Preparing for the CFA exam requires a deep understanding of hedge fund strategies, an essential component of alternative investments. Mastery of these strategies, including long/short equity, global macro, event-driven, and relative value approaches, is crucial. This knowledge provides valuable insights into portfolio management, risk mitigation, and alpha generation for sophisticated investors.

Learning Objective

In studying "Hedge Fund Strategies" for the CFA exam, you should learn to understand the various strategies employed by hedge funds to generate returns, including long/short equity, market neutral, merger arbitrage, and distressed investing. Analyze how these strategies aim to manage risk and achieve absolute returns regardless of market conditions. Evaluate the principles of leveraging, derivatives usage, and risk management techniques in hedge funds. Additionally, explore how hedge fund performance is measured, benchmarked, and how different strategies react to market movements. Apply your knowledge to interpret hedge fund strategies within portfolio construction and their impact on overall investment performance.

Overview of Hedge Fund Strategies

Hedge funds are specialized investment vehicles designed to achieve high returns through diverse strategies and flexible investment approaches. Unlike traditional funds, hedge funds operate with fewer regulatory constraints, offering unique opportunities to capitalize on different market scenarios.

Flexibility in Strategy: Hedge funds can invest in a wide range of asset classes, including equities, bonds, derivatives, commodities, and currencies, allowing them to quickly adapt to changing market conditions.

Focus on Absolute Returns: Unlike mutual funds, which typically aim to outperform a benchmark index, hedge funds strive for positive returns regardless of market direction.

Use of Leverage: Hedge fund managers often use leverage to amplify returns, which can enhance gains but also carries increased risk.

Short Selling: By taking both long and short positions, hedge funds can profit from both rising and falling markets, offering opportunities for outperformance during market downturns.

Diverse Strategies: Common hedge fund strategies include long/short equity, market neutral, event-driven (e.g., merger arbitrage), relative value (e.g., fixed-income arbitrage), and global macro strategies.

Manager Incentives: Most hedge funds use a "2 and 20" fee structure—charging a 2% management fee and a 20% performance fee—to align managers’ interests with the success of the fund.

Risk Management: Hedge funds employ advanced risk management techniques, including derivatives, hedging strategies, and strict risk controls to mitigate losses.

In summary, hedge funds provide an essential mechanism for portfolio diversification and risk management, employing sophisticated strategies to achieve consistent, risk-adjusted returns.

