Preparing for the CFA Exam requires a comprehensive understanding of “Cost of Capital: Advanced Topics,” a critical component of corporate finance. Mastery of weighted average cost of capital (WACC), cost of equity, and cost of debt in various scenarios is essential. This knowledge provides insights into capital budgeting, financial strategy, and investment decisions, crucial for achieving a high CFA score.

Learning Objective

In studying “Cost of Capital: Advanced Topics” for the CFA Exam, you should learn to understand the intricacies of calculating the weighted average cost of capital (WACC) and its application in capital budgeting and strategic decision-making. Analyze the various approaches to estimating the cost of equity, including the capital asset pricing model (CAPM), dividend discount model (DDM), and risk premium methods. Evaluate the impact of leverage, capital structure, and market conditions on the cost of debt and equity. Additionally, explore how adjustments for taxes and country-specific risks influence WACC and apply this knowledge to practical valuation and investment scenarios.

Understanding Cost of Capital

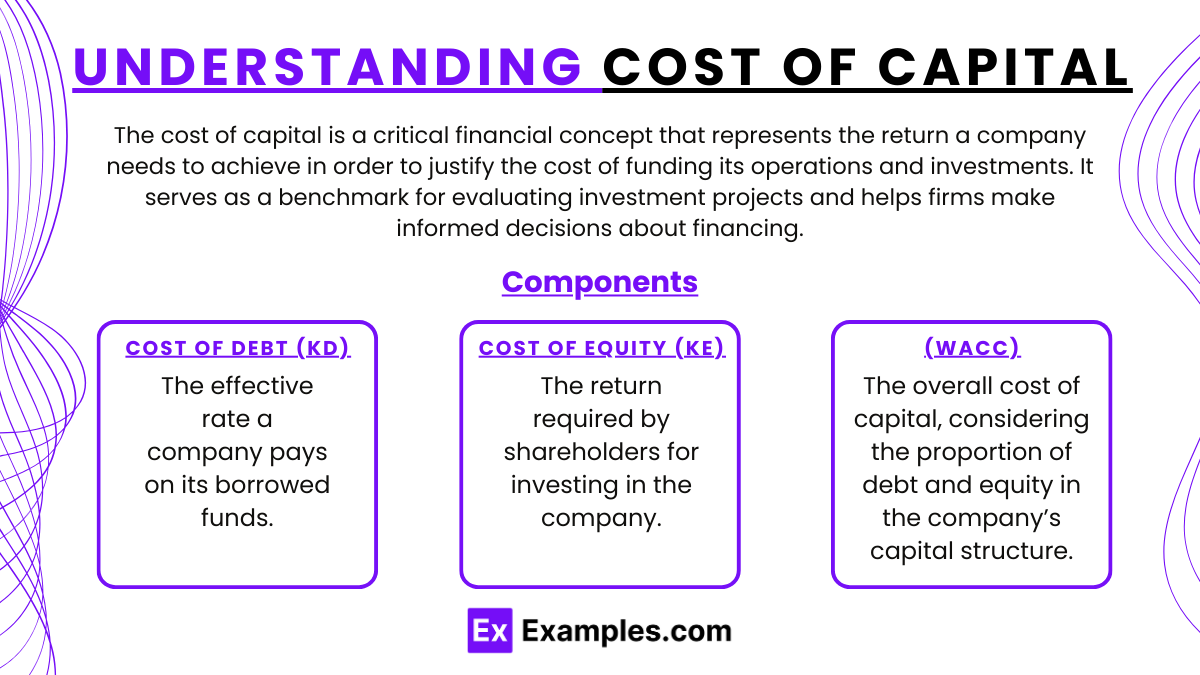

The cost of capital is a critical financial concept that represents the return a company needs to achieve in order to justify the cost of funding its operations and investments. It serves as a benchmark for evaluating investment projects and helps firms make informed decisions about financing.

Components of Cost of Capital

- Cost of Debt (Kd)

- The effective rate a company pays on its borrowed funds.

- Typically lower than equity costs because interest payments are tax-deductible.

- Calculation:

- Cost of Equity (Ke)

- The return required by shareholders for investing in the company.

- Higher than the cost of debt because equity holders face more risk than lenders.

- Calculation Methods:

- Capital Asset Pricing Model (CAPM): $ K_e = R_f + \beta (R_m – R_f) $, where Rf is the risk-free rate, β is the stock’s beta, and (Rm−Rf) is the market risk premium.

- Dividend Discount Model (DDM): $ K_e = \frac{D_1}{P_0} + g $, where D1 is the expected dividend, P0 is the current stock price, and g is the growth rate.

- Weighted Average Cost of Capital (WACC)

- The overall cost of capital, considering the proportion of debt and equity in the company’s capital structure.

- Calculation: $ WACC = \frac{E}{V} \times K_e + \frac{D}{V} \times K_d \times (1 – \text{Tax Rate}) $, where E is the market value of equity, D is the market value of debt, and V is E+D (total capital).

