Derivative Instrument and Derivative Market Features are essential components of modern financial markets, enabling investors to manage risk, speculate on price movements, and enhance portfolio performance. These instruments—such as forwards, futures, options, and swaps—derive their value from underlying assets like stocks, bonds, commodities, and currencies. The market features of derivatives, including leverage, liquidity, and counterparty risk, play a critical role in determining their use and effectiveness.

Learning Objectives

In studying “Derivative Instruments and Derivative Market Features” for the CFA exam, you should learn to understand the key types of derivative instruments, including forwards, futures, options, and swaps, and analyze their applications in managing financial risks. Evaluate the characteristics of derivative markets, differentiating between exchange-traded and over-the-counter (OTC) derivatives. Explore concepts such as leverage, margin requirements, and the roles of market participants like hedgers, speculators, and arbitrageurs. Additionally, examine the risks associated with derivatives, including counterparty and liquidity risk, and apply your understanding to assess how these instruments support investment and hedging strategies in financial markets.

Derivative Instruments

Derivative instruments are financial contracts whose value is derived from the value of an underlying asset, index, or interest rate. They are often used for hedging risks, speculation, and enhancing portfolio efficiency. Common underlying assets include stocks, bonds, commodities, currencies, interest rates, and market indexes.

Types of Derivative Instruments:

- Forwards: Customized contracts between two parties to buy or sell an asset at a predetermined price on a specific future date. These are traded over-the-counter (OTC), making them customizable but also riskier due to counterparty risk.

- Futures: Standardized contracts traded on exchanges to buy or sell an asset at a set price on a future date. Unlike forwards, futures involve daily settlement through a clearinghouse, which reduces credit risk.

- Options: Contracts that give the buyer the right (but not the obligation) to buy (call option) or sell (put option) an asset at a specified price before or at expiration. Options are either American-style (exercise anytime before expiration) or European-style (exercise only at expiration).

- Swaps: OTC contracts where two parties exchange cash flows based on a notional principal. Common swaps include interest rate swaps, currency swaps, and commodity swaps, often used for managing interest rate risk and currency exposure.

- Exotic Derivatives: These include complex instruments like options on swaps (swaptions), structured notes, and other derivatives with payoffs based on multiple underlying variables or unique triggers.

Derivative Market

The derivative market is a financial market for instruments that derive their value from an underlying asset, index, or interest rate. Key types of derivatives include futures, options, forwards, and swaps. These instruments are used by investors, traders, and institutions for hedging risk, speculating on price movements, or gaining exposure to an asset without directly owning it. Derivative markets allow participants to hedge risks, speculate on the future price movements of assets, or gain access to otherwise inaccessible markets or assets. The market for derivatives is divided into OTC markets and exchange-traded markets, each with unique characteristics, benefits, and risks.

There are two main segments in the derivative market:

- Exchange-Traded Derivatives (ETD): These are standardized contracts traded on formal exchanges, such as futures and options, with specific contract terms and regulations. They provide transparency, liquidity, and lower counterparty risk due to the exchange acting as an intermediary.

- Over-the-Counter (OTC) Derivatives: These are customized contracts traded directly between parties, often used in more complex or tailored financial transactions. While OTC derivatives provide greater flexibility, they carry higher counterparty risk, as they are not traded on a regulated exchange.

Derivatives play a crucial role in the financial ecosystem by enabling participants to manage risks, leverage positions, and access markets more flexibly. However, they also introduce significant risks, particularly due to leverage, and can contribute to market volatility.

