Preparing for the CFA Exam demands a thorough grasp of credit analysis for corporate issuers, an essential aspect of financial evaluation. Mastery of corporate credit metrics, financial ratios, and risk assessment techniques provides valuable insights into a company's creditworthiness and debt obligations, essential for analyzing investment potential and achieving a high CFA score.

Learning Objective

In studying "Credit Analysis for Corporate Issuers" for the CFA Exam, you should aim to understand the key metrics and methods used to evaluate a company's creditworthiness. Examine financial ratios, cash flow analysis, and debt structure to assess a firm's ability to meet its obligations. Analyze the principles behind credit rating methodologies and factors influencing credit spreads and defaults. Evaluate qualitative elements, such as management quality and industry risks, alongside quantitative metrics. Additionally, explore how economic conditions and market trends impact corporate credit. Apply this knowledge to interpret real-world credit scenarios and make informed investment decisions in CFA practice cases.

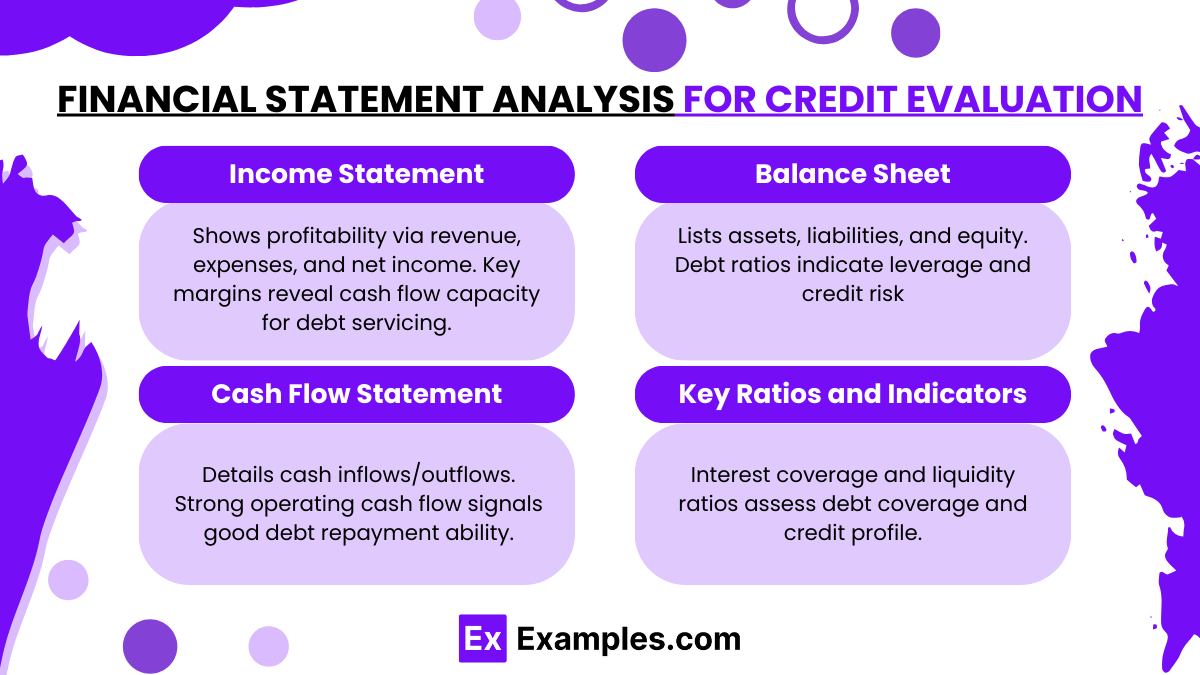

Financial Statement Analysis for Credit Evaluation

Financial statement analysis is a critical component of credit evaluation for corporate issuers, providing insights into a company’s financial stability, profitability, and ability to meet debt obligations. By analyzing the income statement, balance sheet, and cash flow statement, credit analysts gain a comprehensive view of a company’s financial health and potential risks. Here’s how each financial statement contributes to the credit evaluation process:

Income Statement:

The income statement reveals a company’s profitability by detailing revenue, expenses, and net income over a specific period. Key metrics, such as gross margin, operating margin, and net profit margin, provide insights into cost control, revenue generation, and profitability trends. High profitability ratios may indicate a strong capacity to generate cash flow, which is crucial for debt servicing.

