Preparing for the CFA Exam requires a comprehensive understanding of “Hedge Funds,” a key area within alternative investments. Mastery of hedge fund strategies, structures, and risk management techniques is essential. This knowledge provides insights into portfolio diversification, absolute return generation, and advanced investment tactics, critical for achieving a high CFA score.

Learning Objective

In studying “Hedge Funds” for the CFA Exam, you should aim to understand the core strategies, structures, and performance metrics of hedge funds as an alternative investment class. Analyze the different hedge fund strategies, including long-short equity, global macro, event-driven, and relative value, and how each seeks to achieve absolute returns. Evaluate the risk management techniques unique to hedge funds, such as leverage, short selling, and derivatives use. Additionally, explore fee structures, including management and performance fees, and their impact on investor returns. Apply this knowledge to assess hedge funds’ role in portfolio diversification, risk-adjusted returns, and advanced investment tactics, preparing for practical application on the CFA Exam.

Overview of Hedge Funds as Alternative Investments

Hedge funds are a type of alternative investment vehicle that pools capital from accredited investors and institutions to invest in a variety of assets and strategies. Unlike mutual funds, hedge funds are not subject to some of the regulations that are designed to protect investors, which allows them to pursue more diverse and often riskier strategies. Here’s an overview of hedge funds as an alternative investment:

Investment Strategies:

Hedge funds employ a wide range of investment strategies, including but not limited to:

- Long/Short Equity: Buying undervalued stocks while short-selling overvalued stocks.

- Market Neutral: Seeking to avoid some forms of market risk by balancing long and short positions in similar assets.

- Global Macro: Making leveraged bets on currency, interest rates, commodities, or stock indices, based on macroeconomic trends.

- Event-Driven: Capitalizing on stock pricing inefficiencies that may occur before or after a corporate event, like mergers, acquisitions, or bankruptcies.

- Arbitrage: Exploiting the price differences between related financial instruments or markets.

Hedge Fund Structures and Fee Models

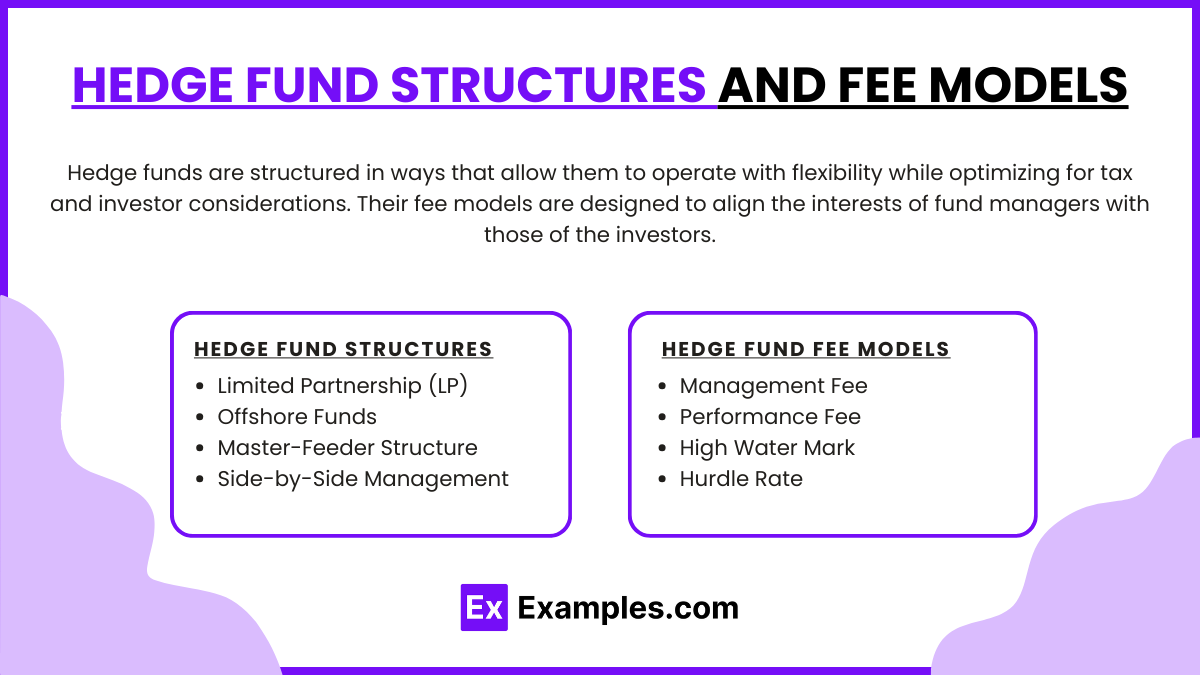

Hedge funds are structured in ways that allow them to operate with flexibility while optimizing for tax and investor considerations. Their fee models are designed to align the interests of fund managers with those of the investors. Here’s an overview of common hedge fund structures and their associated fee models:

