Preparing for the CFA Exam requires a comprehensive understanding of “Environmental, Social, and Governance” (ESG) factors, a crucial component of responsible investing. Mastery of how ESG considerations impact financial analysis, investment strategies, and corporate behavior is essential. This knowledge provides insights into sustainability, ethical practices, and long-term value creation, critical for achieving a high CFA score.

Learning Objective

In studying “Environmental, Social, and Governance” (ESG) for the CFA Exam, you should learn to understand the principles and practices behind integrating ESG factors into financial analysis and investment decisions. Analyze how environmental factors, such as climate change and resource management, social factors, including labor practices and community impact, and governance factors, such as corporate leadership and ethics, influence corporate performance and investor choices. Evaluate ESG scoring, reporting frameworks, and the role of regulations in promoting sustainable practices. Apply this knowledge to assess investment risks, identify opportunities, and align portfolios with sustainability objectives, preparing for practical exam applications.

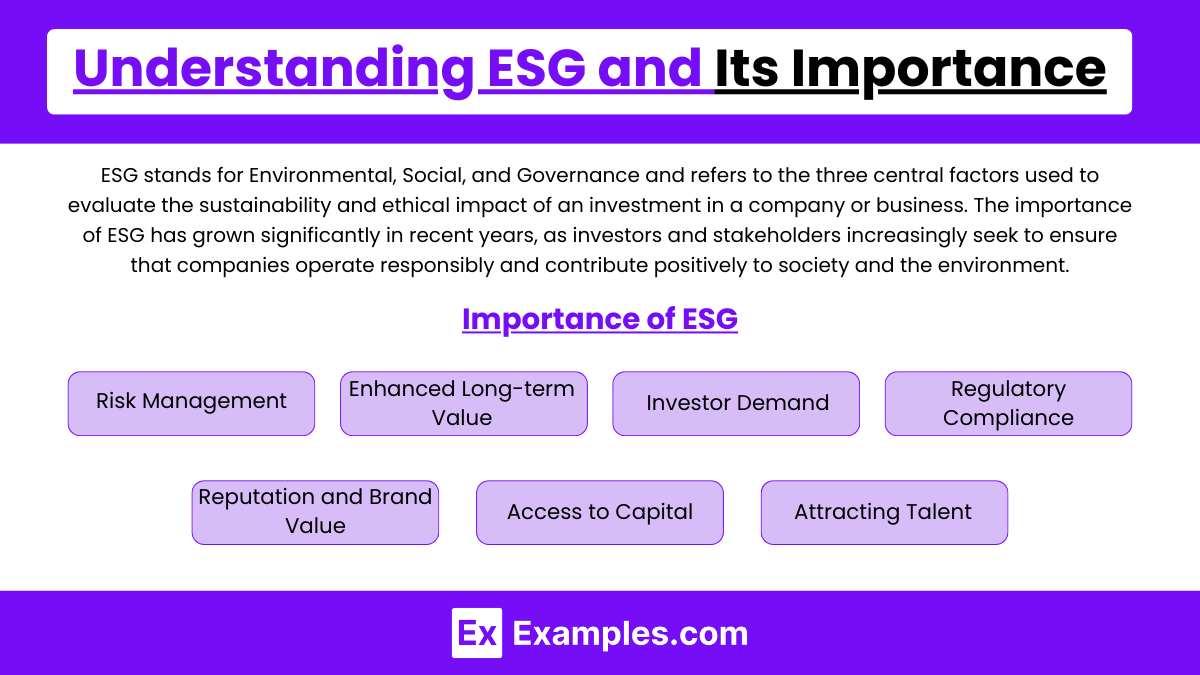

Understanding ESG and Its Importance

ESG stands for Environmental, Social, and Governance and refers to the three central factors used to evaluate the sustainability and ethical impact of an investment in a company or business. The importance of ESG has grown significantly in recent years, as investors and stakeholders increasingly seek to ensure that companies operate responsibly and contribute positively to society and the environment.

Importance of ESG

- Risk Management

- Integrating ESG considerations helps identify and mitigate potential risks that could impact a company’s financial performance, such as environmental liabilities, labor disputes, and regulatory penalties.

- Enhanced Long-term Value

- Companies with strong ESG practices are often better positioned for long-term success, as they are more likely to attract and retain customers, employees, and investors who prioritize sustainability and ethical practices.

- Investor Demand

- The rise of socially responsible investing (SRI) and the increasing focus on sustainable practices have made ESG criteria a standard part of investment analysis. Investors use ESG metrics to identify companies that align with their values and offer sustainable growth prospects.