Balance Sheet:

The balance sheet offers a snapshot of a company’s financial position by listing assets, liabilities, and equity at a given point in time. Key ratios, like the debt-to-equity ratio and debt-to-asset ratio, help assess the degree of leverage and financial risk. A high level of debt relative to equity might indicate increased credit risk, as the company could face challenges in meeting its financial obligations during economic downturns.

Cash Flow Statement:

The cash flow statement provides an overview of cash inflows and outflows from operating, investing, and financing activities. A strong operating cash flow indicates that the company generates sufficient cash from core operations to cover debt repayments. Meanwhile, cash flows from financing activities reveal the extent to which a company relies on external funding. Consistent positive cash flows from operations typically signal healthy liquidity and creditworthiness.

Key Ratios and Indicators:

Beyond the core financial statements, specific ratios are essential in credit analysis. Ratios like the interest coverage ratio (EBIT/Interest Expense) measure a company’s ability to cover interest payments from earnings, while the current ratio (Current Assets/Current Liabilities) and quick ratio (Quick Assets/Current Liabilities) provide insight into short-term liquidity. High ratios in these areas suggest that the company can more comfortably meet short-term and long-term debt obligations, enhancing its credit profile.

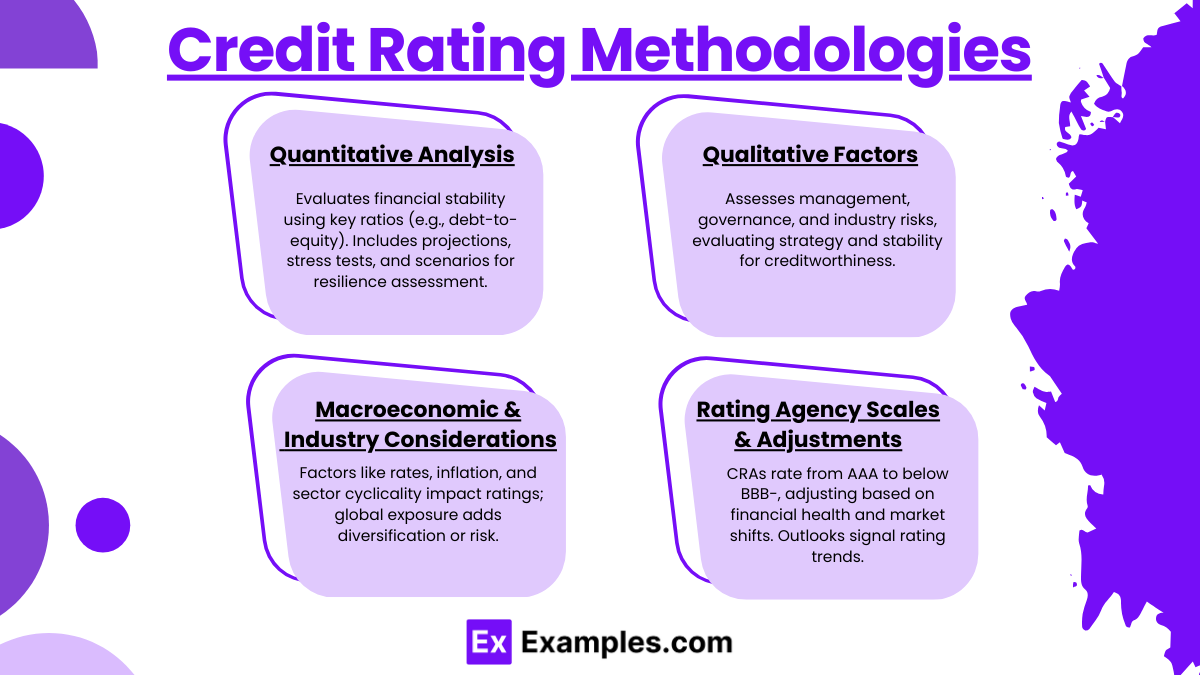

Credit Rating Methodologies

Credit rating methodologies provide a structured approach to assessing the creditworthiness of corporate issuers. These methodologies are employed by credit rating agencies (CRAs), such as Moody’s, Standard & Poor’s (S&P), and Fitch, to assign ratings that reflect the likelihood of a company meeting its debt obligations. Understanding these methodologies is crucial for credit analysts, as they help gauge the risk associated with corporate bonds and other debt instruments. Here are the core components of credit rating methodologies:

