Preparing for the CFA exam requires a solid grasp of exchange-traded funds (ETFs), a key component of investment analysis. Mastery of ETF mechanics, creation and redemption processes, trading liquidity, and cost efficiency is essential. This knowledge offers insights into portfolio diversification, risk management, and cost-effective investment strategies, crucial for CFA success.

Learning Objective

In studying “Exchange-Traded Funds: Mechanics & Applications” for the CFA exam, you should learn to understand the structure and functioning of ETFs, including the creation and redemption process and the role of authorized participants. Analyze how ETFs provide liquidity, cost efficiency, and diversification. Evaluate key ETF metrics such as tracking error, expense ratios, and spreads. Additionally, explore different types of ETFs, including equity, fixed-income, and specialty ETFs, and their impact on portfolio construction and risk management. Apply this knowledge to assess ETF performance, trading strategies, tax efficiency, and their use in portfolio diversification and tactical asset allocation.

Structure and Functioning of Exchange-Traded Funds (ETFs)

Exchange-Traded Funds (ETFs) are investment vehicles that pool money from multiple investors to purchase a diversified portfolio of assets, including stocks, bonds, commodities, or other assets. ETFs trade on stock exchanges, allowing investors to buy and sell shares throughout the trading day at market prices, similar to individual stocks. The structure of ETFs offers several benefits, including liquidity, transparency, and cost efficiency.

Creation and Redemption Process

The unique structure of ETFs revolves around the creation and redemption process, primarily facilitated by Authorized Participants (APs). Here is how it works:

- Creation: When demand for an ETF increases, APs create new ETF shares by purchasing the underlying assets (securities in the ETF’s portfolio) and delivering them to the ETF issuer in exchange for ETF shares. These shares are then introduced into the market for trading.

- Redemption: Conversely, when there is excess supply or declining demand for ETF shares, APs can redeem ETF shares by exchanging them with the issuer for the underlying assets. This process ensures that the ETF price remains closely aligned with the net asset value (NAV) of its underlying assets.

Role of Primary and Secondary Markets

- Primary Market: This is where APs interact with the ETF issuer to create or redeem shares. Retail investors typically do not participate directly in the primary market.

- Secondary Market: Retail and institutional investors buy and sell ETF shares on stock exchanges, creating liquidity. The intraday trading of ETFs differentiates them from mutual funds, which can only be traded at the end-of-day NAV.

Advantages Compared to Mutual Funds

ETFs offer several advantages over traditional mutual funds:

- Intraday Trading: ETFs can be traded throughout the day at market prices, unlike mutual funds, which are priced only at the end of the trading day.

- Lower Expense Ratios: ETFs often have lower management fees and expenses than mutual funds.

- Transparency: ETF holdings are typically disclosed daily, providing investors with a clear view of their underlying assets.

Types of ETFs

- Equity ETFs: Track a stock market index or sector.

- Fixed-Income ETFs: Focus on bonds, including government, corporate, and municipal bonds.

- Commodity ETFs: Provide exposure to commodities like gold, oil, or agricultural products.

- Specialty ETFs: Focus on specific strategies, sectors, regions, or asset classes, such as thematic or leveraged/inverse ETFs.

In summary, ETFs function through a unique structure that allows for liquidity, efficient pricing, and diverse exposure across asset classes. Understanding the creation and redemption mechanisms, trading dynamics, and comparative benefits helps investors leverage ETFs effectively in portfolio management.

ETF Trading Mechanics and Liquidity

ETFs offer the ability to trade on stock exchanges throughout the trading day, providing flexibility and transparency to investors. Unlike mutual funds, ETFs allow for intraday buying and selling at market prices, making them more dynamic and responsive to market changes.

