Investing in real estate through publicly traded securities allows investors to access the real estate market without direct ownership of properties. These investments, typically through Real Estate Investment Trusts (REITs), Real Estate Operating Companies (REOCs), and mortgage-backed securities, offer liquidity, diversification, and income potential. Unlike traditional real estate, publicly traded securities can be easily bought and sold on exchanges, providing flexibility for investors. They also offer potential inflation protection and steady income streams, making them an attractive option for diversifying portfolios and achieving long-term financial goals.

Learning Objectives

In studying ” Investments in Real Estate Through Publicly Traded Securities” for the CFA Exam, you should learn to analyze various real estate investment vehicles such as Real Estate Investment Trusts (REITs), Real Estate Operating Companies (REOCs), and mortgage-backed securities (MBS). Understand how these publicly traded securities provide exposure to real estate assets without direct ownership. Evaluate valuation metrics, including Net Asset Value (NAV) and Funds from Operations (FFO), and examine risk factors like interest rate sensitivity and leverage. Additionally, explore the role of real estate securities in portfolio diversification, income generation, and inflation protection to apply these concepts in CFA-style portfolio management scenarios.

Investing in real estate through publicly traded securities is an essential part of the CFA curriculum within alternative investments. Publicly traded real estate securities provide investors with exposure to real estate markets without direct property ownership, offering liquidity, transparency, and diversification. These securities typically include Real Estate Investment Trusts (REITs), Real Estate Operating Companies (REOCs), and mortgage-backed securities (MBS). Here’s an in-depth look at these investment vehicles, their characteristics, valuation approaches, and risk factors.

1. Types of Publicly Traded Real Estate Securities

a) Real Estate Investment Trusts (REITs)

REITs are corporations that own, operate, or finance income-producing real estate across various sectors. They were created to provide retail investors with a way to invest in large-scale, diversified real estate portfolios. REITs generally offer high dividend yields, as they are required to distribute at least 90% of their taxable income to shareholders.

- Equity REITs: These own and manage income-generating properties. They generate revenue primarily through rent collected from tenants.

- Mortgage REITs (mREITs): These invest in mortgages or mortgage-backed securities rather than physical properties. They earn income through the interest from mortgage payments.

- Hybrid REITs: These combine both equity and mortgage REIT strategies.

b) Real Estate Operating Companies (REOCs)

REOCs are similar to REITs but are not subject to the same tax structure or income distribution requirements. These companies may reinvest their earnings rather than distribute dividends, which provides them with more flexibility in reinvesting for growth. REOCs are common in markets where REITs face regulatory restrictions or are less common.

c) Mortgage-Backed Securities (MBS)

Mortgage-backed securities are pooled debt obligations backed by real estate loans, primarily residential mortgages. MBS provide investors with exposure to the real estate market indirectly, as these securities represent claims on the cash flows from the underlying mortgages. MBS are typically issued by government-sponsored entities, such as Fannie Mae and Freddie Mac, or private entities in the case of non-agency MBS.

2. Advantages of Investing in Real Estate via Publicly Traded Securities

- Liquidity: Unlike direct real estate investments, REITs and REOCs can be bought and sold on stock exchanges, offering greater liquidity.

- Diversification: Publicly traded real estate securities offer a way to diversify a portfolio. They typically have a low correlation with stocks and bonds, which helps reduce overall portfolio risk.

- Lower Capital Requirement: Investing in REITs allows investors to gain exposure to real estate without the need for significant capital outlay, which is typically required in direct real estate investment.

- Income Generation: REITs, in particular, are known for providing a steady income stream due to their high dividend yields.

3. Valuation of Publicly Traded Real Estate Securities

Valuing real estate securities differs from traditional equity valuation due to the specific characteristics of these assets. Common valuation metrics include:

- Net Asset Value (NAV): NAV represents the estimated market value of a REIT’s assets minus its liabilities. It is a popular measure, as it reflects the intrinsic value of the real estate assets owned by the REIT.

- Funds from Operations (FFO): FFO adjusts net income for non-cash items like depreciation and gains or losses from property sales. FFO is widely used in the real estate industry to measure a REIT’s operating performance and is often presented on a per-share basis.

- Adjusted Funds from Operations (AFFO): AFFO goes further by adjusting FFO for capital expenditures needed to maintain properties, offering a more accurate measure of a REIT’s cash available for distribution.

- Price-to-FFO and Price-to-AFFO Ratios: Similar to price-to-earnings (P/E) ratios, these ratios are used to assess the valuation of REITs. A lower ratio may indicate a potentially undervalued REIT, while a higher ratio may suggest overvaluation.

