Preparing for the CFA Exam requires a comprehensive understanding of “Currency Management: An Introduction,” a crucial component of international finance. Mastery of exchange rate mechanisms, currency risk factors, and hedging strategies is essential. This knowledge provides insights into managing currency exposure, optimizing transaction costs, and enhancing portfolio returns, critical for achieving a high CFA score.

Learning Objective

In studying “Currency Management: An Introduction” for the CFA Exam, you should learn to understand the mechanisms of currency exchange and the dynamics that influence exchange rates. Analyze the various risks associated with currency fluctuations and the methods used to manage these risks, including natural hedging, forward contracts, and options. Evaluate the impact of currency movements on international investments and global financial strategies. Additionally, explore how effective currency management can protect and enhance the value of international portfolios. Apply this knowledge to developing comprehensive currency risk management strategies that align with broader financial objectives and market conditions.

Introduction to Currency Management

Currency management involves strategies and practices that businesses and investors use to manage risks and opportunities associated with foreign exchange (FX) exposure. It is crucial for companies operating internationally and investors with global portfolios, as currency fluctuations can impact profitability, investment returns, and financial stability.

Importance of Currency Management

- Risk Mitigation: Helps manage and reduce risks related to exchange rate volatility that can affect cash flow, revenues, and asset values.

- Enhancing Returns: Strategic currency exposure can be used to enhance investment returns when currencies appreciate in value.

- Cost Management: Minimizes potential losses due to unfavorable currency movements, protecting the bottom line.

- Diversification: Provides a way to diversify portfolios by adding currency as an asset class, which can offer unique risk and return characteristics.

Understanding Currency Markets

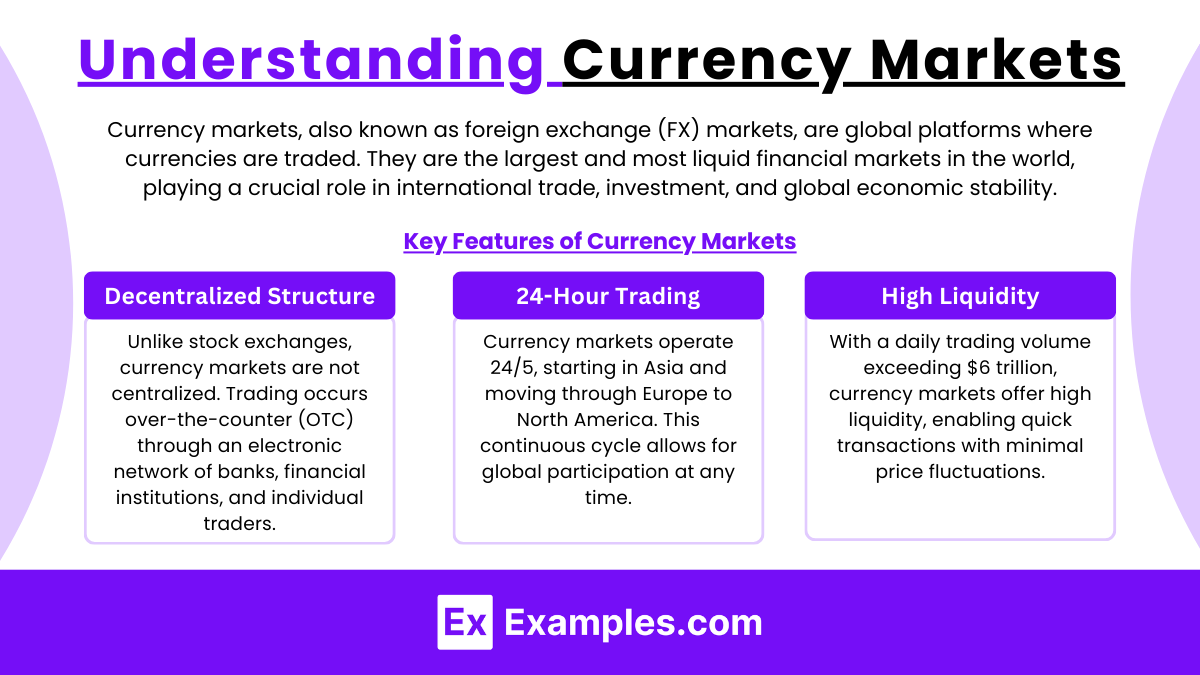

Currency markets, also known as foreign exchange (FX) markets, are global platforms where currencies are traded. They are the largest and most liquid financial markets in the world, playing a crucial role in international trade, investment, and global economic stability.

