Preparing for the CFA Exam requires a comprehensive understanding of "Investments in Private Capital: Equity and Debt," a crucial area of alternative investments. Mastery of private equity and private debt structures, valuation, and risk factors is essential. This knowledge provides insights into financing growth, generating returns, and managing portfolio risks, critical for achieving a high CFA score.

Learning Objective

In studying "Investments in Private Capital: Equity and Debt" for the CFA Exam, you should aim to understand the characteristics, structures, and valuation methods of private capital investments, including private equity and private debt. Analyze the key stages of private equity, from venture capital and growth equity to buyouts and distressed investing, as well as private debt financing options like mezzanine and direct lending. Evaluate risk factors such as illiquidity and management fees, along with return drivers like operational improvements and leverage. Apply this knowledge to assess the role of private capital in portfolio diversification and long-term return potential, preparing for practical applications on the CFA Exam.

Overview of Private Capital Investments

Private capital investments refer to capital investment into companies that are not publicly traded. These investments are primarily made through private equity, venture capital, private debt, and real estate vehicles, among others.

Types of Private Capital Investments

Private Equity:

Focuses on investing in private companies with the aim of improving their value through strategic guidance, operational improvements, and financial restructuring.

Can involve buyouts, growth capital, and turnaround investments where the investor takes significant ownership stakes.

Venture Capital:

Targets early-stage companies with high growth potential.

Venture capitalists provide funding in exchange for equity, often bringing management expertise and industry connections to the table.

Private Debt:

Includes non-bank loans, mezzanine financing, distressed debt, and direct lending.

Investors typically receive fixed interest payments, offering an income stream plus the potential for capital gains if debt is converted to equity.

Real Estate Private Capital:

Investment in residential, commercial, or industrial real estate projects.

Can involve development, rehabilitation, or repositioning of properties to increase their value and generate high returns.

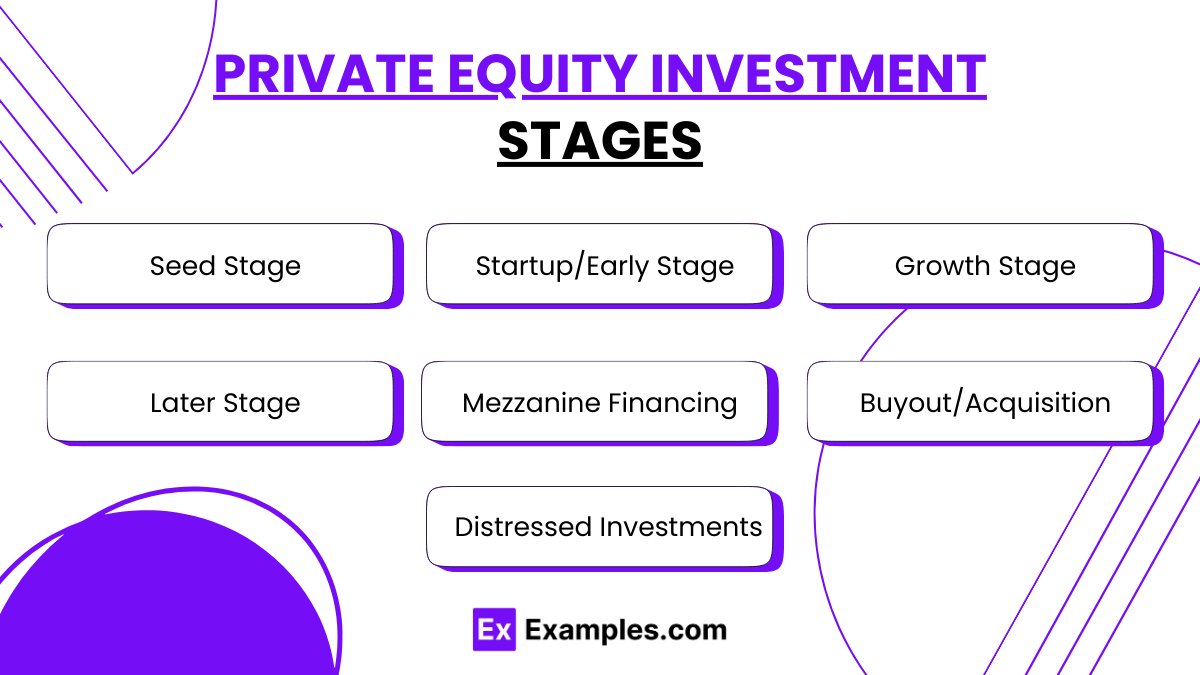

Private Equity Investment Stages

Private equity (PE) investment involves various stages, each targeting different types of companies based on their maturity, market position, and funding requirements. Understanding these stages is crucial for both investors and companies seeking private equity funding. Here’s a breakdown of the key stages in private equity investment:

1. Seed Stage

Focus: Initial funding to help an idea or early version of a product get off the ground.

