusts capital structure through debt refinancing and equity changes.

- Aims to improve financial stability and manage solvency.

- Operational Restructuring

- Streamlines operations, reduces costs, and optimizes processes.

- Focuses on core activities to enhance efficiency and profitability.

- Mergers and Acquisitions (M&A)

- Combines or acquires companies for market expansion and synergies.

- Strengthens competitive positioning.

- Divestitures and Spin-offs

- Sells or separates parts of the business to focus on core segments.

- Unlocks value and reallocates resources.

- Corporate Takeovers and Buyouts

- Gains control through share or asset purchases (e.g., LBOs, MBOs).

- Restructures ownership for better strategic control.

- Recapitalization

- Alters debt-to-equity ratio to stabilize finances.

- Optimizes capital structure for growth or defense.

- Debt Restructuring

- Modifies debt terms to ease obligations and avoid bankruptcy.

- Includes renegotiating interest rates and repayment schedules.

- Corporate Reorganization

- Changes in management, operations, or legal structures.

- Aligns organization for improved efficiency and strategic focus.

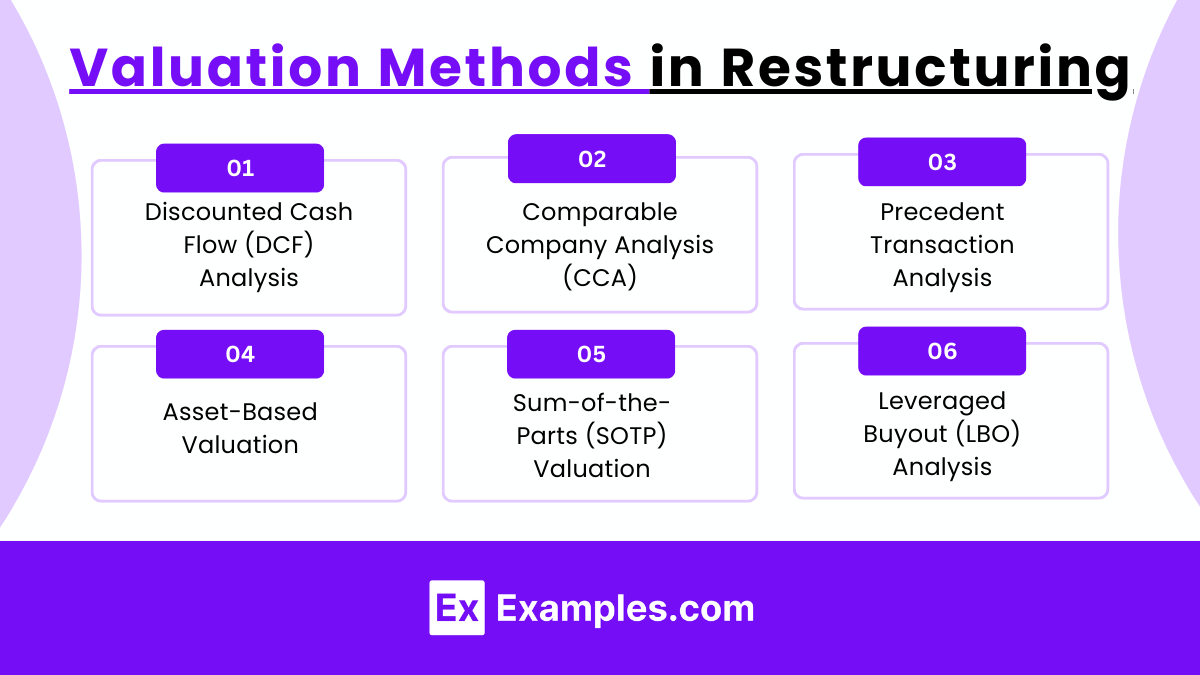

Valuation Methods in Restructuring

Valuation methods play a critical role in corporate restructuring, helping to assess the value of business units, assets, or the entire company for effective decision-making. Here are the primary valuation methods used in restructuring:

- Discounted Cash Flow (DCF) Analysis

- Use: Projects future cash flows, discounted to present value.

