Exchange Rate Calculations are fundamental for understanding currency markets and global financial transactions. This topic explores the principles behind currency conversions, bid-ask spreads, and cross-currency calculations. It delves into direct and indirect quotations, forward rates, and the mechanics of calculating appreciation or depreciation of currencies. Proficiency in these concepts is essential for assessing foreign exchange exposure and making informed decisions in international finance. Mastery of exchange rate calculations aids in evaluating currency risks and optimizing portfolio strategies across global markets.

Learning Objectives

In studying "Exchange Rate Calculations" for the CFA, you should learn to understand and apply various exchange rate conventions, including direct and indirect quotes. Develop proficiency in calculating cross-rates between currencies, as well as converting amounts from one currency to another using bid-ask spreads. Analyze and interpret the impact of currency appreciation and depreciation on investment values and international transactions. Evaluate forward exchange rates and understand how they relate to interest rate differentials between countries. Additionally, gain the ability to apply these calculations in real-world scenarios, such as risk management, international investment analysis, and global economic assessments.

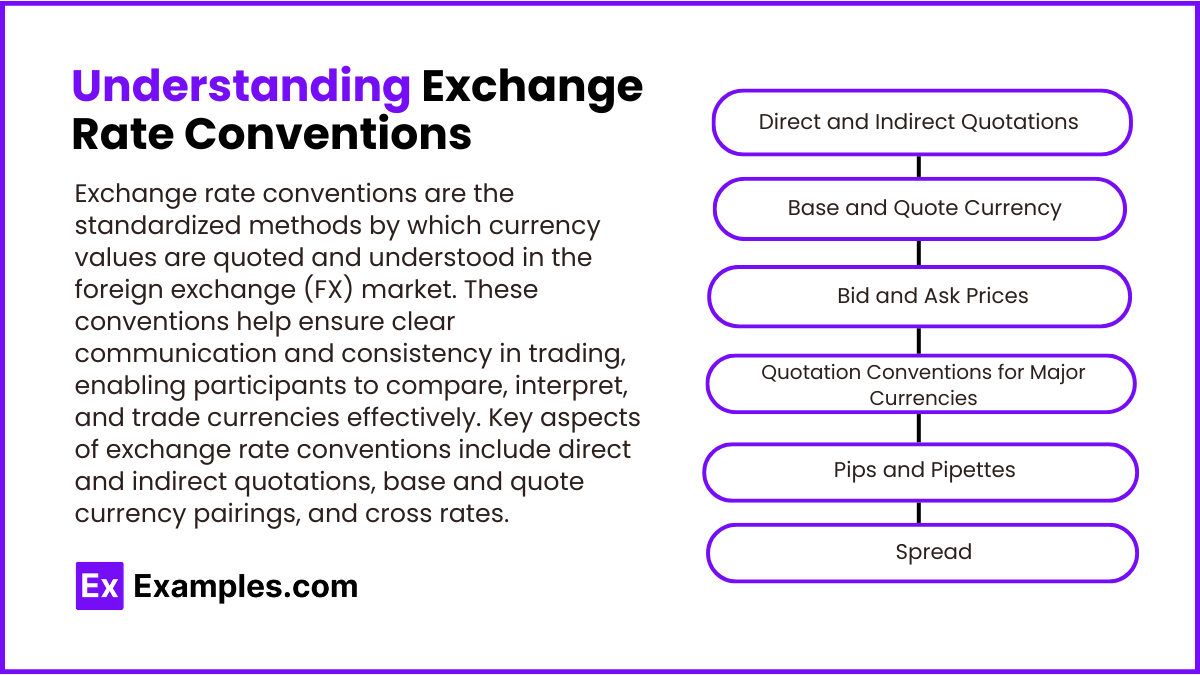

Understanding Exchange Rate Conventions

Exchange rate conventions are the standardized methods by which currency values are quoted and understood in the foreign exchange (FX) market. These conventions help ensure clear communication and consistency in trading, enabling participants to compare, interpret, and trade currencies effectively. Key aspects of exchange rate conventions include direct and indirect quotations, base and quote currency pairings, and cross rates. Here’s an overview of these conventions and how they operate in the FX market.