Advanced Considerations in WACC Calculation

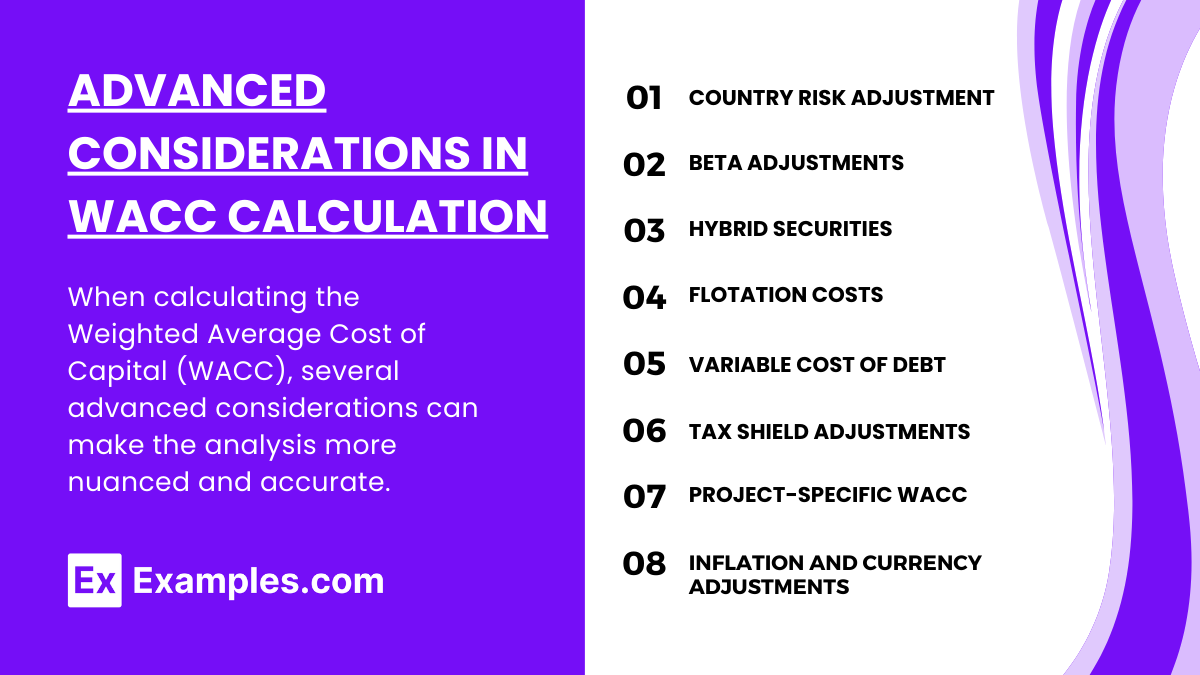

When calculating the Weighted Average Cost of Capital (WACC), several advanced considerations can make the analysis more nuanced and accurate. These factors can significantly impact the outcome and inform better financial decisions:

- Country Risk Adjustment

- Add a country risk premium to the cost of equity for international projects.

- Ensures a realistic reflection of country-specific risks.

- Beta Adjustments

- Use unlevered beta for comparisons and re-levered beta for new capital structures.

- Improves risk estimation for the equity portion.

- Hybrid Securities

- Include instruments like convertible bonds and preferred stock in WACC.

- Accurately represents funding costs with diverse capital structures.

- Flotation Costs

- Adjust cost of equity or debt for issuance expenses.

- Reflects true costs of raising new capital.

- Variable Cost of Debt

- Calculate a blended rate for different types of debt (fixed and variable).

- Accurately reflects the overall cost of debt.

- Tax Shield Adjustments

- Use the effective tax rate for more precise savings from debt.

- Ensures a realistic after-tax cost of debt.

- Project-Specific WACC

- Tailor WACC using project-specific risks and betas.

- Aligns investment analysis with unique project profiles.

- Inflation and Currency Adjustments

- Adjust WACC for inflation and currency risks in international projects.

- Reflects economic conditions accurately for specific regions.

Implications of Cost of Capital on Investment Decisions

The cost of capital has significant implications for a company’s investment decisions. It serves as a benchmark that guides the evaluation of potential projects, strategic planning, and overall financial management. Here’s an overview of the key implications:

- Investment Evaluation

- Used as the benchmark for NPV analysis; projects with returns above the cost of capital are pursued.

- Serves as the hurdle rate for assessing project viability.

- Capital Budgeting

- Helps prioritize projects that offer higher returns than the cost of capital.

- Aligns investments with long-term strategic goals.

- Risk Assessment

- Adjusted for high-risk projects to ensure sufficient returns.

- Considers industry-specific risk profiles.

- Financing Strategy

- Guides decisions on debt vs. equity financing for optimal capital structure.

- Helps manage leverage to minimize WACC.

- Performance Benchmarking

- Evaluates ongoing projects against the cost of capital to ensure value creation.

- Supports comparative analysis with industry standards.