Quantitative Analysis:

Quantitative analysis focuses on measurable financial metrics, such as profitability, leverage, and liquidity. CRAs analyze key financial ratios—such as the debt-to-equity ratio, interest coverage ratio, and EBITDA margin—to understand a company’s financial stability.

Historical performance and financial projections are evaluated to estimate future cash flows, assess the impact of existing debt, and determine the company’s ability to meet its obligations under various economic conditions.

Analysts may also use stress testing and scenario analysis to evaluate how a company might perform under adverse conditions, such as economic downturns or industry disruptions.

Qualitative Factors:

In addition to financial metrics, credit rating agencies consider qualitative factors, which can significantly impact a company’s creditworthiness. These include management quality, corporate governance, business model robustness, and competitive positioning within the industry.

Analysts assess the company’s strategic goals, operational efficiency, and risk management policies to understand how prepared it is for long-term success and stability.

Qualitative analysis also examines industry-specific risks (e.g., regulatory pressures, technological changes) that could impact a company’s financial performance, providing a more comprehensive view of potential vulnerabilities.

Macroeconomic and Industry Considerations:

Economic and industry-specific trends heavily influence credit ratings. CRAs evaluate the impact of factors like interest rates, inflation, GDP growth, and commodity prices on the company’s operations and financial performance.

Industry cyclicality is also critical; companies in cyclical industries, such as automotive or energy, may be rated more conservatively than those in more stable sectors like utilities, given their susceptibility to economic fluctuations.

CRAs often consider global market conditions, as international exposure can either add diversification benefits or increase risks due to foreign exchange volatility and geopolitical uncertainty.

Rating Agency Scales and Adjustments:

Each CRA has its own rating scale, ranging from high-grade (AAA or Aaa) to speculative-grade (below BBB- or Baa3), with finer distinctions within each category (e.g., AA+, AA, AA-). These ratings reflect the agency’s view of the issuer’s credit risk and the relative likelihood of default.

Ratings may be adjusted over time based on changes in the issuer’s financial health, industry environment, or macroeconomic conditions. Rating outlooks (positive, stable, or negative) indicate the CRA’s expectations for potential future changes, while rating watches are more immediate signals of likely upgrades or downgrades.

Credit rating methodologies provide a framework that combines financial, qualitative, and macroeconomic analysis, enabling investors and stakeholders to understand the risk profile of corporate issuers. These ratings play a critical role in financial markets by helping investors make informed decisions about bond investments and pricing corporate debt