- Regulatory Compliance

- As governments and international bodies push for stricter regulations on environmental impact and corporate responsibility, ESG practices help companies stay ahead of legal requirements and avoid penalties.

- Reputation and Brand Value

- Companies that prioritize ESG can build a positive reputation, fostering brand loyalty and customer trust. This can translate into a competitive advantage and increased profitability.

- Access to Capital

- Firms with strong ESG profiles often have easier access to capital, as many financial institutions and investment funds now integrate ESG criteria into their lending and investment processes.

- Attracting Talent

- Organizations that demonstrate a commitment to social and environmental responsibility tend to attract and retain top talent, as more employees seek workplaces aligned with their personal values.

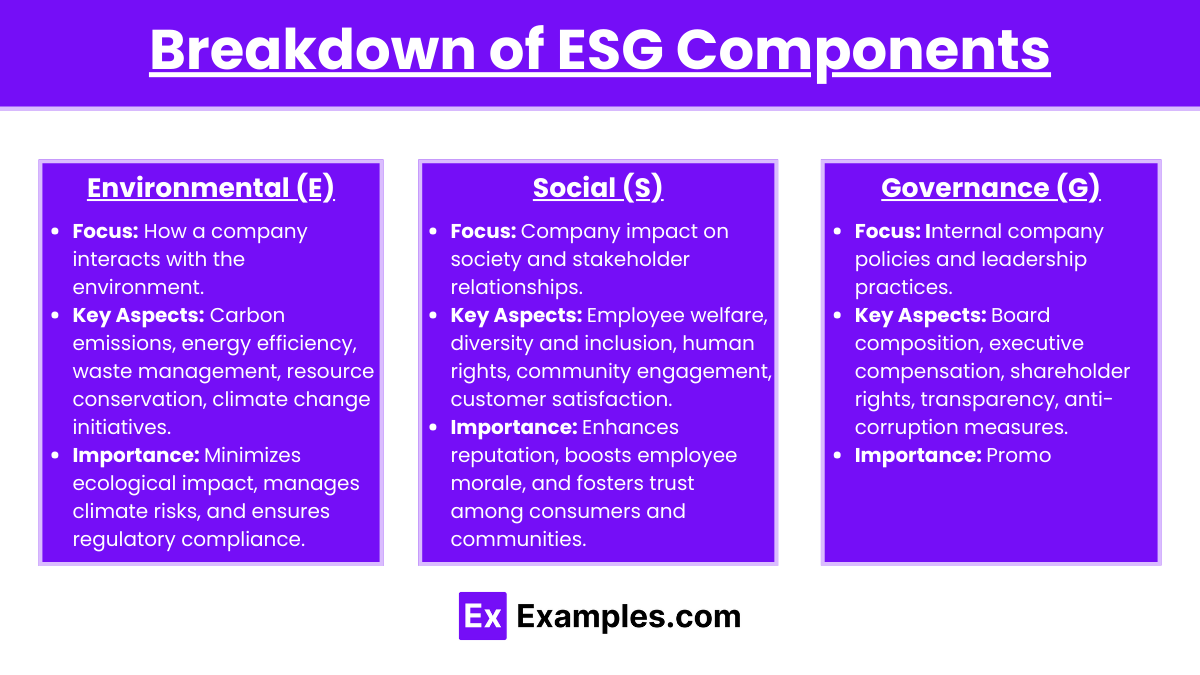

Breakdown of ESG Components

1. Environmental (E)

- Focus: How a company interacts with the environment.

- Key Aspects: Carbon emissions, energy efficiency, waste management, resource conservation, climate change initiatives.

- Importance: Minimizes ecological impact, manages climate risks, and ensures regulatory compliance.

2. Social (S)

- Focus: Company impact on society and stakeholder relationships.

- Key Aspects: Employee welfare, diversity and inclusion, human rights, community engagement, customer satisfaction.

- Importance: Enhances reputation, boosts employee morale, and fosters trust among consumers and communities.

3. Governance (G)

- Focus: Internal company policies and leadership practices.

- Key Aspects: Board composition, executive compensation, shareholder rights, transparency, anti-corruption measures.

