Preparing for the CFA Exam necessitates a deep understanding of “Ethics and Trust in the Investment Profession,” a foundational component of the Ethics and Professional Standards area. Mastery of ethical practices, professional conduct, and trust principles is essential. This knowledge is critical for maintaining integrity, upholding industry standards, and ensuring client confidence, pivotal for achieving success on the CFA Exam.

Learning Objective

In studying “Ethics and Trust in the Investment Profession” for the CFA Exam, you should aim to thoroughly understand the ethical norms and trust principles fundamental to the finance industry. This includes mastering the CFA Institute’s Code of Ethics and Standards of Professional Conduct, analyzing real-world applications of ethical practices, and evaluating the consequences of unethical behavior. Explore case studies to identify ethical dilemmas and appropriate resolutions. Gain insights into building and maintaining trust with clients, managing conflicts of interest, and enhancing professional integrity. Apply this knowledge to assess scenarios and make ethical decisions in CFA exam questions and in professional conduct.

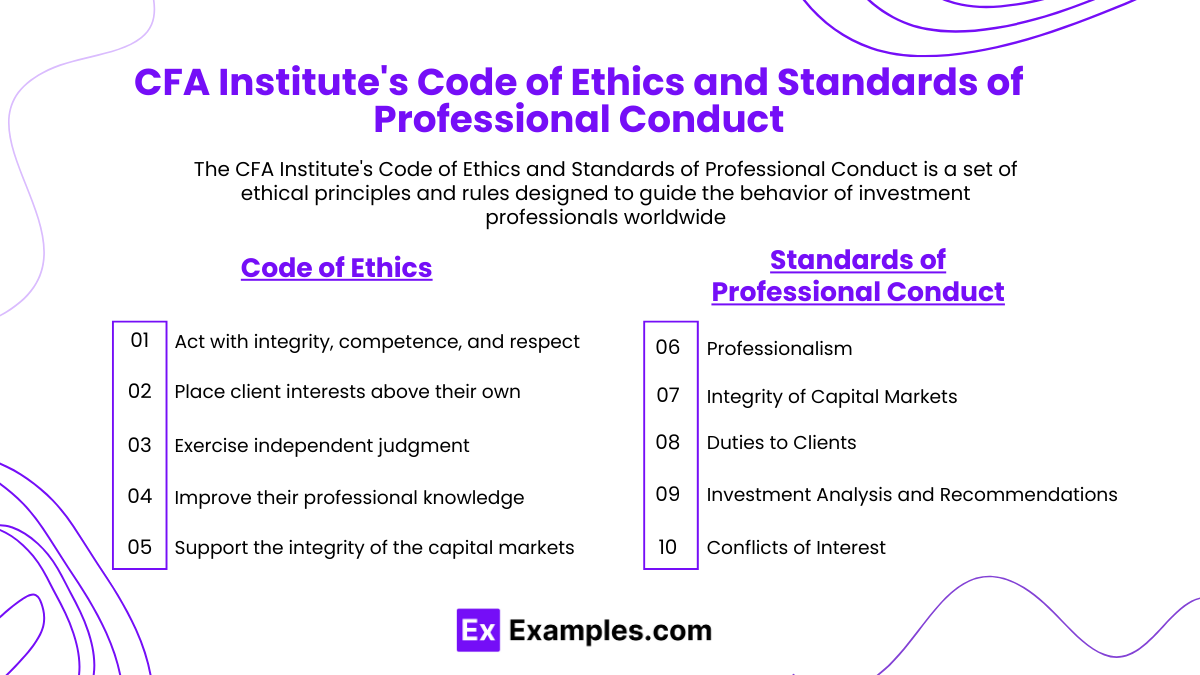

CFA Institute’s Code of Ethics and Standards of Professional Conduct

Code of Ethics

The Code outlines six ethical principles that require CFA professionals to:

- Act with integrity, competence, and respect.

- Place client interests above their own.

- Exercise independent judgment.

- Maintain and improve their professional knowledge.

- Support the integrity of the capital markets.

- Act in a manner that reflects positively on the profession.

Standards of Professional Conduct

The Standards detail specific professional responsibilities in seven key areas:

- Professionalism: Requires honesty, fair dealing, and compliance with applicable laws and regulations.

