Preparing for the CFA Exam requires a comprehensive understanding of the “Global Investment Performance Standards” (GIPS), which provide a framework for calculating and presenting investment performance. GIPS aims to promote transparency and fair representation of investment performance, ensuring that investors receive reliable and comparable information. Mastery of GIPS principles enables candidates to evaluate performance claims critically, assess manager effectiveness, and understand the ethical implications of performance reporting. This knowledge is essential for candidates pursuing the CFA exam as they navigate the complexities of investment performance evaluation.

Learning Objectives

In studying “Introduction to the Global Investment Performance Standards” for the CFA, you should aim to understand the key principles and methodologies that define investment performance reporting. This includes recognizing the requirements for performance calculation, the importance of transparency, and the ethical considerations in presenting performance results. Mastery of these standards enables you to assess performance claims critically, understand the implications for investors and managers, and create strategies that align with the GIPS framework, ensuring a fair representation of investment results in the global marketplace.

What are GIPS?

The Global Investment Performance Standards (GIPS) represent a universally accepted set of principles designed to provide guidance for investment firms regarding the calculation and presentation of investment performance. The goal is to ensure that performance reports are fair, comparable, and consistent across the industry. GIPS cover various aspects of performance measurement, including:

- Calculation of Returns: How returns should be calculated to ensure comparability.

- Presentation of Performance: Guidelines on how to present performance results to clients and stakeholders.

- Disclosures: Requirements for disclosures that enhance the transparency of performance reports.

GIPS are structured to apply to all asset classes, including equities, fixed income, and alternative investments, ensuring that all investment management firms can adopt the standards regardless of their specific focus.

Purposes of Global Investment Performance Standards

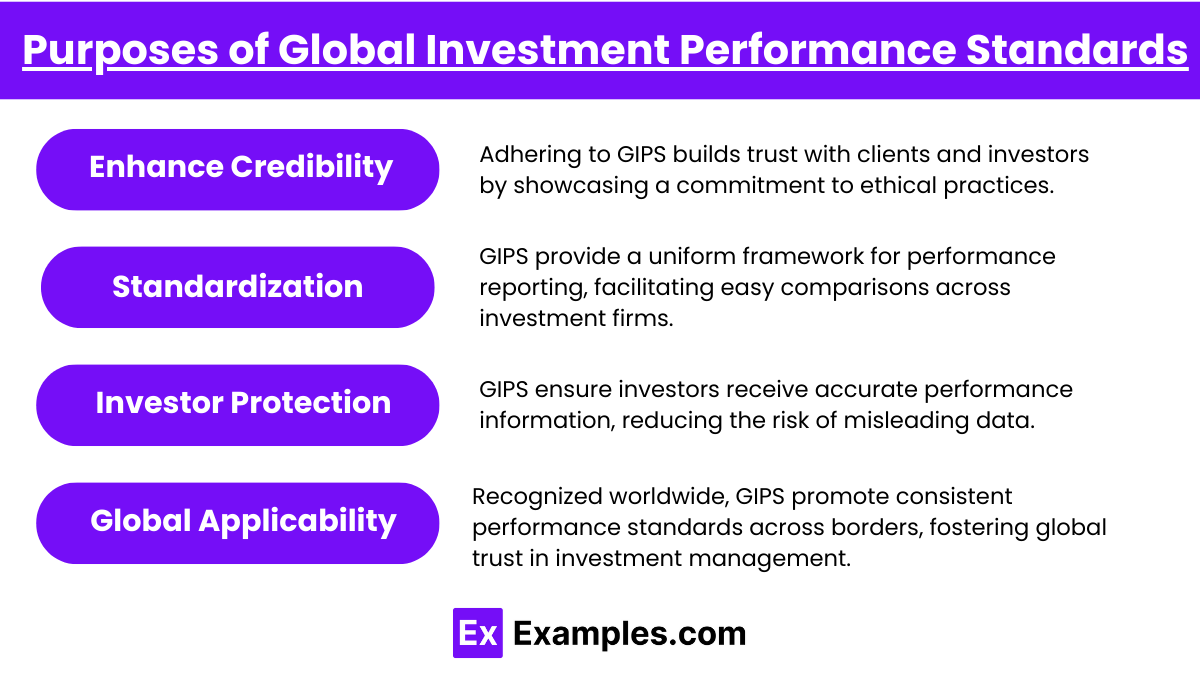

- Enhance Credibility: By adhering to GIPS, firms demonstrate a commitment to ethical practices, which can significantly enhance their credibility in the eyes of clients and investors. This commitment to transparency helps attract and retain clients seeking trustworthy investment management.

