Preparing for the CFA Exam demands a thorough understanding of credit risk, a critical factor in financial analysis and investment decisions. Mastery of concepts like credit ratings, default probability, and credit spreads is essential. This knowledge enhances insights into evaluating borrower solvency, mitigating risk, and optimizing credit portfolios, key for a high CFA score.

Learning Objective

In studying “Credit Risk” for the CFA Exam, you should learn to evaluate the risk of loss due to a borrower’s potential inability to meet financial obligations. Understand key concepts, including credit ratings, probability of default, loss given default, and exposure at default. Analyze methods of assessing credit risk, such as credit scoring models and credit spread analysis, and examine how factors like economic conditions, industry trends, and borrower-specific financial health influence credit risk. Additionally, apply these principles to evaluate the creditworthiness of corporations, governments, and other borrowers, preparing to interpret credit risk measures in CFA practice scenarios.

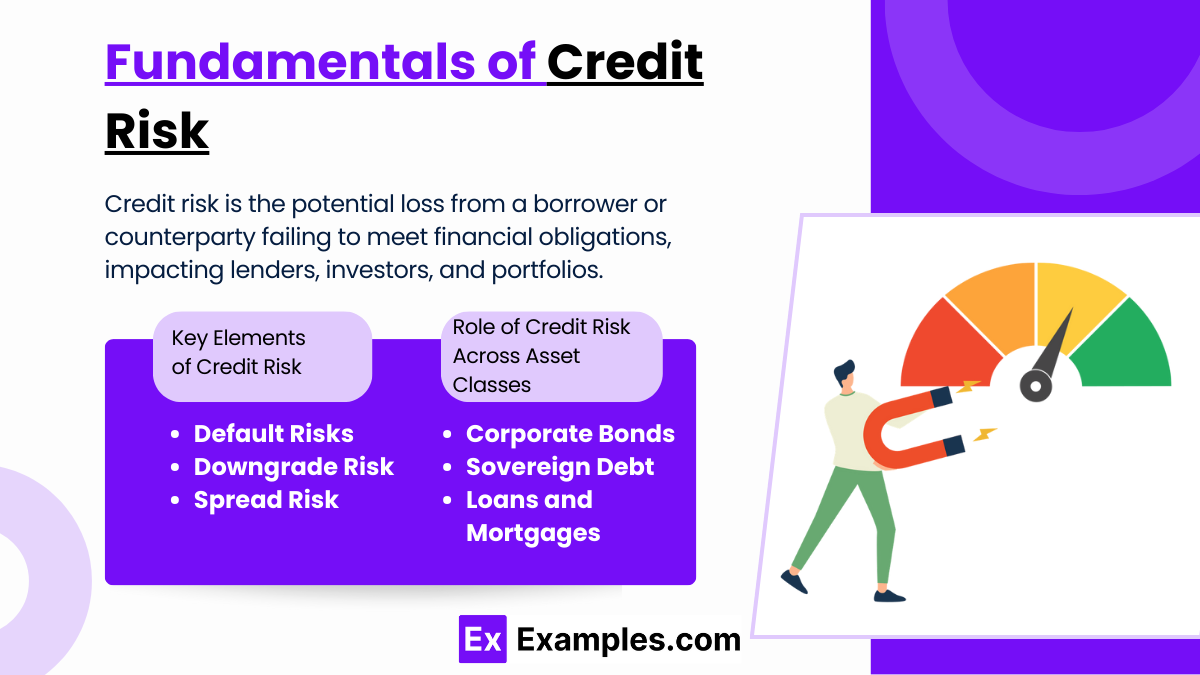

Fundamentals of Credit Risk

Credit risk is the possibility of a loss arising from a borrower or counterparty failing to meet its financial obligations in a timely manner. This risk affects financial institutions, investors, and any entity involved in lending or extending credit. Understanding the fundamentals of credit risk is crucial for financial professionals, as it directly impacts investment decisions, lending practices, and the assessment of portfolio health.

Key Elements of Credit Risk

- Default Risk: This is the risk that a borrower will be unable to make the required payments on their debt obligations. Default risk is especially pertinent for bond investors and lenders, as a default results in a complete or partial loss of the principal and/or interest.

- Downgrade Risk: Downgrade risk refers to the potential for a borrower’s credit rating to be lowered by a credit rating agency, such as Moody’s or S&P. A downgrade can increase the cost of borrowing, reduce the value of the borrower’s outstanding debt, and signal to investors increased risk.