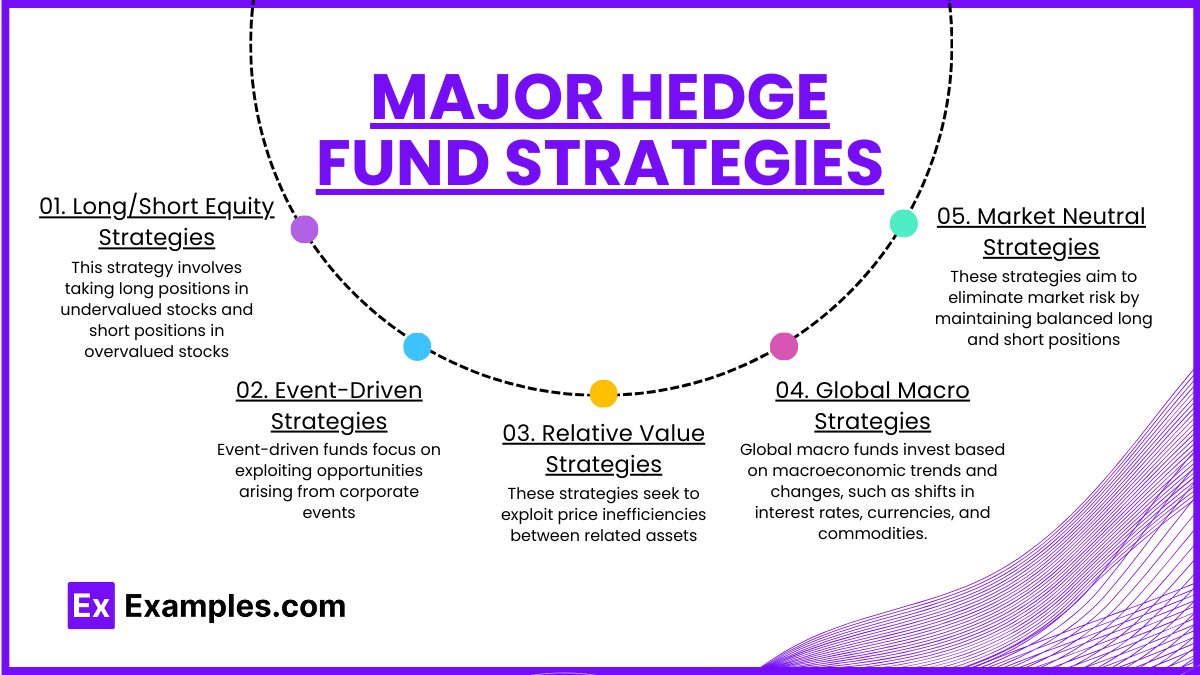

Major Hedge Fund Strategies

Hedge funds use a variety of sophisticated strategies to generate returns, mitigate risk, and take advantage of market inefficiencies. Here are the major hedge fund strategies:

Long/Short Equity Strategies:

This strategy involves taking long positions in undervalued stocks and short positions in overvalued stocks. By betting on both rising and falling prices, hedge fund managers aim to profit regardless of market direction. This approach provides flexibility in managing market risk and can be market-neutral if balanced correctly.Event-Driven Strategies:

Event-driven funds focus on exploiting opportunities arising from corporate events such as mergers, acquisitions, bankruptcies, restructurings, and spin-offs. Examples include:Merger Arbitrage: Involves buying shares of a target company and shorting shares of the acquiring company, profiting from the price movements related to the merger.

Distressed Investing: Targets companies facing financial distress or bankruptcy, aiming to capitalize on potential recoveries or restructurings.

Relative Value Strategies:

These strategies seek to exploit price inefficiencies between related assets. Examples include:Convertible Arbitrage: Involves buying a company’s convertible securities and shorting its common stock to take advantage of mispricings.

Fixed-Income Arbitrage: Focuses on finding price discrepancies among bonds, interest rates, or other fixed-income securities.

Global Macro Strategies:

Global macro funds invest based on macroeconomic trends and changes, such as shifts in interest rates, currencies, and commodities. These managers take a "big picture" view of economic developments across countries and regions and use a wide range of instruments, including futures, options, and swaps, to capitalize on broad market movements.Market Neutral Strategies:

These strategies aim to eliminate market risk by maintaining balanced long and short positions. Market-neutral funds seek to generate returns through security selection rather than market direction, providing consistent, uncorrelated returns over time.Quantitative Strategies:

Quant funds rely on complex mathematical models and algorithms to identify investment opportunities. These funds often employ systematic trading strategies across large datasets and markets, using high-frequency trading, statistical arbitrage, and other data-driven methods.

Hedge fund strategies vary widely in terms of risk, complexity, and market exposure. While some strategies focus on mitigating market risk, others embrace leverage and volatility to achieve their objectives. A deep understanding of these strategies is crucial for investment professionals aiming to evaluate or incorporate hedge fund strategies into portfolios.

