Preparing for the CFA Exam requires a comprehensive understanding of “Financial Reporting Quality,” a core topic in evaluating financial statements and corporate transparency. Mastery of earnings quality, balance sheet quality, cash flow quality, and revenue recognition practices is essential. This knowledge provides critical insights into detecting earnings manipulation, assessing management’s reporting choices, and identifying sustainable performance indicators. A strong grasp of Financial Reporting Quality enables a deeper analysis of a company’s financial health, reliability of its reported metrics, and ultimately, supports achieving a high CFA score.

Learning Objectives

In studying “Financial Reporting Quality” for the CFA, you should learn to assess the integrity of financial statements and detect potential earnings manipulation. This includes understanding the quality of earnings, balance sheet integrity, and the consistency of cash flow reporting. Develop proficiency in identifying red flags in revenue recognition, expense capitalization, and the treatment of non-recurring items. Analyze the effects of accounting policies on financial ratios and overall financial transparency. Evaluate the reliability of a company’s reported results to assess its true economic position and sustainability. Additionally, gain the ability to apply these skills in real-world scenarios, such as conducting due diligence, assessing creditworthiness, and making informed investment decisions based on quality financial reporting.

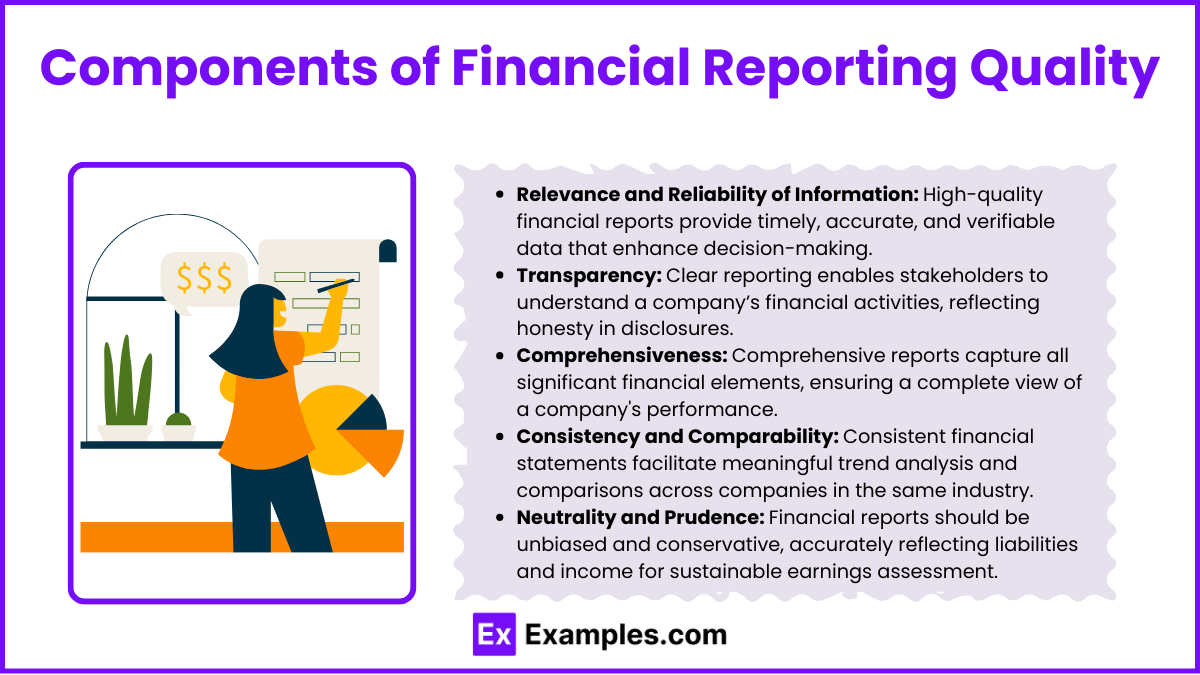

Components of Financial Reporting Quality

- Relevance and Reliability of Information: High-quality financial reports are relevant and provide timely data, enhancing the predictive value for decision-making. Reliability ensures the data is accurate, verifiable, and free from material misstatements.

- Transparency: Transparency is critical, allowing stakeholders to understand the company’s financial activities clearly. Transparent reporting reflects a company’s operations, assets, and liabilities without obfuscation, helping exam candidates evaluate a firm’s honesty in disclosures.

- Comprehensiveness: A high-quality report captures all significant financial elements comprehensively, which includes revenues, expenses, assets, liabilities, and equity. This completeness provides a holistic view of the company’s performance, reducing the risk of omission or selective reporting.

- Consistency and Comparability: Financial statements should be consistent across reporting periods and comparable across companies in the same industry. This consistency allows for meaningful trend analysis and cross-sectional comparisons, key skills tested on the CFA exam.

- Neutrality and Prudence: Reports should be unbiased and avoid aggressive assumptions, making conservative choices where estimates are needed. Prudence ensures that liabilities and expenses are not understated, and assets and income are not overstated, which is crucial in assessing the sustainability of earnings.