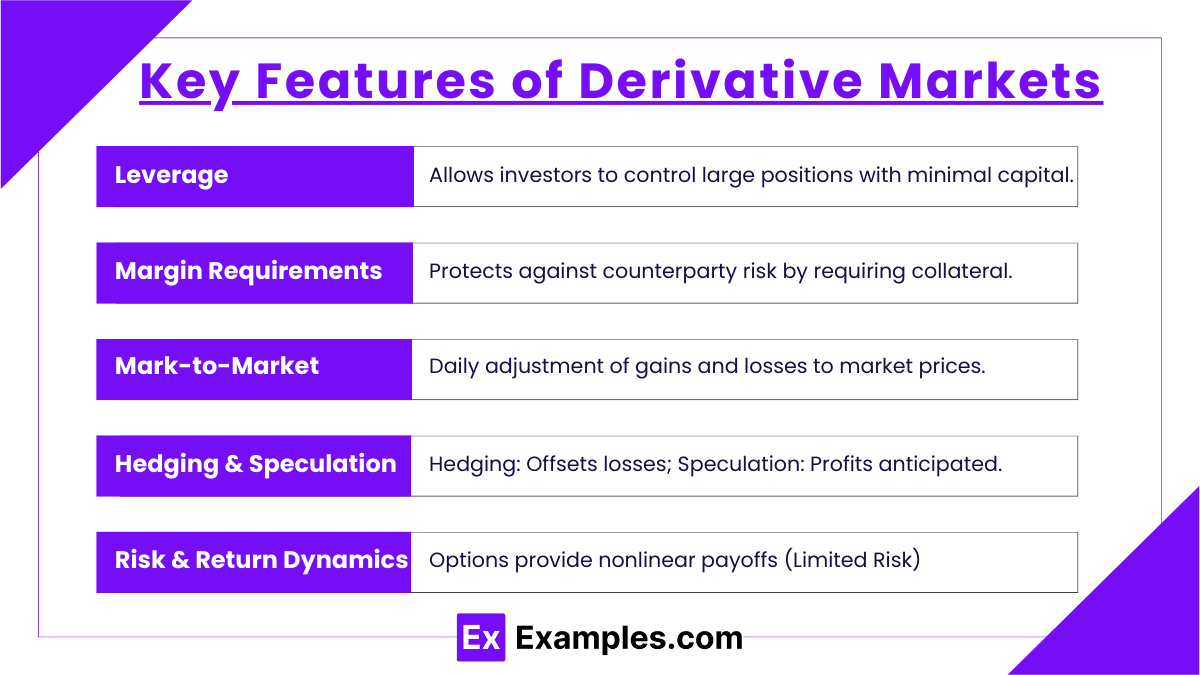

Key Features of Derivative Markets

- Leverage:

- Allows investors to control large positions with minimal capital.

- Amplifies both potential gains and losses.

- Requires effective risk management to prevent excessive losses.

- Margin Requirements:

- Protects against counterparty risk by requiring collateral.

- Includes initial margin at trade initiation and maintenance margin throughout.

- Margin calls occur if the balance falls below the maintenance level, ensuring sufficient funds.

- Mark-to-Market:

- Daily settlement of profits and losses based on current market prices.

- Reduces credit risk by preventing accumulation of large losses.

- Ensures transparency by aligning positions with market valuations.

- Hedging and Speculation:

- Hedging: Used to offset potential losses in other investments (e.g., airlines hedging fuel costs).

- Speculation: Used to profit from anticipated price movements.

- Both activities enhance market liquidity and facilitate varied investment strategies.

- Risk and Return Dynamics:

- Options provide nonlinear payoffs (limited risk, high upside potential).

- Futures and forwards have linear payoffs (proportional gains and losses).

- Understanding these dynamics is essential for managing exposure and making informed decisions.