Hedge Fund Structures

- Limited Partnership (LP)

- Most hedge funds are established as limited partnerships, where the fund manager serves as the general partner (GP), and the investors act as limited partners (LPs). This structure limits the liability of the investors to their investment in the fund.

- Offshore Funds

- Many hedge funds are also set up in offshore jurisdictions like the Cayman Islands, Bermuda, or the British Virgin Islands to provide tax advantages and regulatory benefits for international investors and the fund managers.

- Master-Feeder Structure

- This setup involves a master fund that aggregates capital from various feeder funds, which may include both onshore and offshore entities, allowing for a pooled investment strategy across different types of investors.

- Side-by-Side Management

- Hedge funds sometimes manage separate accounts and pooled vehicles simultaneously, ensuring that different types of investments are managed in parallel to cater to various investor needs.

Hedge Fund Fee Models

- Management Fee

- Typically, hedge funds charge a management fee calculated as a percentage of assets under management (AUM). The standard rate is around 2%, but it can vary depending on the fund size and strategy complexity. This fee covers operational costs, salaries, and other administrative expenses.

- Performance Fee

- In addition to the management fee, hedge funds usually charge a performance fee, which is a percentage of the profits earned by the fund. The most common structure is the “two and twenty” model, where the performance fee is 20% of the profits. This fee model incentivizes fund managers to generate positive returns since their earnings are significantly impacted by the fund’s performance.

- High Water Mark

- Many hedge funds include a high water mark in their fee structure, which ensures that performance fees are only paid on new profits. This means that if a fund loses money in one period, it must first recoup those losses in subsequent periods before any performance fees can be charged again.

- Hurdle Rate

- Some funds implement a hurdle rate, which is a minimum return level that the fund must achieve before charging any performance fees. This rate can be fixed or tied to a benchmark rate like the LIBOR or a government securities yield.