Indicators of Poor Financial Reporting Quality

- Frequent Restatements: Frequent financial restatements suggest issues with initial reporting quality. It raises concerns about the integrity of a company’s accounting practices and management, which could signal underlying financial or operational instability.

- Large Discrepancies Between Operating Cash Flow and Net Income: Significant differences between cash flow and net income often indicate aggressive accrual accounting or unsustainable earnings. For example, a company may record high sales revenue on credit, but low cash flow from operations could indicate collection issues or uncollectible receivables.

- High Levels of Estimation: Reliance on estimates, such as provisions for doubtful accounts or warranty expenses, can allow for manipulation. Scrutinizing areas with high estimation provides insights into management’s intentions and the firm’s potential vulnerabilities.

- Significant Unusual or Non-Recurring Items: Large, irregular items such as one-time gains or losses can distort the true picture of financial health. Identifying such items and understanding their impact is critical for CFA candidates, as the exam often emphasizes sustainable income over reported net income.

- Weak Internal Controls: Inadequate internal controls may lead to errors or fraudulent activities. Companies with poor internal control systems are more likely to present inaccurate financial data, making it crucial for CFA candidates to consider internal control quality when analyzing financial reporting.

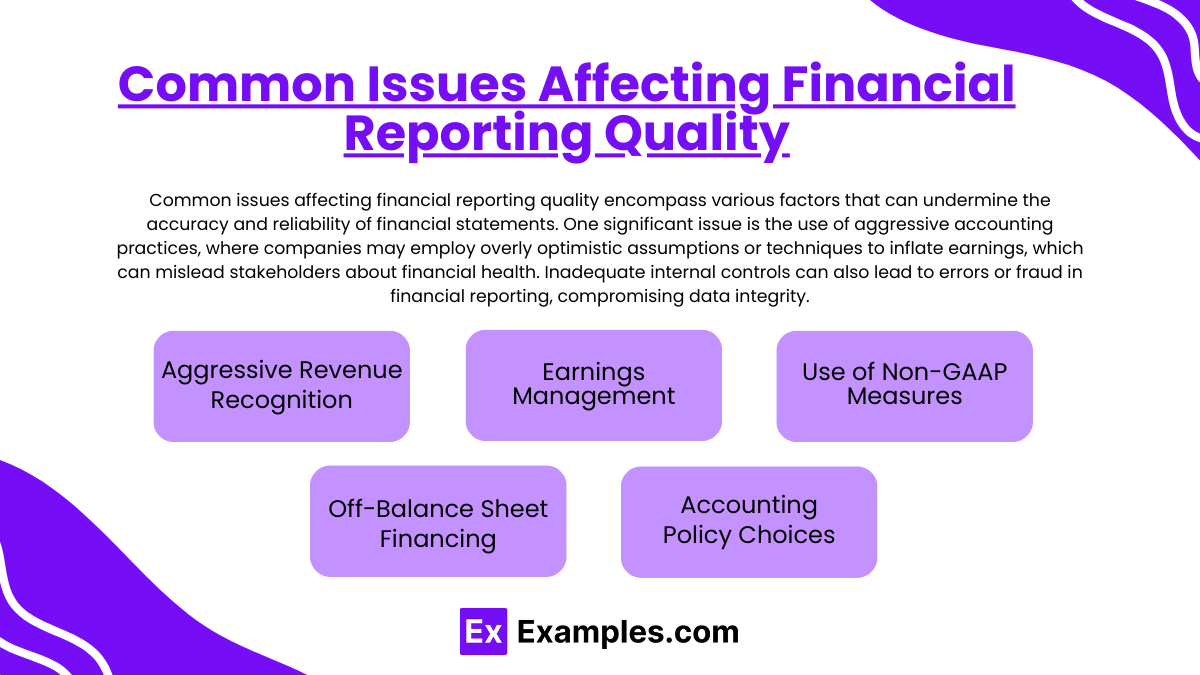

Common Issues Affecting Financial Reporting Quality

- Aggressive Revenue Recognition: Companies may accelerate revenue recognition to inflate earnings, especially if they use less conservative accounting practices. CFA candidates should know how to identify unusual revenue spikes and assess if revenue recognition aligns with company policy and economic reality.

- Earnings Management: Manipulating expenses, often by deferring or accelerating recognition, is a tactic to smooth earnings. This can create an appearance of stability or growth that does not reflect the company’s actual financial health. Recognizing signs of earnings management is critical, as it directly impacts the assessment of a firm’s operating performance.

- Use of Non-GAAP Measures: Non-GAAP financial measures can provide a clearer view of performance but may be used to paint an overly positive picture. Candidates should assess if non-GAAP measures are reasonable and consistent, or if they obscure true profitability.

- Off-Balance Sheet Financing: This involves keeping certain liabilities off the balance sheet, such as operating leases, to make financial health appear better. Understanding off-balance sheet financing helps in evaluating the true leverage and risk profile of a company.