Investment Purpose: Often used for market research, product development, and building a management team.

Investors: Typically involves angel investors or early-stage venture capital firms.

2. Startup/Early Stage

Focus: Companies that have a developed product or service but are in the initial phases of commercial operation.

Investment Purpose: Funds are used for marketing, hiring staff, and further product development.

Investors: Venture capital firms are common investors at this stage, providing capital in exchange for equity.

3. Growth Stage (Series A & B Funding)

Focus: Companies that have proven their business model and shown some revenue growth but need funding to expand operations or market presence.

Investment Purpose: Scaling up operations, expanding into new markets, increasing sales and marketing efforts.

Investors: Growth equity investors and venture capital firms typically invest during these rounds.

4. Later Stage (Series C & D Funding)

Focus: Well-established companies that look for additional funding to optimize their operations, develop new products, or expand globally.

Investment Purpose: To build out a solid infrastructure for a company nearing a public offering or a major corporate sale.

Investors: Includes more substantial private equity firms, late-stage venture capitalists, and sometimes strategic investors.

5. Mezzanine Financing/Bridge Funding

Focus: Companies preparing for a public offering or a significant corporate sale in the near term.

Investment Purpose: To finance specific growth projects or restructure existing debt.

Investors: Private equity firms, venture capital, and debt funds that provide subordinated debt, which is often convertible into equity.

6. Buyout/Acquisition

Focus: Acquisition of a majority or significant minority stake in relatively mature companies.

Investment Purpose: To take control of a company's operations and actively enhance its value through strategic redirection, operational improvements, and cost reduction.

Investors: Larger private equity firms specializing in leveraged buyouts (LBOs).

7. Turnaround/Distressed Investments

Focus: Investing in underperforming or distressed companies with the aim of turning them around.

Investment Purpose: Restructuring operations, improving profitability, and stabilizing finances.

Investors: Specialized private equity firms with expertise in restructuring and turnaround strategies.

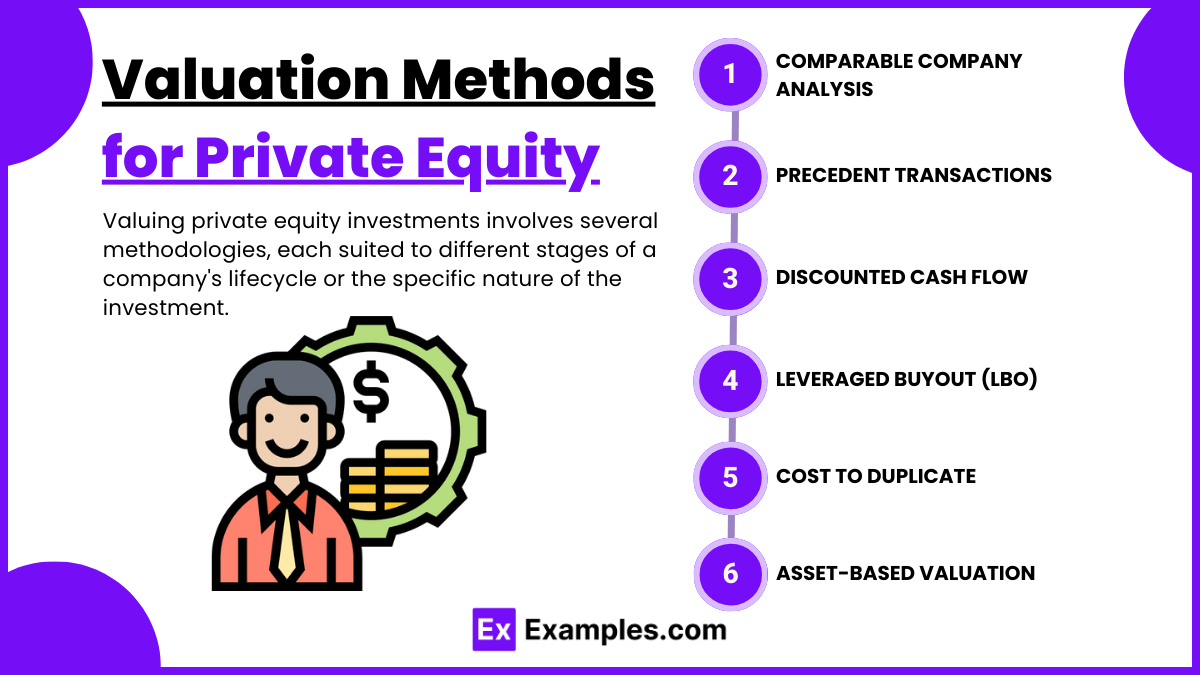

Valuation Methods for Private Equity

Valuing private equity investments involves several methodologies, each suited to different stages of a company's lifecycle or the specific nature of the investment. Here are some of the most commonly used valuation methods in private equity:

1. Comparable Company Analysis (Comps)

This method involves comparing the target company to publicly traded companies with similar operational, financial, and market characteristics.