1. Direct and Indirect Quotations

An exchange rate quote can be either direct or indirect, depending on the perspective of the country or currency being referenced.

Direct Quotation: A direct quote shows the amount of domestic currency needed to purchase one unit of a foreign currency. For example, in the U.S., if the USD/EUR rate is 1.10, it means 1 euro costs 1.10 U.S. dollars.

Example: For a U.S.-based individual, a direct quote for the British pound (GBP) might be 1 GBP = 1.30 USD, indicating that 1.30 U.S. dollars are needed to buy 1 British pound.

Indirect Quotation: An indirect quote shows the amount of foreign currency needed to purchase one unit of the domestic currency. It’s the reciprocal of the direct quote. In the previous example, the indirect quote would be 1 USD = 0.91 EUR, showing how much of the foreign currency (euro) is needed for one unit of domestic currency (dollar).

Example: For a U.S.-based individual, an indirect quote for the British pound (GBP) might be 1 USD = 0.77 GBP, meaning 0.77 British pounds are needed to buy 1 U.S. dollar.

2. Base and Quote Currency

Exchange rates are typically presented as currency pairs, with the format "Base/Quote." The first currency in the pair is known as the base currency, and the second is the quote currency.

Base Currency: This is the currency against which the value is measured. In the pair USD/EUR, USD is the base currency.

Quote Currency: This is the currency in which the base currency is quoted. In USD/EUR, EUR is the quote currency, and the rate represents how many euros are needed to buy one U.S. dollar.

Example: In the currency pair EUR/USD, if the exchange rate is 1.20, it means 1 euro (base currency) is equal to 1.20 U.S. dollars (quote currency).

3. Bid and Ask Prices

In the FX market, exchange rates are typically quoted with two prices: the bid price and the ask price.

Bid Price: This is the price at which the market (or dealer) is willing to buy the base currency and sell the quote currency. It’s usually the lower of the two prices.

Ask Price: This is the price at which the market (or dealer) is willing to sell the base currency and buy the quote currency. It’s usually the higher price and includes the dealer’s margin.

Example: For the EUR/USD pair, a quote might appear as 1.1990/1.2000. The bid price is 1.1990 (price the dealer will buy euros), and the ask price is 1.2000 (price the dealer will sell euros).

4. Quotation Conventions for Major Currencies

In the FX market, certain conventions are typically used to standardize quotes for major currencies. For example, some currency pairs are quoted with the U.S. dollar as the base currency, while others use it as the quote currency.

Dollar as Base: For certain pairs like USD/JPY (U.S. dollar to Japanese yen) or USD/CHF (U.S. dollar to Swiss franc), the U.S. dollar is the base currency.

Dollar as Quote: For other pairs like EUR/USD (euro to U.S. dollar) and GBP/USD (British pound to U.S. dollar), the dollar is the quote currency.

Inverse Quotes: Some currencies are quoted both ways (e.g., USD/EUR and EUR/USD), but usually, the more liquid or widely used format is preferred for market efficiency.

Example: EUR/USD is conventionally quoted as 1 EUR = X USD, while USD/JPY is quoted as 1 USD = X JPY.

5. Pips and Pipettes

The FX market uses "pips" to measure small changes in currency rates, allowing for easy comparison of price movements.

Pip: A pip is the smallest standard price movement in an exchange rate, typically the fourth decimal place for most currency pairs (e.g., EUR/USD moving from 1.2000 to 1.2001 represents a 1-pip change).

Pipette: A pipette represents a fractional pip (one-tenth of a pip) and is shown as the fifth decimal place (e.g., EUR/USD moving from 1.20000 to 1.20001 represents a 1-pipette change).

