Preparing for the CFA Exam requires a strong foundation in “Ethics Application,” a core component of professional conduct in finance. This area focuses on applying ethical principles to real-world situations, ensuring integrity and transparency in decision-making. Mastery of Ethics Application enables candidates to recognize and navigate complex ethical dilemmas, adhere to the CFA Institute’s Code of Ethics and Standards of Professional Conduct, and uphold public trust in the financial industry.

Learning Objectives

In studying “Ethics Application” for the CFA, you should aim to understand the foundational concepts of ethical behavior and how they apply to professional decision-making in finance. This involves recognizing the importance of integrity, transparency, and adherence to industry standards in interactions with clients, employers, and the public. The ethical principles encompass loyalty, fairness, and accountability, which guide professionals in handling conflicts of interest, ensuring client confidentiality, and maintaining a high level of service. Mastery of these principles enables you to uphold public trust, mitigate reputational risks, and foster a positive, compliant working environment.

Key Areas in Ethics Application

1. Professionalism

- Knowledge of the Law: Prioritize understanding and compliance with local and international laws and follow the stricter rule when there’s a conflict.

- Independence and Objectivity: Financial professionals are expected to act independently and avoid bias. Refuse any inducements or influences from clients, employers, or external sources that may impact objectivity.

- Misrepresentation and Misconduct: Uphold honesty and avoid misrepresentation of skills, qualifications, or results. Misconduct, including illegal or unethical practices, is strictly prohibited.

2. Market Integrity

- Material Nonpublic Information: Confidential information must remain private, with strict prohibition against using insider information to benefit personally or on behalf of clients.

- Market Manipulation: Professionals should avoid any actions that could distort market prices or deceive other investors, ensuring transparency and fair practices.

3. Responsibilities as a Member

- Conduct as a Candidate: Uphold ethical conduct throughout the process and adhere to all standards outlined.

- Reference to Membership: Accurately represent membership status and avoid misrepresenting qualifications or credentials.

4. Duties to Employers

- Loyalty: Employees should act in the best interest of their employer, maintaining confidentiality and acting honestly.

- Additional Compensation Arrangements: Avoid accepting gifts, benefits, or compensation that could interfere with job responsibilities, unless permitted by the employer.

- Responsibilities of Supervisors: Supervision duties include ensuring employees adhere to ethical standards, instituting policies to maintain ethical practices within the organization.

5. Investment Analysis and Recommendations

- Diligence and Reasonable Basis: Ensure thorough, factual analysis before making investment recommendations or taking action on behalf of clients.

- Communication with Clients and Prospective Clients: Maintain clear, complete, and accurate communication, providing all relevant information to clients.

- Record Retention: Professionals are expected to keep detailed records of all analyses, recommendations, and client communications.

6. Conflicts of Interest

- Disclosure of Conflicts: Disclose any conflicts of interest that may impact professional judgment or advice provided to clients.

- Priority of Transactions: Client transactions must always take precedence over personal investments.

- Referral Fees: Disclosure of referral fees is essential to maintain transparency and client trust.

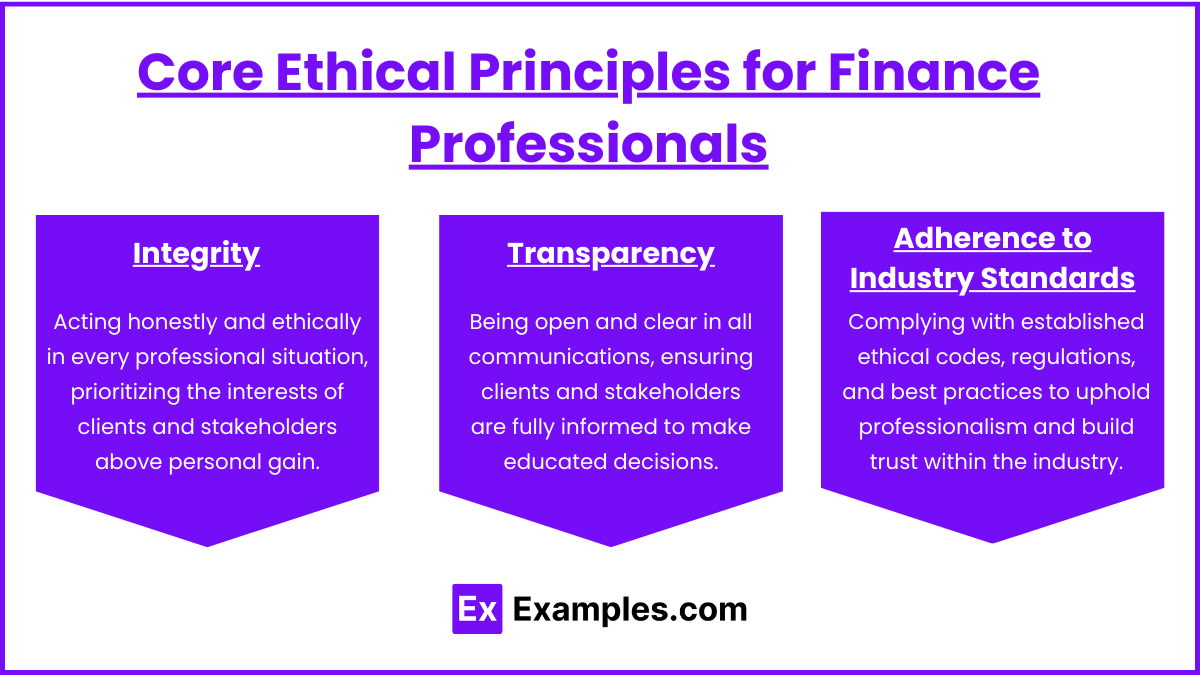

Core Ethical Principles for Finance Professionals

- Integrity

Integrity forms the cornerstone of ethical behavior, requiring finance professionals to act honestly and in the best interests of their clients and stakeholders. It involves adhering to moral principles and refraining from actions that could harm others, even if they might provide personal or corporate gain. - Transparency