- Importance: Promo

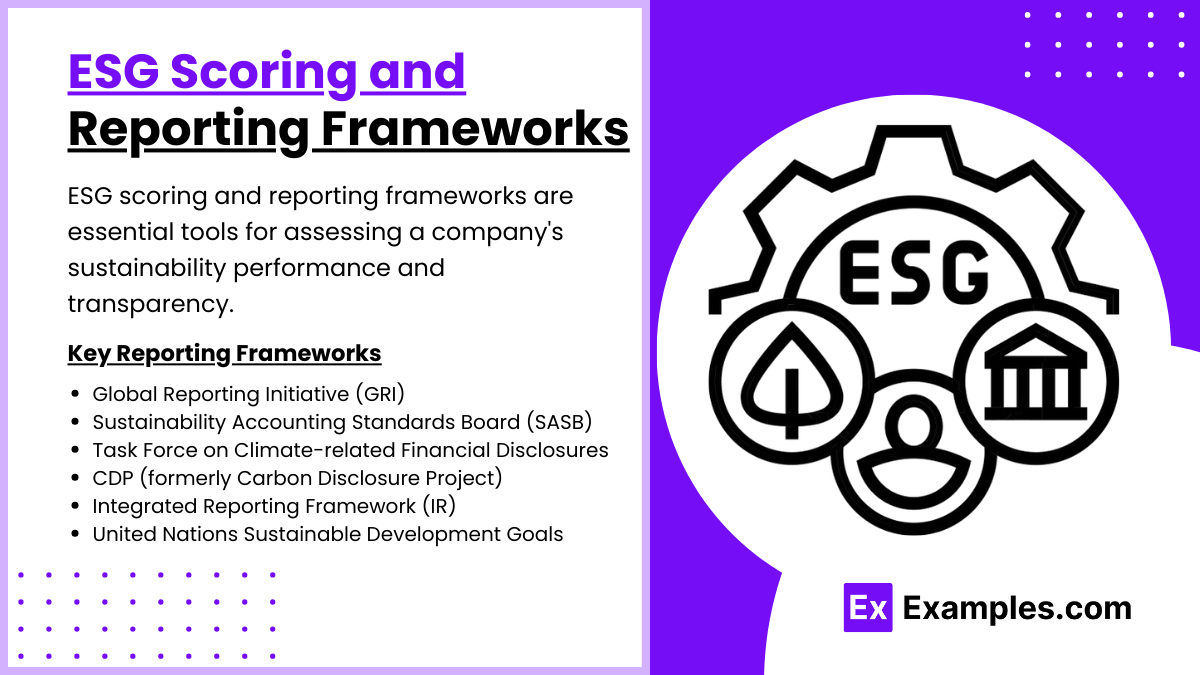

ESG Scoring and Reporting Frameworks

ESG scoring and reporting frameworks are essential tools for assessing a company’s sustainability performance and transparency. These frameworks help investors, regulators, and stakeholders understand how a company manages its environmental, social, and governance responsibilities. Here’s an overview of ESG scoring and the main reporting frameworks:

Key Reporting Frameworks

- Global Reporting Initiative (GRI)

- Provides standards for sustainability reporting, covering a wide range of ESG topics such as energy use, human rights, and governance practices.

- Importance: Widely adopted by companies to disclose their sustainability impacts in a structured and transparent way.

- Sustainability Accounting Standards Board (SASB)

- Industry-specific standards that identify ESG issues likely to affect financial performance.

- Importance: Helps companies provide financially material ESG information to investors, facilitating better decision-making.

- Task Force on Climate-related Financial Disclosures (TCFD)

- Provides recommendations for disclosing climate-related financial risks and opportunities.

- Importance: Helps companies report on how climate change may impact their financial performance, supporting investor analysis and resilience planning.

- CDP (formerly Carbon Disclosure Project)

- Specializes in disclosures related to environmental impacts, particularly carbon emissions, water security, and deforestation.

- Importance: Provides a comprehensive system for reporting environmental data and aligning with climate action goals.

- Integrated Reporting Framework (IR)

- Aims to integrate financial and non-financial information to show how an organization’s strategy, governance, and performance create value over time.

- Importance: Supports a holistic approach to reporting, linking ESG and financial data for comprehensive insights.

- United Nations Sustainable Development Goals (UN SDGs)

- Provides a global framework for sustainability with 17 goals addressing key areas such as poverty, health, and environmental protection.

- Importance: Companies align their ESG initiatives with these goals to demonstrate their commitment to global priorities.

ESG Risks and Opportunities

ESG (Environmental, Social, and Governance) factors present both risks and opportunities for companies and investors. Understanding these can help in developing strategies that promote sustainability while maximizing returns and mitigating potential challenges.

ESG Risks

- Environmental Risks

- Climate Change: Companies face physical risks from extreme weather and regulatory risks from carbon emissions policies.

- Resource Scarcity: Limited access to natural resources can impact operations and supply chains.

- Pollution and Waste Management: Failing to manage waste and pollution can lead to fines, reputational damage, and operational disruptions.

- Social Risks

- Labor Issues: Poor labor practices, including unsafe working conditions and low wages, can result in strikes, high turnover, and legal liabilities.

- Diversity and Inclusion: Companies lacking diversity and inclusive practices may face public backlash and miss out on innovation and talent.