Example: If GBP/USD moves from 1.3050 to 1.3051, it’s a 1-pip change. If it moves from 1.30500 to 1.30501, it’s a 1-pipette change.

6. Spread

The spread is the difference between the bid and ask prices in an FX quote. It represents the cost of trading, as it’s effectively the margin earned by dealers for facilitating transactions.

Factors Affecting Spread: Spreads are typically tighter (smaller) for major currency pairs with high liquidity, such as EUR/USD, and wider (larger) for less liquid pairs.

Impact on Cost: A wider spread increases the cost of trading, while a narrower spread is more cost-effective for traders.

Example: If EUR/USD has a bid-ask quote of 1.1990/1.2000, the spread is 0.0010, or 10 pips.

Converting Currency Amounts Using Bid-Ask Spreads

When converting currency in the foreign exchange (FX) market, bid-ask spreads play a critical role in determining the effective rate and the amount you will receive or need to pay. The bid price is the rate at which a dealer buys the base currency (and sells the quote currency), while the ask price is the rate at which the dealer sells the base currency (and buys the quote currency). Understanding how to use these bid-ask rates for conversions helps ensure accurate transactions.

1. Basic Concepts of Bid and Ask Rates

Bid Price: The rate at which the dealer or market maker is willing to buy the base currency and sell the quote currency.

Ask Price: The rate at which the dealer is willing to sell the base currency and buy the quote currency.

Spread: The difference between the ask and bid prices, representing the dealer’s margin.

Example: Suppose the EUR/USD bid-ask quote is 1.1990/1.2000. This means:

The dealer buys euros (and sells dollars) at 1.1990 USD per EUR (bid price).

The dealer sells euros (and buys dollars) at 1.2000 USD per EUR (ask price).

2. Converting from Base Currency to Quote Currency

When converting an amount from the base currency to the quote currency, use the bid price for a sale and the ask price for a purchase:

Buying the Base Currency: Use the ask price.

Selling the Base Currency: Use the bid price.

Example: Converting EUR 10,000 to USD with an EUR/USD bid-ask of 1.1990/1.2000:

If Buying Euros (Converting USD to EUR): Use the ask price, 1.2000.

If Selling Euros (Converting EUR to USD): Use the bid price, 1.1990.

Calculation:

If converting EUR 10,000 to USD by selling euros:

USD received = EUR 10,000 × 1.1990 = USD 11,990.

3. Converting from Quote Currency to Base Currency

When converting from the quote currency to the base currency, the rates are used in reverse:

Buying the Base Currency: Use the ask price.

Selling the Quote Currency: Use the bid price.

Example: Converting USD 12,000 to EUR with an EUR/USD bid-ask of 1.1990/1.2000:

If Buying Euros (Converting USD to EUR): Use the ask price, 1.2000.

Calculation:

If converting USD 12,000 to EUR by buying euros:

EUR received = USD 12,000 ÷ 1.2000 = EUR 10,000.

