Preparing for the CFA Exam necessitates a clear understanding of “Credit Analysis Models,” a core concept in credit risk management. This principle explains how credit analysis assesses the likelihood of a borrower’s default and the potential losses in case of default. Knowledge of credit analysis models, which encompass various quantitative and qualitative techniques, allows candidates to evaluate a company’s creditworthiness based on financial ratios, cash flow analysis, and industry risk. Proficiency in this area enables candidates to identify and mitigate credit risks, assess credit ratings, and structure effective credit policies. This foundational knowledge supports the goal of achieving a high CFA score.

Learning Objectives

In studying “Credit Analysis Models” for the CFA, you should learn to understand the essential methodologies behind assessing a borrower’s creditworthiness and the associated risk of default. This involves analyzing financial statements, evaluating key financial ratios, and considering both quantitative and qualitative factors that impact credit risk. Understanding credit analysis models enables you to anticipate potential default scenarios and measure credit risk exposure for various types of borrowers, from corporate entities to sovereigns. Mastery of this area allows you to develop effective credit risk mitigation strategies, improve lending decisions, and optimize credit portfolio management, which are crucial for sound financial decision-making in credit risk management.

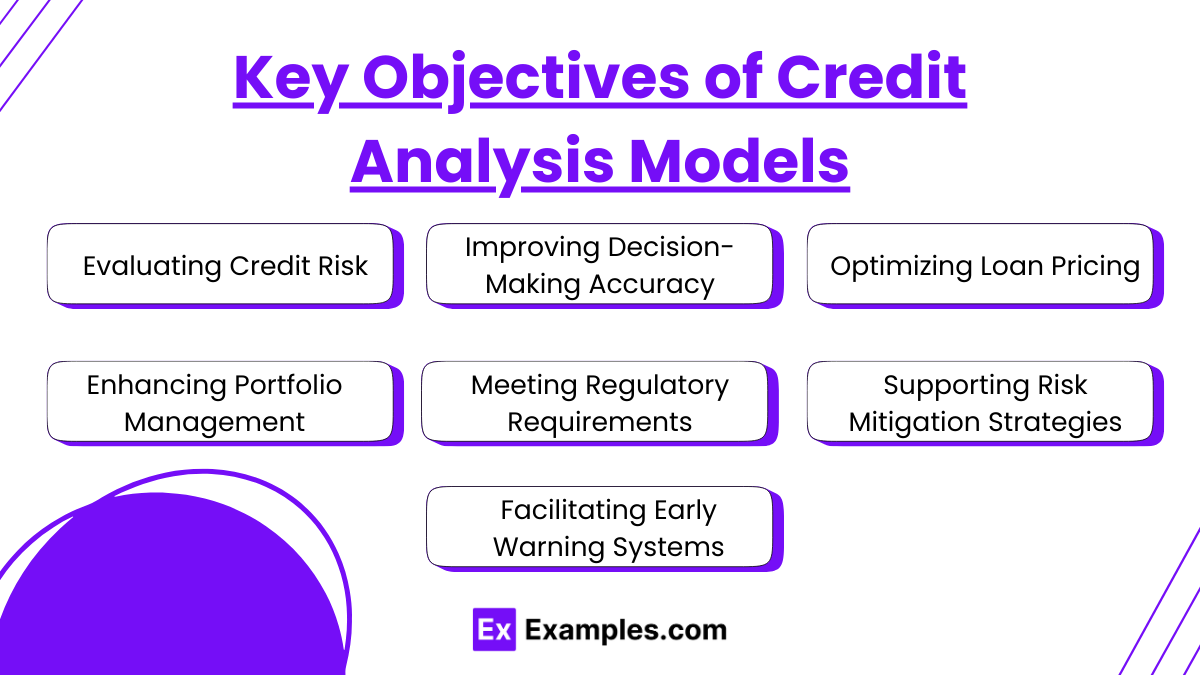

Key Objectives of Credit Analysis Models

The key objectives of credit analysis models are essential for assessing a borrower’s creditworthiness and reducing potential risks in lending and investment decisions. Here’s a breakdown of their primary goals:

1. Evaluating Credit Risk

- The main goal is to determine the likelihood that a borrower will meet their financial obligations. This includes assessing the risk of default, late payments, and overall credit behavior, allowing lenders to make informed decisions about loan approvals and terms.

