Preparing for the CFA Exam requires a solid foundation in “Digital Assets,” an emerging area of finance that includes cryptocurrencies, blockchain-based tokens, and other digital financial instruments. Understanding Digital Assets helps candidates grasp the principles of decentralized finance, tokenization, and the implications for traditional asset classes. Mastery of this topic allows for insights into the mechanics of blockchain, risk factors associated with digital assets, and the evolving regulatory landscape. This knowledge is crucial for candidates aiming in the CFA exam by navigating the complexities of modern financial innovations.

Learning Objectives

In studying “Introduction to Digital Assets” for the CFA, you should aim to understand the fundamental concepts behind digital finance, including the blockchain, tokenization, and decentralized systems. This includes recognizing the unique characteristics of cryptocurrencies, the technological foundation of blockchain, and the evolving regulatory and security concerns in digital asset markets. Mastery of these concepts enables you to analyze the impact of digital assets on traditional financial markets and create well-informed investment strategies that consider the risks and opportunities of this growing asset class.

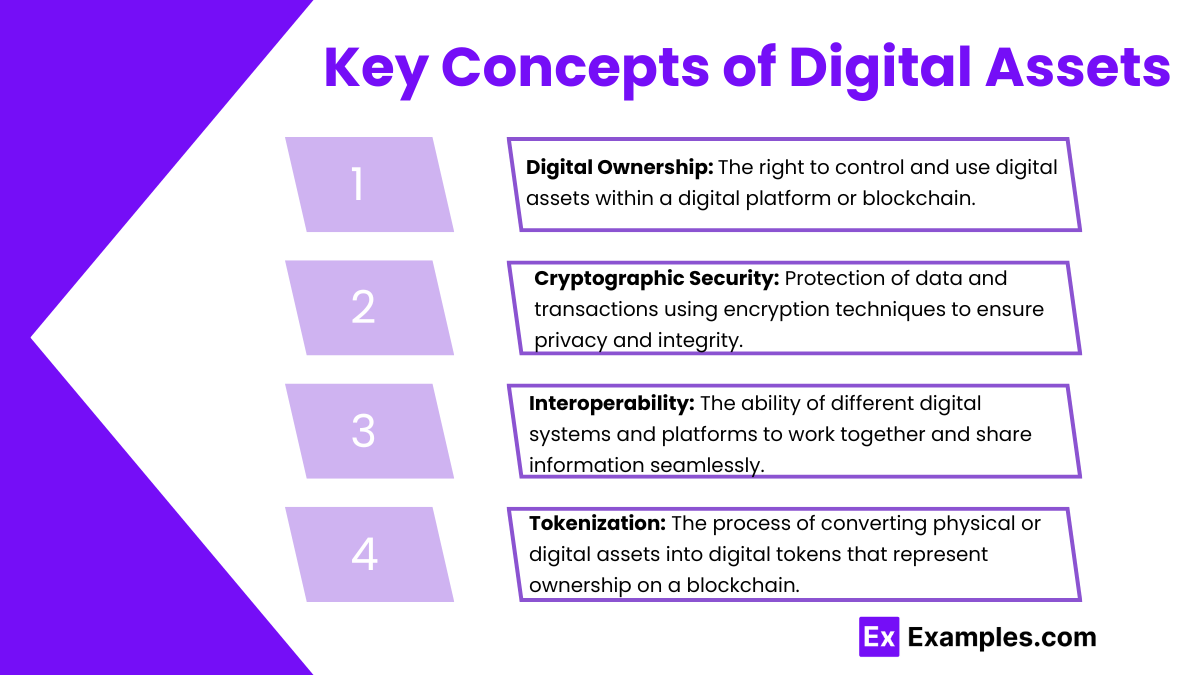

Key Concepts of Digital Assets

This section introduces the foundational ideas that define digital assets. Digital assets include anything stored in a digital format—like files, multimedia, and even digital ownership rights. They’re valuable because they can be owned, traded, and used by businesses or individuals in the same way physical assets are. Key concepts include:

- Digital Ownership: This refers to the rights that come with owning a digital item. Ownership allows control over the asset, including the ability to sell, lease, or use it for profit.

