Preparing for the CFA Exam requires an understanding of “Credit Default Swaps (CDS),” an essential tool in managing credit risk. CDS act as insurance against credit defaults, allowing parties to transfer risk. Understanding CDS helps candidates analyze credit protection costs, assess default risk, and manage exposure effectively. Mastery of this concept supports a high CFA score by deepening insights into advanced credit risk management strategies.

Learning Objectives

In studying “Credit Default Swaps (CDS)” for the CFA, you should aim to understand the essential mechanisms for transferring credit risk and protecting against default events. This involves learning how CDS function as financial agreements where one party compensates another in the event of a borrower’s default, effectively insuring against credit risk. Analyzing the pricing and market factors that affect CDS spreads, along with understanding their role in credit portfolio management, are central to mastering this topic. Understanding CDS enables you to gauge potential credit exposures across various entities, from corporate borrowers to sovereigns. Mastery in this area allows you to build effective credit risk strategies, enhance risk mitigation, and optimize financial decision-making in managing credit portfolios.

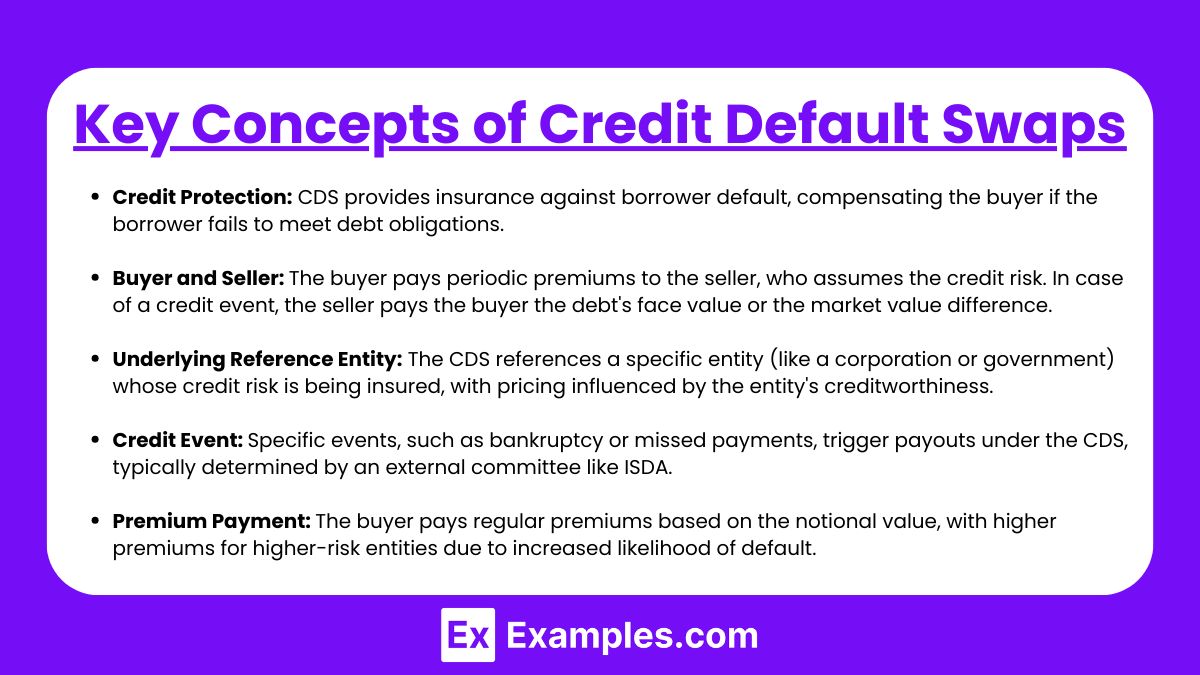

Key Concepts of Credit Default Swaps

1. Credit Protection:

- A CDS provides a way for investors or lenders to protect themselves against the risk of a borrower defaulting on a debt obligation. It acts similarly to insurance, allowing the buyer to mitigate credit risk on a specific debt instrument (e.g., bond or loan).

- If the referenced debt issuer defaults or experiences a significant credit event, the CDS seller compensates the buyer for losses, usually up to the debt’s full notional value.

2. Buyer and Seller:

- The two primary parties in a CDS are the buyer (protection buyer) and the seller (protection seller). The buyer pays periodic premiums to the seller for the duration of the contract.

- The seller assumes the credit risk of the reference entity. If a credit event occurs, the seller is obligated to pay the buyer either the face value of the debt or the difference between face value and current market value, depending on the settlement type.