- Dividend Yield: Given REITs’ income distribution requirements, dividend yield is another important metric, especially for income-focused investors. It is calculated by dividing the annual dividend by the share price.

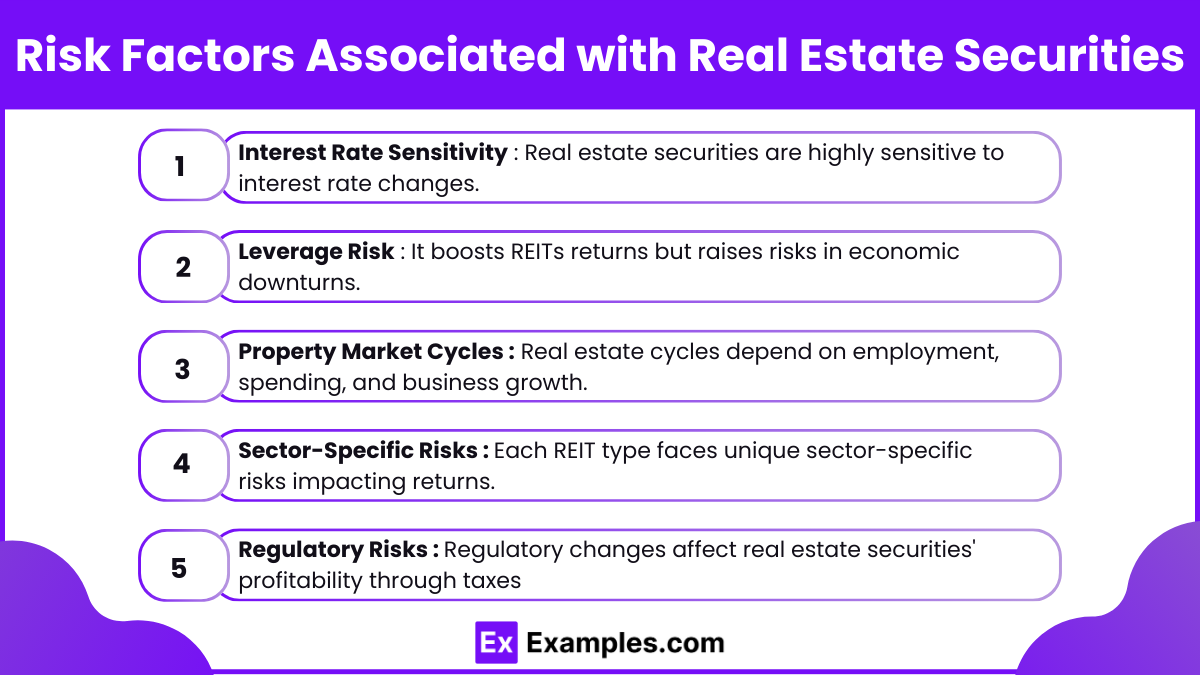

4. Risk Factors Associated with Real Estate Securities

- Interest Rate Sensitivity: Real estate securities are highly sensitive to interest rate changes. Rising interest rates increase borrowing costs and may reduce demand for real estate investments, potentially lowering REIT prices.

- Leverage Risks: REITs and REOCs often use leverage to acquire properties, which can amplify returns but also increases the risk of loss in a downturn. Investors should be aware of the debt-to-equity ratios of these companies.

- Property Market Cycles: Real estate markets are cyclical, affected by economic factors such as employment rates, consumer spending, and business expansion. An economic downturn can negatively impact occupancy rates and rental income.

- Sector-Specific Risks: Different types of REITs, such as retail, office, industrial, or residential, are exposed to sector-specific risks. For instance, a retail REIT may be vulnerable to shifts in consumer behavior toward online shopping, while an office REIT may be affected by trends in remote work.

- Regulatory Risks: Changes in tax laws, zoning regulations, and other policies can impact the profitability of real estate securities. REITs, in particular, face regulatory requirements, such as maintaining a certain percentage of income from real estate sources and distributing a significant portion of earnings to shareholders.

Examples

Example 1: Equity REITs (e.g., Simon Property Group Inc.)

Equity Real Estate Investment Trusts (REITs) like Simon Property Group Inc., one of the largest retail REITs in the U.S., own and operate income-generating properties such as shopping malls and commercial centers. These REITs generate revenue primarily from rental income collected from tenants and are required to distribute at least 90% of their taxable income to shareholders in the form of dividends, making them an attractive option for income-focused investors. Equity REITs are valued based on factors like net asset value (NAV), funds from operations (FFO), and adjusted funds from operations (AFFO).