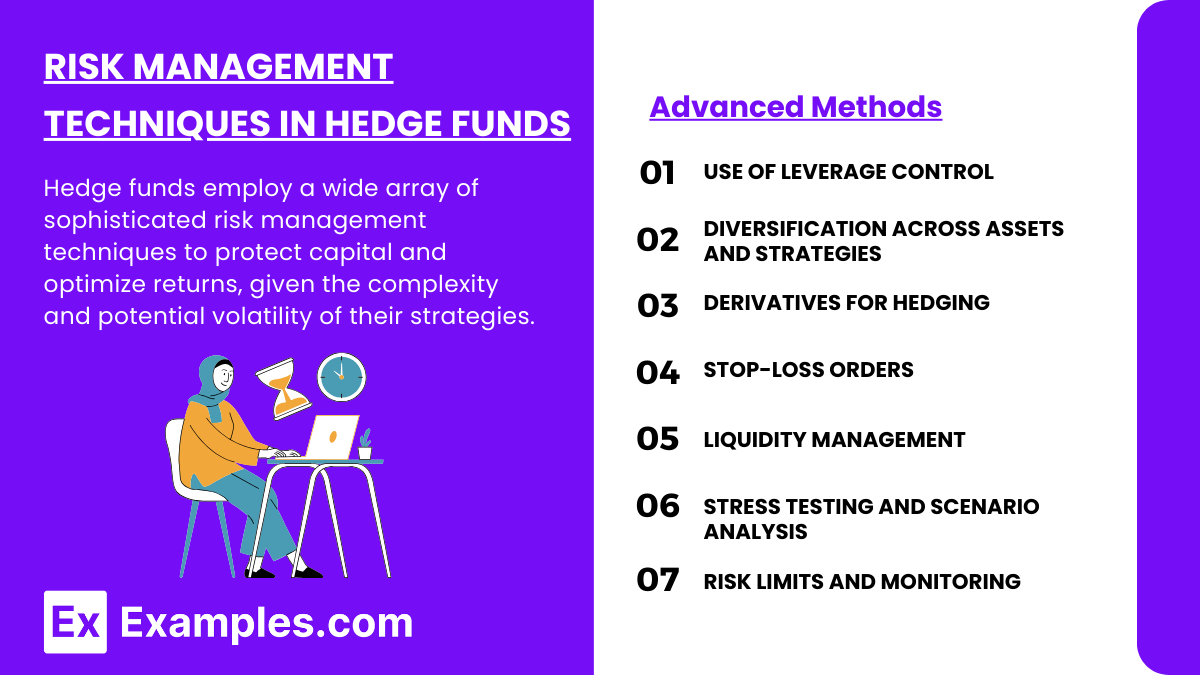

Risk Management Techniques in Hedge Funds

Hedge funds employ a wide array of sophisticated risk management techniques to protect capital and optimize returns, given the complexity and potential volatility of their strategies. Effective risk management is crucial due to the often high-risk nature of hedge fund investments, including leverage, derivatives, and short-selling. Here are some key techniques:

Use of Leverage Control:

Hedge funds often use leverage to amplify potential returns. However, excessive leverage increases risk, making it essential to implement limits and controls to ensure that the fund's exposure to losses remains manageable. Managers continuously monitor leverage ratios to maintain a healthy balance.Diversification Across Assets and Strategies:

Diversification helps reduce risk by spreading investments across various asset classes, sectors, geographic regions, and strategies. By reducing dependence on any single investment or market trend, hedge funds can mitigate potential losses from isolated events.Derivatives for Hedging:

Hedge funds frequently use derivatives such as options, futures, and swaps to hedge market exposure. This allows funds to protect against adverse market movements, interest rate changes, or currency fluctuations while maintaining their underlying positions.Stop-Loss Orders:

To protect against significant market losses, hedge funds often use stop-loss orders. These predefined triggers automatically liquidate positions when prices fall to a specified level, limiting potential losses and preserving capital during market downturns.Liquidity Management:

Liquidity risk is a major concern for hedge funds. Managers must carefully balance the fund’s liquidity needs with investor redemption policies, portfolio composition, and market conditions. By maintaining sufficient liquid assets and instituting redemption gates, they can avoid forced selling during unfavorable conditions.Stress Testing and Scenario Analysis:

Hedge funds often conduct regular stress testing and scenario analysis to assess how their portfolios would perform under extreme market conditions. These tests evaluate potential risks and vulnerabilities, helping managers adjust their strategies and positions accordingly.Risk Limits and Monitoring:

Most hedge funds employ strict risk limits, setting maximum allowable exposures to specific asset classes, positions, or risk factors. Advanced monitoring systems provide real-time data on market changes, portfolio performance, and risk exposures, enabling timely responses.Counterparty Risk Management:

Given their reliance on counterparties (e.g., brokers, clearinghouses), hedge funds actively manage counterparty risk by diversifying relationships and assessing the creditworthiness of each party. This ensures that they can fulfill obligations even if one counterparty defaults.

In summary, effective risk management is at the core of hedge fund operations. By employing a combination of leverage control, diversification, derivatives, stop-loss orders, and other tools, hedge funds aim to maximize returns while minimizing potential losses and navigating complex market environments.

