Free Cash Flow Valuation is a fundamental approach in equity analysis, focusing on a firm’s ability to generate cash beyond operational costs and reinvestments. This method estimates a company's intrinsic value by discounting future cash flows, either to the firm (FCFF) or specifically to equity holders (FCFE). It’s particularly valuable for assessing companies with irregular dividends, high reinvestment needs, or significant debt. By capturing cash flows available to capital providers, Free Cash Flow Valuation offers a comprehensive view of a company’s financial health and long-term profitability.

Learning Objectives

In studying "Equity: Free Cash Flow Valuation" for the CFA Exam, you should learn to evaluate Free Cash Flow to the Firm (FCFF) and Free Cash Flow to Equity (FCFE) as key valuation techniques. Understand how these cash flow models estimate intrinsic value by focusing on cash generated for capital providers, including both debt and equity holders. Analyze when to apply FCFF versus FCFE, especially in cases of varying capital structures. Assess the role of discount rates, such as WACC for FCFF and cost of equity for FCFE. Apply these principles to valuing firms with irregular dividends or significant debt in CFA practice scenarios.

Free Cash Flow (FCF) valuation is an essential approach in equity analysis. It calculates the intrinsic value of a firm by focusing on its cash flow generation capabilities, making it particularly valuable for firms with irregular or no dividends. Free Cash Flow Valuation is favored for valuing companies where dividend payments may not fully capture the value or profitability due to reinvestment in the business.

1. Introduction to Free Cash Flow Valuation

Free Cash Flow (FCF) is a measure of a company's ability to generate cash after accounting for capital expenditures required to maintain or expand its asset base. It is a crucial indicator of a company’s financial health and its potential to generate cash flows available to investors.

In valuation, Free Cash Flow Valuation (FCFV) provides a method to estimate the intrinsic value of a firm by discounting future cash flows. It’s especially relevant for valuing companies where dividends are not a reliable reflection of cash flow potential or where the company is likely reinvesting profits back into the business.

There are two main forms of Free Cash Flow used in valuation:

Free Cash Flow to the Firm (FCFF): Cash flow available to all capital providers (both debt and equity holders).

Free Cash Flow to Equity (FCFE): Cash flow available only to equity holders after all expenses, taxes, and debt obligations have been paid.

2. Types of Free Cash Flow Valuation Models

Free Cash Flow (FCF) serves as a foundation for intrinsic valuation, offering insights into a firm's cash generation beyond mere accounting profits. In the valuation process, two primary types of Free Cash Flow are commonly used to assess a company’s value: Free Cash Flow to the Firm (FCFF) and Free Cash Flow to Equity (FCFE). Each type provides a distinct perspective on cash flows, tailored to different analytical needs and capital structure.