- Accounting Policy Choices: Companies may choose accounting policies that better reflect economic reality or that paint a more favorable picture. For example, varying depreciation methods can lead to significant differences in reported income. CFA candidates need to scrutinize these policies and understand their impact on financial statements.

Examples

Example 1. Evaluating Earnings Sustainability

High-quality financial reporting enables analysts to distinguish between recurring earnings and one-time gains or losses. For instance, if a company shows consistent profit growth, financial reporting quality helps assess whether this growth stems from core operations or is propped up by non-recurring events, such as asset sales or tax benefits. By focusing on high-quality reports, analysts can more accurately gauge the sustainability of earnings, which is crucial in long-term investment decisions.

Example 2. Detecting Earnings Manipulation

Financial reporting quality is essential for identifying red flags in earnings manipulation, such as aggressive revenue recognition or deferred expense tactics. A company may, for example, recognize future revenues prematurely to inflate current earnings. Analysts who prioritize financial reporting quality examine footnotes and disclosures to spot inconsistencies and assess if revenues align with actual cash flow. This use of quality reporting helps safeguard investors from overvaluing companies with artificially inflated earnings.

Example 3. Assessing Management Transparency

Transparent financial reporting provides clear insight into a company’s operational risks and management integrity. For instance, companies with high-quality reporting practices will thoroughly disclose information on significant transactions, debt obligations, and contingent liabilities. Analysts use this transparency to evaluate management’s openness about potential risks, aiding in assessing the reliability of the company’s financial health and the credibility of its leadership.

Example 4. Comparing Industry Peers

Financial reporting quality allows for meaningful comparisons across companies within the same industry. For example, if two companies in the same sector report vastly different profit margins, high-quality reporting helps determine whether the difference results from genuine operational efficiency or from inconsistent accounting practices. Analysts can thus use financial reporting quality to ensure that comparisons are fair and reflect the true performance of each company within its industry.

Example 5. Evaluating Financial Health During Economic Downturns

In challenging economic periods, companies with high financial reporting quality often stand out by maintaining transparent, reliable disclosures that reflect actual financial health. For example, during an economic downturn, companies might resort to non-GAAP adjustments to minimize apparent losses. High-quality financial reporting helps investors see past these adjustments to understand a company’s true resilience. This approach provides a clearer picture of the company’s financial strength and adaptability in tough times, critical for making informed investment decisions.

Practice Questions

Question 1

Which of the following best describes the primary purpose of high-quality financial reporting?

A) To maximize reported earnings for investor confidence

B) To provide accurate, transparent, and reliable information for informed decision-making

C) To comply with all accounting standards without deviation

D) To reduce the company’s tax liabilities

Answer: B) To provide accurate, transparent, and reliable information for informed decision-making

Explanation:

The main purpose of high-quality financial reporting is to provide users—investors, analysts, and other stakeholders—with accurate, transparent, and reliable information. This allows them to make well-informed decisions based on a company’s true financial condition. High-quality reporting reflects the real economic activities of the company, without distortions aimed at maximizing earnings, minimizing taxes, or simply achieving regulatory compliance. Choices A, C, and D reflect narrower objectives that do not align with the primary goal of high-quality financial reporting, which is to enable transparency and reliable analysis of financial health.

Question 2

Which of the following scenarios might indicate a lower quality of financial reporting?

A) Consistently high cash flow relative to reported net income

B) Frequent use of non-GAAP financial measures that adjust earnings upwards

C) A stable trend in revenue and expenses over multiple reporting periods

D) Detailed disclosures of risks and uncertainties in the company’s footnotes

Answer: B) Frequent use of non-GAAP financial measures that adjust earnings upwards

Explanation:

Frequent use of non-GAAP measures, especially those that consistently adjust earnings upwards, can be a red flag for lower financial reporting quality. Non-GAAP adjustments can sometimes provide additional insight, but when used excessively or aggressively, they may distort the company’s true performance and present a misleadingly positive financial picture. High-quality financial reporting relies on standardized GAAP measures to ensure comparability and transparency. By contrast, scenarios A, C, and D generally reflect high-quality financial reporting practices, as they suggest consistency, transparency, and a thorough disclosure of relevant information.

Question 3

Which ratio might an analyst use to assess the quality of earnings in financial reporting?

A) Quick Ratio

B) Debt-to-Equity Ratio

C) Quality of Income Ratio

D) Price-to-Earnings Ratio

Answer: C) Quality of Income Ratio

Explanation:

The Quality of Income Ratio (calculated as Operating Cash Flow / Net Income) is used to assess the quality of a company’s earnings. This ratio indicates how much of the reported net income is supported by actual cash flow. A high-quality ratio suggests that earnings are primarily cash-based, rather than accrual-based, which is more sustainable and less likely to be manipulated. The other options—Quick Ratio, Debt-to-Equity Ratio, and Price-to-Earnings Ratio—focus on liquidity, capital structure, and valuation, respectively, and do not specifically measure the quality of reported earnings. Therefore, the Quality of Income Ratio is the best measure for analyzing financial reporting quality in terms of earnings reliability.