Preparing for the CFA Exam requires a comprehensive understanding of “Introduction to Risk Management,” a fundamental topic in finance. Mastery of risk identification, assessment, and mitigation strategies is essential. This knowledge provides insights into safeguarding assets, optimizing returns, and achieving financial objectives, critical for achieving a high CFA score.

Learning Objective

In studying “Introduction to Risk Management” for the CFA Exam, you should aim to understand the fundamental principles of identifying, assessing, and managing various types of financial risk, including market, credit, operational, and liquidity risk. Analyze the methods used to measure risk exposure, such as Value at Risk (VaR) and scenario analysis. Evaluate strategies for mitigating risk, including diversification, hedging, and insurance. Additionally, explore the role of risk management in achieving financial stability and aligning with investment objectives. Apply this knowledge to assess risk in portfolio construction, asset allocation, and financial decision-making, preparing you for practical applications on the CFA Exam.

Understanding Risk Management

Risk management in investing involves identifying, assessing, and controlling potential financial risks to protect a portfolio’s value and achieve long-term objectives. Here are the key concepts:

- Risk Identification: Recognizing various risks, such as market risk, credit risk, and liquidity risk, that could affect investments.

- Risk Assessment: Evaluating the potential impact and likelihood of identified risks, helping prioritize which ones need attention.

- Diversification: Spreading investments across assets, sectors, and geographies to reduce the impact of any single asset’s poor performance.

- Asset Allocation: Balancing risk and return by distributing investments among asset classes (e.g., stocks, bonds) based on the investor’s risk tolerance and goals.

- Hedging: Using financial instruments like options or futures to protect against adverse price movements.

- Regular Monitoring: Continuously assessing the portfolio to adjust for changing market conditions or risks.

Types of Financial Risk

Financial risk refers to the potential for losses in an investment due to various factors. Here are the main types of financial risk:

- Market Risk: The risk of losses due to changes in market conditions, such as stock prices, interest rates, and currency exchange rates.

- Credit Risk: The possibility that a borrower will default on their financial obligations, affecting bondholders and lenders.

- Liquidity Risk: The risk of not being able to sell an asset quickly without impacting its price, often relevant for assets with low trading volumes.

- Operational Risk: Risks arising from internal failures, such as system breakdowns, human errors, or fraud, that can impact financial performance.

- Interest Rate Risk: The potential for losses due to changes in interest rates, which can affect the value of bonds and other fixed-income securities.

- Inflation Risk: The risk that inflation will erode the purchasing power of returns, affecting assets like cash and fixed income.

- Political/Regulatory Risk: The risk of financial losses due to changes in government policy, regulation, or geopolitical events impacting markets.

- Currency (Exchange Rate) Risk: The risk of losses due to fluctuations in foreign exchange rates, particularly for investors in international markets.

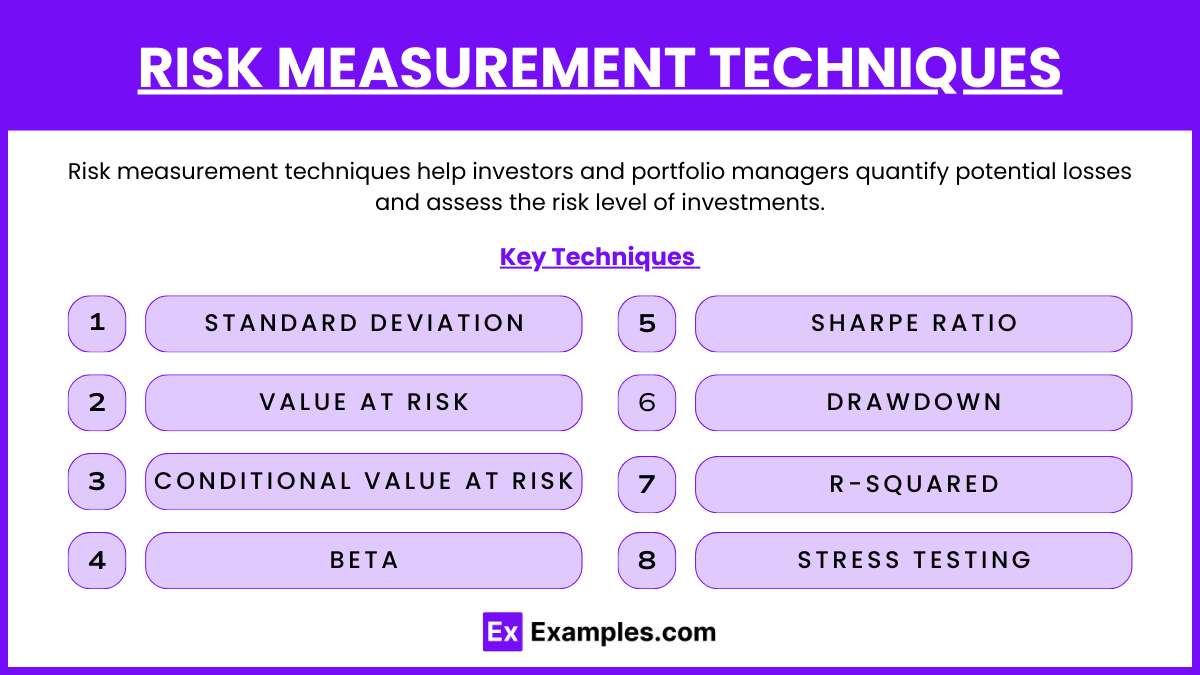

Risk Measurement Techniques

Risk measurement techniques help investors and portfolio managers quantify potential losses and assess the risk level of investments. Here are key techniques used:

- Standard Deviation: Measures the variability of returns from the mean, indicating how much returns can fluctuate. Higher standard deviation implies higher volatility and risk.