1. Free Cash Flow to the Firm (FCFF)

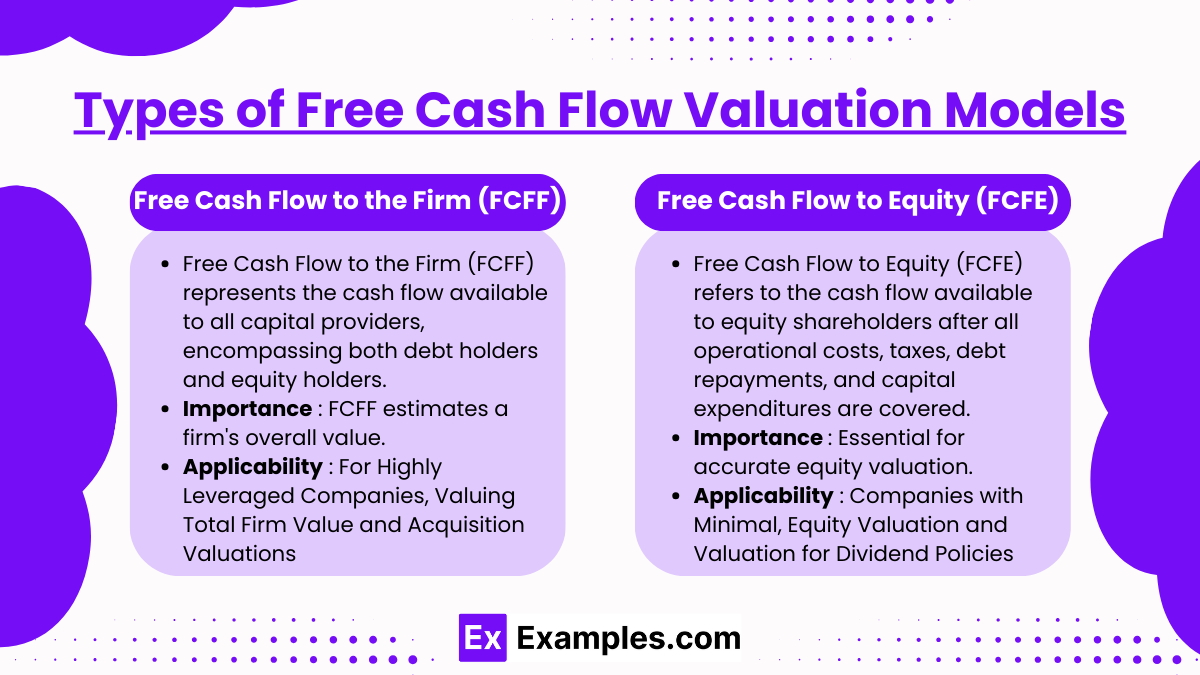

Free Cash Flow to the Firm (FCFF) represents the cash flow available to all capital providers, encompassing both debt holders and equity holders. FCFF captures the total cash generated by the firm’s operations after necessary investments in capital expenditures and working capital, but before accounting for any payments to debt or equity holders.

Importance: FCFF is essential for estimating the overall enterprise value (EV) of a firm, as it reflects the cash flow that can be used to meet obligations to both debt holders and shareholders. By valuing FCFF, analysts can calculate the value of the firm independent of its capital structure, making it a preferred metric for mergers and acquisitions, where a company’s total value is more relevant than equity value alone.

Applicability:

Highly Leveraged Companies: Firms with significant debt obligations benefit from FCFF analysis, as it measures cash flows prior to interest payments and debt service. This allows for a clear assessment of the firm’s ability to generate sufficient cash to meet both its debt and equity requirements.

Valuing Total Firm Value: When an analyst needs to assess the value of a company as a whole rather than just its equity portion, FCFF is appropriate, as it disregards the specifics of debt vs. equity distribution.

Acquisition Valuations: FCFF is often used in scenarios where potential acquirers want to evaluate a firm’s total operational value before considering the effects of its financing structure.

FCFF Calculation Formula:

The formula for FCFF incorporates multiple financial statement items, as follows:

FCFF=EBIT×(1−Tax Rate)+Depreciation and Amortization−Capital Expenditures−Change in Working Capital

2. Free Cash Flow to Equity (FCFE)

Free Cash Flow to Equity (FCFE) refers to the cash flow available to equity shareholders after all operational costs, taxes, debt repayments, and capital expenditures are covered. FCFE indicates the amount of cash a company can potentially return to its equity investors (shareholders) either through dividends or share buybacks.

Importance:

FCFE focuses exclusively on the cash flows that are directly available to equity holders, making it a crucial metric for equity valuation. By isolating cash flows specific to equity holders, FCFE provides insights into the firm’s capacity to generate returns for shareholders without factoring in obligations to debt holders. This specificity makes FCFE a valuable tool for estimating the intrinsic value of a company's equity.Applicability:

Companies with Minimal or Predictable Debt: FCFE is most effective for firms with low levels of debt or companies that have stable debt structures. Since FCFE excludes cash flows related to debt servicing, it is especially suitable for companies where debt financing is either insignificant or consistently managed.

Equity Valuation: When assessing the value of a firm solely from the perspective of equity shareholders, FCFE is ideal, as it provides a direct estimate of cash flows attributable only to equity holders.

Valuation for Dividend Policies: FCFE can serve as an indicator of a firm’s potential to pay dividends, making it useful for equity analysts who wish to forecast future dividends based on available free cash flows.