Key Features of Currency Markets

- Decentralized Structure:

- Unlike stock exchanges, currency markets are not centralized. Trading occurs over-the-counter (OTC) through an electronic network of banks, financial institutions, and individual traders.

- Main Hubs: Major trading centers include London, New York, Tokyo, and Singapore.

- 24-Hour Trading:

- Currency markets operate 24/5, starting in Asia and moving through Europe to North America. This continuous cycle allows for global participation at any time.

- Advantage: Offers flexibility for investors and businesses to manage currency exposure around the clock.

- High Liquidity:

- With a daily trading volume exceeding $6 trillion, currency markets offer high liquidity, enabling quick transactions with minimal price fluctuations.

- Impact: High liquidity reduces transaction costs and spreads.

Currency Risk Factors

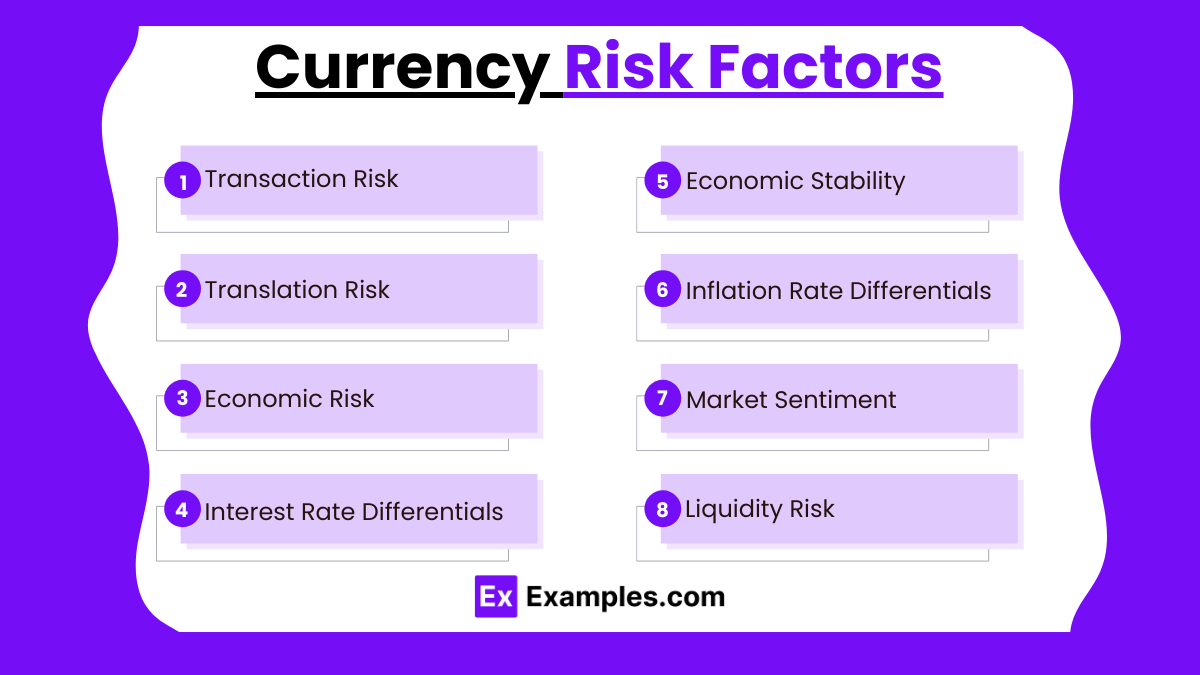

Currency risk factors, or foreign exchange risks, arise from changes in exchange rates that can impact investments, business operations, and financial results. Managing these risks is essential for companies and investors involved in international activities. Here are the key currency risk factors:

- Transaction Risk

- Definition: Risk from exchange rate changes between transaction agreement and settlement.

- Impact: Affects cash flows for importers/exporters.

- Management: Use forward contracts and options.

- Translation Risk

- Definition: Risk from converting foreign subsidiary financials into a parent company’s currency.

- Impact: Alters reported earnings.

- Management: Balance sheet and natural hedging.

- Economic Risk

- Definition: Long-term risk affecting a company’s market value due to exchange rate changes.