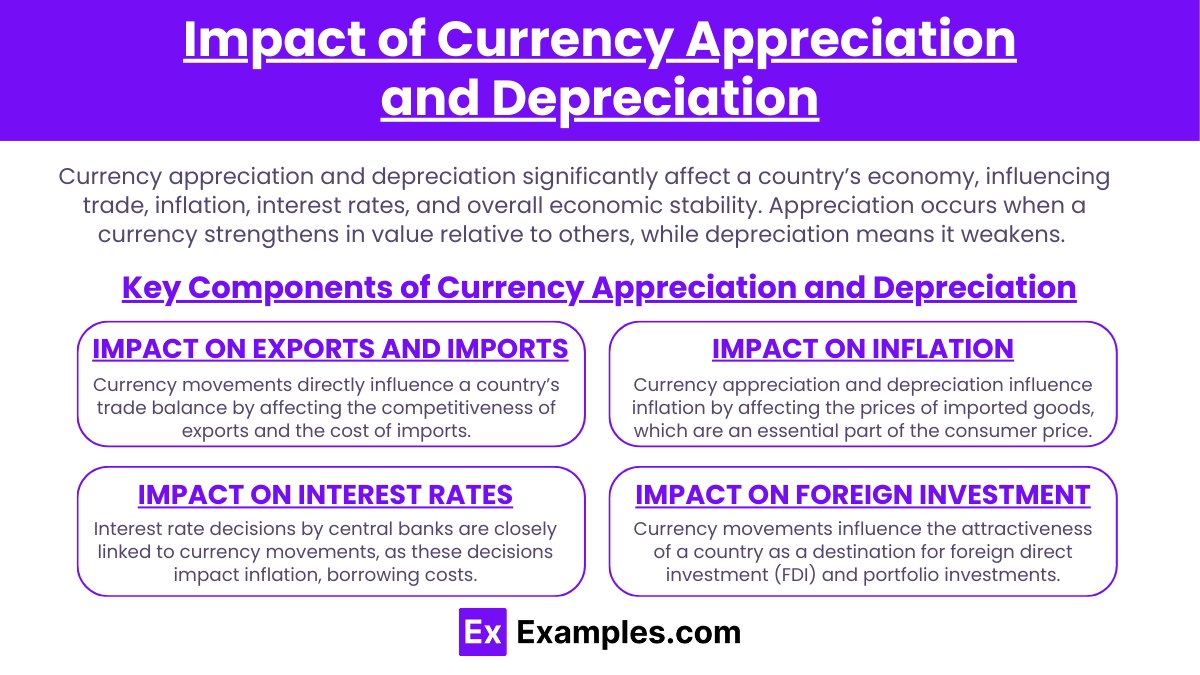

Impact of Currency Appreciation and Depreciation

Currency appreciation and depreciation significantly affect a country’s economy, influencing trade, inflation, interest rates, and overall economic stability. Appreciation occurs when a currency strengthens in value relative to others, while depreciation means it weakens. Both movements have distinct impacts on businesses, consumers, investors, and governments. Here’s a detailed look at these effects and how they play out in the economy.

Key Components

1. Impact on Exports and Imports

Currency movements directly influence a country’s trade balance by affecting the competitiveness of exports and the cost of imports.

Appreciation:

Exports: When a currency appreciates, exports become more expensive for foreign buyers, potentially reducing demand for domestic goods abroad.

Imports: Appreciation makes imports cheaper for domestic consumers and businesses, potentially increasing demand for foreign goods and services.

Trade Balance: An appreciated currency can lead to a trade deficit if export demand falls and imports rise, negatively impacting domestic industries reliant on exports.

Example: If the Japanese yen appreciates against the U.S. dollar, Japanese cars become more expensive in the U.S., potentially reducing sales, while American products become cheaper for Japanese consumers, increasing U.S. imports into Japan.

Depreciation:

Exports: A depreciated currency makes exports cheaper and more attractive to foreign buyers, boosting demand for domestic products.

Imports: Depreciation makes imports more expensive, reducing demand for foreign goods and services and encouraging consumers to buy domestically.

Trade Balance: A weaker currency often improves the trade balance by increasing exports and reducing imports, supporting domestic production.

Example: If the Brazilian real depreciates, Brazilian coffee becomes cheaper internationally, potentially boosting exports, while imported electronics become more expensive, decreasing demand for foreign goods.

2. Impact on Inflation

Currency appreciation and depreciation influence inflation by affecting the prices of imported goods, which are an essential part of the consumer price index (CPI).

Appreciation:

An appreciating currency lowers the price of imports, potentially decreasing overall inflation. Lower import costs reduce the price of goods and services, such as oil, food, and electronics, easing inflationary pressures.

Central banks may find it easier to manage inflation with an appreciated currency, allowing for more stable monetary policy.