2. Improving Decision-Making Accuracy

- By using comprehensive data and sophisticated modeling techniques, credit analysis models aim to enhance the accuracy of credit evaluations. This supports financial institutions in identifying high-risk and low-risk borrowers with greater precision.

3. Optimizing Loan Pricing

- Credit analysis models help in setting appropriate interest rates and terms by quantifying credit risk. Higher-risk borrowers may face higher interest rates to compensate for the increased risk, while lower-risk borrowers receive more favorable terms, creating a balanced risk-reward system.

4. Enhancing Portfolio Management

- Effective credit analysis enables lenders to manage their loan portfolios strategically, ensuring a mix of different risk levels. By diversifying their portfolios, lenders can mitigate the impact of potential defaults on overall profitability.

5. Meeting Regulatory Requirements

- Credit analysis models are also designed to comply with regulatory standards and guidelines. They provide documentation and evidence of risk assessment processes, which are crucial for audits and compliance with laws like Basel III and other financial regulations.

6. Supporting Risk Mitigation Strategies

- Credit analysis models play a crucial role in developing risk mitigation strategies for lenders. By identifying potential risks associated with individual borrowers or market conditions, institutions can implement measures such as tighter credit policies, enhanced monitoring, or the use of credit derivatives to protect against potential losses.

7. Facilitating Early Warning Systems

- These models can be used to create early warning systems that detect changes in a borrower’s credit profile before they lead to defaults. By analyzing trends in repayment behavior, financial health, and external factors, lenders can proactively manage and address potential risks, enabling them to take timely actions to minimize losses.

