Forward Commitment and Contingent Claim Features and Instruments are fundamental components of derivatives, widely used in financial markets for risk management, hedging, and speculation. Forward commitments, including forwards, futures, and swaps, obligate both parties to fulfill contract terms at a future date, offering predictable cash flows and linear payoffs. In contrast, contingent claims, such as options and credit default swaps, provide rights without obligation, leading to non-linear payoffs based on specific events. Understanding these instruments’ structures and applications is essential for effectively managing risk and leveraging market opportunities.

Learning Objectives

In studying “Forward Commitment and Contingent Claim Features and Instruments” for the CFA exam, you should learn to understand key types of derivative instruments, including forwards, futures, options, and swaps. Analyze how these instruments are used in hedging, speculation, and risk management, and evaluate their distinct payoff structures, obligations, and associated risks. Assess forward commitments’ binding nature versus contingent claims’ conditional payoffs, exploring applications like currency hedging with forwards, interest rate swaps, and risk mitigation through options and credit default swaps. Apply this understanding to interpret real-world scenarios and assess strategic uses of derivatives in CFA practice questions.

1. Forward Commitments

Forward commitments are derivative contracts that establish an obligation for both parties to transact an underlying asset at a future date for a specified price. The parties are bound to fulfill the contract, regardless of the market’s movements, making these instruments firm commitments.

Key Types of Forward Commitments:

- Forward Contracts:

- Nature: Over-the-counter (OTC) agreements where two parties agree to buy or sell an asset at a set price on a future date.

- Customization: Highly customizable, as parties can negotiate terms like quantity, price, and settlement.

- Risk: Counterparty risk is significant since the contract is private and lacks exchange clearing.

- Usage: Often used by corporations to hedge specific risks, such as commodity prices or foreign exchange.

- Futures Contracts:

- Nature: Standardized contracts traded on exchanges to buy or sell an asset at a predetermined price on a set future date.

- Clearing and Settlement: Involves a clearinghouse, which guarantees performance by acting as the counterparty for all transactions, reducing counterparty risk.

- Daily Settlement: Marked to market daily, where gains or losses are settled each day to manage risk and margin requirements.

- Usage: Common among institutional investors and traders due to high liquidity and low counterparty risk.

- Swaps:

- Nature: OTC contracts in which two parties exchange cash flows based on notional principal amounts. Swaps are structured around interest rates, currencies, or commodities.

- Types of Swaps:

- Interest Rate Swaps: Exchange fixed interest payments for floating ones (or vice versa) to manage interest rate exposure.

- Currency Swaps: Exchange principal and interest payments in different currencies to hedge foreign exchange risks.

- Customization: Can be tailored to suit the specific cash flow needs of the counterparties.

- Usage: Frequently used by corporations and financial institutions for hedging interest rate and currency exposure.

2. Contingent Claims

Contingent claims are derivatives where the payoff depends on the occurrence of a specific event. Unlike forward commitments, contingent claims do not impose an obligation to buy or sell the underlying asset unless the conditions are met.

Key Types of Contingent Claims:

- Options: A financial contract providing the buyer the right, but not the obligation, to buy or sell an underlying asset at a specified strike price before or at expiration. Options come in two main forms:

- Types:

- Call Option: Grants the right to buy the asset.

- Put Option: Grants the right to sell the asset.

- American vs. European Options: American options can be exercised anytime before expiration, whereas European options can only be exercised at expiration.

- Types:

- Credit Default Swaps (CDS): A contract similar to insurance, where the buyer pays a premium to the seller in exchange for protection against a specific credit event, like a default or downgrade of a reference entity. If the event occurs, the buyer receives compensation, making CDS a contingent claim based on credit risk.

- Nature: CDS is a type of insurance-like contingent claim that pays off if a specific credit event occurs, such as a default or credit downgrade of a reference entity.

- Usage: Used by investors to hedge credit risk or speculate on the creditworthiness of companies or sovereign entities.

- Payoff Profile: The buyer of a CDS receives payment if the reference entity defaults, making CDS a contingent claim based on credit events.