- Standardization: GIPS provide a standardized framework for performance measurement and reporting. This uniformity allows investors to compare performance across different investment firms and products easily, making it a vital tool for informed decision-making.

- Investor Protection: GIPS aim to protect investors by ensuring that they receive accurate and truthful performance information. By fostering transparency, GIPS help mitigate the risks associated with misleading or incomplete performance data.

- Global Applicability: GIPS are recognized internationally, which helps promote a uniform standard for performance reporting across borders, fostering global trust and consistency in investment management.

Key Components of Global Investment Performance Standards

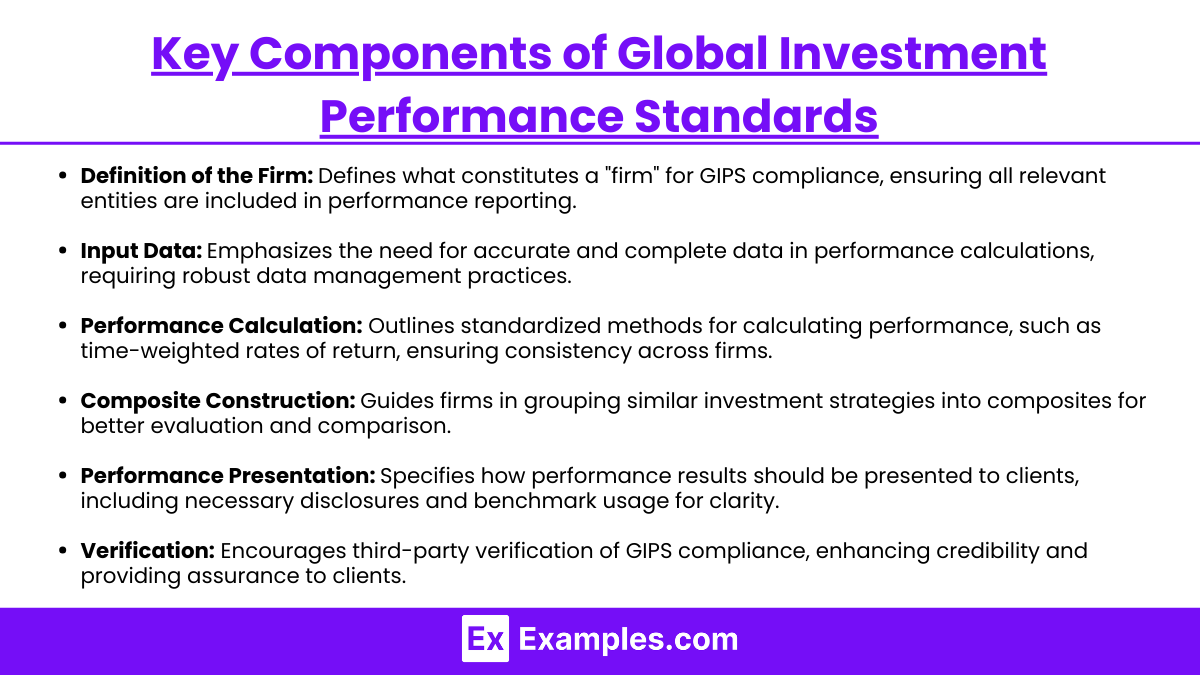

The key components of the Global Investment Performance Standards (GIPS) provide a framework for investment firms to ensure accurate, consistent, and transparent performance reporting. Here are the main components explained:

- Definition of the Firm: This component establishes what constitutes a “firm” for the purpose of GIPS compliance, ensuring that all relevant entities under a single investment management organization are included in performance reporting.

- Input Data: This section emphasizes the importance of using accurate and complete data for performance calculations. It mandates firms to maintain robust data management practices to support reliable performance reporting.

- Performance Calculation: GIPS outlines standardized methodologies for calculating performance, including time-weighted rates of return. This ensures that all firms use consistent methods, making comparisons more straightforward and reliable.

- Composite Construction: This component guides firms in grouping similar investment strategies into composites, which allows for better performance evaluation and comparison. Composites should include all discretionary portfolios that the firm manages, ensuring comprehensive representation.

- Performance Presentation: This section details how performance results must be presented to clients, including required disclosures and the appropriate use of benchmarks. This ensures that investors receive clear and comprehensive information about investment performance.