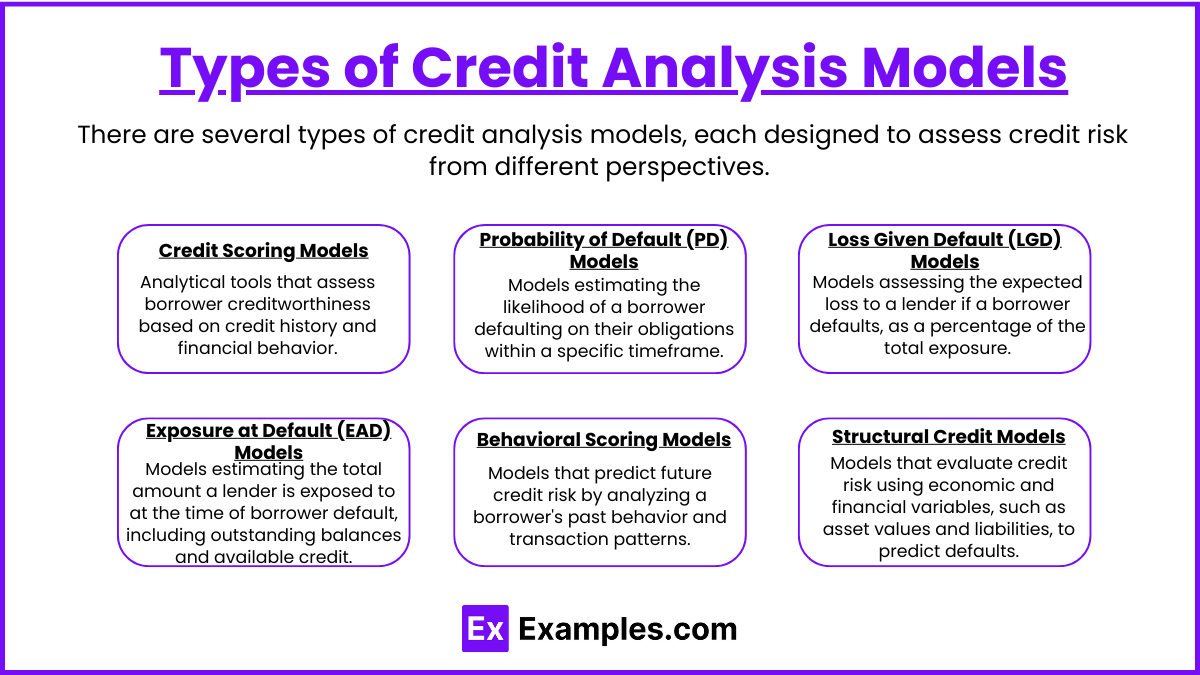

Types of Credit Analysis Models

There are several types of credit analysis models, each designed to assess credit risk from different perspectives. These models leverage financial data, behavioral insights, and market indicators to predict a borrower’s likelihood of default and inform lending decisions. Here are the primary types of credit analysis models:

1. Credit Scoring Models

- Purpose: Widely used for individual consumer lending, these models generate a numerical score that reflects the creditworthiness of a borrower.

- Method: FICO and VantageScore are common examples, which analyze factors like payment history, credit utilization, length of credit history, and types of credit used.

- Use: Popular for assessing consumer loans, credit card eligibility, and basic loan approvals.

2. Probability of Default (PD) Models

- Purpose: Calculate the likelihood that a borrower will default on their debt obligations within a specific timeframe.

- Method: PD models use historical data and predictive analytics to estimate the default probability, which can be adjusted based on economic conditions.

- Use: Frequently applied in corporate lending and in regulatory risk assessments for financial institutions.

3. Loss Given Default (LGD) Models

- Purpose: Determine the expected loss in the event of a borrower’s default, factoring in recoveries from collateral or bankruptcy proceedings.

- Method: LGD models consider asset type, collateral value, and recovery processes, estimating the portion of the loan that may be irrecoverable.

- Use: Important for risk-pricing loans and setting aside reserves, commonly used in corporate and project finance.

4. Exposure at Default (EAD) Models

- Purpose: Assess the amount of exposure a lender faces if a borrower defaults at any point.

- Method: EAD models estimate outstanding loan balance and possible future drawdowns, providing an exposure figure for risk assessment.

- Use: Primarily used in corporate credit analysis, especially for loans with revolving credit facilities.

5. Behavioral Scoring Models

- Purpose: Analyze a borrower’s past behavior to predict future repayment performance.

- Method: These models use data such as payment patterns, account usage, and spending behavior to adjust the creditworthiness assessment.

- Use: Useful for managing ongoing credit lines and assessing risk on current accounts rather than new loan applicants.

6. Structural Credit Models

- Purpose: Often used for corporate credit analysis, these models evaluate a company’s capital structure and likelihood of insolvency.

- Method: Structural models (e.g., the Merton model) treat a company’s equity as a call option on its assets, estimating default risk based on asset and debt valuation.

- Use: Employed in corporate bond rating, credit risk management, and investment decision-making.