- Spread Risk: Credit spread is the difference between the yield of a credit security and a risk-free benchmark, such as government bonds. Spread risk is the risk that the spread will widen due to perceived increased risk in the borrower’s credit quality. Wider spreads typically indicate greater perceived credit risk.

Importance of Credit Risk in Financial Analysis

Credit risk affects the value of investments and the stability of the financial system. High credit risk can lead to significant losses and increased volatility in the financial markets. By evaluating credit risk, analysts can make informed decisions about lending, investing, and managing risk exposure.

Role of Credit Risk Across Asset Classes

- Corporate Bonds: Investors in corporate bonds face credit risk based on the issuing company’s financial health and ability to repay debt. High-yield or “junk” bonds are particularly vulnerable to credit risk.

- Sovereign Debt: Credit risk for government bonds depends on a country’s economic stability and ability to repay its debt. Emerging markets typically exhibit higher credit risk than developed countries.

- Loans and Mortgages: Financial institutions assume credit risk when issuing loans or mortgages, as borrowers may default due to various personal, economic, or market factors.

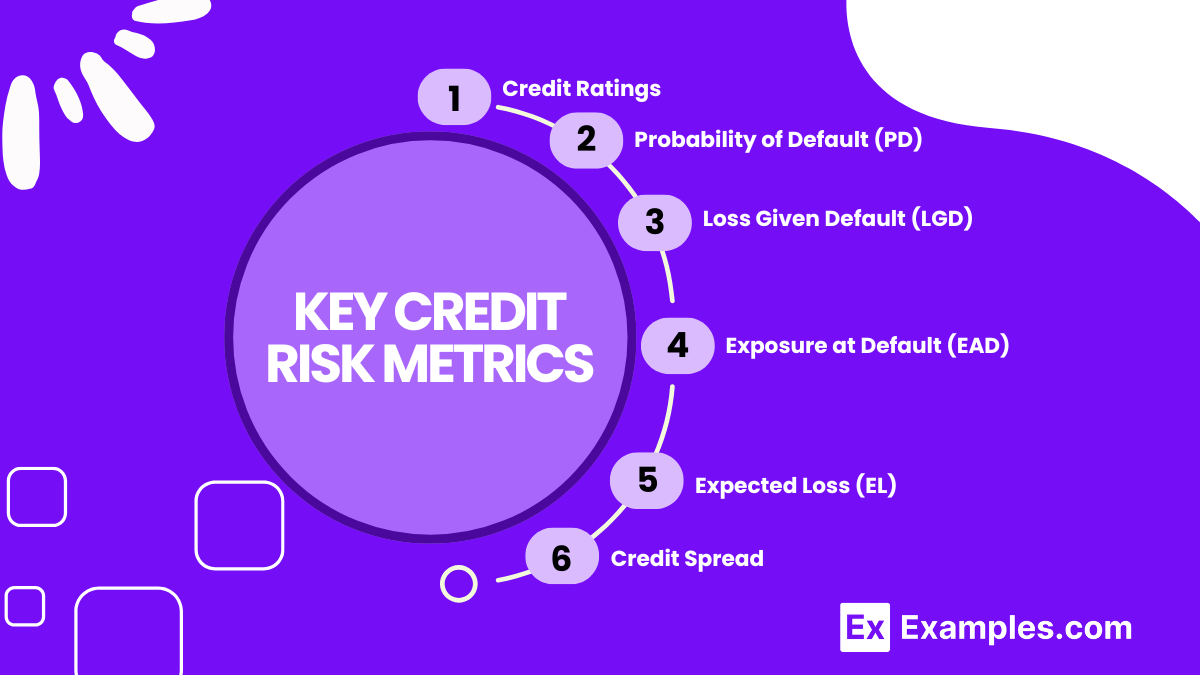

Key Credit Risk Metrics

Credit risk metrics are quantitative tools used to evaluate the likelihood of a borrower defaulting on debt obligations and the potential financial impact of that default. These metrics are essential in assessing the creditworthiness of corporations, governments, and other entities, allowing investors and lenders to make informed decisions about risk exposure.

1. Credit Ratings

Credit ratings are assessments provided by agencies like Moody’s, S&P, and Fitch, reflecting the creditworthiness of an entity or a specific debt issue. Ratings range from high-grade (AAA or Aaa) to speculative-grade (below BBB or Baa). High ratings indicate a low likelihood of default, while lower ratings signify higher default risk. Ratings are based on a borrower’s financial health, industry conditions, and macroeconomic factors.