- Community Relations: Negative impacts on local communities can damage a company’s reputation and lead to protests or loss of social license to operate.

- Governance Risks

- Ethical Violations: Issues like corruption, fraud, and lack of transparency can lead to regulatory penalties and loss of investor confidence.

- Board Structure: Companies with weak governance structures may struggle with strategic direction, accountability, and shareholder alignment.

- Data Privacy and Security: Failing to protect customer data can lead to breaches, lawsuits, and reputational harm.

ESG Opportunities

- Environmental Opportunities

- Sustainable Practices: Investing in renewable energy and sustainable resources can lead to cost savings and open new revenue streams.

- Green Innovation: Developing eco-friendly products and technologies can attract environmentally conscious consumers and new markets.

- Compliance Advantage: Proactively meeting environmental regulations can reduce future compliance costs and risks.

- Social Opportunities

- Employee Engagement: Promoting good labor practices and workplace conditions can boost productivity, reduce turnover, and attract top talent.

- Customer Loyalty: Companies that demonstrate a commitment to social responsibility can enhance brand loyalty and attract socially conscious consumers.

- Community Partnerships: Building strong relationships with local communities can lead to smoother operations and positive public perception.

- Governance Opportunities

- Transparency and Accountability: Strong governance practices foster trust among stakeholders and can enhance company valuation.

- Ethical Leadership: Companies with robust ethics and anti-corruption measures are better positioned to avoid scandals and maintain investor confidence.

- Diverse Boards: Diverse leadership can improve decision-making, promote innovation, and better represent stakeholder interests.

Examples

Example 1: Case Study: Tesla’s ESG Performance

Analyze how Tesla’s focus on sustainability and renewable energy aligns with strong environmental ESG scores, while discussing potential challenges in its governance practices, such as transparency and board composition. This example can show the dual nature of ESG factors and their impact on stock valuation.

Example 2: Impact of EU Sustainable Finance Disclosure Regulation (SFDR)

Study the SFDR’s influence on investment funds and asset managers in the EU. Discuss how the regulation has improved transparency for investors regarding sustainability practices and how this has shifted investment strategies towards more ESG-aligned portfolios.

Example 3: Comparing ESG Ratings of Tech Giants

Examine the ESG ratings of major tech companies, such as Apple, Microsoft, and Amazon, and how their labor practices, environmental initiatives, and corporate governance have impacted their scores. Discuss how these ratings affect their appeal to socially conscious investors.

Example 4: Thematic ESG Investing: Renewable Energy Funds

Explore the growth of renewable energy funds as an ESG thematic investing strategy. Analyze how funds focusing on wind, solar, and other renewable energy companies have performed compared to traditional energy funds, and the role that regulatory incentives play in their growth.

Example 5: ESG-Driven Activist Investor Influence

Discuss a case where activist investors pushed a company to adopt better ESG practices, such as improving carbon emission standards or enhancing diversity and inclusion policies. Highlight how investor engagement and pressure can drive significant changes in corporate strategies and market perceptions.

Practice Questions

Question 1

Which of the following best describes a primary benefit of integrating ESG factors into investment analysis?

A. It ensures higher annual returns than traditional investments

B. It enhances risk management and long-term value creation

C. It guarantees no volatility in the portfolio

D. It minimizes tax obligations

Answer:

B. It enhances risk management and long-term value creation

Explanation:

Integrating ESG factors into investment analysis helps investors better assess and manage potential risks related to environmental, social, and governance issues. This approach supports long-term value creation by identifying sustainable and responsible companies that may have a competitive advantage in their industries.

Question 2

Which of the following would most likely be considered a governance factor in ESG analysis?

A. Carbon emissions reporting

B. Community impact initiatives

C. Board structure and executive compensation

D. Energy consumption

Answer:

C. Board structure and executive compensation

Explanation:

Governance factors in ESG analysis focus on the internal practices and policies of a company, such as board composition, executive pay, and shareholder rights. This aspect ensures that the company is managed in a way that aligns with shareholder interests and ethical standards.

Question 3

What is one potential challenge in using ESG ratings provided by third-party agencies?

A. ESG ratings are always consistent across agencies

B. ESG ratings are based solely on financial performance

C. Lack of standardization can lead to discrepancies in ratings

D. ESG ratings eliminate the need for any further due diligence

Answer:

C. Lack of standardization can lead to discrepancies in ratings

Explanation:

A significant challenge with ESG ratings is the lack of standardization among rating agencies, which can result in discrepancies and varied assessments of the same company. This variation makes it necessary for investors to conduct their own due diligence and consider multiple sources to form a comprehensive view of a company’s ESG performance.