- Value at Risk (VaR): Estimates the maximum potential loss within a given time frame at a specific confidence level (e.g., 95%). VaR is widely used for assessing downside risk.

- Conditional Value at Risk (CVaR): Measures the average losses that occur beyond the VaR threshold, providing insight into tail risk or extreme losses.

- Beta: Assesses an asset’s sensitivity to market movements. A beta greater than 1 means the asset is more volatile than the market, while a beta less than 1 indicates lower volatility.

- Sharpe Ratio: Calculates risk-adjusted return by dividing the portfolio’s excess return over the risk-free rate by its standard deviation. A higher Sharpe ratio indicates better risk-adjusted performance.

- Drawdown: Measures the peak-to-trough decline in an investment’s value over a period, highlighting the potential downside risk.

- R-squared: Indicates the percentage of a portfolio’s movements that can be attributed to movements in a benchmark index, providing context for diversification and systemic risk.

- Stress Testing: Simulates extreme market scenarios to evaluate how a portfolio would perform in adverse conditions, such as a financial crisis.

Implementing a Risk Management Framework

Implementing a risk management framework is essential for identifying, measuring, and controlling risks within a portfolio. This structured approach helps align risk management practices with an investor’s objectives and risk tolerance. Key steps include:

- Risk Identification: Recognize relevant risks (market, credit, liquidity) within the portfolio.

- Risk Assessment: Quantify risks using tools like standard deviation and Value at Risk (VaR).

- Risk Tolerance & Limits: Set acceptable risk levels based on goals and tolerance, such as maximum drawdown limits.

- Risk Mitigation: Control risk through diversification, asset allocation, and hedging techniques.

- Monitoring & Reporting: Track risks and compliance regularly through reports to detect deviations.

- Review & Adjustment: Periodically adjust the framework to align with changing market conditions or goals.

Examples

Example 1: Managing Market Risk in an Equity Portfolio

- Study the application of Value at Risk (VaR) in assessing potential losses in an equity portfolio. Analyze how VaR helps quantify exposure and informs decisions on setting stop-loss orders or using options to hedge against market volatility.

Example 2: Credit Risk in Corporate Bond Investments

- Explore credit risk management in a corporate bond portfolio by examining the role of credit ratings and credit default swaps (CDS) in hedging against potential defaults. Discuss strategies for diversifying bond holdings to reduce the impact of credit events on portfolio value.

Example 3: Hedging Currency Risk for International Investments

- Evaluate the use of currency futures and options to hedge against currency fluctuations in a portfolio with significant international exposure. Examine how these tools help manage the risk of adverse currency movements that could impact returns from foreign investments.

Example 4: Liquidity Risk During Market Downturns

- Analyze the liquidity challenges faced by investment portfolios during periods of market stress, such as the 2008 financial crisis. Study strategies like maintaining cash reserves and holding highly liquid assets to ensure that a portfolio can meet redemption requests without forced selling.

Example 5: Operational Risk Management in a Financial Institution

- Investigate operational risk in a bank, focusing on risks related to internal processes, cyber threats, and compliance. Discuss the implementation of risk management frameworks, including insurance policies and robust internal controls, to mitigate potential operational losses.

Practice Questions

Question 1

Which of the following best describes Value at Risk (VaR)?

A. It estimates the maximum potential loss over a specified period at a given confidence level.

B. It identifies all potential risks in a portfolio without quantifying them.

C. It measures only systematic risk associated with a portfolio.

D. It guarantees no losses beyond a specified threshold.

Answer:

A. It estimates the maximum potential loss over a specified period at a given confidence level.

Explanation:

Value at Risk (VaR) is a widely used risk management tool that provides an estimate of the potential maximum loss over a defined time period with a given confidence level (e.g., 95% or 99%). It does not guarantee no losses beyond the threshold but gives a statistical measure of the likelihood of larger losses.

Question 2

What is the primary purpose of diversification in risk management?

A. To eliminate all market risks

B. To reduce unsystematic risk by spreading investments across different assets

C. To increase the volatility of the portfolio for higher returns

D. To guarantee positive returns in all market conditions

Answer:

B. To reduce unsystematic risk by spreading investments across different assets

Explanation:

Diversification aims to reduce unsystematic risk, or asset-specific risk, by investing across various asset classes, sectors, and geographies. While it cannot eliminate market-wide (systematic) risk, diversification helps reduce the overall portfolio risk by not being overly reliant on any single asset or asset class.

Question 3

An investor uses futures contracts to lock in prices for raw materials in a manufacturing portfolio. This is an example of managing which type of risk?

A. Market risk

B. Credit risk

C. Operational risk

D. Liquidity risk

Answer:

A. Market risk

Explanation:

Using futures contracts to lock in prices is a way to hedge against market risk, specifically price volatility in raw materials. By securing a set price, the investor reduces the uncertainty related to price fluctuations in the future, helping to stabilize costs and manage potential market risk.