Preparing for the CFA Exam necessitates a thorough understanding of “Guidance for Standards I-VII,” essential components of ethical and professional conduct. Mastery of these standards regarding professionalism, integrity of capital markets, and duties to clients and employers is crucial. This knowledge underpins ethical decision-making and professional accountability, pivotal for attaining success on the CFA Exam.

Learning Objective

In studying “Guidance for Standards I-VII” for the CFA Exam, you should aim to grasp the ethical frameworks and professional standards essential to finance. Understand and apply Standards I-VII, which cover areas such as professionalism, integrity of capital markets, and duties to clients and employers. Analyze real-world scenarios to recognize ethical dilemmas and determine appropriate conduct under the CFA Code of Ethics. Additionally, explore how these standards guide the behavior of finance professionals towards ethical practices, ensuring trust and transparency in financial markets. Apply this knowledge in practical situations and CFA exam questions to demonstrate proficiency in ethical decision-making.

Understanding Professionalism and Integrity of Capital Markets

Professionalism (Standard I)

Professionalism requires CFA members and candidates to adhere to the highest ethical standards. This not only involves compliance with applicable laws and regulations but also the cultivation of a personal and professional demeanor that reflects well on the finance professional, their firm, and the entire investment profession. Key aspects include:

- Knowledge of the Law: Finance professionals must understand and comply with all laws, rules, and regulations applicable to their professional activities. Ignorance of the law does not excuse violations. If laws conflict with the Code and Standards, professionals must adhere to the stricter of the law or the Code and Standards.

- Independence and Objectivity: Members are urged to maintain their independence and objectivity in their professional activities. They must not offer, solicit, or accept any gift, benefit, compensation, or consideration that reasonably could be expected to compromise their own or another’s independence and objectivity.

- Misconduct: The CFA Code of Ethics specifically prohibits members from engaging in any professional conduct involving dishonesty, fraud, or deceit, or committing any act that reflects adversely on their professional reputation, integrity, or competence.

Integrity of Capital Markets (Standard II)

Integrity of capital markets emphasizes the role of finance professionals in maintaining market efficiency through ethical conduct. Important elements include:

- Material Nonpublic Information: Finance professionals must not act or cause others to act on material nonpublic information that could affect the prices of securities. The prohibition against trading on insider information is crucial to ensuring all market participants have equal access to information.

- Market Manipulation: Professionals are prohibited from practices that distort prices or artificially inflate trading volumes with the intent to mislead market participants. Such manipulations can undermine the efficiency and fairness of financial markets.