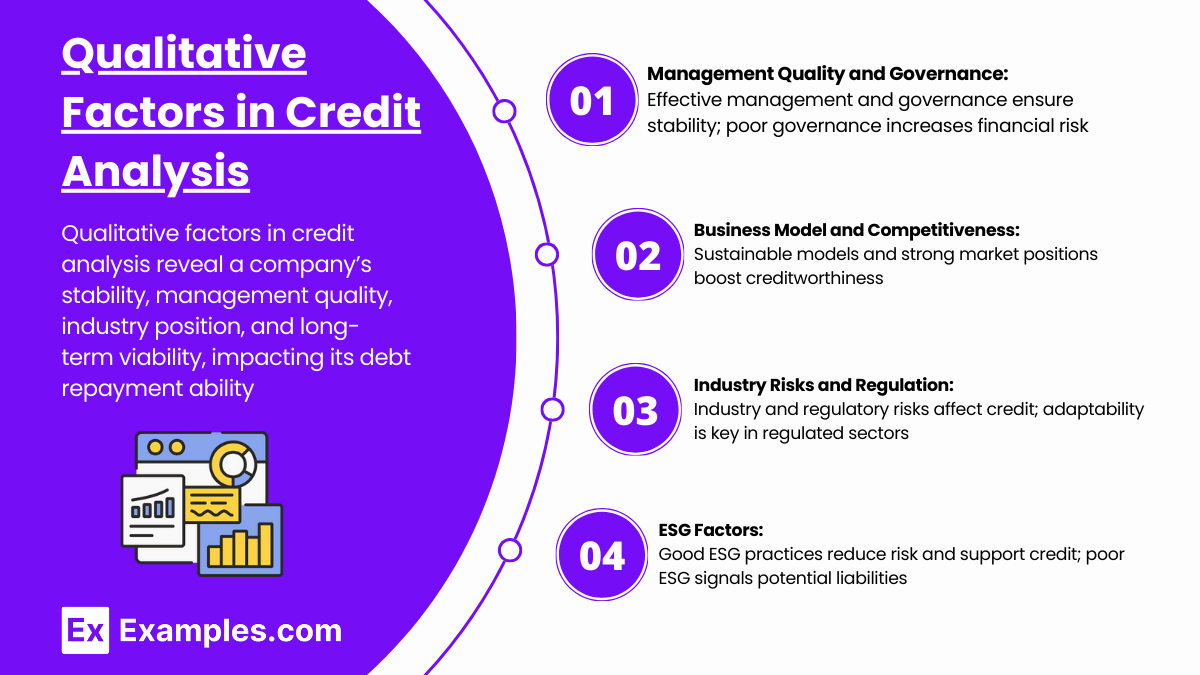

Qualitative Factors in Credit Analysis

Qualitative factors in credit analysis are essential for understanding aspects of a corporate issuer’s creditworthiness that go beyond financial metrics. These factors provide insight into a company’s operational stability, management, industry position, and long-term viability, all of which can significantly impact its ability to meet debt obligations. Here are the key qualitative factors considered in credit analysis:

Management Quality and Corporate Governance:

Strong, experienced management is crucial for effective decision-making and navigating market challenges. Credit analysts assess the management team’s track record, strategic vision, and adaptability to changing market conditions.

Corporate governance is also evaluated, with a focus on transparency, accountability, and alignment of management interests with those of shareholders and creditors. Poor governance practices can increase the risk of financial mismanagement or unethical behavior, which can harm the company’s financial health and creditworthiness.

Business Model and Competitive Position:

The sustainability and competitiveness of a company’s business model are fundamental to its creditworthiness. Analysts assess how the company generates revenue, its customer base, and its value proposition within the industry.

Competitive positioning, including market share, pricing power, and product differentiation, are critical indicators of a company’s resilience. A strong competitive position can help maintain stable revenues, even in challenging market conditions, while a weaker position could make the company more vulnerable to competition and economic fluctuations.

Industry Risks and Regulatory Environment:

Industry-specific risks, such as technology disruptions, regulatory changes, and cyclical volatility, can greatly impact a company’s credit risk. Credit analysts evaluate the stability of the industry, identifying potential challenges that may affect the issuer’s financial performance.

Companies in highly regulated industries, like healthcare or financial services, face unique risks due to regulatory scrutiny, compliance costs, and the potential for policy changes. Analysts examine the company’s ability to adapt to regulatory shifts and its track record in managing compliance.

Environmental, Social, and Governance (ESG) Factors:

ESG considerations are increasingly integral to credit analysis as they impact long-term sustainability and reputational risk. Environmental factors may include the company’s carbon footprint, resource use, and impact on climate change.

Social factors cover labor practices, community impact, and customer relations, while governance factors focus on board structure, executive compensation, and shareholder rights. Strong ESG practices can enhance creditworthiness by reducing exposure to legal, regulatory, and reputational risks, while poor ESG practices can be red flags for potential future liabilities.