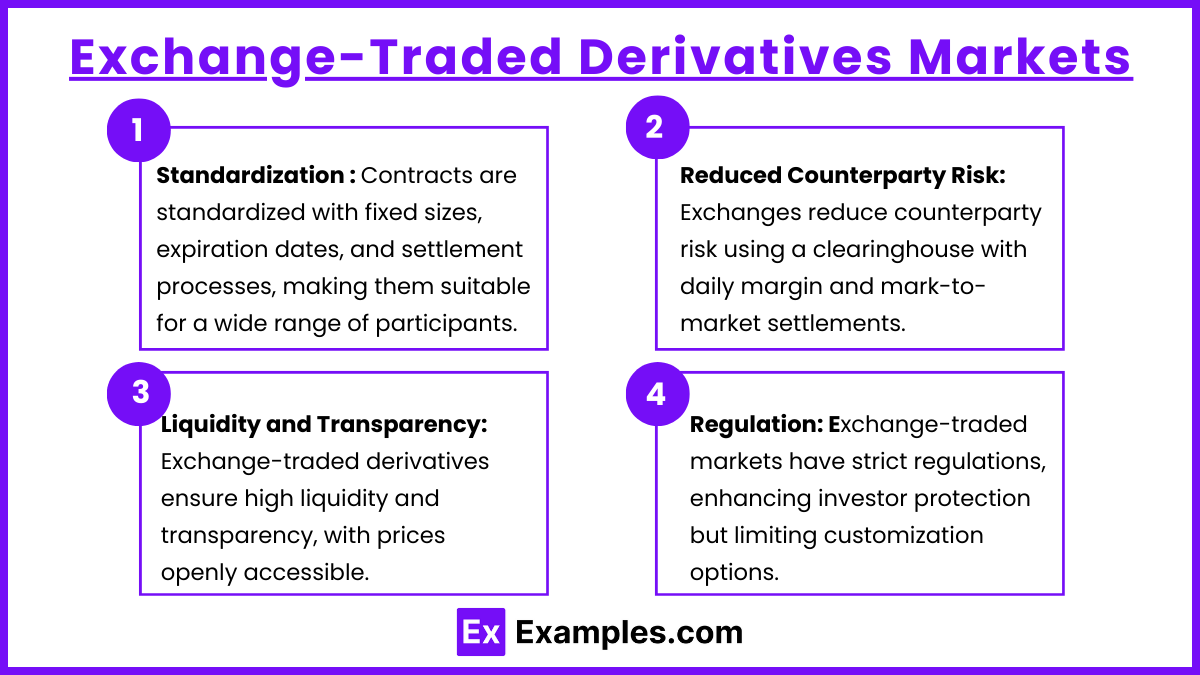

Exchange-Traded Derivatives Markets

- Standardization: Contracts are standardized with fixed sizes, expiration dates, and settlement processes, making them suitable for a wide range of participants.Exchange-traded derivatives, like futures and options, have standardized contract specifications, including fixed contract sizes, expiration dates, and settlement processes, allowing them to be easily traded across various market participants. This standardization promotes ease of trading, reduces ambiguity, and ensures consistency in terms, making these instruments suitable for institutional and retail investors alike. However, standardization can limit flexibility, as specific terms cannot be tailored to the unique needs of each participant, unlike in OTC markets.

- Reduced Counterparty Risk: Exchanges use a clearinghouse that acts as the counterparty to both sides of a transaction, reducing credit risk through daily margin requirements and mark-to-market settlements. Exchange-traded derivatives employ a central clearinghouse that acts as the counterparty for every trade, effectively reducing counterparty risk by guaranteeing each transaction. The clearinghouse requires initial and maintenance margins from both sides to manage potential defaults. It also employs daily mark-to-market settlements, where gains and losses are calculated and settled at the end of each trading day, further protecting parties from excessive losses. This mechanism provides a secure environment for trading and helps mitigate credit risk inherent in direct transactions.

- Liquidity and Transparency: Exchange-traded derivatives typically offer greater liquidity and price transparency, as prices are publicly available and widely disseminated. One of the main advantages of exchange-traded derivatives is their high level of liquidity, meaning these instruments can be bought and sold with minimal price impact. This liquidity stems from the large number of market participants and the standardized nature of contracts. Additionally, price transparency is enhanced because trades are conducted on public exchanges, and prices are widely disseminated in real time. This transparency aids investors in making informed decisions, as they have immediate access to current pricing and market trends.

- Regulation: Exchange-traded markets are highly regulated, which increases investor protection but also limits customization compared to OTC markets.Exchange-traded markets operate under strict regulatory oversight, governed by bodies like the U.S. Commodity Futures Trading Commission (CFTC) or the Securities and Exchange Commission (SEC). These regulations ensure that exchanges follow specific rules to protect investors, uphold market integrity, and prevent fraud or market manipulation. While regulation increases investor confidence and safety, it can restrict certain actions, such as customization of contracts or speculative practices, to align with market standards and compliance requirements. This regulated environment, however, can make exchange-traded derivatives preferable for risk-averse participants seeking transparency and reliability.

Examples

Example 1: Leverage and Margin Requirements in Futures Contracts

Futures contracts allow investors to control large positions with a relatively small initial investment, a concept known as leverage. For instance, if an investor wants exposure to 100,000 dollars worth of oil futures, they may only need to post a margin of 5,000 dollars. However, due to daily mark-to-market requirements, they must maintain sufficient funds in their account to cover potential losses, ensuring credit risk is minimized on the exchange. This feature allows traders to increase potential returns but also magnifies losses, making careful margin management critical.

Example 2: Customized Hedging with OTC Derivatives

Companies often use OTC derivatives for customized hedging solutions. For example, an airline might enter an OTC forward contract to lock in the price of jet fuel for six months. Unlike standardized futures, this forward contract is tailored to the airline’s specific needs, allowing for precise risk management without the need for daily margin requirements. However, this flexibility also introduces counterparty risk, as the contract relies on the financial stability of the other party involved.