Example: If the euro appreciates against the U.S. dollar, European countries importing U.S. oil will pay less in euros, potentially reducing inflation in the Eurozone.

Depreciation:

A depreciated currency raises the cost of imports, often leading to higher inflation as imported goods become more expensive.

Increased import prices can lead to cost-push inflation, as businesses pass on higher costs to consumers. Central banks may need to raise interest rates to control inflation, potentially slowing economic growth.

Example: If the Indian rupee depreciates, imported crude oil becomes more expensive, raising fuel prices domestically and contributing to inflationary pressures.

3. Impact on Interest Rates

Interest rate decisions by central banks are closely linked to currency movements, as these decisions impact inflation, borrowing costs, and overall economic activity.

Appreciation:

An appreciating currency can allow central banks to maintain or lower interest rates, as lower import costs help control inflation.

Lower interest rates can encourage borrowing and investment, supporting economic growth. However, too much appreciation can reduce export competitiveness, potentially slowing down the economy over time.

Example: The U.S. dollar’s appreciation in 2022 allowed the Federal Reserve some flexibility with its rate decisions, as lower import costs helped manage inflation.

Depreciation:

Central banks may raise interest rates in response to currency depreciation to combat rising inflation from higher import costs and attract foreign investment.

Higher interest rates can strengthen the currency by attracting capital inflows but may also slow economic growth by making borrowing more expensive.

Example: Turkey’s central bank raised interest rates in 2023 to counter the depreciation of the Turkish lira and reduce inflation, despite concerns over slowing economic growth.

4. Impact on Foreign Investment

Currency movements influence the attractiveness of a country as a destination for foreign direct investment (FDI) and portfolio investments.

Appreciation:

An appreciating currency may attract foreign investment, as a stronger currency increases returns for foreign investors when they repatriate their earnings.

However, a strong currency can make assets more expensive for foreign investors, which may reduce FDI in industries reliant on cheaper production costs.

Example: A stronger U.S. dollar attracts global investors to U.S. assets, but the high cost of the dollar may deter companies from investing in manufacturing facilities.

Depreciation:

A depreciated currency makes assets cheaper for foreign investors, potentially attracting FDI and portfolio investments.

However, currency depreciation may deter investment if it’s viewed as a sign of economic instability or if investors expect further devaluation.

Example: A weaker British pound following Brexit attracted foreign investors to U.K. real estate, as properties became cheaper in terms of foreign currencies.

Applying Exchange Rate Calculations in Real-World Scenarios

Exchange rate calculations are essential in various real-world scenarios, from international trade to travel, investments, and risk management. These calculations involve understanding bid-ask spreads, cross rates, currency conversions, and forward rates to manage currency exposure effectively. Below are examples of how exchange rate calculations are applied in real-life situations.

Importing Goods: Businesses use the ask rate to calculate how much domestic currency is needed to pay for foreign imports, ensuring they cover costs accurately.

Exporting Goods: Exporters convert foreign sales revenue back to their domestic currency using the bid rate, determining their actual income in local terms.

Traveling Abroad: Travelers exchange home currency to foreign currency at the ask rate, helping them budget for their trip expenses in a foreign country.

Hedging Future Costs: Companies use forward contracts to lock in a future exchange rate, protecting themselves from potential currency fluctuations.

Currency Arbitrage: Traders look for small rate differences across markets, called cross rates, to profit by buying low in one currency and selling high in another.

Investing Overseas: Investors consider changes in exchange rates to calculate potential gains or losses on foreign investments, ensuring they understand total returns.

Paying Foreign Debt: Companies with foreign-denominated loans use the ask rate to determine the amount they’ll need to repay in their currency, factoring in exchange rates.

Budgeting for Spread Costs: Importers include the bid-ask spread in their calculations, as it represents the extra cost of currency exchange.

Receiving Foreign Dividends: Investors use the bid rate to convert dividends from foreign stocks into their home currency, helping them estimate total income.