It's particularly useful for valuing mature companies that operate in industries with many public comparables.

Metrics such as price-to-earnings (P/E), EV/EBITDA, or price-to-sales ratios of comparable companies are used to derive valuation multiples that are applied to the private company.

2. Precedent Transactions

This approach looks at prices paid for similar companies in recent transactions within the same industry.

Useful when there is a sufficient volume of recent deals in the market that can provide relevant transaction multiples.

Valuation is based on transaction multiples like price-to-earnings, price-to-revenue, or EV/EBITDA derived from similar deals.

3. Discounted Cash Flow (DCF) Analysis

The DCF method estimates the present value of an investment based on its forecasted future cash flows.

Appropriate for companies with predictable and stable cash flows and for growth companies where future potential can be reasonably estimated.

Future cash flows are projected based on detailed financial modeling and are discounted back to the present using a discount rate that reflects the riskiness of the cash flows.

4. Leveraged Buyout (LBO) Analysis

This is a specific financial model used to determine the potential return on equity, based on the use of significant amounts of debt to finance the purchase of a company.

Typically used in scenarios where a private equity firm aims to acquire a company using a combination of equity and borrowed money.

The LBO model projects the business's operating results and estimates the exit value, calculating the potential internal rate of return (IRR) to equity investors.

5. Cost to Duplicate

Estimates the cost to recreate the business asset by asset from the ground up.

This can be suitable for startups or technology companies where the value is closely tied to proprietary technologies or intellectual property.

Summing the costs associated with reproducing the company's physical, technological, and intellectual property assets.

6. Asset-Based Valuation

This method values a company based on the value of its assets net of liabilities.

More common for companies that hold significant tangible assets or for distressed companies where liquidation is a possibility.

Assets are valued at either their book value or, more realistically, their market value, if liquidated.

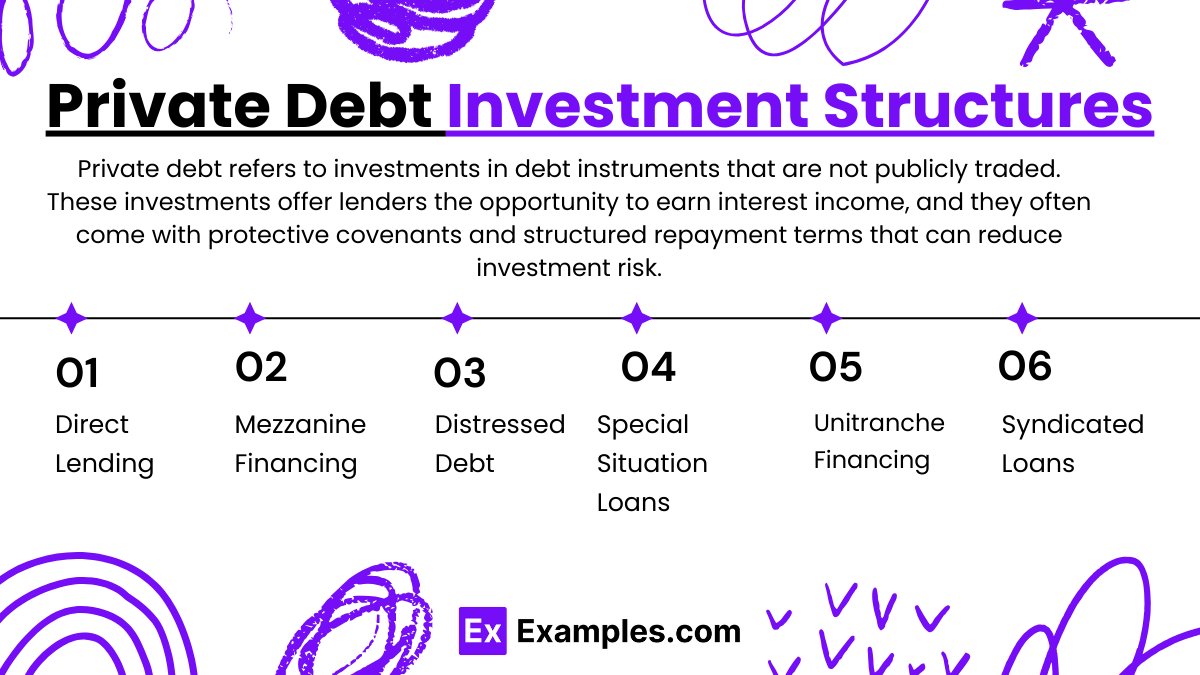

Private Debt Investment Structures

Private debt refers to investments in debt instruments that are not publicly traded. These investments offer lenders the opportunity to earn interest income, and they often come with protective covenants and structured repayment terms that can reduce investment risk. Here’s a breakdown of common structures in private debt investments:

1. Direct Lending

Involves lending directly to SMEs or larger corporations without an intermediary.