By evaluating these qualitative factors alongside quantitative metrics, credit analysts gain a deeper understanding of a corporate issuer’s stability and potential risks. These insights help in forming a holistic view of the company’s ability to meet its debt obligations, especially under varying economic and market conditions

Market and Economic Influences on Corporate Credit

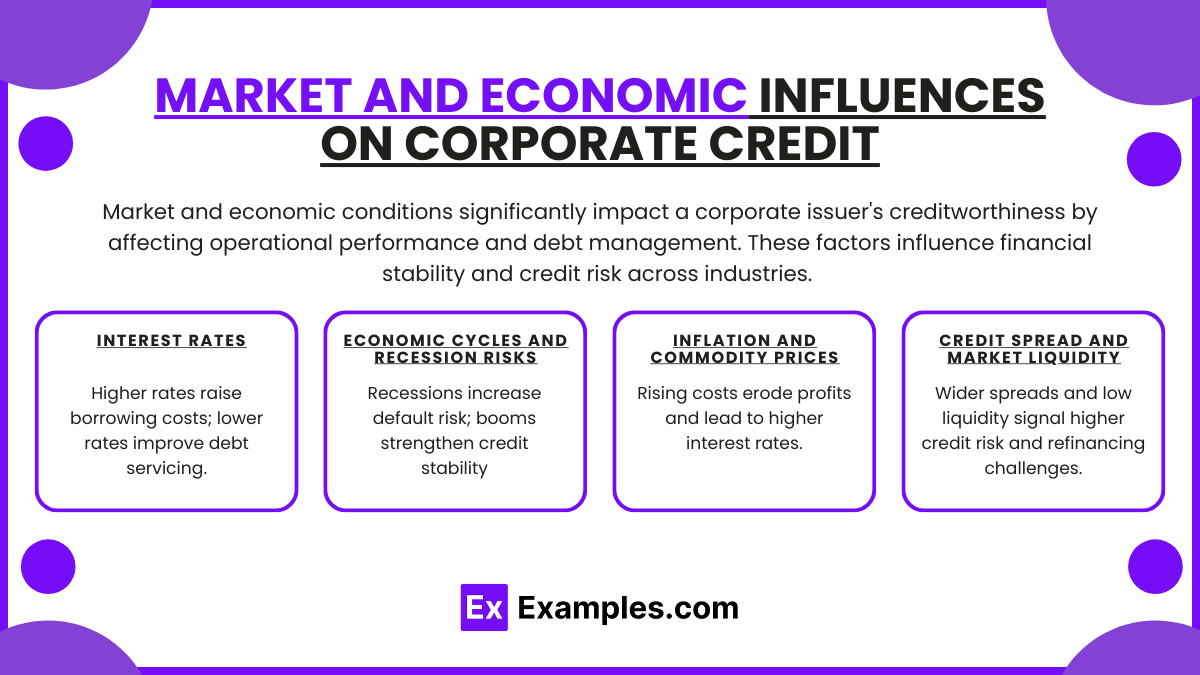

Market and economic conditions play a significant role in determining a corporate issuer’s creditworthiness, as they impact both the company's operational performance and its ability to manage debt obligations. These influences can affect a wide range of industries, altering financial stability and credit risk levels for corporate issuers. Key market and economic factors considered in credit analysis include:

Interest Rates:

Interest rate changes directly impact borrowing costs for corporate issuers. Higher interest rates increase the cost of servicing existing debt and make new debt more expensive, which can strain cash flow and reduce a company's ability to meet obligations.

For highly leveraged companies, rising interest rates can significantly elevate credit risk. Conversely, lower interest rates can improve cash flow by reducing debt servicing costs, making it easier to maintain or improve credit standing.

Economic Cycles and Recession Risks:

Economic cycles influence corporate credit risk as companies in cyclical industries (e.g., consumer goods, automotive) tend to be more vulnerable to economic downturns, which can reduce revenues and profitability.

In recessionary environments, decreased consumer spending and business investment often result in higher default risks and increased pressure on corporate debt. Economic booms, on the other hand, typically enhance corporate cash flows and credit quality, with lower default rates and better financial stability.