Features of Forward Commitments and Contingent Claims

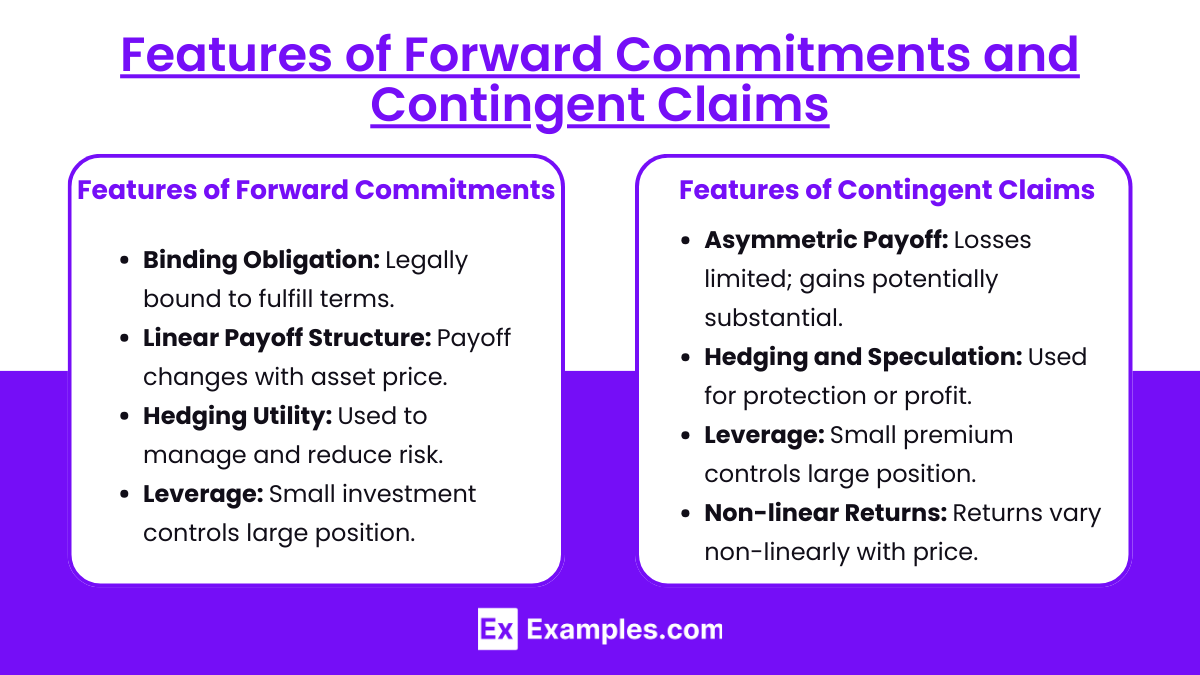

Features of Forward Commitments:

- Binding Obligation: Parties are legally obligated to fulfill the contract terms.

- Linear Payoff Structure: The payoff is directly proportional to changes in the underlying asset’s price, creating a “linear” relationship.

- Hedging Utility: Primarily used for hedging and reducing risk, as they lock in prices and eliminate price uncertainty.

- Leverage: These contracts allow for leveraged exposure, where small investments control large asset positions, amplifying both gains and losses.

Features of Contingent Claims:

- Asymmetric Payoff: Options provide an asymmetric payoff structure, where potential losses are limited to the premium paid by the buyer, while gains can be substantial.

- Hedging and Speculation: Options are versatile tools used for both hedging against adverse price movements and speculating on potential price changes.

- Leverage: Options allow for leveraged exposure, enabling the control of significant positions with a relatively small premium outlay.

- Non-linear Returns: Due to their asymmetric payoff, options and other contingent claims exhibit a non-linear relationship between changes in the underlying asset’s price and the instrument’s value.