- Cryptographic Security: Security measures, often based on cryptography (like blockchain technology), protect the authenticity and security of digital assets. This is especially important for assets like cryptocurrencies and NFTs.

- Interoperability: This is the ability for digital assets to work across different platforms or systems. For instance, digital files that can be opened in multiple applications are more versatile and valuable.

- Tokenization: The process of converting assets (physical or digital) into digital tokens allows them to be easily bought, sold, and traded online. This is a key concept in cryptocurrencies and NFTs.

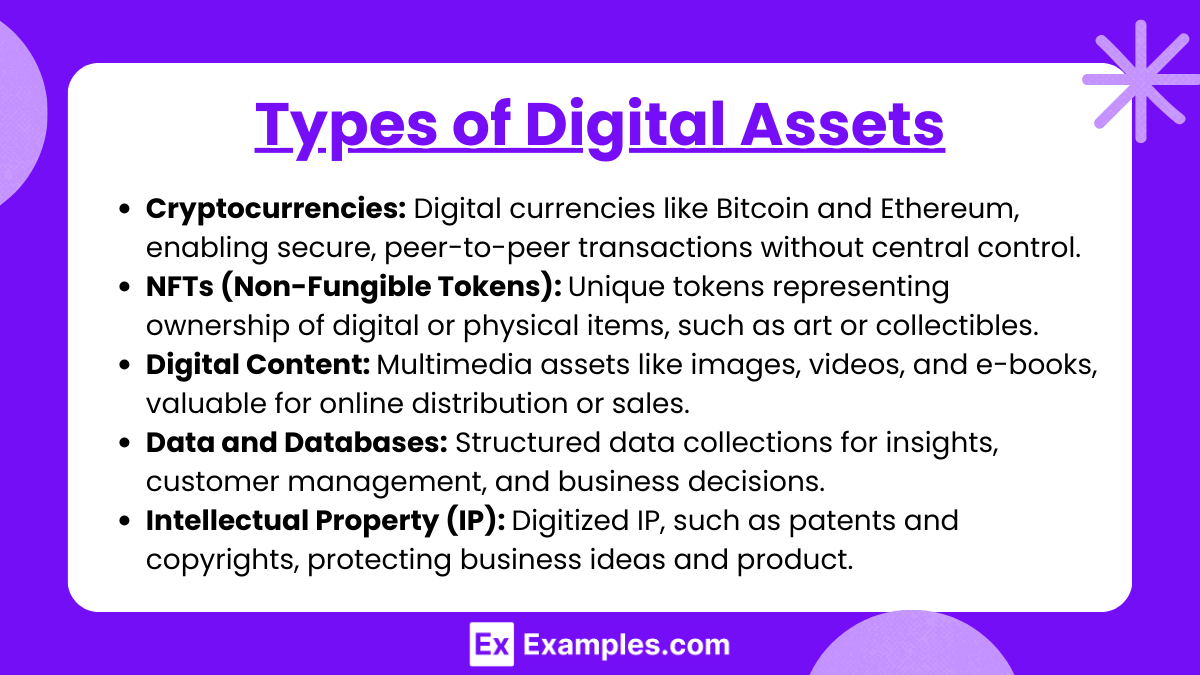

Types of Digital Assets

Digital assets can take many forms, and this section breaks down some of the most common types:

- Cryptocurrencies: Digital forms of money like Bitcoin or Ethereum. These are decentralized currencies based on cryptographic technology, allowing secure, peer-to-peer transactions without a central authority.

- NFTs (Non-Fungible Tokens): NFTs are unique tokens that signify ownership of specific digital or physical items, often tied to digital art, music, or collectibles. Each NFT is unique and can be sold or traded.