3. Underlying Reference Entity:

- The CDS references a specific entity, like a corporation or government, known as the reference entity. This entity’s credit risk is being insured.

- The financial health and creditworthiness of the reference entity affect the pricing of the CDS, as higher perceived risk leads to higher premium rates.

4. Credit Event:

- A CDS contract specifies events that trigger a payout. Common credit events include bankruptcy (insolvency of the reference entity), failure to pay (missed debt payments), and debt restructuring (altering the terms of the debt due to financial distress).

- The occurrence of a credit event is typically determined by an external committee, such as the International Swaps and Derivatives Association (ISDA), which decides if a contract payout is warranted.

5. Premium Payment:

- The buyer of a CDS pays a regular premium, known as the spread, which is a fixed percentage of the CDS’s notional value. This payment is made periodically (e.g., quarterly or semiannually) over the life of the contract.

- Premium amounts depend on the credit quality of the reference entity; higher-risk entities require higher premiums due to the increased likelihood of default.

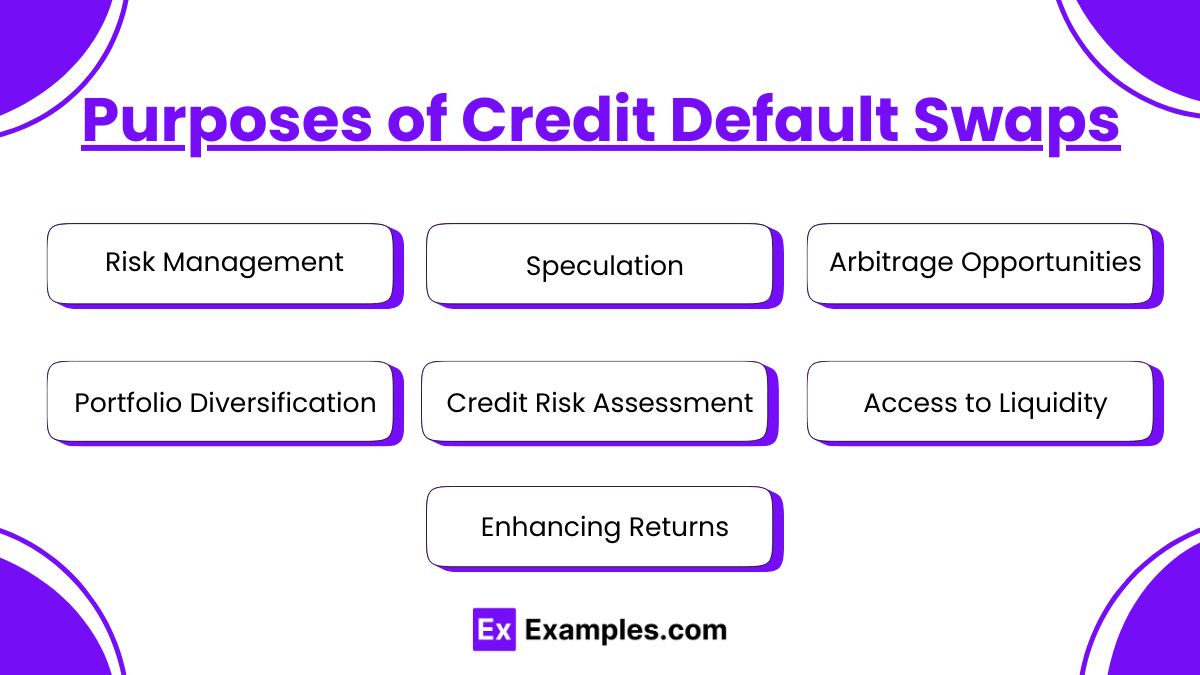

Purposes of Credit Default Swaps

Credit Default Swaps (CDS) are financial derivatives used primarily for risk management and speculative purposes. Here are the main purposes of credit default swaps:

- Risk Management: CDS allow investors to transfer the credit risk of a particular bond or loan. By purchasing a CDS, an investor can protect themselves against the default of a borrower, effectively hedging their exposure.

- Speculation: Investors can use CDS to speculate on the creditworthiness of a borrower. If an investor believes a company’s credit risk will increase, they might buy a CDS, betting that the cost of the swap will rise as the risk of default increases.

- Arbitrage Opportunities: Traders may exploit discrepancies between the prices of bonds and their corresponding CDS. If the CDS is undervalued relative to the bond’s yield, an arbitrageur may buy the CDS while shorting the bond to profit from the convergence of prices.