- Intraday Trading and Real-Time Pricing:

ETFs trade on stock exchanges during market hours, allowing for intraday buying and selling at market prices. Unlike mutual funds, which trade only at end-of-day net asset value (NAV), ETFs offer flexibility to capitalize on market movements throughout the day. - Liquidity Sources:

ETF liquidity is derived from both the secondary market (investor trading on exchanges) and the primary market (creation and redemption process involving Authorized Participants, or APs). This structure ensures that ETF shares can be traded easily and efficiently. - Role of Market Makers and Authorized Participants (APs):

Market makers and APs provide liquidity by quoting buy and sell prices, facilitating trades, and engaging in the creation and redemption of ETF shares. Their activity helps maintain alignment between an ETF’s market price and its NAV, ensuring market stability and efficient pricing. - Arbitrage Mechanism:

The creation and redemption process corrects price discrepancies between an ETF’s market price and its NAV. If an ETF trades at a premium, APs create new shares to increase supply and lower the price. Conversely, if it trades at a discount, APs redeem shares, reducing supply and raising the price. This arbitrage maintains price efficiency. - Bid-Ask Spreads:

The bid-ask spread reflects the difference between the highest price buyers are willing to pay and the lowest price sellers are willing to accept. Narrow spreads indicate high liquidity, while wider spreads may reflect lower liquidity or trading activity. - Costs and Trading Considerations:

When trading ETFs, investors should consider transaction costs such as commissions, bid-ask spreads, and potential market impact costs. ETFs with high trading volumes and tight spreads generally have lower costs and better liquidity, enhancing their attractiveness to investors.

In summary, ETF trading mechanics and liquidity are driven by intraday trading, primary and secondary market dynamics, market makers and APs, and the arbitrage mechanism, ensuring efficient, flexible, and transparent trading.

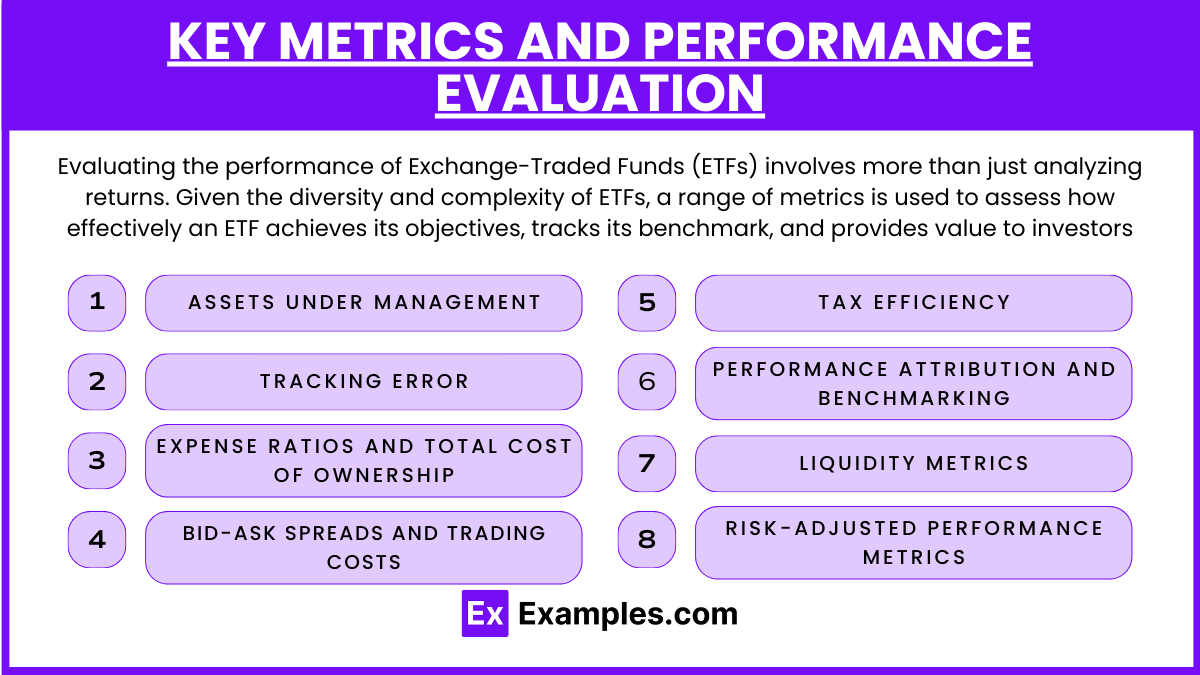

Key Metrics and Performance Evaluation

Evaluating the performance of Exchange-Traded Funds (ETFs) involves more than just analyzing returns. Given the diversity and complexity of ETFs, a range of metrics is used to assess how effectively an ETF achieves its objectives, tracks its benchmark, and provides value to investors. Here are some of the key metrics and methods used to evaluate ETF performance:

1. Tracking Error

Tracking error measures the deviation between the performance of an ETF and its underlying index or benchmark. A lower tracking error indicates that the ETF closely replicates the performance of its benchmark. Persistent tracking errors may result from factors like management fees, trading costs, or portfolio inefficiencies.