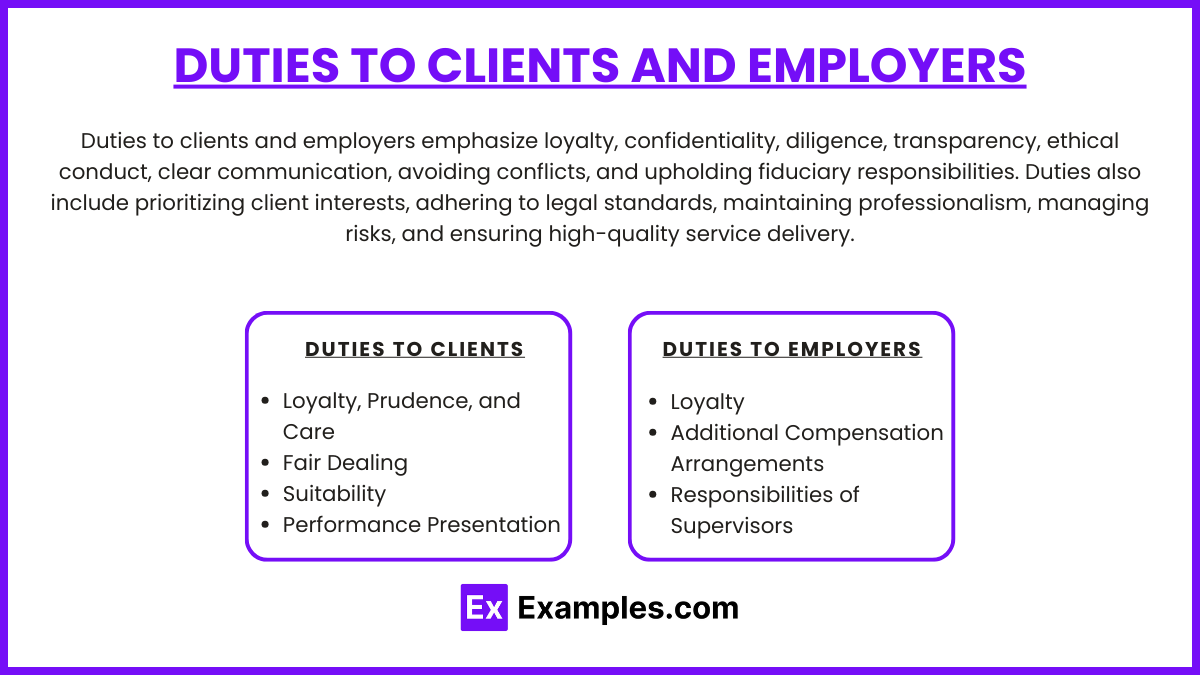

Duties to Clients and Employers

Duties to Clients (Standard III)

This standard emphasizes that the client’s interests come first. Finance professionals must:

- Loyalty, Prudence, and Care: Members and candidates are required to act with loyalty, prudence, and care in managing and advising on client assets. This duty supersedes any obligations to one’s employer, colleagues, or own interests.

- Fair Dealing: All clients should be treated fairly. This means providing investment analysis and making investment decisions in a manner that does not favor one client over another. For example, when distributing limited investment opportunities among clients, it should be done fairly based on each client’s objectives and circumstances.

- Suitability: When managing an investment portfolio or providing investment advice, members must consider the client’s investment objectives, personal circumstances, and risk tolerance to ensure that investment recommendations are suitable and aligned with their goals.

- Performance Presentation: Ensure that investment performance is reported accurately and without misrepresentation. It must not be misleading in any way to the client.

- Confidentiality: Protect the confidentiality of all client information. This obligation extends beyond the duration of the professional relationship.

Duties to Employers (Standard IV)

The duties towards employers also require adherence to high ethical standards:

- Loyalty: While loyalty to an employer is important, it does not override the duty to act ethically and legally. Members must balance this loyalty with the obligation to act in the best interest of clients.

- Additional Compensation Arrangements: Before entering into any arrangements that might benefit the employee at the expense of the employer (such as bonuses or profit sharing from third parties for recommending products or services), written consent must be obtained from all parties involved.

- Responsibilities of Supervisors: Those in supervisory roles are obligated to make reasonable efforts to ensure that those under their supervision comply with applicable laws, rules, and regulations. This includes creating an environment that discourages unethical or illegal behavior and addresses any deviations from the standard promptly.

Investment Analysis, Recommendations, and Actions

Here are five key points for Investment Analysis, Recommendations, and Actions:

- Thorough Research: Conduct comprehensive, unbiased research using credible sources and sound methodologies.

- Client-Centered Recommendations: Tailor recommendations to each client’s financial goals, risk tolerance, and specific needs.

- Transparency and Disclosure: Clearly communicate risks, assumptions, and potential returns, ensuring clients are fully informed.

- Conflict-Free Advice: Ensure recommendations are free from personal or corporate bias, prioritizing the client’s best interests.

- Timely and Accurate Execution: Execute investment actions promptly and accurately to align with analysis and recommendations.

These practices reinforce trust, integrity, and client-focused service in financial decisions.

Conflicts of Interest and Responsibilities

The Conflicts of Interest and Responsibilities section in the CFA Standards of Professional Conduct focuses on how finance professionals should handle situations where personal interests could interfere with client or employer interests.

- Identifying Conflicts is essential, requiring professionals to recognize any factors that might compromise their objectivity, such as personal investments or relationships.

