Preparing for the CFA Exam requires a comprehensive understanding of “Economic Growth,” a fundamental topic in macroeconomics. Mastery of the drivers of growth, including productivity, capital investment, and technological advancement, is essential. This knowledge provides insights into long-term economic trends, investment opportunities, and policy impacts, crucial for achieving a high CFA score.

Learning Objective

In studying “Economic Growth” for the CFA Exam, you should aim to understand the fundamental factors that drive economic growth, including capital accumulation, labor force expansion, and technological advancement. Analyze the role of productivity, human capital, and government policies in fostering sustainable growth. Evaluate growth models such as the Solow-Swan model and the endogenous growth theory to comprehend how economies expand over time. Additionally, explore the impacts of economic growth on investment opportunities, business cycles, and macroeconomic stability. Apply this knowledge to assess economic forecasts, identify growth trends, and make informed investment decisions for practical applications on the CFA Exam.

Overview of Economic Growth

Economic growth refers to the increase in the production and consumption of goods and services in an economy over a period of time. It is typically measured by the rate of change in Gross Domestic Product (GDP), which is the total value of all goods and services produced within a country. Economic growth is crucial for improving living standards, reducing poverty, and increasing employment opportunities. Here’s a comprehensive overview of the key aspects and drivers of economic growth:

Characteristics of Economic Growth

- Sustainable vs. Unsustainable Growth: Sustainable growth is achieved without depleting natural resources or causing significant environmental damage, whereas unsustainable growth may lead to long-term negative consequences.

- Real vs. Nominal Growth: Real growth adjusts for inflation, providing a more accurate picture of an economy’s progress, while nominal growth includes inflation and might overstate economic health.

Fundamental Drivers of Economic Growth

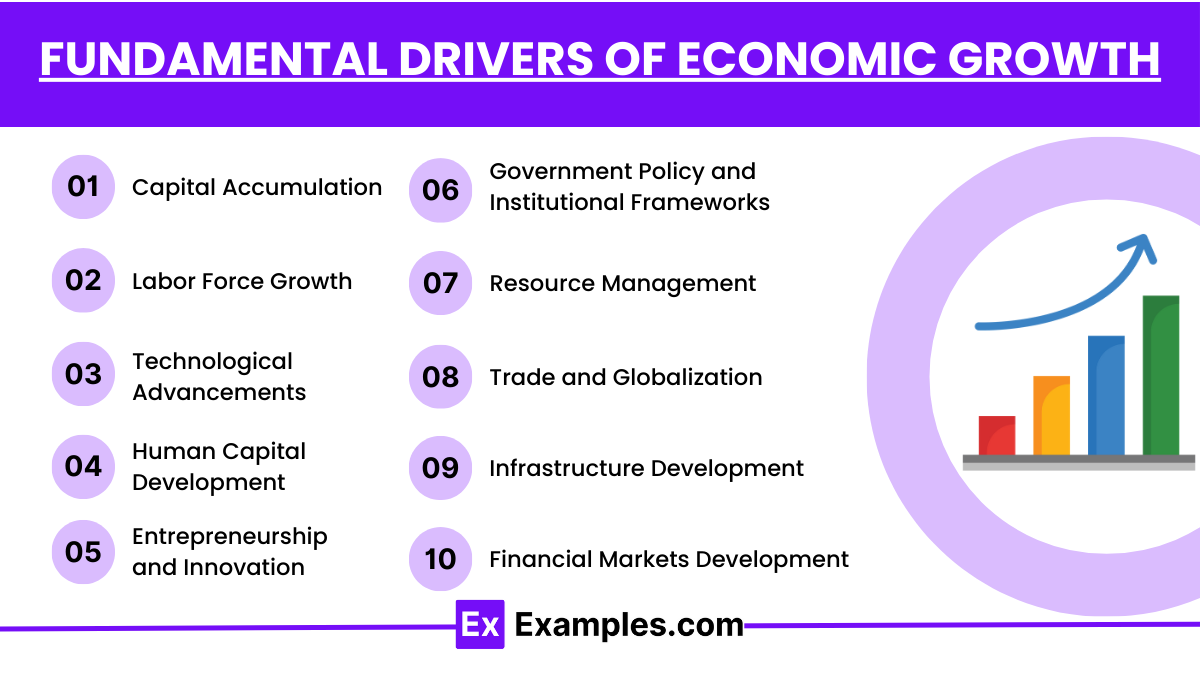

Economic growth is a multifaceted phenomenon influenced by a variety of factors that contribute to the increase in the output of goods and services in an economy. Understanding the fundamental drivers of economic growth helps policymakers and economists devise strategies to enhance efficiency and improve living standards. Here’s a closer look at these primary drivers:

1. Capital Accumulation

- Investment in physical assets like buildings, machinery, and technology is crucial for increasing production capacity. More capital means more productive capacity, which is essential for growth.

2. Labor Force Growth

- The size and quality of the labor force are critical; growth can stem from increasing the number of workers or improving the quality through education and training. A skilled workforce is more productive and capable of driving innovation.