Differences Between Forward Commitments and Contingent Claims

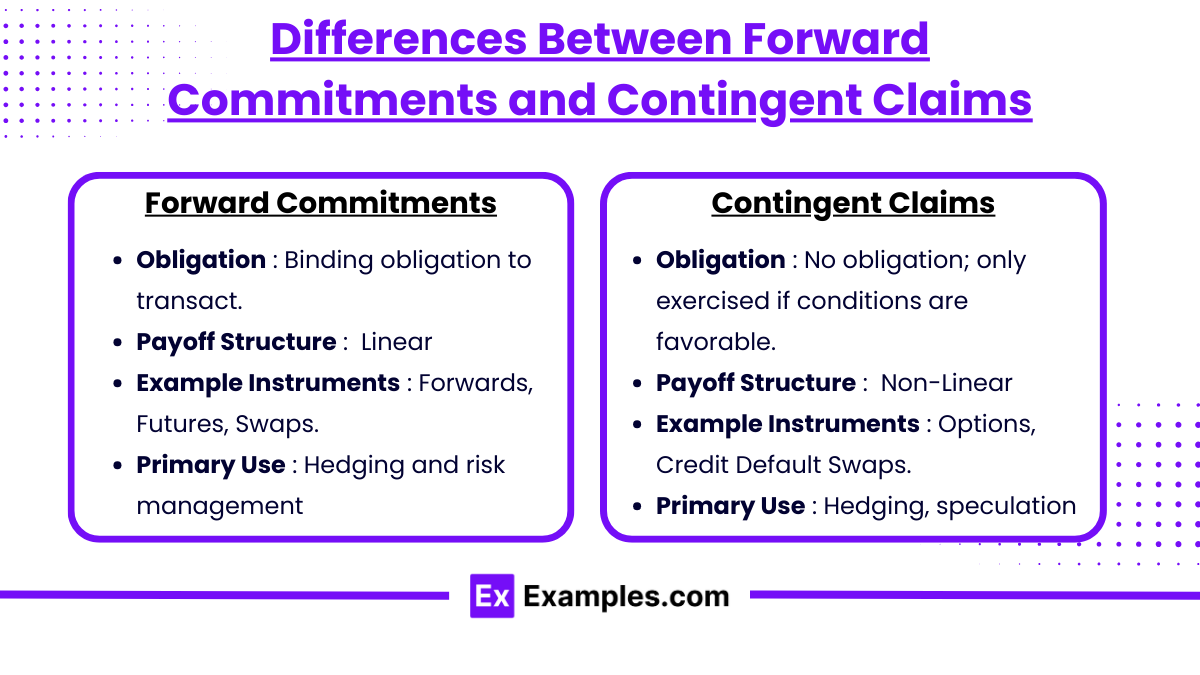

| Feature | Forward Commitments | Contingent Claims |

| Obligation | Binding obligation to transact | No obligation; exercised if conditions are favorable |

| Payoff Structure | Linear | Non-linear |

| Example Instruments | Forwards, Futures, Swaps | Options, Credit Default Swaps |

| Primary Use | Hedging and risk management | Hedging, speculation, leveraging |

Examples

Example 1: Forward Contract on Currency for Hedging

A multinational corporation expecting to receive payments in euros in six months may enter a forward contract to sell euros and buy U.S. dollars at a predetermined rate. This forward commitment locks in the exchange rate, protecting the company from adverse currency fluctuations. Since it is an OTC agreement, the forward contract is customizable but carries counterparty risk, as it depends on the financial strength of the other party.

Example 2: Futures Contract on Commodities for Speculation

An investor who expects oil prices to increase might buy oil futures contracts on an exchange, gaining exposure to oil price movements without owning the physical commodity. Futures contracts are standardized and settled daily, reducing counterparty risk through a clearinghouse. If oil prices rise, the futures contract will increase in value, allowing the investor to profit from the price movement. However, if oil prices drop, the investor will face daily mark-to-market losses, demonstrating the binding nature of futures.