- Disclosure of Conflicts ensures transparency by informing clients and employers of any potential bias, allowing them to make informed decisions.

- Managing Conflicts involves taking steps to mitigate bias, often by staying neutral or removing oneself from certain decisions if necessary.

For those in Supervisory Roles, there’s an added responsibility to establish policies and monitor compliance to prevent conflicts within their teams.

Examples

Example 1: Professionalism in Practice

A CFA charter holder is offered confidential information about an upcoming merger by an old college friend who works at one of the companies involved. The charter holder declines to receive the information, citing the CFA Institute’s guidelines on professionalism and integrity of capital markets, which prohibit acting on or sharing material nonpublic information.

Example 2: Integrity of Capital Markets

An investment analyst notices unusual trading volumes in a stock just before major news announcements. Suspecting market manipulation, the analyst reports the observations to the compliance department and refrains from making any trades based on this observation, adhering to the standards of integrity of capital markets.

Example 3: Duties to Clients

A financial advisor discovers that a new financial product offers higher returns compared to what her clients are currently invested in, but with significantly higher risks that do not align with the clients’ risk profiles. The advisor decides not to recommend the product to her clients, prioritizing their risk tolerance and investment goals, in line with her duty to act in the best interest of her clients.

Example 4: Duties to Employers

A portfolio manager learns of a job opportunity at another firm that promises a higher salary and better career prospects. Before engaging in discussions with the other firm, the manager informs her current employer and seeks permission to explore the opportunity, ensuring that her actions remain transparent and loyal to her current employer.

Example 5: Conflicts of Interest

A CFA candidate working for an asset management firm is tasked with selecting a service provider for a new investment tool. One of the bidders is a company owned by his brother. To avoid any conflict of interest, he discloses the relationship to his supervisor and recuses himself from the decision-making process, ensuring that the selection remains unbiased and in the best interest of his employer.

Practice Questions

Question 1

A portfolio manager learns about a potential takeover that will likely cause a stock to appreciate significantly. What is the most appropriate course of action under the CFA Standards of Professional Conduct?

A. Purchase the stock for his personal account before the information becomes public.

B. Inform his clients about the potential takeover and advise them to purchase the stock.

C. Report the insider information to the compliance department and refrain from trading.

D. Wait until a public announcement is made before making any trades on the stock.

Correct Answer: C

Explanation: Under the CFA Standards, it is required to handle material non-public information with integrity. The portfolio manager must report the insider information to the compliance department and refrain from trading or recommending trades based on that information to prevent market manipulation and maintain market integrity.

Question 2

An investment analyst is offered a job by a company she is currently analyzing for her employer. According to the CFA Standards, what should she do?

A. Accept the job offer, provided she discontinues her analysis of the company to avoid conflict of interest.

B. Immediately disclose the job offer to her employer and recuse herself from further analysis of the company.

C. Continue her analysis and accept the job, as long as she does not let the offer affect her conclusions.

D. Reject the job offer to avoid any appearance of conflict of interest.

Correct Answer: B

Explanation: The analyst should disclose the job offer to her employer to manage any conflict of interest transparently. Recusing herself from further analysis ensures that her professional judgment remains unbiased, adhering to the CFA Standards regarding integrity and objectivity.

Question 3

If a financial advisor’s family member is the CFO of a publicly traded company, what must the advisor do when recommending the company’s stock to her clients under the CFA Standards?

A. Avoid recommending the stock altogether to avoid a conflict of interest.

B. Recommend the stock without disclosure since family relationships do not necessarily imply bias.

C. Disclose the relationship to her clients and provide unbiased advice based on sound analysis.

D. Only recommend the stock if it is expected to underperform to demonstrate objectivity.

Correct Answer: C

Explanation: Disclosing any personal relationships that could be perceived as a conflict of interest is mandatory under the CFA Standards. The advisor should inform her clients about her relationship to ensure transparency, but can still recommend the stock if her analysis supports its potential value, provided she remains objective in her assessment.