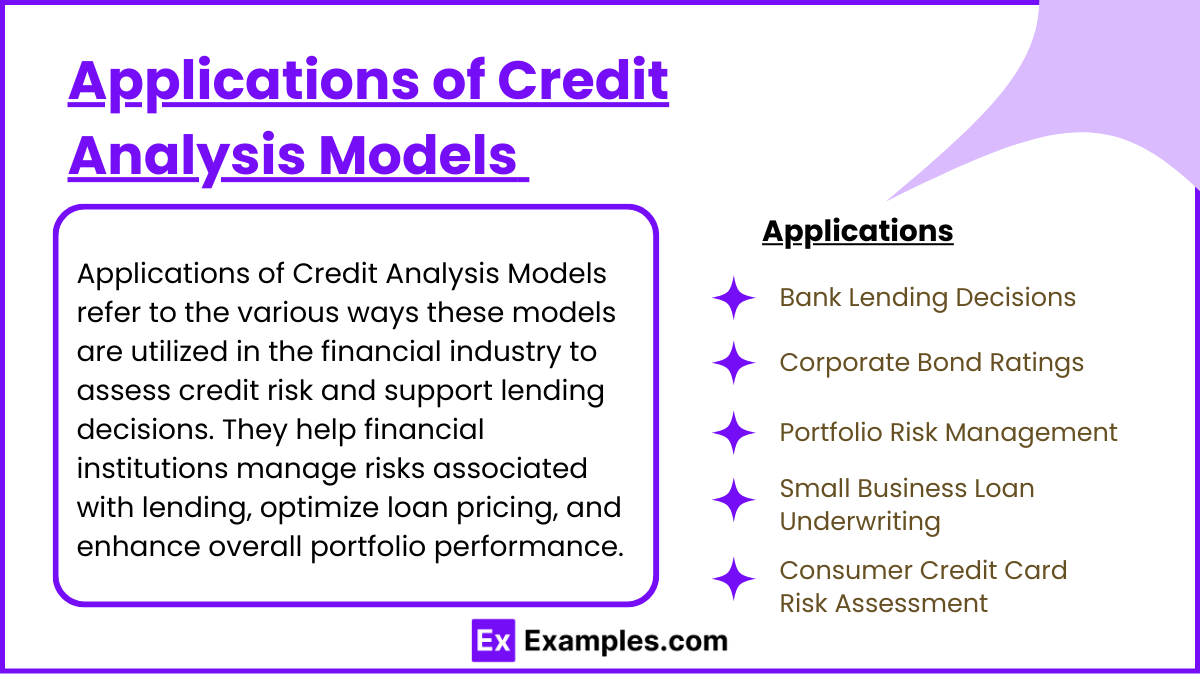

Applications of Credit Analysis Models

Credit analysis models are essential for assessing the creditworthiness of borrowers, whether individuals, businesses, or government entities. Here are some key applications of these models across different areas:

1. Bank Lending Decisions

- Model: Traditional Credit Scoring Models (e.g., FICO Score)

- Application: Used by banks and financial institutions to assess an individual’s or a business’s creditworthiness before issuing loans, helping minimize the risk of defaults.

2. Corporate Bond Ratings

- Model: Structural Models (e.g., Merton Model)

- Application: Credit rating agencies apply these models to evaluate corporate bond issuers’ financial health, impacting the bond’s credit rating and investor confidence.

3. Portfolio Risk Management

- Model: Reduced-Form Models (e.g., Credit Risk+, CreditMetrics)

- Application: Applied in financial institutions to estimate potential losses in loan portfolios, allowing better risk distribution and capital allocation for credit risk.

4. Small Business Loan Underwriting

- Model: Machine Learning and AI Models

- Application: Used by lenders to assess small business risk, especially in fintech, where alternative data (e.g., transaction history) helps in determining loan approval and terms.

5. Consumer Credit Card Risk Assessment

- Model: Logistic Regression, Decision Trees

- Application: These models are widely used to determine eligibility and set credit limits for consumers applying for credit cards based on their likelihood of repayment.

6. Predicting Defaults in Real Estate Mortgages

- Model: Probability of Default (PD) Models

- Application: Commonly used in mortgage lending to evaluate the likelihood of a borrower defaulting on their loan, which helps lenders manage mortgage portfolios more effectively.

Examples

Example 1. Evaluating Corporate Creditworthiness

Credit analysis models are often used by financial analysts to assess the creditworthiness of corporations seeking loans or issuing bonds. By analyzing financial ratios, cash flow statements, and debt levels, these models can provide a comprehensive view of a company’s ability to meet its financial obligations. This approach allows lenders and investors to make informed decisions about the potential risks and returns associated with lending to or investing in the company.

