Preparing for the CFA Exam requires a comprehensive grasp of “Derivative Benefits, Risks, and Issuer and Investor Uses”, a critical topic in financial risk management and investment strategies. Derivatives are financial instruments that derive their value from an underlying asset, such as stocks, bonds, commodities, or currencies. They offer significant benefits, such as risk management, cost efficiency, and access to otherwise inaccessible markets. For issuers, derivatives provide a method to hedge against price fluctuations and enhance capital efficiency. For investors, they enable portfolio diversification, potential high returns, and strategic exposure to assets.

Learning Objectives

In studying “Derivative Benefits, Risks, and Issuer and Investor Uses” for the CFA, you will gain insight into how derivatives provide both opportunities and challenges in financial markets. Understanding these financial instruments involves analyzing their value derived from underlying assets, allowing participants to hedge risks, manage costs, and achieve strategic portfolio diversification. This topic also covers the unique benefits derivatives offer to issuers—such as efficient capital allocation—and the high-return potential for investors.

Introduction to Derivatives

Derivatives are financial instruments whose value is dependent on the price movements of an underlying asset, which could be anything from stocks and bonds to commodities or currencies. Derivatives allow participants to hedge risks, enhance returns, and access asset classes that may otherwise be inaccessible. In the CFA exam, understanding derivatives is critical as they play a major role in financial risk management and portfolio strategies.

Benefits of Derivatives

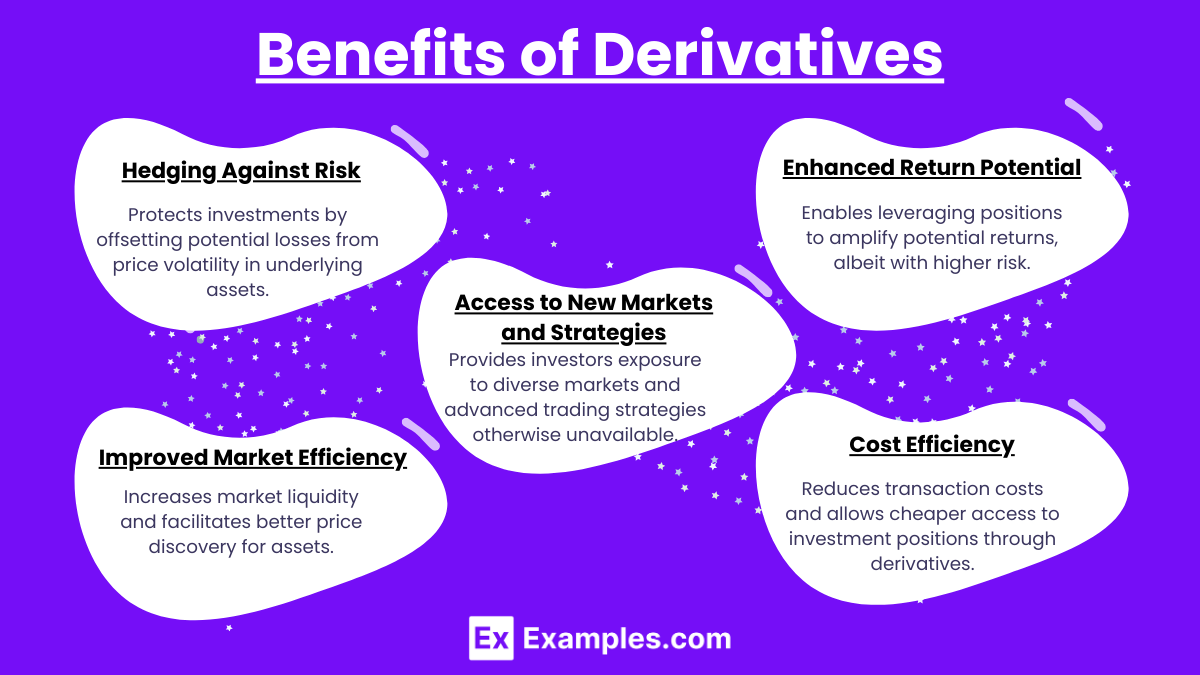

1. Hedging Against Risk

- Hedging against risk involves using financial instruments to offset potential losses from price fluctuations in assets. It’s a strategy to protect investments by reducing exposure to unpredictable market movements.