FCFE Calculation Formula:

FCFE is calculated by taking net income and adjusting it for non-cash expenses, capital expenditures, changes in working capital, and net borrowing. The formula is asfollows:

FCFE=Net Income+Depreciation and Amortization−Capital Expenditures−Change in Working Capital+Net Borrowing

3. Calculating Key Components in FCF Models

EBIT (Earnings Before Interest and Taxes): Represents the core operating earnings of the firm before financing costs.

Net Income: Used in calculating FCFE, representing earnings available to equity holders.

Depreciation and Amortization: Non-cash expenses added back to EBIT or Net Income because they do not affect cash flow.

Capital Expenditures (CapEx): Funds used to acquire or upgrade physical assets.

Changes in Working Capital: Increase in working capital is a cash outflow, while a decrease is a cash inflow.

Net Borrowing: Cash flows from new debt or repayment of debt, relevant in calculating FCFE.

4. Discount Rates for FCF Valuation

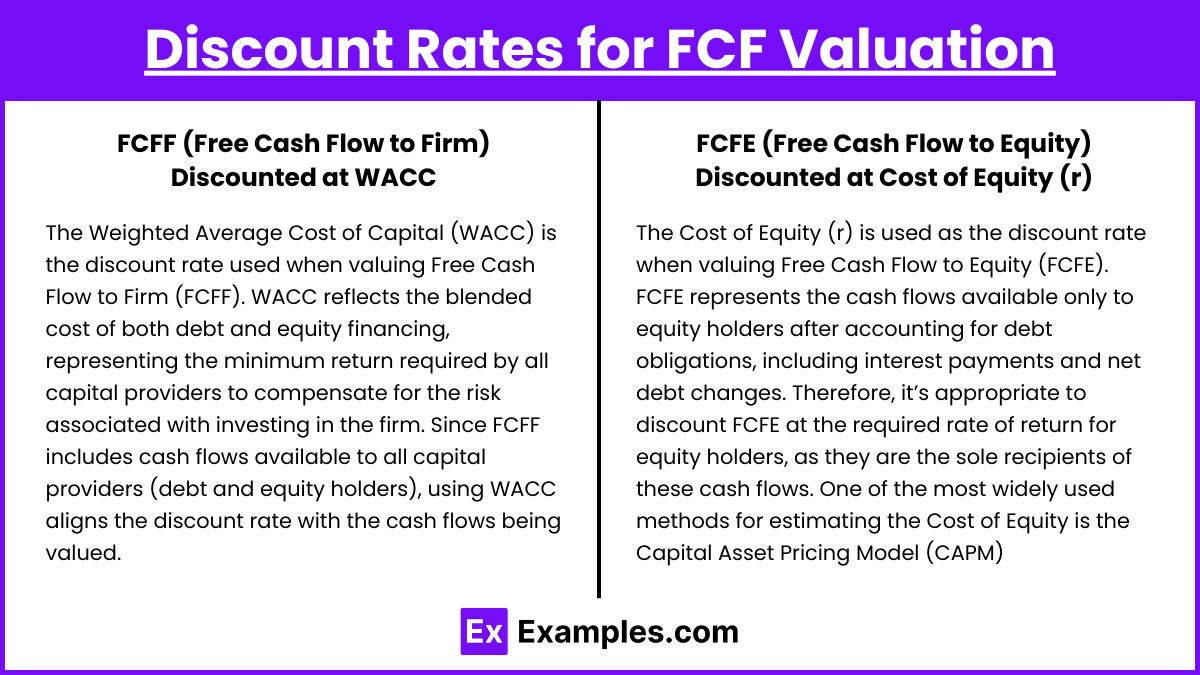

FCFF (Free Cash Flow to Firm) Discounted at WACC:

The Weighted Average Cost of Capital (WACC) is the discount rate used when valuing Free Cash Flow to Firm (FCFF). WACC reflects the blended cost of both debt and equity financing, representing the minimum return required by all capital providers to compensate for the risk associated with investing in the firm. Since FCFF includes cash flows available to all capital providers (debt and equity holders), using WACC aligns the discount rate with the cash flows being valued.