- Portfolio Diversification: Investors can use CDS to gain exposure to different credit markets without directly holding the underlying debt instruments. This can help diversify a portfolio and manage overall risk.

- Credit Risk Assessment: CDS spreads can serve as indicators of market perception regarding a borrower’s credit risk. Investors can analyze these spreads to gauge the creditworthiness of different entities.

- Access to Liquidity: CDS can provide liquidity to investors who may want to exit their credit exposures without selling the underlying bonds or loans directly. This can be particularly useful in illiquid markets.

- Enhancing Returns: By using CDS, investors can potentially enhance their returns on investment through leveraging, allowing them to take on larger positions than they could by directly holding the underlying debt.

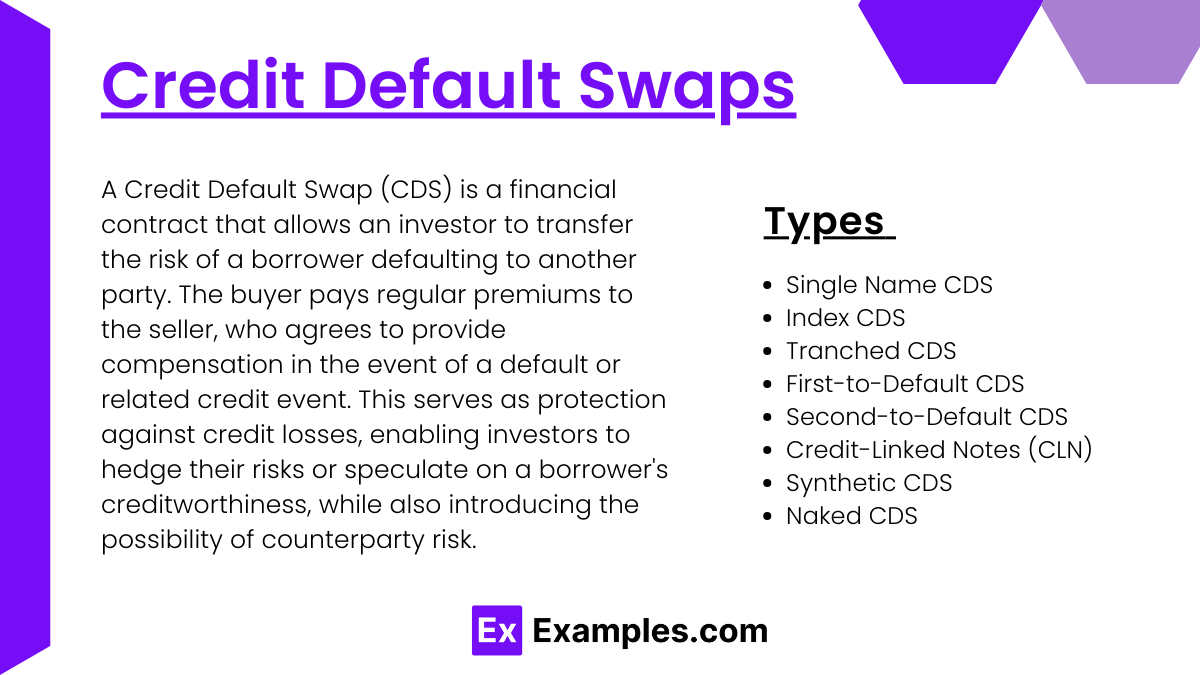

Types of Credit Default Swaps

Credit Default Swaps (CDS) are financial derivatives that allow an investor to “swap” or transfer the credit risk of a borrower. There are several types of CDS, each serving different purposes and structures. Here are the main types:

- Single Name CDS: This type provides protection against the default of a specific reference entity, such as a corporation or sovereign government. The buyer pays premiums to the seller in exchange for a payoff in case of default.

- Index CDS: These swaps provide protection against a basket of reference entities. They are used to hedge or speculate on credit risk across a broader market rather than on a single entity. An example is the CDX index in the U.S. and the iTraxx index in Europe.

- Tranched CDS: This structure divides the credit risk of a reference portfolio into different layers or “tranches,” each with varying levels of risk and return. Investors can buy exposure to different tranches, allowing for tailored risk management.

- First-to-Default CDS: This type offers protection against the first default within a specified portfolio of reference entities. It is often used in structured finance to manage the risk of multiple defaults.