3. Technological Advancements

- Innovation and technological improvements are perhaps the most significant drivers of economic growth. Advancements in technology can lead to new products, improve efficiency, and reduce production costs.

4. Human Capital Development

- Investing in education and health to enhance the productivity and efficiency of the workforce. Human capital is integral to economic growth as it improves the quality of the labor force.

5. Entrepreneurship and Innovation

- Entrepreneurs mobilize the other factors of production, introduce new products and technologies, and improve processes. Their role is vital in coordinating resources and fostering economic dynamics.

6. Government Policy and Institutional Frameworks

- Effective governance, sound economic policies, stable legal and political systems, and protective property rights are fundamental for fostering an environment conducive to economic growth. These factors provide the necessary stability and predictability for private investment.

7. Resource Management

- Efficient utilization and management of natural resources ensure that these resources contribute to economic growth without causing ecological harm, thus supporting sustainable development.

8. Trade and Globalization

- Openness to trade allows countries to specialize in manufacturing goods where they have a comparative advantage, exchange products, technologies, and ideas, and access larger markets, all of which can boost economic growth.

9. Infrastructure Development

- Quality infrastructure in transportation, communication, energy, and utilities is crucial for economic activities, reducing costs, and enhancing business capabilities.

10. Financial Markets Development

- Well-functioning financial markets facilitate the allocation of resources and mobilize savings, making funds available for investment by businesses and individuals.

Role of Productivity in Economic Growth

Productivity plays a central role in economic growth and is often seen as the most important economic indicator of a country’s long-term economic health and potential. It refers to the efficiency of production processes and is measured by the ratio of outputs (goods and services) produced to inputs used in production, such as labor and capital. Here’s an overview of how productivity impacts economic growth:

Importance of Productivity

- Efficiency Increase: Productivity growth means more output is produced with the same amount of inputs. This increase in efficiency often leads to lower production costs and higher output, which is crucial for competitive advantage on a global scale.

- Income Levels: Higher productivity boosts incomes, as businesses can afford to pay workers more due to increased output. This often translates into a higher standard of living.

- Price Stability: When productivity increases, companies can produce goods at lower costs, which can help stabilize prices or even lower them, making products more accessible to consumers.

- Economic Expansion: Enhanced productivity allows an economy to grow rapidly without causing inflation. With greater output, the economy can expand, creating more jobs and wealth.

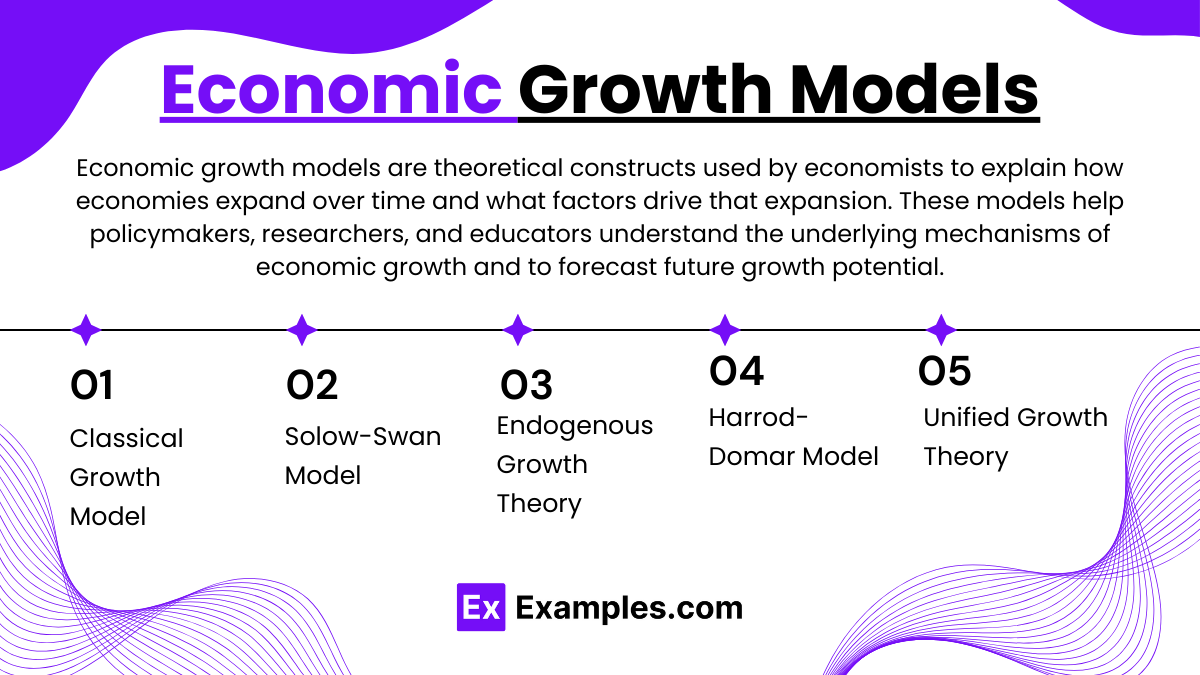

Economic Growth Models

Economic growth models are theoretical constructs used by economists to explain how economies expand over time and what factors drive that expansion. These models help policymakers, researchers, and educators understand the underlying mechanisms of economic growth and to forecast future growth potential. Here’s an overview of some of the most influential economic growth models:

1. Classical Growth Model

- Developed by: Thomas Malthus and David Ricardo.