2. Probability of Default (PD)

Probability of Default (PD) measures the likelihood that a borrower will be unable to meet debt obligations over a specified time period, typically one year. It’s expressed as a percentage, where a higher PD indicates greater default risk. This metric is often determined through credit scoring models and can vary by borrower, industry, and economic conditions.

3. Loss Given Default (LGD)

Loss Given Default (LGD) is the percentage of an asset’s value that a lender is likely to lose if the borrower defaults. LGD takes into account recovery rates—what lenders may be able to recoup through collateral liquidation, asset sales, or restructuring. For example, secured loans often have lower LGD due to recoverable collateral, whereas unsecured loans may have high LGD.

4. Exposure at Default (EAD)

Exposure at Default (EAD) represents the total value of an asset or obligation at risk if a borrower defaults. It encompasses both outstanding balances and potential future exposures, such as unused credit lines. EAD is critical in estimating the total amount of money at risk in case of default, helping lenders manage capital allocation.

5. Expected Loss (EL)

Expected Loss (EL) combines PD, LGD, and EAD to estimate the anticipated loss due to credit risk. The formula is typically:Expected Loss (EL) = PD × LGD × EAD

This metric provides a more comprehensive measure of credit risk, as it considers both the likelihood of default and the potential financial impact. EL is used to determine loan pricing, reserve requirements, and capital needs.

6. Credit Spread

Credit spread is the difference in yield between a risky security (such as a corporate bond) and a risk-free benchmark (like a government bond). The spread compensates investors for taking on additional credit risk. Higher spreads reflect increased risk perception, while tighter spreads indicate lower perceived risk. Credit spreads fluctuate with changes in the issuer’s financial health, industry risk, and macroeconomic factors.

Importance of Credit Risk Metrics

These metrics allow financial professionals to:

- Evaluate creditworthiness and identify high-risk borrowers.

- Determine loan and bond pricing based on risk levels.

- Allocate capital and reserves to cover potential losses.

- Monitor portfolio risk exposure and make adjustments to reduce risk

Credit Risk Assessment Models

Credit risk assessment models are analytical frameworks used to evaluate the likelihood of borrower default and quantify credit risk. These models aid financial institutions and investors in assessing the creditworthiness of entities, from individuals to large corporations and governments. By understanding and applying these models, financial professionals can make informed lending and investment decisions, effectively manage portfolios, and mitigate potential losses.

1. Credit Scoring Models

Credit scoring models are widely used for individual borrowers and small businesses. These models assign a numerical score to borrowers based on factors such as payment history, outstanding debt, credit utilization, and credit history length. Higher scores reflect a lower risk of default, while lower scores indicate a higher probability of default. Popular credit scoring systems, such as FICO, rely on historical data to generate predictive insights about credit risk.

Credit scoring models are often used in consumer lending, credit card approvals, and small business loans, where a standardized, data-driven approach is effective for assessing large volumes of borrowers.

2. Structural Models (e.g., Merton Model)

Structural models, such as the Merton model, are based on the principles of option pricing and apply primarily to corporations. These models assume that a firm’s assets and liabilities follow certain patterns and can predict default risk by examining the relationship between a firm’s asset value and its debt obligations. In the Merton model:

- A firm’s equity is treated as a call option on its assets.

- Default occurs when the value of the firm’s assets falls below the face value of its liabilities, as equity holders would “walk away” from the obligation.

This model uses inputs like asset volatility and leverage to assess the likelihood of default, making it particularly valuable for companies with complex financial structures and for assessing default risk over different time horizons.

3. Reduced-Form Models

Reduced-form models assess default risk using statistical techniques rather than relying on the structure of a firm’s balance sheet. Unlike structural models, which rely on asset value, reduced-form models look at historical default rates, macroeconomic factors, and industry-specific risks to estimate the probability of default. Common variables include interest rates, economic indicators, and firm-specific data like stock prices.

These models provide flexibility in incorporating real-time market data and can adapt to changes in economic conditions or industry trends. Reduced-form models are often used in bond pricing and are well-suited for analyzing large groups of credit instruments, such as in bond portfolio management.

4. Credit Migration and Transition Models

Credit migration and transition models track changes in credit ratings over time and assess the likelihood of borrowers moving from one credit rating category to another. This approach is valuable for managing portfolios with varying levels of credit quality and is especially useful in fixed-income markets.