Formula:

Where:

E = Market value of equity

D = Market value of debt

V = Total market value of equity and debt (E + D)

r_e = Cost of equity

r_d = Cost of debt

FCFE (Free Cash Flow to Equity) Discounted at Cost of Equity (r):

The Cost of Equity (r) is used as the discount rate when valuing Free Cash Flow to Equity (FCFE). FCFE represents the cash flows available only to equity holders after accounting for debt obligations, including interest payments and net debt changes. Therefore, it’s appropriate to discount FCFE at the required rate of return for equity holders, as they are the sole recipients of these cash flows.The Cost of Equity reflects the return that equity investors require, given the risk they are assuming by investing in the company. One of the most widely used methods for estimating the Cost of Equity is the Capital Asset Pricing Model (CAPM)

Formula: r = Rf + β (Rm− Rf)

Where:

R_f = Risk-free rate

β = Beta, or sensitivity to market returns

R_m = Expected return on the market

Examples

Example 1. Valuing a Technology Firm with High Reinvestment Needs

A rapidly growing technology firm reinvests most of its earnings into research and development (R&D) and capital expenditures to support innovation and expansion. Since this company does not pay dividends and its profits are often reinvested into growth, the Dividend Discount Model (DDM) would not accurately capture its value. Instead, Free Cash Flow to Equity (FCFE) is used to estimate the firm’s intrinsic value by projecting future cash flows available to equity holders after meeting its reinvestment needs. By discounting FCFE at the required return on equity, analysts can better understand the value of the firm's growth potential, which would otherwise be missed by dividend-based approaches.

Example 2. Assessing a Mature Utility Company with Stable Cash Flows

A utility company operates in a regulated environment, generating stable and predictable cash flows. This company pays consistent dividends, but the dividends are controlled by regulatory caps, which might not fully reflect the cash flow generated by its operations. Here, Free Cash Flow to the Firm (FCFF) is more appropriate, as it measures cash flows available to all capital providers (debt and equity holders) before accounting for debt payments. By using FCFF and discounting it at the firm’s weighted average cost of capital (WACC), analysts can assess the utility company’s total value, which includes debt obligations—an essential factor given the industry’s high capital requirements.

Example 3. Valuing a Leveraged Buyout (LBO) Target with Significant Debt

In leveraged buyouts, companies are acquired primarily with debt financing, resulting in a high level of leverage. For an LBO target, the ability to generate cash flow for debt repayment is critical. Here, FCFF is used to assess the firm’s capacity to generate cash flows before interest payments, helping potential acquirers understand whether the target can cover its debt obligations. By projecting FCFF and discounting it at WACC, analysts can calculate the total enterprise value of the target. This valuation considers cash flows before debt servicing, making it suitable for assessing the feasibility and potential returns of a highly leveraged acquisition.

Example 4. Estimating Equity Value for a Financial Firm with Minimal Debt

A financial firm, such as an investment advisory company, operates with low levels of debt due to regulatory requirements. Since the company is minimally leveraged, FCFE provides a direct measure of cash flow available to equity holders, making it an ideal valuation tool in this context. Analysts use FCFE to project future cash flows available to shareholders and discount them at the cost of equity, focusing solely on equity-specific returns. This approach gives a clearer picture of the firm’s potential value to shareholders, as debt is not a significant factor in the company’s financial structure.

Example 5. Valuing a Manufacturing Company in a Cyclical Industry

A manufacturing company operates in a cyclical industry, where its revenues and cash flows fluctuate with economic conditions. During economic downturns, the company may need to retain cash rather than pay dividends, even if it has the capacity to generate positive free cash flows. In such cases, FCFF can be applied to capture the firm’s intrinsic value by estimating cash flows generated across the economic cycle. By discounting FCFF at WACC, analysts evaluate the company’s value through various market conditions, providing an intrinsic value estimate that reflects the firm’s long-term cash-generating potential, regardless of its dividend policy.

Practice Questions

Question 1

Which of the following statements about Free Cash Flow to the Firm (FCFF) and Free Cash Flow to Equity (FCFE) is most accurate?

A) FCFF represents the cash flow available only to equity shareholders after all obligations have been met.

B) FCFE is discounted at the Weighted Average Cost of Capital (WACC) because it reflects cash flows available to both debt and equity holders.

C) FCFF is used to calculate the enterprise value of a firm by discounting it at WACC, while FCFE is used to determine the equity value by discounting it at the required rate of return on equity.