2. Enhanced Return Potential

- Investors use derivatives to leverage positions, allowing them to amplify returns. By investing a fraction of the total asset value, they gain exposure to larger price movements without the need for full capital commitment.

3. Improved Market Efficiency

- Derivatives contribute to market efficiency by providing liquidity and price discovery for the underlying asset. The existence of derivative markets helps in reflecting accurate asset prices as they respond quickly to market information.

4. Cost Efficiency

- Transactions involving derivatives are typically lower in cost compared to traditional assets due to the leverage and liquidity involved, making them attractive for both individual and institutional investors.

5. Access to New Markets and Strategies

- Derivatives offer exposure to otherwise inaccessible markets, such as emerging markets or commodities, through structured products. Additionally, they support advanced trading strategies, like options spreads and swaps.

Risks Associated with Derivatives

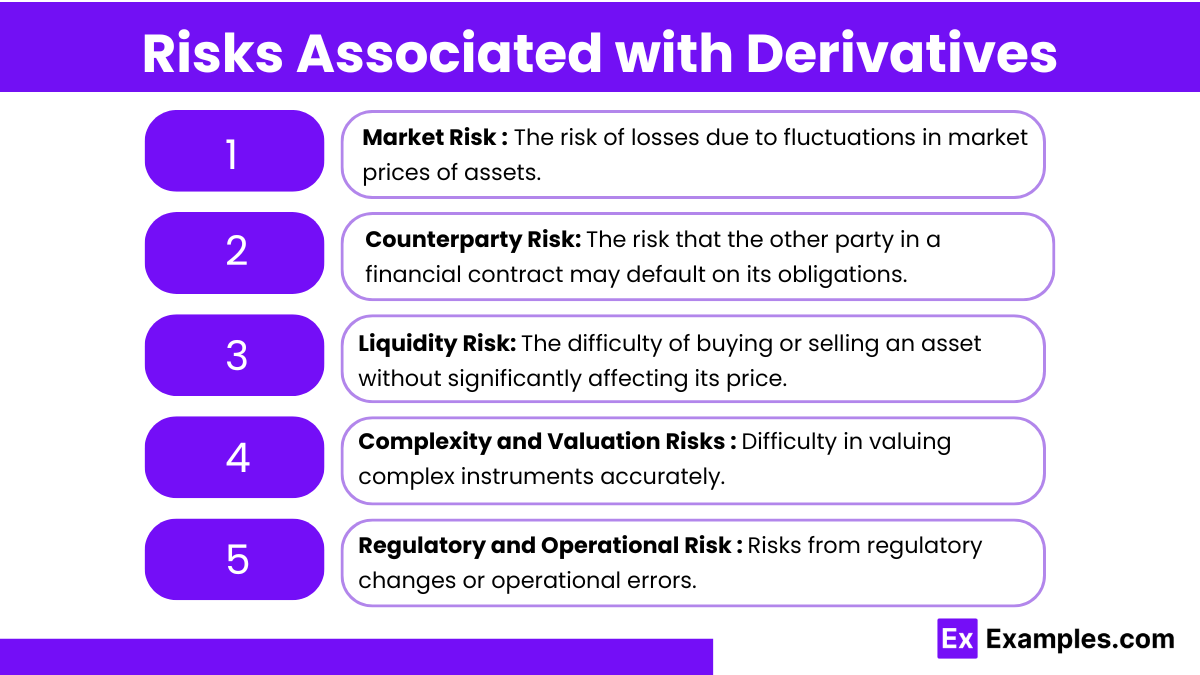

1. Market Risk

- Derivatives are highly sensitive to market conditions, and adverse price movements can lead to significant losses. The leverage inherent in many derivatives can amplify these losses.

2. Counterparty Risk

- In over-the-counter (OTC) derivatives, the risk of the other party defaulting on their obligations is a major concern, particularly in cases where there is no clearinghouse guarantee.

3. Liquidity Risk

- Certain derivatives may lack liquidity, meaning that they cannot be sold quickly without affecting their price. Illiquid markets can lead to challenges in executing large orders or in managing exit strategies.