- Strengths: Captures intrinsic value based on projected performance.

- Challenges: Heavily dependent on assumptions.

- Comparable Company Analysis (CCA)

- Use: Benchmarks against similar public companies for market valuation.

- Strengths: Real-time, market-driven.

- Challenges: Requires truly comparable companies.

- Precedent Transaction Analysis

- Use: Analyzes past similar deals for valuation multiples.

- Strengths: Reflects real market prices.

- Challenges: May be impacted by differing market conditions.

- Asset-Based Valuation

- Use: Values a company by its assets minus liabilities.

- Strengths: Tangible and straightforward.

- Challenges: Ignores future earnings potential.

- Sum-of-the-Parts (SOTP) Valuation

- Use: Values individual business units separately.

- Strengths: Highlights segment-specific value.

- Challenges: Complex and requires detailed segment data.

- Leveraged Buyout (LBO) Analysis

- Use: Values a company based on acquisition using debt.

- Strengths: Emphasizes cash flow and debt capacity.

- Challenges: Accurate cash flow projections are essential.

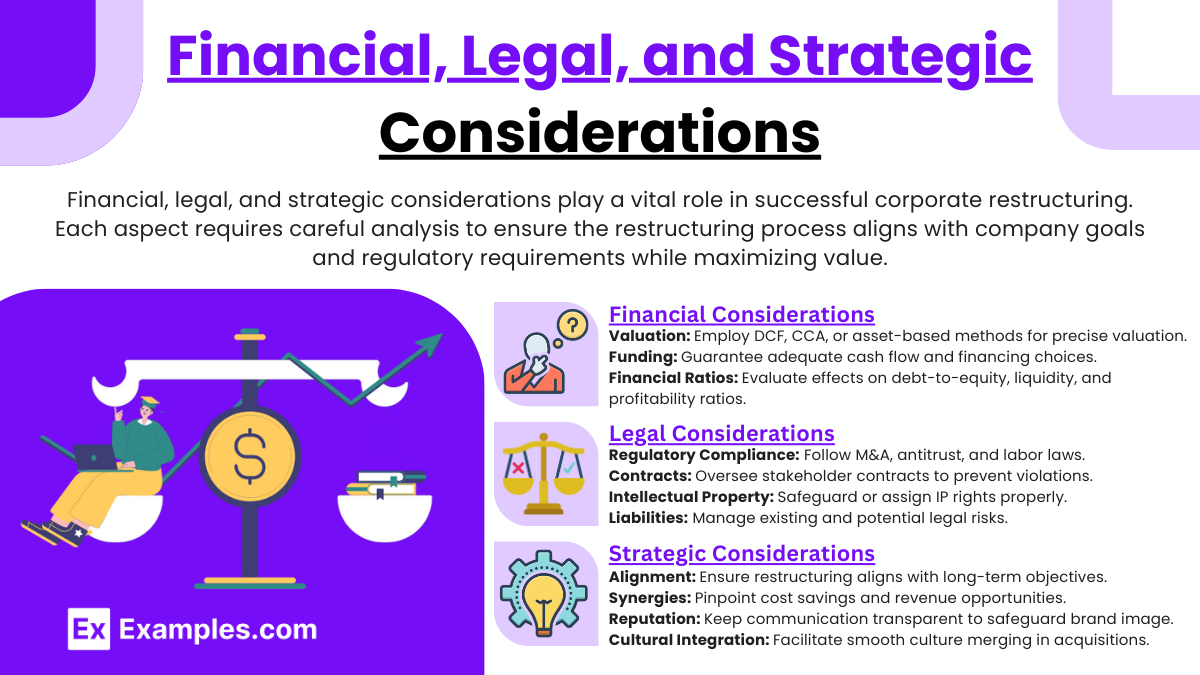

Financial, Legal, and Strategic Considerations

Financial, legal, and strategic considerations play a vital role in successful corporate restructuring. Each aspect requires careful analysis to ensure the restructuring process aligns with company goals and regulatory requirements while maximizing value.

1. Financial Considerations

- Valuation: Accurate valuation using DCF, CCA, or asset-based methods is essential.