- Verification: GIPS encourages firms to undergo third-party verification of their compliance with the standards. Verification enhances credibility and provides assurance to clients that the firm adheres to GIPS guidelines.

Examples

Example 1. Enhancing Reporting Accuracy

Using the “Introduction to the Global Investment Performance Standards” (GIPS) can significantly enhance the accuracy of investment performance reporting. By adhering to these internationally recognized standards, investment firms can ensure that their performance data is consistent, comparable, and transparent. This not only builds trust with clients but also helps to mitigate the risk of misrepresentation, leading to more informed investment decisions.

Example 2. Facilitating Compliance

The GIPS standards provide a framework for investment managers to demonstrate compliance in a rigorous and standardized manner. Using the “Introduction to the Global Investment Performance Standards” helps firms develop policies and procedures that align with these guidelines, ensuring that all performance presentations meet the required ethical and professional standards. This compliance can be a valuable differentiator in a competitive market, showcasing the firm’s commitment to high standards of practice.

Example 3. Improving Client Relationships

By using the “Introduction to the Global Investment Performance Standards,” firms can enhance their client relationships through greater transparency and accountability. The GIPS standards encourage firms to present performance results in a clear and standardized way, making it easier for clients to understand and evaluate the performance of their investments. This transparency fosters trust and can lead to stronger, long-term client partnerships.

Example 4. Supporting Marketing Efforts

Investment firms can leverage the “Introduction to the Global Investment Performance Standards” as part of their marketing strategy. By emphasizing adherence to GIPS in promotional materials, firms can differentiate themselves from competitors and appeal to institutional investors who prioritize standardized and verifiable performance reporting. This can enhance the firm’s reputation and attract new clients who value ethical investment practices.

Example 5. Educating Stakeholders

Using the “Introduction to the Global Investment Performance Standards” serves as an educational tool for various stakeholders, including clients, investment professionals, and regulatory bodies. By familiarizing stakeholders with GIPS, firms can promote a better understanding of performance metrics and the importance of ethical standards in investment management. This education can lead to more engaged clients and a well-informed investment community, ultimately contributing to a more robust market environment.

Practice Questions

Question 1

What is the primary purpose of the Global Investment Performance Standards (GIPS)?

A) To standardize the fees charged by investment firms.

B) To provide a framework for calculating and presenting investment performance results.

C) To regulate the investment industry and enforce compliance.

D) To create a universal currency for global investments.

Correct Answer: B) To provide a framework for calculating and presenting investment performance results.

Explanation:

The primary purpose of GIPS is to establish a standardized methodology for calculating and presenting investment performance results. This framework is designed to ensure that performance data is reported in a manner that is consistent, comparable, and transparent, enabling investors to make informed decisions. While GIPS helps improve the integrity and accuracy of performance reporting, it does not regulate fees, enforce compliance, or create a universal currency.

Question 2

Which of the following statements is true regarding the GIPS standards?

A) GIPS are mandatory for all investment firms globally.

B) GIPS allow for flexibility in performance presentation based on the firm’s discretion.

C) Compliance with GIPS is voluntary but recommended for investment firms.

D) GIPS do not require the use of specific performance measurement methodologies.

Correct Answer: C) Compliance with GIPS is voluntary but recommended for investment firms.

Explanation:

Compliance with GIPS is indeed voluntary; however, it is strongly recommended for investment firms that wish to enhance their credibility and the trust of clients. Adhering to GIPS allows firms to present their performance in a standardized manner that is widely recognized by investors. While GIPS provide guidelines for performance measurement and presentation, they do not dictate mandatory compliance, and firms can choose whether to follow the standards. The standards encourage consistency and comparability without restricting the use of specific methodologies, as long as they align with GIPS principles.

Question 3

What is one key benefit of adhering to GIPS for investment firms?

A) It guarantees superior investment returns.

B) It enhances the firm’s marketing and competitive positioning.

C) It eliminates the need for performance audits.

D) It standardizes compensation structures across the industry.

Correct Answer: B) It enhances the firm’s marketing and competitive positioning.

Explanation:

One of the significant benefits of adhering to GIPS for investment firms is that it enhances their marketing and competitive positioning. By demonstrating compliance with a globally recognized set of standards, firms can differentiate themselves in a crowded market, appealing to institutional and sophisticated investors who prioritize transparency and integrity in performance reporting. While GIPS do not guarantee superior returns or eliminate the need for audits, they do provide a framework that can help firms build trust with clients and stakeholders, leading to stronger business relationships. GIPS do not address compensation structures; thus, that option is incorrect.