D) FCFE and FCFF both include interest expense as they represent cash flows available to all stakeholders.

Answer: C) FCFF is used to calculate the enterprise value of a firm by discounting it at WACC, while FCFE is used to determine the equity value by discounting it at the required rate of return on equity.

Explanation:

Option A is incorrect because FCFF represents the cash flow available to both debt and equity holders, not just equity shareholders. FCFE, on the other hand, represents the cash flow specifically available to equity holders after all obligations, including debt servicing, have been met.

Option B is incorrect because FCFE is discounted at the cost of equity, not WACC. WACC is used to discount FCFF as it reflects the required return from all capital providers (both debt and equity holders).

Option D is incorrect because FCFE excludes interest expenses, as it is calculated after accounting for debt servicing. FCFF, however, is calculated before interest payments, as it considers cash flows available to all capital providers.

Option C is correct because FCFF is used to calculate the enterprise value of the firm, with WACC as the discount rate, while FCFE calculates equity value by using the cost of equity as the discount rate.

Question 2

When valuing a company with a high debt load, which Free Cash Flow metric would typically be more appropriate and why?

A) FCFE, because it represents the cash flow available after accounting for debt servicing, providing a clearer picture for highly leveraged companies.

B) FCFF, because it captures cash flows available before debt service, making it suitable for evaluating companies where debt significantly impacts cash flow.

C) FCFE, because it excludes capital expenditures, allowing a more direct measurement of cash flow for leveraged firms.

D) FCFF, because it uses the cost of equity as the discount rate, which accounts for the higher risk associated with debt.

Answer: B) FCFF, because it captures cash flows available before debt service, making it suitable for evaluating companies where debt significantly impacts cash flow.

Explanation:

Option A is incorrect because while FCFE does account for debt servicing, it reflects only the cash flow available to equity holders after debt payments. In a high-debt scenario, FCFF is generally more appropriate, as it captures cash flows available before debt service, helping analysts assess the firm’s overall ability to generate cash for all capital providers.

Option C is incorrect because FCFE does not exclude capital expenditures. Both FCFE and FCFF deduct capital expenditures, as they represent necessary investments to maintain or grow the firm.

Option D is incorrect because FCFF is discounted at WACC, not the cost of equity. WACC accounts for both debt and equity holders, making it appropriate for valuing FCFF, especially in leveraged companies.

Option B is correct because FCFF represents cash flows before debt service and is discounted using WACC, making it the preferred measure when analyzing companies with high debt levels. This approach allows analysts to evaluate the firm’s overall cash-generating capacity without being skewed by specific financing choices.

Question 3

Which of the following best describes the relationship between Free Cash Flow to the Firm (FCFF), Free Cash Flow to Equity (FCFE), and the firm's debt?

A) FCFF is always greater than or equal to FCFE because FCFF represents cash flow before debt payments, while FCFE is after debt obligations are met.

B) FCFE is typically greater than FCFF in leveraged firms because debt financing increases cash flow to equity holders.

C) FCFF is generally less than FCFE because it includes capital expenditures, while FCFE does not.

D) FCFE is discounted at WACC, while FCFF is discounted at the cost of equity, to account for the impact of debt on equity holders.

Answer: A) FCFF is always greater than or equal to FCFE because FCFF represents cash flow before debt payments, while FCFE is after debt obligations are met.

Explanation:

Option A is correct because FCFF represents cash flow before debt payments are made, so it includes cash flows available to both debt and equity holders. FCFE, on the other hand, is calculated after debt obligations have been met, which usually makes it equal to or lower than FCFF.

Option B is incorrect because FCFE is typically less than or equal to FCFF, not greater. Debt financing generally reduces FCFE, as interest and principal repayments must be covered before any cash flow is available to equity holders.

Option C is incorrect because both FCFF and FCFE account for capital expenditures. The main difference is that FCFE is calculated after debt servicing, while FCFF is not.

Option D is incorrect because FCFE is discounted at the cost of equity, and FCFF is discounted at WACC. This aligns with the fact that FCFF represents cash flows for all capital providers, while FCFE is focused on equity holders only.