- Impact: Influences competitive positioning.

- Management: Diversify operations and align revenues/costs.

- Interest Rate Differentials

- Definition: Risk from varying interest rates between countries.

- Impact: Affects currency appreciation/depreciation.

- Management: Monitor rates, use swaps or forward agreements.

- Political and Economic Stability

- Definition: Risk from instability leading to currency fluctuations.

- Impact: Affects countries with political/economic turmoil.

- Management: Limit exposure to high-risk areas.

- Inflation Rate Differentials

- Definition: Risk from differing inflation rates eroding purchasing power.

- Impact: High inflation leads to currency depreciation.

- Management: Use inflation-linked securities, diversify.

- Market Sentiment and Speculation

- Definition: Risk from rapid currency changes due to investor behavior.

- Impact: Triggers short-term volatility.

- Management: Use active currency management and options.

- Liquidity Risk

- Definition: Risk of high transaction costs in low-participation markets.

- Impact: Affects smaller currencies.

- Management: Trade major currency pairs, diversify.

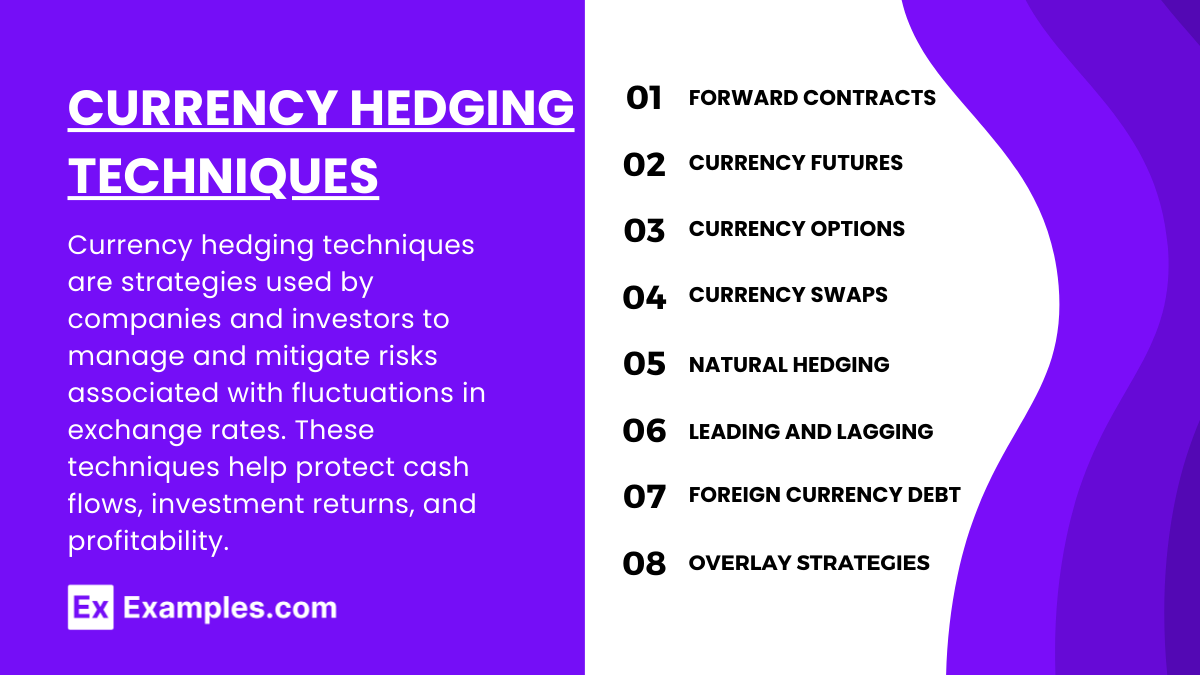

Currency Hedging Techniques

Currency hedging techniques are strategies used by companies and investors to manage and mitigate risks associated with fluctuations in exchange rates. These techniques help protect cash flows, investment returns, and profitability. Here’s an overview of the primary currency hedging techniques:

- Forward Contracts

- Custom agreements to buy/sell currency at a set rate on a future date.

- Advantage: Locks in rates and eliminates uncertainty.

- Limitation: No flexibility if market shifts favorably.

- Currency Futures

- Standardized contracts on exchanges for set future currency trades.

- Advantage: High liquidity and low counterparty risk.