2. Expense Ratios and Total Cost of Ownership

- Expense Ratios: Represents the annual fees charged by the ETF as a percentage of its assets under management (AUM). Lower expense ratios are generally favorable for investors.

- Total Cost of Ownership: Includes trading costs (e.g., commissions and bid-ask spreads), impacting an ETF’s overall cost and net returns.

3. Bid-Ask Spreads and Trading Costs

- Bid-Ask Spread: Reflects the difference between buying (ask) and selling (bid) prices. Narrow spreads indicate higher liquidity, while wider spreads may lead to higher transaction costs.

- Trading Costs: Buying and selling ETF shares incur costs that can impact returns, especially for short-term trading.

4. Tax Efficiency

ETFs are often more tax-efficient than mutual funds due to their in-kind creation and redemption processes, which help minimize taxable events. This can significantly affect after-tax returns for investors.

5. Performance Attribution and Benchmarking

- Performance Attribution: Analyzes sources of an ETF’s returns (e.g., asset allocation, security selection) to understand drivers of performance.

- Benchmark Comparison: Comparing an ETF to its benchmark helps gauge how accurately it tracks intended exposure. Consistent underperformance may indicate inefficiencies or management issues.

6. Liquidity Metrics

- Average Daily Trading Volume: Higher trading volumes often mean greater liquidity, reducing costs and making it easier to trade.

- Market Impact Costs: Large trades can move the market price of an ETF, especially for less liquid funds, causing market impact costs.

7. Risk-Adjusted Performance Metrics

- Standard Deviation and Beta: Measure an ETF’s volatility and sensitivity to market movements, helping investors understand risk exposure.

- Sharpe Ratio: Evaluates returns relative to risk (measured by standard deviation). Higher values indicate better risk-adjusted performance.

- Sortino Ratio: Focuses solely on downside risk, offering a targeted view of risk-adjusted returns.

8. Assets Under Management (AUM)

The total value of assets held by an ETF indicates its size and investor interest. Higher AUM typically suggests greater liquidity and can lead to tighter bid-ask spreads, lower costs, and potentially higher efficiency. Conversely, smaller ETFs may face higher spreads and less trading activity, potentially affecting investor transactions and costs.

Applications in Portfolio Management and Risk Mitigation

ETFs (Exchange-Traded Funds) play a vital role in portfolio management and risk mitigation strategies due to their flexibility, cost efficiency, and diverse range of offerings. They enable investors to achieve specific investment goals, enhance diversification, manage risk exposure, and implement both active and passive investment strategies. Here’s a breakdown of their key applications:

1. Diversification Benefits and Asset Allocation Strategies

ETFs offer instant diversification by providing exposure to a broad range of asset classes, sectors, or regions. They allow investors to spread risk across different market segments, reducing the impact of a single asset’s poor performance. For example, broad-market index ETFs provide exposure to hundreds or thousands of securities, enhancing the risk-return profile of a portfolio.

2. Tactical Asset Allocation Using Sector and Thematic ETFs

Investors can use sector-specific or thematic ETFs to implement tactical asset allocation strategies, adjusting their exposure based on market conditions, economic cycles, or emerging trends. For example, during a technology boom, investors may increase their allocation to technology sector ETFs to capitalize on potential gains.

3. Risk Management and Hedging Strategies

ETFs can be used as effective tools for risk management. Investors can hedge specific risks by using inverse ETFs (which move in the opposite direction of a particular index) or by investing in bond or commodity ETFs to reduce portfolio volatility during market downturns. Leveraged ETFs can provide amplified exposure, but they come with increased risk and are best suited for short-term strategies.

4. Leveraged and Inverse ETFs: Applications and Risks

Leveraged ETFs aim to amplify the daily returns of an underlying index, providing a multiple (e.g., 2x or 3x) of the index’s performance. Inverse ETFs offer the opposite performance, profiting from declines in the index. While these instruments can be useful for tactical trading or hedging, they carry greater risks due to daily rebalancing and compounding effects over time.

5. Role of ETFs in Passive and Active Management Approaches

- Passive Management: ETFs are frequently used in passive investment strategies to track market indexes or sectors. This approach aims to match market performance with lower fees and minimal trading costs.