- Integrity of Capital Markets: Prohibits insider trading and practices that could harm the fairness of markets.

- Duties to Clients: Ensures fair dealing, loyalty, and confidentiality, with clients’ interests prioritized.

- Duties to Employers: Encourages diligence, loyalty, and compliance with organizational policies.

- Investment Analysis and Recommendations: Requires thorough and diligent research, transparency, and honest representation.

- Conflicts of Interest: Mandates disclosure of potential conflicts and prioritization of client interests.

- Responsibilities as a CFA Institute Member or Candidate: Requires adherence to the Code and Standards.

Together, these guidelines ensure ethical practices, foster professionalism, and enhance the credibility of the investment profession.

Real-World Applications of Ethical Practices

Real-world applications of ethical practices in finance are essential to maintain trust, safeguard clients, and enhance the reputation of the financial industry. Here are some examples of how ethical principles are applied in practice:

- Client-First Decision-Making: Financial advisors prioritize their clients’ interests over personal or corporate gains. This could mean recommending products or strategies that align with clients’ goals, even if they offer lower commissions.

- Transparency in Investment Advice: Ethical professionals provide clear, accurate, and complete information about investment risks and costs, allowing clients to make informed decisions.

- Avoiding Conflicts of Interest: Fund managers disclose any potential conflicts, such as holding shares in a company they recommend, and ensure that their actions don’t harm client interests.

- Fair Treatment of All Clients: Investment firms ensure all clients have equal access to new investment opportunities, research, and recommendations to prevent favoritism or unfair advantages.

- Confidentiality and Data Protection: Ethical professionals safeguard client information, using it only for authorized purposes, and avoid sharing it without consent.

- Compliance with Regulations: Financial professionals adhere to regulatory requirements, ensuring practices like insider trading and market manipulation are avoided, which helps maintain fair and efficient markets.

- Socially Responsible Investing (SRI): Advisors offer SRI options, helping clients invest in companies that align with ethical values, like environmental sustainability and corporate responsibility.

These practices build trust, enhance the integrity of financial markets, and contribute to a positive reputation for professionals and institutions within the industry.

Consequences of Unethical Behavior

Unethical behavior in finance can lead to serious consequences that impact individuals, organizations, and the broader financial system. Here’s a brief look at these consequences:

- Loss of Client Trust: Unethical actions, such as misleading clients or mishandling their funds, erode trust. This can lead to clients withdrawing their assets and damages the professional’s reputation.

- Legal and Financial Penalties: Regulators may impose fines, sanctions, or even jail time for unethical practices like insider trading or fraud, leading to significant financial and personal costs.

- Career Damage: Financial professionals involved in unethical behavior risk losing their licenses or certifications, such as the CFA or CPA, which can limit future job prospects.

- Damage to Firm Reputation: Unethical behavior can tarnish an organization’s reputation, resulting in lost business, declining stock value, and difficulty attracting top talent.

- Systemic Risk to Markets: Widespread unethical practices, such as those seen in financial crises, can destabilize markets, erode investor confidence, and lead to economic downturns affecting the broader economy.

- Loss of Public Confidence: Unethical behavior reduces public confidence in financial markets and institutions, potentially leading to reduced investment and lower economic growth.

These consequences emphasize the need for strong ethical standards and practices to ensure the stability, integrity, and trustworthiness of the financial industry.

Building and Maintaining Trust with Clients

Building and maintaining trust with clients is essential for financial professionals and is achieved through consistent ethical behavior, transparency, and reliable service. Here are key ways this trust is developed:

- Prioritizing Client Interests: By consistently acting in the best interest of clients—making recommendations that align with their goals and financial situations—advisors demonstrate loyalty and care.

- Transparency and Honesty: Clear, accurate, and complete communication about fees, risks, and investment options fosters confidence, allowing clients to feel informed and respected.

- Delivering Consistent Results: Meeting or exceeding client expectations by following a disciplined investment process and managing risk reinforces reliability.

- Confidentiality: Safeguarding client information builds trust by respecting privacy and security, showing professionalism in handling sensitive data.

- Regular, Open Communication: Keeping clients updated on their portfolio performance, market conditions, and any relevant changes demonstrates accountability and attentiveness.

- Ethical Conduct and Compliance: Following ethical standards and regulatory requirements reassures clients that their investments are being managed responsibly.