- Limitation: Less customization compared to forwards.

- Currency Options

- Contracts giving the right (not obligation) to buy/sell currency at a set rate.

- Advantage: Protects against adverse moves while allowing gains.

- Limitation: High premium costs.

- Currency Swaps

- Exchanges of principal/interest payments between two currencies.

- Advantage: Long-term exposure management.

- Limitation: Complex to arrange.

- Natural Hedging

- Aligning revenues and expenses in the same currency.

- Advantage: Low-cost, operational approach.

- Limitation: Requires multi-currency operations.

- Leading and Lagging

- Adjusting payment timing based on currency trends.

- Advantage: Simple method.

- Limitation: Limited by payment flexibility.

- Foreign Currency Debt

- Borrowing in foreign currency to match revenue streams.

- Advantage: Offsets exposure.

- Limitation: Adds interest rate risk.

- Overlay Strategies

- Separate currency management from portfolio assets.

- Advantage: Dynamic management without altering core strategy.

- Limitation: Higher fees and complexity.

Examples

Example 1: Using Forward Contracts to Hedge Transaction Risk

A U.S.-based company anticipates a payment of €1 million from a European customer in three months. To lock in the exchange rate and protect against potential euro depreciation, the company enters into a forward contract to sell euros and buy U.S. dollars at a predetermined rate.

Example 2: Natural Hedging by Revenue and Cost Matching

A multinational corporation with operations in multiple countries aligns its revenue and costs in the same currency. For instance, a Canadian manufacturer with significant sales in the U.S. chooses to source raw materials from U.S. suppliers, thereby reducing its exposure to USD/CAD fluctuations.

Example 3: Currency Swaps in Managing Economic Risk

Two companies in different countries with opposite currency needs enter into a currency swap agreement. A British company that receives payments in USD swaps with an American company that incurs costs in GBP. This swap helps both parties manage currency exposure without impacting their cash flows.

Example 4: Effectiveness of Options in Managing Translation Risk

A corporation headquartered in Japan holds assets in Europe. Concerned about the potential rise of the yen against the euro, it purchases put options on euros. This strategy provides the right to sell euros at a set price, limiting the impact of a stronger yen on the euro-denominated assets when converting to the home currency.

Example 5: Impact of Central Bank Policy Changes on Currency Management Strategies

The European Central Bank announces a significant interest rate decrease, which is expected to weaken the euro against other major currencies. Portfolio managers holding euro-denominated assets may increase their hedging activities using derivatives like futures and options to protect against forecasted depreciation.

Practice Questions

Question 1

What is the primary purpose of using forward contracts in currency management?

A. To speculate on future currency movements

B. To hedge against currency risk

C. To invest in foreign currencies without direct exposure

D. To enhance the yield of currency investments

Answer:

B. To hedge against currency risk

Explanation:

The primary purpose of using forward contracts in currency management is to hedge against currency risk. By locking in an exchange rate today for a transaction that will occur in the future, companies and investors can protect themselves from the adverse movements in currency exchange rates that could impact the value of their international transactions.

Question 2

Which strategy would a company use to naturally hedge its currency exposure?

A. Entering into a series of short-term forward contracts

B. Matching revenue and expenses in the same foreign currency

C. Purchasing currency options

D. Investing surplus cash in foreign treasury bonds

Answer:

B. Matching revenue and expenses in the same foreign currency

Explanation:

A natural hedging strategy involves matching revenue and expenses in the same foreign currency to minimize the net exposure. This approach reduces the need for financial hedging instruments like forwards or options because the inflows and outflows essentially offset each other, thus naturally protecting against currency fluctuations.

Question 3

How do currency options provide a hedge against currency risk?

A. They offer the obligation to buy or sell currency at a fixed rate.

B. They require physical delivery of the currency at contract maturity.

C. They provide the right, but not the obligation, to buy or sell currency at a fixed rate.

D. They adjust the exchange rate according to the market fluctuations at the time of contract settlement.

Answer:

C. They provide the right, but not the obligation, to buy or sell currency at a fixed rate.

Explanation:

Currency options give the holder the right, but not the obligation, to buy or sell a specified amount of a foreign currency at a predetermined price on or before a specified date. This flexibility allows the holder to protect against adverse currency movements while still being able to benefit from favorable movements, unlike forward contracts which lock in a rate and create an obligation to transact.