Adjusting to Rate Changes: Exporters may gain or lose money if exchange rates shift after a sale, affecting their revenue in home currency when they finally convert.

Examples

Example 1: Traveling Abroad

When a traveler plans a trip to Europe and needs to convert their home currency (e.g., US dollars) into euros, they will use the current exchange rate to determine how much euros they will receive. For instance, if the exchange rate is 1 USD to 0.85 EUR, and the traveler exchanges $500, they will receive 425 euros. This calculation is essential for budgeting expenses while traveling.

Example 2: Importing Goods

A company that imports electronics from Japan must calculate the cost in its local currency. If the price of a smartphone is 50,000 Japanese yen and the exchange rate is 1 USD to 110 JPY, the company would convert the yen to dollars by dividing the yen amount by the exchange rate. This helps the company understand the total cost of goods in terms of its own currency, allowing for accurate financial planning.

Example 3: Exporting Products

An American exporter selling goods to Canada needs to account for the exchange rate to price its products competitively. If the export price is set at 1,000 CAD and the exchange rate is 1 CAD to 0.75 USD, the exporter would calculate the equivalent price in USD to understand their earnings. This information is crucial for making pricing decisions and assessing profitability.

Example 4: Currency Hedging

A business engaged in international trade may use exchange rate calculations for hedging purposes. For example, if a company expects to receive payment in euros in three months but fears the euro will depreciate, it might enter a forward contract to lock in the current exchange rate. Understanding the exchange rates allows the company to mitigate potential losses due to unfavorable currency fluctuations.

Example 5: Foreign Investment Returns

An investor purchasing stocks in a foreign market must consider exchange rate calculations to determine the true return on investment. If an investor buys shares in a European company for 1,000 euros and later sells them for 1,200 euros, they need to convert those amounts into their home currency. If the exchange rate changes from 1 EUR to 1.10 USD at the time of purchase to 1 EUR to 1.20 USD at the time of sale, calculating the returns in their currency will provide a clearer picture of the investment's performance.

Practice Questions

Question 1

If the exchange rate between the US dollar and the British pound is 1 USD to 0.75 GBP, how many British pounds will you receive for 400 US dollars?

A) 300 GBP

B) 400 GBP

C) 500 GBP

D) 350 GBP

Correct Answer: A) 300 GBP.

Explanation: To find out how many British pounds you receive for 400 US dollars, you would multiply the amount in dollars by the exchange rate. In this case, 400 USD multiplied by 0.75 GBP results in 300 GBP. Understanding exchange rates is essential for currency conversion, which is vital for travelers and businesses engaged in international trade.

Question 2

A company in the US plans to import machinery from Germany costing 50,000 euros. If the current exchange rate is 1 EUR to 1.10 USD, what is the total cost of the machinery in US dollars?

A) 45,000 USD

B) 50,000 USD

C) 55,000 USD

D) 60,000 USD

Correct Answer: C) 55,000 USD.

Explanation: To calculate the total cost in US dollars, you multiply the cost in euros by the exchange rate. In this case, 50,000 EUR times 1.10 USD equals 55,000 USD. This calculation is crucial for businesses to assess the full cost of imports, which affects budgeting and pricing strategies.

Question 3

If the exchange rate changes from 1 USD to 0.80 EUR to 1 USD to 0.70 EUR, what does this indicate about the US dollar?

A) The US dollar has appreciated against the euro.

B) The US dollar has depreciated against the euro.

C) The euro has become weaker.

D) There is no change in the value of the currencies.

B) The US dollar has depreciated against the euro.Correct Answer: B) The US dollar has depreciated against the euro.

Explanation: A depreciation of the US dollar means that it now takes more dollars to purchase the same amount of euros. When the exchange rate changes from 0.80 EUR to 0.70 EUR for 1 USD, it indicates that the dollar has lost value relative to the euro. Understanding these changes is important for assessing international purchasing power and making informed financial decisions.