- Shareholder Value

- Ensures investments contribute positively to shareholder wealth.

- Enhances market perception and investor confidence.

- Strategic Flexibility

- Adapts to changes in market conditions and interest rates.

- Essential for evaluating mergers and acquisitions.

Practical Applications and Case Studies

Practical applications of the cost of capital extend across various aspects of corporate finance, strategic planning, and investment decision-making. Companies use it to evaluate potential projects, determine the best financing strategy, and ensure shareholder value is maximized. Here are some practical applications along with illustrative case studies:

Practical Applications

- Project Evaluation: Used as a discount rate in NPV and IRR calculations to assess project viability.

- Optimal Capital Structure: Helps balance debt and equity to minimize WACC.

- Performance Measurement: Ensures ongoing projects contribute positively to shareholder value.

- M&A Decisions: Evaluates whether potential acquisitions will exceed WACC for value creation.

Case Studies

- Apple Inc.: Utilized low cost of debt for share buybacks, enhancing shareholder value and EPS.

- Tesla: Balanced debt and equity strategically to fund expansion, aligning with its WACC.

- GE: Used WACC for project analysis, focusing on value-adding projects and divesting underperforming units.

- Facebook (Meta Platforms): Evaluated the WhatsApp acquisition to ensure it exceeded WACC, aligning with long-term growth.

Examples

Example 1: Calculating WACC for a Multi-National Corporation

Analyze how a global company like Coca-Cola or General Electric calculates its WACC, considering multiple sources of debt, equity, and different tax rates across countries. Discuss how currency risks and geopolitical factors are integrated into their cost of capital.

Example 2: Impact of a Debt Issuance on WACC

Study a case where a company issues bonds to raise capital and analyze how the new debt impacts its overall WACC. Include calculations that show how the after-tax cost of debt affects the weighted average cost of capital and, subsequently, investment decisions.

Example 3: Evaluating a Project in an Emerging Market

Provide an example of a company considering a project in an emerging market, where country risk adjustments are necessary. Discuss how adding a country risk premium to the cost of equity or WACC can affect the viability of the project.

Example 4: Comparison of Cost of Equity Using CAPM vs. DDM

Compare the results of estimating the cost of equity for a company using both the Capital Asset Pricing Model (CAPM) and the Dividend Discount Model (DDM). Analyze the differences in results and discuss which method may be more appropriate under certain conditions.

Example 5: Effect of Capital Structure Changes on WACC

Examine a scenario where a company shifts its capital structure by increasing leverage. Show how this impacts the WACC and the trade-offs involved, including the benefits of tax shields and the potential rise in financial distress costs as leverage increases.

Practice Questions

Question 1

A company is calculating its WACC and has the following data: cost of equity is 10%, pre-tax cost of debt is 6%, the corporate tax rate is 30%, the market value of equity is 500 million dollars, and the market value of debt is 200 million dollars. What is the company’s WACC?

A. 8.4%

B. 9.0%

C. 7.5%

D. 8.1%

Answer:

D. 8.1%

Explanation:

To calculate WACC, use the formula:

$ WACC = \left(\frac{E}{V} \times R_e\right) + \left(\frac{D}{V} \times R_d \times (1 – T_c)\right) $

Where:

- E=500 million (market value of equity)

- D=200 million (market value of debt)

- V=E+D=700 million (total market value)

- Re=10% (cost of equity)

- Rd=6% (cost of debt)

- Tc=30% (tax rate)

Plug in the values:

$ WACC = \left(\frac{500}{700} \times 10\%\right) + \left(\frac{200}{700} \times 6\% \times (1 – 0.3)\right) $

$ WACC = 0.0714 + 0.0103 = 0.0817 \text{ or } 8.1\% $

Question 2

Which of the following is not a common method for estimating the cost of equity?

A. Capital Asset Pricing Model (CAPM)

B. Dividend Discount Model (DDM)

C. Bond Yield Plus Risk Premium Method

D. Net Present Value (NPV) Method

Answer:

D. Net Present Value (NPV) Method

Explanation:

The Net Present Value (NPV) method is used for evaluating investment projects and is not a method for estimating the cost of equity. The common methods for estimating the cost of equity include CAPM, DDM, and the Bond Yield Plus Risk Premium Method.

Question 3

What is the primary impact on WACC when a company increases its leverage, assuming no change in market conditions?

A. WACC always decreases due to the tax shield on debt

B. WACC remains the same, as debt and equity weight changes cancel out

C. WACC may decrease initially but could increase if financial distress costs outweigh the tax benefits

D. WACC always increases due to higher risk from additional debt

Answer:

C. WACC may decrease initially but could increase if financial distress costs outweigh the tax benefits

Explanation:

Increasing leverage initially lowers the WACC due to the tax shield on debt. However, as debt levels continue to rise, the risk of financial distress and bankruptcy costs can outweigh the tax benefits, causing the WACC to increase. This trade-off is central to the trade-off theory of capital structure.