- Digital Content: Any multimedia content, like images, videos, music, or e-books. These are valuable for businesses as they can be distributed or sold online.

- Data and Databases: These include structured collections of data, often used by businesses to gain insights, manage customer relationships, or improve decision-making.

- Intellectual Property (IP): Digitized IP includes patents, copyrights, or trademarks that are valuable to businesses as they protect proprietary ideas or products.

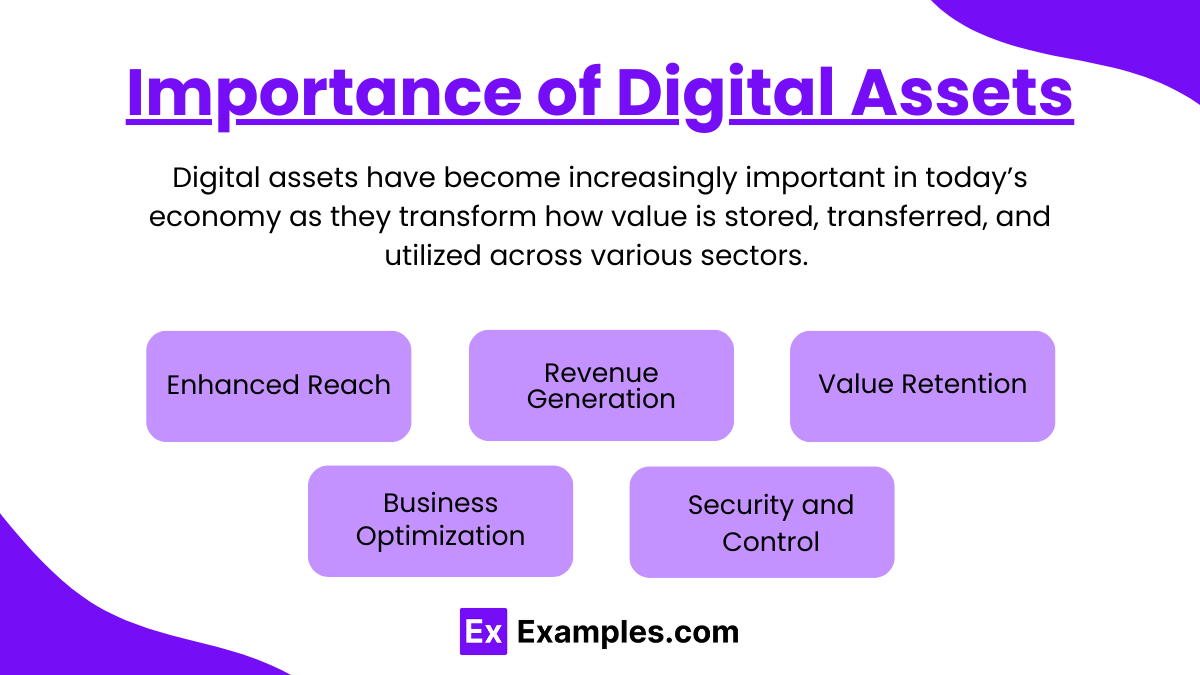

Importance of Digital Assets

The final section highlights why digital assets matter in today’s digital landscape. Here’s a breakdown:

- Enhanced Reach: Digital assets help companies connect with a global audience. For example, digital marketing content can reach people worldwide.

- Revenue Generation: Companies can monetize digital assets by selling digital content, offering subscription-based services, or licensing content.

- Value Retention: Certain digital assets can increase in value over time, like cryptocurrencies or NFTs, making them potential investment opportunities.

- Business Optimization: Data-driven assets allow companies to improve their strategies and decision-making, making their operations more efficient.

- Security and Control: Owning digital assets means having secure, controlled access to valuable information or content, ensuring that intellectual property is protected.