Inflation and Commodity Prices:

Inflationary pressures can increase operating costs for corporations, especially those relying on commodities or raw materials. Rising prices for inputs like energy, metals, or agricultural products can erode profit margins if the company cannot pass these costs on to customers.

Persistent inflation also influences central bank policies, often leading to interest rate hikes, which further affect corporate borrowing costs and cash flows. Conversely, stable or low inflation generally supports better financial performance and creditworthiness.

Credit Spread and Market Liquidity:

Credit spreads—the difference between corporate bond yields and risk-free government bond yields—reflect the market’s assessment of credit risk. Widening spreads indicate higher perceived risk, often due to economic uncertainties, industry-specific challenges, or deteriorating corporate fundamentals.

Market liquidity is also crucial, as it affects a company's access to funding. In a liquid market, corporations can more easily refinance debt or issue new bonds. However, during periods of market stress or financial crisis, liquidity can dry up, making it harder for companies to manage debt, which increases default risk.

Understanding these market and economic factors helps credit analysts assess the potential impact of macroeconomic trends on a corporate issuer's credit profile. By anticipating how these external factors may affect cash flows, leverage, and financial flexibility, analysts can make more informed judgments about a company’s ability to withstand economic pressures and continue servicing its debt

Examples

Example 1

A technology company with high levels of debt has maintained a strong interest coverage ratio due to steady cash flows from recurring software subscriptions. Credit analysts review this favorable cash flow stability, noting that the company's predictable revenue stream supports its debt repayment ability, even during economic downturns.

Example 2

An energy firm in a cyclical industry has a high debt-to-equity ratio, indicating significant leverage. Analysts identify heightened credit risk, especially during low-demand periods, as the company's cash flow becomes strained. They also consider commodity price volatility, which could further impact its ability to service debt.

Example 3

A retail corporation undergoing a management change is assessed for credit risk. Credit analysts examine qualitative factors, such as the new management team's track record and strategic direction, alongside quantitative metrics. The uncertainty of the leadership transition and its potential effects on profitability are factored into the credit analysis.

Example 4

A manufacturing company with moderate leverage benefits from a diversified customer base across different regions. Analysts recognize that its geographic diversification reduces credit risk, as economic downturns in one region may not significantly impact the company's overall revenue, improving its ability to manage debt.

Example 5

An industrial firm has faced recent regulatory challenges, increasing its compliance costs and operational risks. Credit analysts factor in these industry-specific risks, noting that ongoing regulatory pressures could weaken the firm’s profitability, potentially impacting cash flow and increasing credit risk

Practice Questions

Question 1

Which financial ratio is most commonly used to assess a company's ability to cover its interest obligations?

A. Debt-to-Equity Ratio

B. Interest Coverage Ratio

C. Quick Ratio

D. Current Ratio

Answer: B. Interest Coverage Ratio

Explanation: The interest coverage ratio is a critical metric in credit analysis that assesses a company's ability to meet its interest payments from operating earnings. A higher interest coverage ratio indicates a stronger ability to cover interest obligations, which is a positive indicator for creditworthiness.

Question 2

What is the main focus of qualitative analysis in credit assessment?

A. Evaluating interest coverage and debt ratios

B. Assessing the management team, business model, and industry risks

C. Calculating cash flow from operating activities

D. Analyzing current and quick ratios

Answer: B. Assessing the management team, business model, and industry risks

Explanation: Qualitative analysis in credit assessment involves evaluating non-quantitative factors such as the management team’s expertise, the sustainability of the business model, and industry-specific risks. These factors contribute significantly to a company’s long-term stability and credit risk profile.

Question 3

In the context of credit rating methodologies, what does a negative credit rating outlook indicate?

A. Immediate downgrade is certain

B. Potential downgrade in the future

C. Improvement in the company’s financial metrics

D. Stability in the company’s credit profile

Answer: B. Potential downgrade in the future

Explanation: A negative credit rating outlook suggests that the rating agency anticipates a possible downgrade of the company's credit rating in the near term due to factors such as deteriorating financial performance or increasing industry risk. It is not a definite downgrade but indicates increased credit risk.