4. Complexity and Valuation Risks

- Derivatives, particularly exotic options and structured products, can be highly complex, making them difficult to value accurately. Mispricing or incorrect valuation can lead to significant financial risks.

5. Regulatory and Operational Risk

- Derivatives are subject to varying levels of regulation, depending on jurisdiction and product type. Regulatory changes can impact derivative markets and create operational challenges for compliance.

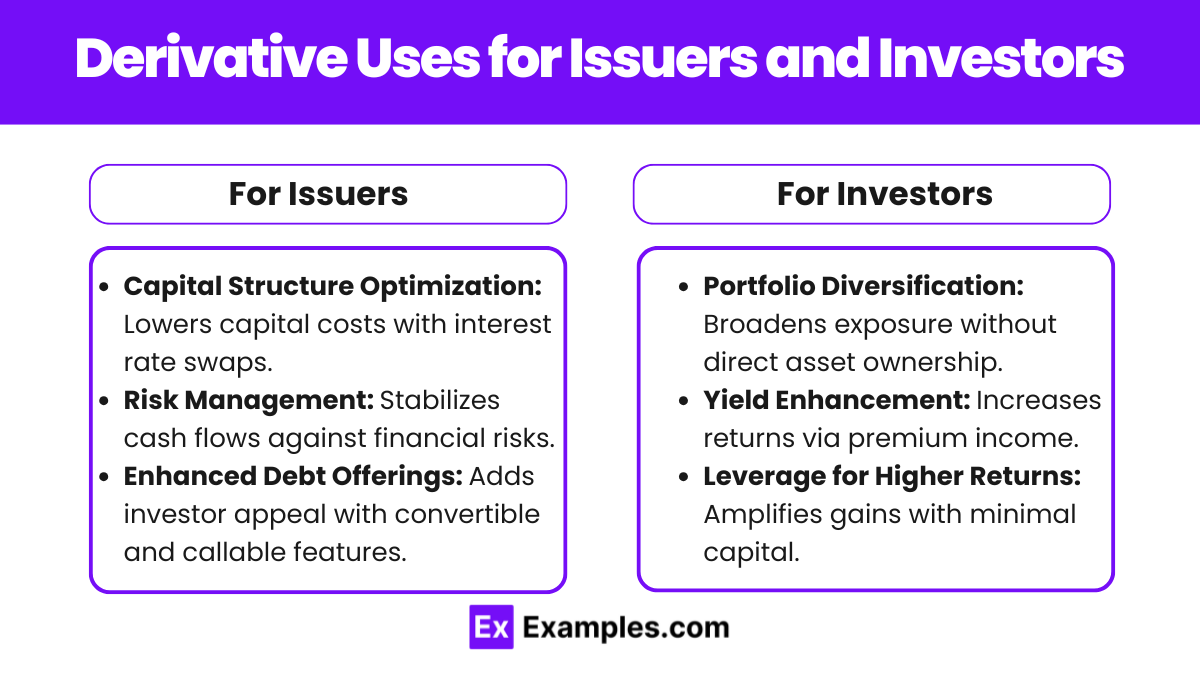

Derivative Uses for Issuers and Investors

For Issuers:

- Capital Structure Optimization

- Issuers use derivatives to manage their capital structure effectively, such as through interest rate swaps that lower the cost of capital.

- Risk Management

- Corporations use derivatives like forward contracts, swaps, and options to manage currency, interest rate, and commodity price risks, stabilizing their cash flows.

- Enhanced Debt Offerings

- Derivatives embedded in debt instruments, like convertible bonds, can make securities more attractive to investors by offering features like conversion to equity or callable structures.

For Investors:

- Portfolio Diversification

- Derivatives offer investors the ability to diversify their portfolios by gaining exposure to different asset classes, geographies, or sectors without directly purchasing the underlying assets.

- Yield Enhancement

- Investors use derivatives to improve portfolio yields. For instance, selling options can provide premium income, and employing structured products can enhance yield under specific conditions.

- Leverage for Higher Returns

- By using derivatives like futures or options, investors can achieve greater market exposure with less capital, allowing for potentially higher returns.