Example 3: Speculation through Options

Options provide a unique payoff structure and appeal to speculators due to their asymmetrical risk profile. For example, an investor might purchase call options on a stock they believe will rise, gaining the right to buy the stock at a set price. If the stock price increases, the option’s value rises, allowing the investor to benefit from the upside with limited risk, as the maximum loss is the premium paid for the option. This risk/reward dynamic is an essential feature that makes options popular among speculators looking for controlled exposure to potential gains.

Example 4: Transparency and Liquidity in Exchange-Traded Derivatives

Exchange-traded derivatives like stock index futures provide high levels of transparency and liquidity, as these contracts are traded on regulated exchanges with publicly available prices. For instance, the S&P 500 futures contract trades on the CME (Chicago Mercantile Exchange), and its price is visible in real time, providing participants with a clear view of the market. The high liquidity ensures participants can enter and exit positions quickly, contributing to price discovery and market efficiency, which are critical features for institutional investors and traders.

Example 5: Arbitrage Opportunities with Swaps

Swaps, particularly interest rate swaps, are commonly used by corporations and financial institutions to manage interest rate exposure. For example, a company with a variable-rate loan might enter a fixed-for-floating interest rate swap to hedge against rising interest rates. This swap allows the company to pay a fixed rate while receiving a floating rate, aligning its cash flows with a predictable interest expense. Moreover, arbitrageurs may exploit differences in swap pricing across markets, contributing to market efficiency by ensuring fair pricing across related instruments.

Practice Questions

Question 1

A company enters into a forward contract to purchase 1,000 barrels of oil at $70 per barrel in six months to hedge against rising oil prices. Which of the following best describes a characteristic of this forward contract?

A. The contract is standardized and traded on an exchange.

B. The contract can be settled daily to manage credit risk.

C. The contract is customizable and subject to counterparty risk.

D. The contract provides the company with the option, but not the obligation, to buy oil at $70.

Answer: C. The contract is customizable and subject to counterparty risk.

Explanation: A forward contract is an over-the-counter (OTC) derivative, meaning it is privately negotiated between two parties and can be customized to fit specific needs, such as the quantity and price in this case. Unlike standardized futures, forward contracts do not trade on exchanges, nor do they involve daily settlement through a clearinghouse, which introduces counterparty risk. In this question, the company is obligated to purchase oil at $70 per barrel, unlike an option, which would allow for flexibility to choose. Therefore, option C accurately describes the characteristics of a forward contract.

Question 2

Which of the following best explains why options are popular among speculators?

A. Options are fully customizable and free from any counterparty risk.

B. Options allow speculators to gain exposure to price movements with limited risk to the premium paid.

C. Options require no initial investment and provide unlimited profit potential.

D. Options provide the right and obligation to buy or sell an underlying asset at a specified price.

Answer: B. Options allow speculators to gain exposure to price movements with limited risk to the premium paid.

Explanation: Options are attractive to speculators because they offer a unique asymmetrical risk profile. For a call option, the holder has the right to buy the underlying asset at a specified price, while for a put option, the holder has the right to sell. Importantly, the maximum loss for an option buyer is limited to the premium paid, while the potential upside (especially for a call option on a rising asset) can be significant. This limited downside with substantial upside potential makes options a preferred choice for speculators. Option B accurately captures this feature. Options are not customizable, as they are standardized when traded on exchanges, nor do they provide an obligation to buy or sell, making the other choices incorrect.

Question 3

An investor uses futures contracts to gain exposure to the S&P 500 index. Which of the following is a primary benefit of using futures over forward contracts for this purpose?

A. Futures contracts eliminate all risk due to the margining process.

B. Futures contracts are settled at expiration without interim cash flows.

C. Futures contracts are highly liquid and involve lower counterparty risk due to exchange clearinghouses.

D. Futures contracts allow for complete customization to fit the investor’s specific requirements.

Answer: C. Futures contracts are highly liquid and involve lower counterparty risk due to exchange clearinghouses.

Explanation: Futures contracts are standardized and traded on exchanges, which makes them highly liquid and transparent. The involvement of a clearinghouse reduces counterparty risk because it guarantees the contract, managing risk through daily mark-to-market settlement and margin requirements. These features make futures contracts more secure and easier to trade than OTC forward contracts. Option C is correct because it highlights these benefits. The other options are incorrect: futures do involve interim cash flows due to daily settlement, they are not customizable, and while margining reduces risk, it does not eliminate it entirely.