Risk Management Techniques in Hedge Funds

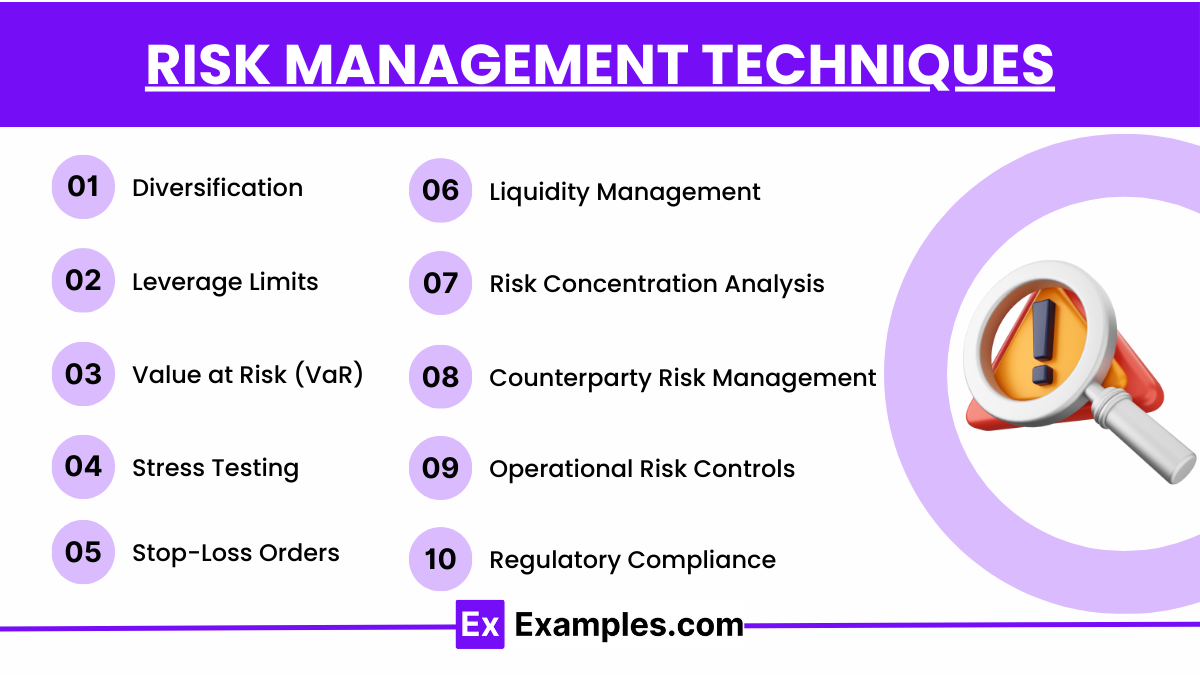

Hedge funds employ sophisticated risk management techniques to navigate the volatile markets in which they operate and to protect the capital of their investors. Effective risk management is critical, as these funds often engage in high-risk strategies that can result in substantial gains or losses. Here’s an overview of common risk management techniques used by hedge funds:

1. Diversification

- Spreading investments across various asset classes, sectors, geographies, and strategies to mitigate risk. This approach helps reduce the impact of any single failing investment on the overall portfolio.

2. Leverage Limits

- Setting strict limits on the amount of leverage, or borrowed money, that can be used in investment strategies to control potential losses.

3. Value at Risk (VaR)

- A statistical technique used to measure the risk of loss on an investment portfolio, estimating the maximum potential loss over a given time period under normal market conditions at a certain confidence level.

4. Stress Testing and Scenario Analysis

- Testing how a portfolio will perform under extreme market conditions by simulating both historical and hypothetical scenarios to evaluate potential impacts.

5. Stop-Loss Orders

- Utilizing stop-loss orders to automatically sell assets at a specified price limit to prevent substantial losses, especially useful in fast-moving market conditions.

6. Liquidity Management

- Ensuring that the fund maintains sufficient liquidity to meet redemption requests and margin calls, which includes keeping a portion of the portfolio in highly liquid assets.

7. Risk Concentration Analysis

- Monitoring and managing concentrations of risk in any single investment or correlated investments that might expose the fund to large potential losses.

8. Counterparty Risk Management

- Assessing and managing the risk associated with counterparties and brokers, particularly in derivative transactions, by diversifying counterparties and reviewing their creditworthiness.

9. Operational Risk Controls

- Implementing controls around trade execution, settlement, and reconciliation processes, with robust internal controls and audit practices to prevent errors and fraud.

10. Regulatory Compliance

- Staying abreast of and complying with relevant regulations that govern trading practices, marketing, and investor relations to avoid legal and regulatory issues.

Methods for Including Hedge Funds in a Portfolio

Including hedge funds in an investment portfolio can offer diversification, reduced overall volatility, and potential for higher returns, particularly during market downturns when traditional investments might underperform. Here are some effective methods for incorporating hedge funds into a portfolio:

1. Assessing Risk Tolerance and Investment Goals

- Before investing in hedge funds, assess your risk tolerance, investment horizon, and financial goals. Hedge funds often employ aggressive strategies that may carry higher risks and liquidity constraints.

- Ensure that hedge funds align with your broader investment strategy and are suitable given your risk tolerance levels.

2. Diversification Strategy

- Use hedge funds to complement traditional investments such as stocks and bonds. The non-correlated nature of many hedge fund strategies can provide benefits during different economic cycles.

- Hedge funds can be used to diversify away specific risks in the portfolio or to gain exposure to unique asset classes and strategies not typically accessible through traditional investments.

3. Allocation

- Determine the appropriate allocation to hedge funds within your portfolio. This usually depends on your risk tolerance and the volatility of the hedge fund strategies.

- Common allocations to alternative investments, including hedge funds, range from 5% to 20% of a total investment portfolio, but this can vary based on individual circumstances and market conditions.

4. Selection of Hedge Fund Managers

- Conduct thorough due diligence when selecting hedge fund managers. Analyze their track records, investment strategies, risk management practices, and fees.

- Look for managers with consistent performance across different market environments, transparent investment practices, and fees that are aligned with performance.

5. Understanding the Fees

- Be aware of the fee structures associated with hedge funds, typically including a management fee and a performance fee (often referred to as “two and twenty”).

- Ensure that the fee structure is reasonable and justifiable based on the returns and the value the hedge fund manager brings to your portfolio.

6. Monitoring and Rebalancing

- Regularly monitor the performance of hedge funds within the portfolio and rebalance as necessary to maintain your desired asset allocation and risk exposure.