Transparency entails being open and honest in communications, ensuring clients and stakeholders are fully informed about financial products, potential risks, and relevant fees. This principle also includes the duty to disclose conflicts of interest, maintaining the trust and confidence of clients. - Adherence to Industry Standards

Industry standards, such as the Code of Ethics and Standards of Professional Conduct, provide a framework for responsible behavior. These standards set expectations for fair dealing, due diligence, and compliance with laws and regulations governing financial transactions.

Importance of Ethical Standards

- Public Trust and Confidence

Ethical behavior is critical for fostering trust between financial professionals and the public. When professionals act with integrity and transparency, it reinforces public confidence in the financial markets and investment industry. - Mitigating Reputational Risks

Unethical conduct can damage a professional’s and firm’s reputation, leading to client loss, regulatory penalties, and long-term business setbacks. By adhering to ethical principles, professionals mitigate reputational risks and protect their careers and organizations. - Creating a Positive Work Environment

A culture of ethics encourages openness, respect, and cooperation within financial firms. Such an environment improves employee morale, reduces internal conflicts, and enhances overall productivity.

Examples

Example 1. Corporate Decision-Making:

In a corporate environment, ethics application involves integrating ethical considerations into decision-making processes. For instance, a company might face a choice between maximizing profits and upholding environmentally sustainable practices. Applying ethics here requires evaluating the long-term impact of each choice, considering stakeholders, and choosing the path that aligns with both legal obligations and moral values.

Example 2. Medical Research

Ethics application is critical in medical research, particularly concerning patient privacy, consent, and the balance of risk and benefit. Researchers must consider ethical guidelines to ensure that trials do not exploit or harm participants. By applying ethics, researchers prioritize participant well-being, gaining consent transparently and minimizing risks to safeguard human rights throughout the study.

Example 3. Journalistic Integrity

In journalism, ethics application helps maintain trust and credibility. Journalists face daily ethical decisions, such as verifying sources, respecting privacy, and avoiding bias. Applying ethics in journalism means striving for accuracy, objectivity, and transparency to provide the public with truthful information, even when faced with pressures or potential conflicts of interest.

Example 4. Educational Assessments

Teachers and educational institutions apply ethics in creating and administering assessments. This involves ensuring that exams are fair, inclusive, and free from cultural or socio-economic biases. By applying ethics, educators ensure that evaluations accurately measure student abilities and knowledge without favoring certain groups or putting others at a disadvantage.

Example 5. Technology Development:

In the field of technology, ethics application plays a key role in guiding innovations, especially concerning privacy and data security. For example, developers of artificial intelligence software must consider ethical implications like bias, accountability, and transparency. By applying ethics in technology, developers create solutions that are both beneficial to users and mindful of their rights, contributing to a socially responsible tech landscape.

Practice Questions

Question 1

Which of the following best describes the primary purpose of ethics application in decision-making?

A. To increase profits by avoiding unnecessary risks

B. To ensure decisions align with legal requirements only

C. To create outcomes that consider the well-being of all stakeholders

D. To focus solely on minimizing financial losses

Answer: C. To create outcomes that consider the well-being of all stakeholders

Explanation:

The primary purpose of ethics application in decision-making is to create outcomes that are fair, just, and considerate of all stakeholders involved. Ethical decision-making goes beyond just following laws or minimizing losses; it requires a thoughtful approach that balances the needs and rights of all parties. This includes considering potential impacts on employees, customers, the community, and the environment. Ethics application ensures that choices made are not just beneficial to the organization but are also socially responsible and sustainable.

Question 2

In a medical research context, which of the following actions demonstrates the application of ethics?

A. Releasing patient data without consent to speed up research

B. Obtaining informed consent from all participants before trials begin

C. Prioritizing profit over the potential side effects of a new drug

D. Ignoring regulatory guidelines to accelerate the study

Answer: B. Obtaining informed consent from all participants before trials begin

Explanation:

In medical research, ethics application is crucial to protect participants’ rights and well-being. Obtaining informed consent from participants before beginning trials is a key ethical requirement. It ensures that participants are fully aware of the risks, benefits, and nature of the study, allowing them to make an informed decision about their involvement. Actions such as releasing data without consent or ignoring regulations would violate ethical standards and could lead to harm or exploitation, undermining trust in the research process.

Question 3

Why is it important for journalists to apply ethics in their reporting?

A. To ensure that they generate high viewership and ad revenue

B. To avoid lawsuits and legal penalties for misreporting

C. To uphold credibility and provide the public with accurate information

D. To give favorable coverage to sponsors and advertisers

Answer: C. To uphold credibility and provide the public with accurate information

Explanation:

Ethics application in journalism is essential for maintaining credibility, public trust, and the integrity of the profession. Journalists are responsible for reporting the truth accurately and objectively, which involves verifying sources, avoiding bias, and respecting individuals’ rights to privacy. By upholding ethical standards, journalists help ensure that the information provided to the public is reliable and unbiased, which is crucial for an informed society. Focusing on viewership or favoring sponsors would compromise the ethical responsibilities of the profession and could mislead the public.