Example 3: Interest Rate Swap for Managing Interest Rate Risk

A corporation with a floating-rate loan might enter an interest rate swap to exchange its floating payments for fixed payments. This swap, a forward commitment, stabilizes the company’s interest expense by locking in a fixed rate, reducing exposure to rising interest rates. Since swaps are OTC instruments, they can be customized to match the loan’s terms but carry counterparty risk, as each party relies on the other’s ability to fulfill their obligation.

Example 4: Call Option on Stock for Upside Speculation

An investor who believes a stock’s price will increase may buy a call option, a contingent claim that grants the right (but not the obligation) to purchase the stock at a specified strike price before expiration. This option provides an asymmetric payoff, where the maximum loss is the premium paid, while the upside is theoretically unlimited. If the stock price exceeds the strike price, the investor can exercise the option to buy at a discount, profiting from the stock’s appreciation.

Example 5: Credit Default Swap (CDS) for Hedging Credit Risk

A bondholder concerned about the issuer’s default risk might purchase a CDS, which acts as a contingent claim. The CDS seller compensates the bondholder if the issuer defaults or experiences a credit event. The bondholder pays periodic premiums for this protection, but if a default occurs, the bondholder receives compensation from the CDS seller. This type of contingent claim is commonly used in credit risk management, especially by institutions looking to hedge exposure to high-yield debt.

Practice Questions

Question 1

A company enters into a forward contract to purchase 10,000 barrels of crude oil at $60 per barrel in three months. This contract is best classified as:

A. A contingent claim that provides the company with the right, but not the obligation, to buy oil.

B. A forward commitment that obligates the company to buy oil at the specified price in the future.

C. A type of option contract that protects the company from adverse price movements.

D. A futures contract that requires daily settlement through an exchange.

Answer: B. A forward commitment that obligates the company to buy oil at the specified price in the future.

Explanation: A forward contract is a binding agreement between two parties to buy or sell an asset at a specified price on a future date. This type of derivative is classified as a forward commitment because both parties are obligated to fulfill the terms of the contract, regardless of how the market price changes. Option A is incorrect because a contingent claim, such as an option, would provide a right but not an obligation. Option C misclassifies the forward as an option contract, while D is incorrect because futures contracts, not forwards, are settled daily through exchanges.

Question 2

Which of the following best describes a feature of an option contract?

A. The buyer is obligated to exercise the contract on the expiration date.

B. It is a forward commitment with a linear payoff structure.

C. The buyer has the right, but not the obligation, to buy or sell the underlying asset.

D. It requires both parties to settle their positions daily through a clearinghouse.

Answer: C. The buyer has the right, but not the obligation, to buy or sell the underlying asset.

Explanation: An option is a contingent claim that grants the buyer the right, but not the obligation, to buy (call option) or sell (put option) the underlying asset at a specified strike price before or at expiration. This feature differentiates options from forward commitments, where both parties are obligated to transact. Option A is incorrect because options do not obligate the buyer to exercise; they may choose not to exercise if it’s unprofitable. B is incorrect because options have a non-linear payoff, while forward commitments have a linear payoff. D mischaracterizes options with daily settlement, which is a feature of exchange-traded futures.

Question 3

An investor buys a credit default swap (CDS) to protect against the potential default of a corporate bond they hold. This CDS is best described as:

A. A forward commitment where the investor is obligated to sell the bond if the corporation defaults.

B. A contingent claim that provides payment to the investor if a specified credit event occurs.

C. An instrument that requires the investor to buy more of the bond in case of default.

D. A derivative instrument that obligates both parties to settle on a fixed date.

Answer: B. A contingent claim that provides payment to the investor if a specified credit event occurs.

Explanation: A credit default swap (CDS) is a contingent claim because its payoff depends on the occurrence of a specified event, such as a credit default by the bond issuer. If a credit event occurs, the CDS seller compensates the CDS buyer for the loss associated with the bond’s default, making it a type of insurance against credit risk. Option A is incorrect, as the investor does not need to sell the bond; they simply receive compensation. C is inaccurate because a CDS does not require further purchases. D is incorrect because CDSs are not forward commitments and do not require fixed settlement dates; instead, they are triggered by specific events.