Through these practices, financial professionals build long-term client relationships based on trust, confidence, and mutual respect, contributing to a positive reputation and lasting success.

Examples

Example 1: Integrity in Financial Reporting

A financial analyst discovers discrepancies in a company’s financial statements that suggest earnings manipulation. Instead of ignoring these findings, the analyst updates the investment recommendation report to reflect the true financial health of the company, thereby upholding integrity in capital markets and protecting potential investors from making misinformed decisions.

Example 2: Conflict of Interest Management

An investment advisor, who receives commissions from certain funds, is selecting investments for a client’s portfolio. To uphold ethical standards and client trust, the advisor fully discloses the commission structure and considers only those investment options that align with the client’s financial goals and risk tolerance, regardless of the potential for personal gain.

Example 3: Fair Treatment of All Clients

A portfolio manager has several clients with varying degrees of wealth and investment sizes. Despite the differences in potential revenue from these clients, the manager provides the same level of thorough market analysis and investment advice to all, ensuring fair treatment and equal opportunity for financial growth, thereby fostering trust and ethical professional conduct.

Example 4: Diligence in Due Diligence

Before recommending a new investment opportunity, a fund manager conducts extensive due diligence, investigating the sustainability, risks, and returns of the opportunity. This thorough analysis ensures that the investment recommendations are based on sound reasoning and adequate evidence, demonstrating diligence and competence in professional activities.

Example 5: Upholding Client Confidentiality

An investment professional learns of a client’s intent to acquire a major stake in a publicly-traded company, information which, if leaked, could influence the stock price. Respecting the confidentiality agreement and ethical standards, the professional keeps this information private and avoids any personal trading based on this knowledge, thereby maintaining the client’s trust and adhering to the integrity of capital markets.

Practice Questions

Question 1

An investment advisor is offered an all-expenses-paid luxury trip by a mutual fund company in exchange for promoting its funds to clients. What should the advisor do to adhere to the CFA Institute’s Standards of Professional Conduct?

A. Accept the trip, acknowledging that fostering good relationships with fund companies can benefit clients.

B. Politely decline the offer and continue to base investment recommendations on the best interests of clients.

C. Accept the trip but disclose this arrangement to all clients before making any recommendations.

D. Negotiate a less extravagant trip to avoid the appearance of a conflict of interest.

Answer: B)Politely decline the offer and continue to base investment recommendations on the best interests of clients.

Explanation:

According to the CFA Institute’s Standards of Professional Conduct, investment professionals must act with integrity and place the interests of clients above their own. Accepting gifts or compensation that could influence their decision-making undermines this principle and could lead to a conflict of interest. The best course of action is to decline such offers, ensuring that investment recommendations are made solely based on the best interests of clients, free from undue influence.

Question 2

What is the most appropriate action for a portfolio manager to take when they realize they have unintentionally received confidential information about a company that could influence its stock price?

A. Trade the stock immediately before the information becomes public.

B. Refrain from trading and promptly report the incident to their compliance department.

C. Share the information with a select group of top clients to protect their investment interests.

D. Wait for the information to be published in the media before making any trades.

Answer: B) Refrain from trading and promptly report the incident to their compliance department.

Explanation:

The ethical response when coming into possession of material non-public information is to avoid trading on or tipping others with that information. The portfolio manager should refrain from trading and immediately report the situation to their compliance department to prevent any potential misuse of the information and to protect the integrity of the capital markets.

Question 3

Which of the following best describes an action that adheres to the CFA Institute’s Standard concerning duties to clients?

A. Using client funds for personal loans as long as the loans are repaid with interest.

B. Investing client funds in high-commission products to increase profitability for the advisory firm.

C. Prioritizing trades in a way that benefits some clients over others based on the size of their accounts.

D. Regularly reviewing client portfolios and adjusting them to ensure they meet the clients’ investment objectives and risk tolerance.

Answer: D) Regularly reviewing client portfolios and adjusting them to ensure they meet the clients’ investment objectives and risk tolerance.

Explanation:

The primary duty of a finance professional to clients is to act in their best interests and manage their investments diligently. Regularly reviewing and adjusting client portfolios to align with their specified goals and risk tolerance ensures that the advisor is acting competently and diligently, maintaining professional behavior and client trust as mandated by the CFA Institute’s standards.