These models use historical data on rating transitions to create transition matrices, which show the probability of an issuer moving from one rating to another within a specific timeframe (e.g., AAA to AA or BB to CCC). Transition matrices allow portfolio managers to anticipate changes in credit quality and proactively adjust portfolios to maintain desired risk levels.

Importance of Credit Risk Assessment Models

These models help financial professionals:

- Identify and quantify credit risk by calculating default probabilities, loss estimates, and recovery potential.

- Optimize capital allocation by determining required reserves for expected and unexpected losses.

- Improve loan and bond pricing by understanding credit risk premiums and adjusting for borrower-specific risk.

- Monitor credit quality by evaluating shifts in creditworthiness and adjusting portfolios based on rating transitions or changing economic conditions

Mitigating and Managing Credit Risk

Mitigating and managing credit risk involves strategies and tools to minimize the impact of borrower defaults and enhance financial stability. Effective management reduces potential losses and helps institutions comply with regulatory requirements.

Key Strategies for Mitigating Credit Risk

- Collateral and Guarantees: Securing loans with collateral (e.g., property, assets) or guarantees reduces potential losses if a borrower defaults, as lenders can recover value through asset liquidation.

- Credit Derivatives: Tools like credit default swaps (CDS) allow lenders to transfer credit risk to other parties, effectively insuring against defaults.

- Diversification: Spreading exposure across multiple borrowers, industries, or regions reduces the impact of any single borrower’s default on the portfolio.

- Credit Portfolio Management: Monitoring and rebalancing credit portfolios enables institutions to adjust exposure in response to changes in borrower risk profiles or economic conditions.

- Regulatory Compliance (e.g., Basel III): Regulations require banks to hold capital reserves proportionate to credit risk, helping ensure resilience against potential losses and supporting broader financial system stability.

Examples

Example 1

A bank extends a loan to a corporation with a high credit rating. However, due to economic downturns and declining revenues, the corporation’s creditworthiness deteriorates, increasing the likelihood of default. The bank may reassess its exposure and adjust loan terms to mitigate risk.

Example 2

An investor purchases high-yield bonds, which offer higher returns but also carry greater credit risk. To offset potential losses, the investor uses credit default swaps (CDS) to hedge against the risk of issuer default on these bonds.

Example 3

A lender assesses the credit risk of a small business applying for a loan by evaluating its credit score, cash flow, and financial statements. Based on this assessment, the lender decides to set a higher interest rate to compensate for the increased risk associated with the business’s limited operating history.

Example 4

A financial institution holds a diversified loan portfolio across various sectors, including technology, healthcare, and real estate. This diversification strategy helps the institution mitigate credit risk, as defaults in one sector are less likely to affect the entire portfolio’s stability.

Example 5

A multinational bank evaluates sovereign credit risk when considering investments in emerging market government bonds. The bank reviews economic stability, political risk, and historical default rates of the country, ultimately deciding to allocate a limited portion of its portfolio to manage the associated risks

Practice Questions

Question 1

Which of the following best defines Credit Risk?

A) The risk of interest rate changes affecting investment returns.

B) The risk that a borrower will not meet their debt obligations.

C) The risk of fluctuations in foreign exchange rates impacting asset values.

D) The risk of inflation reducing purchasing power over time.

Answer: B

Explanation: Credit risk is specifically the risk that a borrower will fail to meet their financial obligations, potentially resulting in a loss for the lender or investor. This is distinct from risks related to interest rates, foreign exchange rates, or inflation.

Question 2

What is the Probability of Default (PD) in credit risk assessment?

A) The likelihood that a borrower will repay the full loan amount.

B) The chance that a borrower will default on debt obligations.

C) The potential recovery rate if a borrower defaults.

D) The yield spread between a risk-free asset and a risky asset.

Answer: B

Explanation: Probability of Default (PD) is a key metric in credit risk assessment that estimates the likelihood that a borrower will fail to meet their debt obligations within a specified period, usually one year. This metric helps lenders understand and quantify the default risk.

Question 3

Which of the following strategies helps mitigate credit risk?

A) Investing in only one sector to maintain focus.

B) Offering loans without collateral to high-risk borrowers.

C) Using credit default swaps (CDS) to transfer risk.

D) Avoiding all investments with any level of risk.

Answer: C

Explanation: Credit default swaps (CDS) are financial derivatives that allow lenders to transfer the risk of default to a third party, effectively insuring against borrower default. This is a common strategy for mitigating credit risk, unlike options A, B, or D, which either increase risk or reduce growth opportunities