- Second-to-Default CDS: Similar to first-to-default swaps, but this type pays out in the event of the second default in a portfolio. This can be useful for managing more complex credit risk scenarios.

- Credit-Linked Notes (CLN): Although not a direct CDS, CLNs are structured products that combine a bond with a credit default swap. They allow investors to gain exposure to a reference credit while receiving interest payments.

- Synthetic CDS: These swaps replicate the economic performance of a bond or loan without actual ownership of the underlying asset. They can be used to gain exposure to credit risk without the need to buy the physical asset.

- Naked CDS: This type involves a party buying a CDS without owning the underlying asset. While this can be a form of speculation, it also raises ethical concerns regarding the potential for excessive risk-taking.

Examples

Example 1. Hedging Against Credit Risk

One of the primary uses of credit default swaps is to hedge against the credit risk associated with bonds or loans. For instance, an investor holding corporate bonds may purchase a CDS to protect against the possibility of the issuing company defaulting on its obligations. If the company fails, the CDS contract pays the investor the face value of the bond, thus mitigating potential losses.

Example 2. Speculating on Credit Quality

Traders and investors can also use credit default swaps to speculate on changes in credit quality. For example, if a trader believes that a company’s creditworthiness will decline, they might buy a CDS on that company’s debt. If the company does experience a downgrade or default, the value of the CDS increases, allowing the trader to sell the contract for a profit.

Example 3. Enhancing Portfolio Diversification

Credit default swaps can enhance portfolio diversification by allowing investors to gain exposure to different sectors or geographies without directly investing in the underlying assets. For instance, an investor may use CDS to take positions on various companies across different industries. This way, they can benefit from potential credit events in multiple sectors while minimizing direct investment risk.

Example 4. Facilitating Arbitrage Opportunities

Investors often use credit default swaps to exploit arbitrage opportunities in the credit markets. For example, if the price of a CDS contract for a specific entity is undervalued compared to the spread on its bonds, a trader might buy the CDS while simultaneously selling the bonds. If the market corrects itself, the trader can profit from the difference between the CDS premium and the bond yield.

Example 5. Managing Counterparty Risk

Financial institutions utilize credit default swaps to manage counterparty risk in derivatives trading. For instance, if a bank enters into a transaction with another financial institution, it can buy a CDS to protect itself against the risk of the counterparty defaulting. This ensures that if the counterparty fails to meet its obligations, the bank can recover its losses through the CDS payout, thereby stabilizing its financial position.

Practice Questions

Question 1

What is the primary purpose of a credit default swap (CDS)?

A) To increase the liquidity of a bond.

B) To provide insurance against the default of a borrower.

C) To enhance the interest rate on a loan.

D) To facilitate currency exchange transactions.

Correct Answer: B) To provide insurance against the default of a borrower.

Explanation:

The primary purpose of a credit default swap is to act as a form of insurance against the risk of default by a borrower, typically a corporation or government entity. In a CDS agreement, the buyer pays periodic premiums to the seller, and in return, the seller agrees to compensate the buyer if the borrower defaults on its debt obligations. This mechanism allows investors to hedge their credit risk or speculate on changes in credit quality.

Question 2

In which scenario would an investor likely purchase a credit default swap?

A) When they expect interest rates to rise.

B) When they believe a company’s creditworthiness will improve.

C) When they want to hedge against potential default on a bond they own.

D) When they are looking to invest in government securities.

Correct Answer: C) When they want to hedge against potential default on a bond they own.

Explanation:

Investors typically purchase credit default swaps as a hedge against the risk of default on a specific bond or loan. For instance, if an investor holds bonds issued by a company and is concerned about the possibility of that company defaulting, they can buy a CDS to protect themselves. If the company defaults, the CDS contract pays out, covering the losses incurred from the bond default. This strategic use of CDS allows investors to mitigate potential risks in their portfolios.

Question 3

What is a potential risk associated with using credit default swaps?

A) Increased market liquidity.

B) Counterparty risk.

C) Guaranteed returns on investment.

D) Tax advantages.

Correct Answer: B) Counterparty risk.

Explanation:

A significant risk associated with credit default swaps is counterparty risk, which is the risk that the other party in the CDS contract (the seller) may default on their obligations. If the seller of the CDS cannot fulfill the terms of the contract during a credit event (like a default), the buyer will not receive the expected payout. This risk became particularly evident during the financial crisis of 2008, when several financial institutions faced insolvency, leading to substantial losses for investors relying on CDS for protection. It is crucial for investors to assess the creditworthiness of the counterparty when entering into CDS agreements.