- Funding: Ensure sufficient cash flow and financing options.

- Financial Ratios: Assess impacts on debt-to-equity, liquidity, and profitability.

- Tax Implications: Minimize tax liabilities through careful planning.

2. Legal Considerations

- Regulatory Compliance: Adhere to laws related to M&A, antitrust, and labor.

- Contracts: Review and manage contracts with stakeholders to avoid breaches.

- Intellectual Property: Protect or transfer IP rights appropriately.

- Liabilities: Address current and potential legal risks.

- Stakeholder Rights: Ensure shareholder and creditor rights are upheld.

3. Strategic Considerations

- Alignment: Restructuring must align with long-term goals.

- Synergies: Identify cost savings and revenue potential.

- Reputation: Maintain transparent communication to protect brand image.

- Cultural Integration: Smoothly integrate cultures in mergers or acquisitions.

- Risk Management: Plan for market, competitor, and operational risks.

Example

Example 1: Case Study: Disney’s Acquisition of 21st Century Fox

Analyze Disney’s acquisition of 21st Century Fox as an example of a strategic merger aimed at expanding its media and entertainment content. Discuss the valuation approach used, expected synergies, integration challenges, and the impact on Disney’s stock price and financials post-acquisition.

Example 2: Example of a Successful Spin-off: PayPal from eBay

Review how eBay’s decision to spin off PayPal into an independent company unlocked significant shareholder value. Examine the strategic rationale behind the spin-off, the effect on both companies’ financial performance, and the market reaction.

Example 3: Leveraged Buyout (LBO) Case: The Acquisition of Dell Technologies

Explore the LBO of Dell Technologies led by Michael Dell and private equity firm Silver Lake Partners. Analyze the structure of the deal, the use of debt financing, the motivations behind going private, and the financial outcomes and challenges following the buyout.

Example 4: Divestiture for Streamlining Operations: General Electric (GE)

Study GE’s divestiture of its financial services arm and non-core business units as part of a larger restructuring effort. Discuss the rationale for the divestiture, its impact on GE’s core business focus, and the subsequent financial performance improvements or setbacks.

Example 5: Turnaround Strategy of a Distressed Company: Ford Motor Company

Examine Ford’s restructuring during the late 2000s financial crisis, focusing on its cost-cutting measures, asset sales, and operational improvements. Evaluate the effectiveness of its strategy in avoiding bankruptcy and returning to profitability without government bailout support.

Practice Questions

Question 1

Which of the following is not typically a reason for a company to engage in a corporate spin-off?

A. To focus on core business operations

B. To create value by separating a high-growth division

C. To diversify into unrelated industries

D. To unlock shareholder value through independence

Answer:

C. To diversify into unrelated industries

Explanation:

A spin-off is generally used to allow a company to focus on its core business by separating a division that operates differently. It helps unlock shareholder value and allows both entities to pursue independent growth. Diversification into unrelated industries is not typically a reason for a spin-off; it’s more aligned with conglomerate mergers or expansions.

Question 2

What is a key risk associated with a leveraged buyout (LBO)?

A. Increased equity dilution

B. High debt levels leading to potential financial distress

C. Reduction in shareholder value

D. Decreased interest expenses

Answer:

B. High debt levels leading to potential financial distress

Explanation:

A leveraged buyout (LBO) involves financing a significant portion of the acquisition with debt. This can lead to high debt levels, which increase the risk of financial distress if the acquired company is unable to generate sufficient cash flow to service the debt. This risk is a primary concern in evaluating the viability of an LBO.

Question 3

Which of the following best describes the main advantage of divestitures for a company?

A. Increasing the overall size of the company

B. Focusing on high-growth sectors by shedding non-core assets

C. Avoiding regulatory scrutiny in mergers

D. Minimizing the company’s tax obligations

Answer:

B. Focusing on high-growth sectors by shedding non-core assets

Explanation:

Divestitures allow a company to streamline operations by selling off non-core or underperforming business units. This enables the company to focus on high-growth areas and improve overall financial and operational performance. Divestitures can also generate cash to strengthen the company’s balance sheet or fund core business investments.