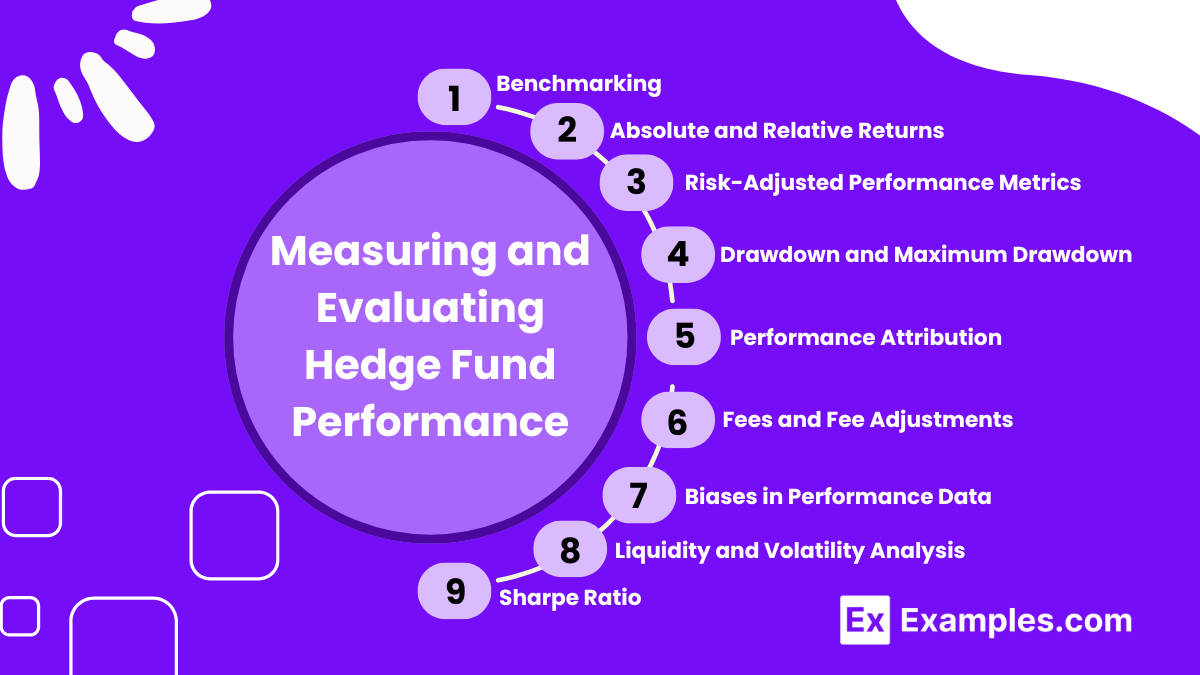

Measuring and Evaluating Hedge Fund Performance

Measuring and evaluating hedge fund performance involves more than simply looking at returns. Since hedge funds often employ complex strategies and carry significant risks, traditional performance metrics may not provide a complete picture. Therefore, a robust evaluation framework incorporates risk-adjusted measures, benchmarking, and various analytical tools to assess performance comprehensively. Here are the key aspects of measuring and evaluating hedge fund performance:

Absolute and Relative Returns:

Hedge funds often aim to generate absolute returns, meaning consistent positive performance regardless of market conditions. However, evaluating performance against a relevant benchmark (relative returns) can help measure how well a fund performs compared to market peers or indices with similar risk characteristics.Risk-Adjusted Performance Metrics:

Common metrics used to assess the risk-adjusted performance of hedge funds include:Sharpe Ratio: This metric evaluates returns relative to risk, calculated as excess returns (over a risk-free rate) divided by the fund's standard deviation. A higher Sharpe ratio indicates better risk-adjusted performance.

Sortino Ratio: Similar to the Sharpe ratio but focuses solely on downside risk (negative deviations), offering a more focused measure of risk-adjusted returns.

Alpha: This measures the excess returns a hedge fund generates over its expected market return, given its risk level (measured by beta). Positive alpha indicates a fund is outperforming its expected return.

Drawdown and Maximum Drawdown:

Drawdown measures the decline in the fund’s value from its peak to its trough over a specific period. Maximum drawdown shows the worst peak-to-trough decline, highlighting the potential loss exposure for investors. Monitoring drawdowns is essential to understand a fund’s risk profile and capacity to recover from losses.Benchmarking:

Comparing hedge fund performance to a relevant benchmark or index provides a context for evaluating its results. However, due to the unique strategies hedge funds employ, finding a comparable benchmark can be challenging. Custom benchmarks or peer-group comparisons may be used to assess performance more accurately.Performance Attribution:

Analyzing the sources of a hedge fund’s returns (e.g., asset allocation, security selection, market timing, or leverage) helps investors understand what drives the fund’s performance. This analysis can identify skill-based returns versus returns driven purely by market movements.Fees and Fee Adjustments:

Hedge funds often charge high management and performance fees (e.g., "2 and 20" structure). When evaluating performance, it is essential to consider net-of-fee returns to understand the true value delivered to investors after fees.Biases in Performance Data:

Hedge fund performance data can be subject to biases, such as survivorship bias (only successful funds remain in indices) and backfill bias (inclusion of historical performance after a fund’s strong start). Awareness of these biases helps ensure more accurate assessments.Liquidity and Volatility Analysis:

Evaluating a fund’s liquidity profile and volatility helps assess its suitability for an investor’s risk tolerance and redemption needs. Funds with high volatility or illiquid assets may pose greater risks during adverse market conditions.