- Hedge fund investments should be reviewed periodically to ensure they continue to meet the initial investment thesis and adjust for any changes in financial goals or market conditions.

7. Liquidity Management

- Consider the liquidity terms of hedge funds, as they often have lock-up periods during which you cannot withdraw your capital.

- Make sure that the liquidity of your hedge fund investments aligns with your overall liquidity needs and that you have sufficient liquid assets to meet any short-term obligations.

8. Tax Considerations

- Understand the tax implications of investing in hedge funds, as they can be complex and vary depending on the fund structure and the investor’s domicile.

- Consult with a tax advisor to navigate potential issues such as offshore investments, K-1 forms, and unrelated business taxable income (UBTI).

Examples

Example 1: Merger Arbitrage in Event-Driven Hedge Funds

Explore how an event-driven hedge fund uses merger arbitrage strategies to profit from mergers and acquisitions. Discuss how the fund takes long positions in target companies and possibly short positions in acquiring companies, aiming to capitalize on expected price changes when deals are announced.

Example 2: Global Macro Fund Positioning in Currency Markets

Study a global macro hedge fund strategy that takes positions in currency markets based on anticipated shifts in interest rates or geopolitical events. Analyze how the fund uses leverage and derivatives to benefit from currency fluctuations, illustrating the role of macroeconomic analysis in hedge fund investing.

Example 3: Fixed-Income Arbitrage in Relative Value Hedge Funds

Examine a fixed-income arbitrage strategy within a relative value hedge fund, which seeks to exploit pricing inefficiencies between related bonds or fixed-income securities. Discuss how the fund uses leverage to amplify returns, while also addressing the risks associated with interest rate changes and market liquidity.

Example 4: Hedge Fund of Funds for Diversified Exposure

Analyze a hedge fund of funds, which invests in a portfolio of different hedge fund strategies to provide diversified exposure. Discuss the benefits of risk reduction and access to multiple hedge fund strategies, as well as the additional layer of fees associated with this structure.

Example 5: Long-Short Equity Strategy During Market Volatility

Explore how a long-short equity hedge fund performs in a volatile market, taking long positions in stocks expected to perform well and short positions in those likely to underperform. Discuss the benefits of market neutrality in reducing exposure to overall market risk and the unique risks of short-selling.

Practice Questions

Question 1

Which of the following is a defining characteristic of hedge funds that distinguishes them from traditional mutual funds?

A. Hedge funds are only allowed to invest in equities

B. Hedge funds seek to achieve absolute returns, often irrespective of market direction

C. Hedge funds typically have low minimum investment requirements

D. Hedge funds are highly regulated and must disclose all holdings

Answer:

B. Hedge funds seek to achieve absolute returns, often irrespective of market direction

Explanation:

Hedge funds are designed to achieve absolute returns by employing various strategies that can generate positive returns even in down markets. Unlike traditional mutual funds, which are often benchmarked against an index, hedge funds aim for positive returns regardless of overall market conditions. They also tend to have higher minimum investment requirements, less regulation, and flexibility to invest in various assets, including derivatives and commodities.

Question 2

Which of the following best describes a long-short equity strategy?

A. Investing only in undervalued stocks

B. Going long on undervalued stocks and short on overvalued stocks

C. Holding a diversified portfolio of government bonds

D. Using options to hedge against currency risk

Answer:

B. Going long on undervalued stocks and short on overvalued stocks

Explanation:

A long-short equity strategy involves taking long positions in stocks that are expected to increase in value (undervalued) and short positions in stocks expected to decline (overvalued). This strategy aims to reduce market risk and potentially generate positive returns regardless of overall market direction. It contrasts with traditional long-only investing, which does not involve short-selling.

Question 3

What is the purpose of a “high-water mark” in hedge fund performance fees?

A. To set a minimum return that must be achieved before management fees are charged

B. To ensure that performance fees are only charged on new profits after a loss

C. To establish the maximum allowable leverage within the fund

D. To calculate the average returns over a specified period

Answer:

B. To ensure that performance fees are only charged on new profits after a loss

Explanation:

A high-water mark is a mechanism used in hedge fund performance fees to ensure that the fund manager only receives performance fees on profits above the highest level previously achieved. If the fund incurs a loss, no performance fees are charged until the fund’s value exceeds its previous peak, ensuring that investors are not charged fees on recovered losses.