Examples

Example 1. Hedging against Price Volatility

Derivatives serve as a tool for hedging, allowing both issuers and investors to mitigate risks associated with price fluctuations. For instance, a commodity producer might use futures contracts to lock in prices, protecting themselves from potential decreases in market value. This hedging practice benefits both the issuer, who achieves price stability, and the investor, who can more predictably anticipate returns. However, improper hedging strategies can amplify losses if market conditions change unfavorably, highlighting the importance of effective risk management.

Example 2. Leveraging Investment Opportunities

Derivatives offer issuers and investors a means to leverage positions, enabling the amplification of potential gains without the need for significant capital investment. Options, for example, allow investors to control a large amount of an asset with a relatively small premium. Issuers can attract investors interested in high-reward opportunities without tying up substantial capital. However, this leverage also increases risk exposure, as losses can exceed the initial investment, requiring careful oversight to prevent excessive risk.

Example 3. Enhancing Portfolio Diversification

By incorporating derivatives, investors can diversify portfolios beyond traditional assets like stocks and bonds. For example, adding currency derivatives can hedge foreign investments, reducing the impact of exchange rate volatility. Issuers benefit by broadening their appeal to a global investor base seeking diversified, risk-adjusted returns. However, derivatives linked to complex assets can introduce unfamiliar risks, requiring investors to understand underlying market dynamics fully.

Example 4. Speculating on Market Movements

Derivatives provide investors with opportunities to speculate on market directions, benefiting from anticipated price movements in various assets. Investors might engage in options trading, betting on upward or downward trends in stock prices to generate profits. Issuers of speculative derivatives can profit by capturing premiums paid by speculators. Nonetheless, speculation carries inherent risks, including the potential for substantial losses if market predictions prove incorrect, underscoring the high-risk nature of speculative strategies.

Example 5. Interest Rate Risk Management

Issuers and investors use interest rate derivatives like swaps to manage exposure to interest rate fluctuations, stabilizing cash flows. For instance, a corporation may enter a swap to exchange a floating interest rate for a fixed rate, aligning its debt obligations with predictable financing costs. This can provide both parties with more stable financial planning. However, if interest rate projections are misjudged, participants might incur losses instead of gains, indicating a need for accurate financial forecasting in derivative use.

Practice Questions

Question 1

Which of the following is a common reason issuers and investors use derivatives for hedging purposes?

A. To increase the overall value of the asset being hedged

B. To protect against unfavorable price fluctuations

C. To speculate on favorable market movements

D. To completely eliminate all risks associated with the asset

Answer: B – To protect against unfavorable price fluctuations

Explanation:

The primary reason for using derivatives in hedging is to reduce the impact of potential adverse price movements in underlying assets. For instance, an airline may hedge against rising fuel prices to maintain stable operating costs. Hedging is not meant to increase asset value (Option A), speculate on gains (Option C), or eliminate all risk (Option D) but rather to limit downside exposure while maintaining some level of predictability.

Question 2

Which benefit do derivatives provide by enabling leverage in investment strategies?

A. They allow investors to avoid all risk in volatile markets

B. They enable control of larger positions with a smaller initial outlay

C. They reduce the need for risk management in a portfolio

D. They ensure profits regardless of market conditions

Answer: B – They enable control of larger positions with a smaller initial outlay

Explanation:

Derivatives allow investors to gain exposure to a larger amount of assets with relatively low capital through leveraged positions. For instance, options or futures contracts can be entered with a small premium or margin compared to the full asset cost. However, leverage also increases risk, as losses can magnify. Options A and C are incorrect, as derivatives do not eliminate risk or reduce the need for careful risk management. Option D is also incorrect because derivatives do not guarantee profits; market conditions directly impact results.

Question 3

What is a primary risk of using derivatives for speculative purposes?

A. The possibility of larger losses than the initial investment

B. Guaranteed returns with limited growth potential

C. Complete immunity to price volatility

D. Reduction in the size of investment losses

Answer: A – The possibility of larger losses than the initial investment

Explanation:

When derivatives are used for speculation, investors take on the risk of potentially losing more than their initial investment, especially in highly leveraged positions such as futures or certain options. For example, if a futures contract moves against the investor’s position, they could be required to cover additional losses. Options B and C are incorrect because derivatives do not provide guaranteed returns or immunity to volatility. Option D is also incorrect; while some derivatives can be used to mitigate risk, speculative derivatives do not inherently reduce losses and can actually increase them in adverse conditions.