- Core Concept: Economic output grows naturally but is limited by population growth and finite resources, leading to a steady state of stabilized per capita incomes.

- Insight: Continuous growth requires technological improvements or new resource discoveries.

2. Solow-Swan Model

- Developed by: Robert Solow and Trevor Swan in the 1950s.

- Core Concept: Emphasizes the role of capital accumulation, labor growth, and technological progress, introducing the concept of a steady state where economies can reach equilibrium.

- Insight: Long-term economic growth driven by technological advancements, with the potential for poorer economies to catch up to richer ones through convergence.

3. Endogenous Growth Theory

- Developed by: Paul Romer, Robert Lucas, and others.

- Core Concept: Growth is generated from within an economy, primarily through internal factors such as human capital, innovation, and knowledge.

- Insight: Economic policies can have lasting impacts on growth rates; emphasizes the importance of knowledge and education without an upper limit to growth.

4. Harrod-Domar Model

- Developed by: Roy Harrod and Evsey Domar post-World War II.

- Core Concept: Based on Keynesian economics, stressing the significance of savings and investment as growth determinants.

- Insight: Economic growth depends on the levels of saving and capital productivity but may be inherently unstable without exact matching of savings to investment.

5. Unified Growth Theory

- Developed by: Oded Galor and others.

- Core Concept: Offers an integrated view of the economic development process, from pre-industrial times through modern economic growth phases.

- Insight: Combines elements of Malthusian dynamics, demographic transitions, and modern growth characteristics to explain the transition from economic stagnation to sustained growth.

Examples

Example 1: Impact of Technological Advancements on U.S. Economic Growth

Analyze how technological innovations, such as advancements in information technology and automation, have contributed to U.S. economic growth over recent decades. Discuss the role of R&D and policy support in fostering these advancements.

Example 2: Solow-Swan Model Applied to Developing Economies

Examine how the Solow-Swan growth model can explain the economic growth trajectory of developing countries, highlighting the importance of capital accumulation and the catch-up effect. Use real-world examples of countries that have experienced rapid growth by investing in infrastructure and education.

Example 3: Case Study: Government Policy and Growth in China

Explore how specific government policies, such as infrastructure investments and economic reforms, have fueled economic growth in China over the past few decades. Evaluate the role of fiscal and monetary policies in supporting this growth.

Example 4: Economic Growth and Environmental Sustainability in Europe

Study the balance between economic growth and sustainability in European countries that prioritize environmental regulations. Discuss how green technologies and policies aimed at reducing carbon emissions impact long-term growth.

Example 5: Challenges of Demographic Shifts on Economic Growth in Japan

Analyze how Japan’s aging population affects its labor force, productivity, and economic growth potential. Discuss how demographic changes present challenges to sustaining economic expansion and what strategies could mitigate these effects.

Practice Questions

Question 1

What is primarily responsible for the convergence in income levels predicted by the Solow-Swan model?

A. High savings rates in developed economies

B. Diminishing returns to capital in poorer countries

C. Technological catch-up by developing countries

D. Equal distribution of natural resources

Answer:

C. Technological catch-up by developing countries

Explanation:

The Solow-Swan model predicts convergence in income levels mainly through technological catch-up, where developing countries adopt existing technologies from developed countries to boost productivity. This process allows them to grow at a faster rate than developed countries, eventually leading to convergence in income levels across nations.

Question 2

Which factor is considered a fundamental driver of economic growth in endogenous growth theory?

A. External trade balances

B. Fixed foreign investment rates

C. Knowledge and innovation

D. Short-term fiscal policies

Answer:

C. Knowledge and innovation

Explanation:

Endogenous growth theory emphasizes the role of knowledge, innovation, and human capital as core drivers of sustainable economic growth. Unlike exogenous factors, these elements are integral to the economic system and can lead to new technological advancements and improvements in productivity that drive growth from within the economy.

Question 3

What impact does a high rate of population growth have on economic growth according to the Solow-Swan model?

A. It invariably increases economic growth by expanding the labor force.

B. It decreases economic growth due to dilution of capital.

C. It has no impact on economic growth.

D. It enhances productivity through increased technological innovation.

Answer:

B. It decreases economic growth due to dilution of capital

Explanation:

According to the Solow-Swan model, while a growing population can increase the labor force, it often leads to a dilution of capital because the same amount of capital is spread over more workers. This dilution can reduce capital per worker unless it is offset by corresponding increases in capital investment, potentially slowing economic growth per capita.