Measuring and evaluating hedge fund performance is a multifaceted process that goes beyond simple returns. By using a combination of risk-adjusted metrics, benchmarking, performance attribution, and an understanding of biases and fees, investors can gain deeper insights into how a hedge fund achieves its returns and the associated risks.

Examples

Example 1: Long/Short Equity Strategy

A hedge fund manager identifies undervalued stocks in the technology sector and buys these "long" positions, expecting their prices to rise. Simultaneously, the manager identifies overvalued stocks in the same or related sectors and sells them "short," profiting from expected declines in their value. By balancing long and short positions, the fund aims to profit from stock selection while reducing overall market exposure.

Example 2: Merger Arbitrage (Event-Driven Strategy)

When a merger between two companies is announced, the hedge fund buys shares of the target company, which typically trade at a discount to the proposed acquisition price. At the same time, the fund might short shares of the acquiring company to hedge against deal risk. If the deal closes successfully, the spread between the acquisition price and the discounted trading price can result in a profit for the fund.

Example 3: Global Macro Strategy

A hedge fund anticipates a significant change in global interest rates based on macroeconomic data. The fund takes positions in currency futures, sovereign bonds, and commodities to profit from the anticipated rate changes. For example, if the fund expects U.S. interest rates to rise, it might take long positions in the U.S. dollar and short positions in gold.

Example 4: Convertible Arbitrage Strategy (Relative Value Strategy)

A hedge fund buys convertible bonds from a company and simultaneously shorts the company's common stock. This strategy seeks to profit from mispricing between the convertible bond and the underlying stock while managing market risk through hedging. Profits are derived from movements in the bond's price relative to the stock price.

Example 5: Distressed Securities Strategy (Event-Driven Strategy)

A hedge fund invests in the bonds or equity of a company facing financial distress or bankruptcy. The fund manager believes that the company will successfully restructure or recover, leading to significant gains in the value of its securities. This strategy requires deep analysis of the company’s potential for recovery and its financial health.

Practice Questions

Question 1:

Which of the following best describes the primary objective of a long/short equity hedge fund strategy?

A) To profit solely from rising stock prices.

B) To eliminate market exposure by holding only long positions.

C) To capitalize on both overvalued and undervalued stocks by taking long and short positions.

D) To exclusively trade in fixed-income securities.

Answer: C) To capitalize on both overvalued and undervalued stocks by taking long and short positions.

Explanation:

The long/short equity strategy aims to profit by taking long positions in undervalued stocks (anticipating their prices will rise) and short positions in overvalued stocks (anticipating their prices will decline). This allows hedge fund managers to generate returns regardless of overall market direction. Options A and B are incorrect because they limit the focus to long positions only, which contradicts the long/short strategy. Option D is incorrect as this strategy focuses on equities, not fixed-income securities.

Question 2:

In a merger arbitrage strategy, a hedge fund typically profits by:

A) Buying shares of the acquiring company and shorting the target company.

B) Investing in convertible bonds to gain a fixed return.

C) Buying shares of the target company at a discount and hedging by shorting the acquiring company’s stock.

D) Engaging in broad market index trading based on economic forecasts.

Answer: C) Buying shares of the target company at a discount and hedging by shorting the acquiring company’s stock.

Explanation:

A merger arbitrage strategy involves buying shares of a target company that is being acquired, typically at a discount to the proposed acquisition price, while hedging potential risks by shorting the acquiring company’s shares. This approach seeks to profit from the difference between the target’s discounted price and the acquisition price upon completion of the deal. Option A is incorrect because it suggests the opposite transaction. Option B is not relevant to merger arbitrage. Option D refers to a broad macroeconomic strategy, not merger arbitrage.

Question 3:

Which of the following hedge fund strategies primarily focuses on exploiting macroeconomic trends and large-scale economic changes?

A) Convertible Arbitrage

B) Global Macro Strategy

C) Event-Driven Strategy

D) Market Neutral Strategy

Answer: B) Global Macro Strategy

Explanation:

Global macro strategies involve taking positions based on macroeconomic trends such as changes in interest rates, currency movements, geopolitical developments, and commodity prices. These funds often use a wide range of instruments, including derivatives, currencies, commodities, and sovereign debt, to take advantage of predicted economic shifts. Option A, Convertible Arbitrage, focuses on price discrepancies in convertible bonds. Option C, Event-Driven Strategy, targets corporate events. Option D, Market Neutral Strategy, seeks balanced long and short positions to neutralize market exposure.