- Active Management: ETFs can also support active strategies by allowing managers to quickly shift exposure or express market views using sector, style, or factor-based ETFs. This flexibility can enhance returns and manage risk within a broader portfolio.

6. Low-Cost and Transparent Portfolio Construction

ETFs generally offer lower fees than mutual funds, contributing to cost-efficient portfolio construction. Their transparency—due to frequent disclosure of holdings—enables investors to understand exactly what they’re investing in, making it easier to align investments with financial goals and risk tolerance.

Examples

Example 1: Sector-Specific ETF for Tactical Allocation

An investor who believes the healthcare sector will outperform the market due to emerging medical technologies and increased demand can invest in a healthcare sector ETF. This approach allows the investor to gain broad exposure to healthcare stocks while maintaining liquidity and minimizing costs compared to investing in individual stocks.

Example 2: Leveraged ETF for Short-Term Trading

A trader aiming to capitalize on anticipated short-term gains in a stock index might use a 2x leveraged ETF that tracks the index’s daily performance. This ETF seeks to deliver double the daily return of the index, providing the potential for higher gains (or losses). This strategy is best suited for short-term speculation due to compounding effects.

Example 3: Bond ETF for Risk Diversification

A conservative investor seeking steady income can diversify their portfolio using a bond ETF, such as one that tracks U.S. government bonds or investment-grade corporate bonds. Bond ETFs provide exposure to multiple bonds and reduce single-security risk, offering a cost-effective alternative to holding individual bonds.

Example 4: Inverse ETF for Hedging Market Downturns

To protect against potential declines in the broader market, an investor may use an inverse ETF, which moves in the opposite direction of a specific index. If the market falls, the inverse ETF gains value, helping offset portfolio losses and managing downside risk.

Example 5: International ETF for Global Exposure

An investor seeking exposure to international markets can invest in a global ETF that tracks a basket of stocks from emerging markets. This strategy allows for geographic diversification, reducing dependence on domestic markets and taking advantage of growth opportunities in foreign economies.

Practice Questions

Question 1:

Which of the following is a primary benefit of using ETFs in a portfolio?

A) ETFs are not subject to any market risks.

B) ETFs can only be traded at the end of the trading day.

C) ETFs provide intraday trading flexibility and liquidity.

D) ETFs have a guaranteed rate of return.

Answer: C) ETFs provide intraday trading flexibility and liquidity.

Explanation:

ETFs are traded on stock exchanges and offer investors the ability to buy and sell shares throughout the trading day at market prices. This flexibility and liquidity distinguish ETFs from mutual funds, which can only be traded at the end-of-day NAV. Option A is incorrect as ETFs are subject to market risks. Option B is incorrect since ETFs trade intraday, unlike mutual funds. Option D is incorrect as ETFs do not have guaranteed returns.

Question 2:

The creation and redemption process of ETFs primarily involves:

A) Retail investors buying shares on the primary market.

B) Authorized Participants creating or redeeming shares to align with market demand.

C) ETFs being issued only once and never adjusted.

D) Direct purchase of ETFs from exchanges by Authorized Participants.

Answer: B) Authorized Participants creating or redeeming shares to align with market demand.

Explanation:

The creation and redemption process is a unique feature of ETFs that helps maintain their price alignment with the underlying assets. Authorized Participants (APs) create new shares by delivering the underlying securities to the ETF issuer or redeem shares by receiving securities in exchange for ETF shares. This process ensures efficient arbitrage and market liquidity. Option A is incorrect as retail investors trade on the secondary market. Option C is incorrect since shares can be created or redeemed as needed. Option D misrepresents the APs’ role, as they interact with the ETF issuer, not through direct market purchase.

Question 3:

A key metric used to evaluate how closely an ETF tracks its benchmark is:

A) Bid-ask spread.

B) Sharpe ratio.

C) Tracking error.

D) Market capitalization.

Answer: C) Tracking error.

Explanation:

Tracking error measures the difference between the performance of an ETF and its benchmark index, reflecting how closely the ETF follows the intended index. Lower tracking error indicates better alignment with the benchmark. Option A, the bid-ask spread, refers to trading costs. Option B, the Sharpe ratio, evaluates risk-adjusted returns. Option D, market capitalization, measures the size of the ETF but does not directly relate to tracking performance.