Example 2. Assessing Individual Credit Scores for Loan Approvals

Credit analysis models are widely used in consumer finance, especially by banks and lending institutions, to determine the creditworthiness of individuals applying for loans or credit cards. By factoring in elements such as credit history, debt-to-income ratio, and payment history, these models generate a credit score that helps lenders evaluate the likelihood of repayment. This method streamlines the approval process while ensuring responsible lending practices.

Example 3. Identifying Risks in Portfolio Management

In asset management, credit analysis models are used to evaluate the credit quality of assets within a portfolio, such as corporate bonds or structured products. Fund managers leverage these models to assess the probability of default or credit downgrades, enabling them to rebalance portfolios to maintain an optimal risk-return profile. This process is essential for managing credit risk exposure and protecting investments in volatile markets.

Example 4. Evaluating Credit Risk in Trade Finance

In international trade, credit analysis models are critical for assessing the risk of non-payment from foreign buyers. Exporters and banks use these models to evaluate a buyer’s financial stability, payment history, and country-specific economic factors. This analysis helps determine the credit terms for trade transactions, minimizing risk for exporters while enabling smoother cross-border transactions.

Example 5. Supporting Regulatory Compliance in Banking

Credit analysis models are also essential for banks to meet regulatory requirements, such as those mandated by Basel III. These models assist in calculating the credit risk capital required to maintain financial stability, as they assess the creditworthiness of borrowers and the potential impact of defaults on a bank’s balance sheet. This analysis is crucial for ensuring that banks have adequate capital reserves to absorb potential credit losses, thereby supporting a more resilient financial system.

Practice Questions

Question 1

Which of the following ratios is most commonly used in credit analysis models to assess a company’s leverage?

A) Current Ratio

B) Debt-to-Equity Ratio

C) Price-to-Earnings Ratio

D) Gross Profit Margin

Answer: B) Debt-to-Equity Ratio

Explanation:

The debt-to-equity (D/E) ratio is a key leverage ratio in credit analysis, as it indicates the proportion of debt a company uses relative to its equity to finance its operations. A higher D/E ratio can signify that a company is more reliant on debt, which increases its financial risk and the potential for default if it cannot meet its obligations. Credit analysts use this ratio to determine if a company has a manageable level of debt or if it is over-leveraged. Other ratios, like the current ratio (which measures liquidity) or the price-to-earnings ratio (which assesses market valuation), are not primarily focused on leverage.

Question 2

Which of the following factors is NOT typically included in a consumer credit analysis model?

A) Payment History

B) Debt-to-Income Ratio

C) Country of Residence

D) Credit Utilization Ratio

Answer: C) Country of Residence

Explanation:

In consumer credit analysis models, factors like payment history, debt-to-income (DTI) ratio, and credit utilization ratio are fundamental. Payment history provides insight into the consumer’s reliability in repaying debts, DTI indicates their capacity to handle additional debt, and credit utilization shows how much of their available credit is used, which affects credit risk. However, the country of residence is generally not a core factor in consumer credit analysis; instead, it may be relevant in certain types of business or trade credit analysis where international risk exposure is considered. Consumer models are focused on financial behaviors rather than geographic factors.

Question 3

What is the primary purpose of using credit analysis models in trade finance?

A) To increase product sales

B) To assess the risk of non-payment from foreign buyers

C) To determine employee compensation

D) To enhance marketing strategies

Answer: B) To assess the risk of non-payment from foreign buyers

Explanation:

In trade finance, credit analysis models are essential for evaluating the likelihood that foreign buyers will fulfill payment obligations. This is particularly important in international transactions, where risks can be heightened by factors like currency fluctuations, economic instability, and differences in legal systems. Credit analysis models help exporters and financial institutions assess the financial stability of foreign buyers, enabling them to establish appropriate credit terms and mitigate risks associated with cross-border trade. The primary focus here is not sales, compensation, or marketing but rather ensuring that the transaction is financially secure.