Examples

Example 1. Educational Course Content

“Introduction to Digital Assets” serves as a foundational module in finance and technology courses, introducing students to key digital asset concepts like blockchain, cryptocurrency, and tokenization. This module helps students understand the basics of digital assets, including their creation, use, and impact on financial systems.

Example 2. Professional Certification

For certifications in financial technology, “Introduction to Digital Assets” is often included as an introductory segment. It provides professionals with essential knowledge of how digital assets operate within the financial ecosystem, helping them apply these principles in roles such as financial analysis, investment, or technology development.

Example 3. Corporate Training Programs

Many corporations have implemented “Introduction to Digital Assets” in their training curriculum to keep employees informed on emerging digital trends. This training enhances employees’ understanding of assets like cryptocurrencies and non-fungible tokens (NFTs), equipping them to handle related business transactions, compliance requirements, and security measures.

Example 4. Investment Strategy Development

Investment firms might use “Introduction to Digital Assets” as a preliminary study for portfolio managers. This module can explain the fundamentals of digital asset markets, risk factors, and potential returns, which aids investors in evaluating whether to include digital assets in client portfolios.

Example 5. Regulatory and Compliance Workshops

Regulatory bodies may use “Introduction to Digital Assets” as part of compliance training workshops to familiarize their employees with digital asset frameworks. Understanding these assets is crucial for regulators to ensure that companies operate within legal parameters when dealing with cryptocurrencies and other digital assets, helping them craft appropriate policies and oversight strategies.

Practice Questions

Question 1

Which of the following best describes a digital asset?

A) A physical asset that is digitized for online viewing

B) Any content or object that exists in a digital format and has value

C) Any cryptocurrency that can be traded on an exchange

D) Only assets created through blockchain technology

Answer: B) Any content or object that exists in a digital format and has value

Explanation: A digital asset refers to any content or object that is stored digitally and has intrinsic value. This broad definition includes items like cryptocurrencies, non-fungible tokens (NFTs), digital files (such as documents, photos, videos), and tokenized assets. The key aspect of a digital asset is that it must exist in a digital format and hold some form of value. Option A is incorrect because a digital asset doesn’t necessarily start as a physical asset. Option C is too narrow, as digital assets are not limited to cryptocurrencies. Option D is incorrect as well, as digital assets do not have to be created on blockchain technology; many digital assets exist outside of blockchain environments.

Question 2

Which of the following is a key feature of blockchain technology that enhances the security of digital assets?

A) Centralized control and management

B) Use of cryptographic hashing

C) Ability to reverse transactions

D) Lack of transparency in transactions

Answer: B) Use of cryptographic hashing

Explanation: Blockchain technology employs cryptographic hashing, which is essential for securing digital assets by creating unique digital fingerprints for each transaction. This process ensures data integrity, making it difficult to alter past transactions and enhancing the security of digital assets. Option A is incorrect because blockchain is decentralized, which enhances its security by distributing control across the network. Option C is also incorrect; transactions on blockchain are immutable and cannot be reversed, which is another aspect of its security. Option D is incorrect, as blockchain is highly transparent; the distributed ledger allows all participants to see the transaction history, which adds another layer of security and trust.

Question 3

Which of the following is an example of a non-fungible digital asset?

A) Bitcoin

B) Ethereum

C) Digital artwork represented as an NFT

D) Stablecoin like USDC

Answer: C) Digital artwork represented as an NFT

Explanation: A non-fungible digital asset is unique and cannot be exchanged on a one-to-one basis with another asset of the same kind, which is what makes NFTs (non-fungible tokens) distinctive. NFTs often represent digital artworks, collectibles, and other unique digital items. Option A (Bitcoin) and Option B (Ethereum) are examples of fungible digital assets, meaning they can be exchanged with others of the same type and retain equal value. Option D (USDC) is a stablecoin, which is also fungible. Only digital artwork represented as an NFT (Option C) is non-fungible because each NFT is unique and distinct in its value and attributes, even if it represents similar artwork.