Loans are typically senior secured with fixed interest rates, offering stable cash flows.

2. Mezzanine Financing

A blend of debt and equity features, subordinated to senior debt.

Higher interest rates, often includes equity components like warrants for enhanced returns.

3. Distressed Debt

Investments in the debt of financially troubled companies with recovery potential.

High risk and potentially high returns, with debt often purchased at a discount.

4. Special Situation Loans

Loans tailored for complex circumstances like turnarounds or bridge financing.

Requires deep understanding of the borrower’s situation, carries higher risk and potential returns.

5. Unitranche Financing

Combines senior and subordinated debt into one layer.

Simplifies the capital stack, generally has a higher cost due to blended rates.

6. Syndicated Loans

Loans arranged by one or more banks and distributed among a group of lenders.

Reduces individual lender risk, used in larger financing needs.

Examples

Example 1: Venture Capital Investment in a Tech Startup

Analyze a venture capital investment in an early-stage technology startup. Discuss the high-risk, high-return nature of such investments, as well as the valuation challenges and exit strategies (e.g., IPO or acquisition) that venture capitalists consider when investing in startups.

Example 2: Leveraged Buyout (LBO) of a Mature Company

Study a private equity firm’s leveraged buyout (LBO) of a stable, cash-generating company. Explore the use of debt to finance the acquisition, the impact of leverage on potential returns, and how operational improvements or financial engineering are used to enhance the value of the acquired company.

Example 3: Direct Lending to a Middle-Market Firm

Examine a direct lending deal where a non-bank institution provides a loan to a middle-market firm. Discuss the role of direct lending in private debt, the higher yields associated with middle-market lending, and the specific risks involved, including credit risk and illiquidity.

Example 4: Mezzanine Financing for Business Expansion

Explore mezzanine financing provided to a company seeking growth capital. Discuss how mezzanine debt combines features of debt and equity, the potential for higher returns through equity participation (warrants), and the subordinated nature of mezzanine debt relative to senior debt.

Example 5: Distressed Debt Investment and Restructuring

Analyze a distressed debt investment where a private capital firm acquires the debt of a financially troubled company at a discount. Examine the potential for high returns through restructuring or recovery, as well as the unique risks, including the possibility of bankruptcy and the complexities of navigating creditor rights.

Practice Questions

Question 1

Which type of private capital investment typically involves acquiring ownership in early-stage companies with high growth potential but also high risk?

A. Growth equity

B. Mezzanine debt

C. Venture capital

D. Leveraged buyout (LBO)

Answer:

C. Venture capital

Explanation:

Venture capital (VC) involves investing in early-stage companies, often in the technology or innovation sectors, with high growth potential. VC investors provide capital in exchange for equity ownership, with the understanding that these investments carry high risk due to the early-stage nature of the companies and their uncertain profitability.

Question 2

Which of the following is a primary characteristic of mezzanine financing in private capital investments?

A. It is secured by the assets of the company

B. It combines features of debt and equity

C. It is exclusively provided to public companies

D. It does not offer higher returns than senior debt

Answer:

B. It combines features of debt and equity

Explanation:

Mezzanine financing is a hybrid form of financing that combines elements of both debt and equity. It is typically unsecured and subordinated to senior debt, but it often includes warrants or options to provide equity-like returns, resulting in higher yield potential than senior debt. Mezzanine financing is commonly used for business expansion or acquisitions.

Question 3

What is the primary purpose of a leveraged buyout (LBO) in private equity?

A. To provide debt financing to distressed companies

B. To acquire a controlling interest in a mature company using substantial debt

C. To invest in early-stage companies with high growth potential

D. To increase liquidity by selling shares on public markets

Answer:

B. To acquire a controlling interest in a mature company using substantial debt

Explanation:

In a leveraged buyout (LBO), a private equity firm acquires a mature company by using a significant amount of debt financing. This approach allows the firm to control the company while minimizing the amount of equity invested. The objective is often to improve the company's operations or financial structure to enhance value and achieve profitable exit options in the future.