Example 2: Mortgage REITs (e.g., Annaly Capital Management Inc.)

Mortgage REITs, such as Annaly Capital Management, invest in mortgages and mortgage-backed securities instead of physical real estate properties. Their income is derived from the interest on mortgages they hold, which makes them highly sensitive to interest rate changes. These REITs are considered riskier than equity REITs because of their exposure to interest rate volatility and leverage. Annaly, for instance, primarily invests in residential mortgage-backed securities (RMBS) and leverages its portfolio to increase returns, which can result in both higher income and higher risks.

Example 3: Hybrid REITs (e.g., New York Mortgage Trust Inc.)

Hybrid REITs combine the characteristics of both equity and mortgage REITs. New York Mortgage Trust Inc., for instance, invests in a mix of residential real estate assets, mortgage-backed securities, and direct loans. This diversified approach allows hybrid REITs to gain exposure to both property income and mortgage interest, balancing risk and reward. Hybrid REITs can be complex to evaluate, as they require assessing both the rental income from properties and the income from interest on mortgage assets.

Example 4: Real Estate Operating Companies (REOCs, e.g., Brookfield Asset Management)

Real Estate Operating Companies like Brookfield Asset Management are companies that own and manage real estate but don’t qualify as REITs due to their reinvestment strategies and lack of distribution requirements. Brookfield is a global asset manager that invests in various sectors of real estate, including office, retail, and industrial properties, with an emphasis on long-term value creation. Unlike REITs, REOCs may reinvest their earnings to fund new developments and acquisitions, potentially leading to higher growth, although investors may not receive consistent dividend income.

Example 5: Real Estate Exchange-Traded Funds (ETFs, e.g., Vanguard Real Estate ETF)

Real estate ETFs, such as the Vanguard Real Estate ETF (VNQ), allow investors to gain broad exposure to a portfolio of real estate companies, including various types of REITs. This ETF tracks an index of domestic real estate stocks and provides diversified exposure to different sectors within real estate. ETFs offer higher liquidity than individual REITs, lower costs, and instant diversification, which can appeal to both individual and institutional investors seeking passive exposure to real estate markets.

Practice Questions

Question 1

Which of the following is the primary difference between a Real Estate Investment Trust (REIT) and a Real Estate Operating Company (REOC)?

A) REITs are required to distribute a significant portion of income to shareholders, while REOCs are not.

B) REOCs are traded on public exchanges, whereas REITs are typically private entities.

C) REITs are primarily involved in mortgage financing, while REOCs focus on physical properties.

D) REOCs are exempt from real estate-related taxes, while REITs must pay property taxes.

Answer: A) REITs are required to distribute a significant portion of income to shareholders, while REOCs are not.

Explanation: The primary difference between a REIT and a REOC is in income distribution and tax structure. REITs must distribute at least 90% of their taxable income to shareholders, which makes them attractive for income-seeking investors. This distribution requirement allows REITs to avoid corporate income tax on distributed income, effectively passing income through to investors. In contrast, REOCs have no such requirement and are free to reinvest their earnings back into their business, which can be advantageous for growth-focused strategies. Options B, C, and D are incorrect: both REITs and REOCs can be traded on public exchanges, REITs are often involved in physical properties rather than solely mortgage financing, and neither entity is exempt from property taxes.

Question 2

Which of the following metrics is most commonly used to assess the operating performance of a REIT?

A) Price-to-Earnings (P/E) ratio

B) Net Operating Income (NOI)

C) Funds from Operations (FFO)

D) Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA)

Answer: C) Funds from Operations (FFO)

Explanation: Funds from Operations (FFO) is the preferred metric for evaluating a REIT’s operating performance. FFO adjusts net income by adding back non-cash items like depreciation and excluding gains or losses on property sales. This adjustment provides a more accurate reflection of the cash-generating ability of the REIT’s core property operations. Unlike traditional corporations, REITs experience significant depreciation due to the nature of real estate, which can distort net income figures. Thus, FFO is considered more indicative of a REIT’s financial health. The P/E ratio (Option A) and EBITDA (Option D) are not specifically tailored for real estate evaluation, and while Net Operating Income (Option B) measures property-specific income, it is less comprehensive than FFO for evaluating overall REIT performance.

Question 3

Which of the following risks is most relevant for investors in mortgage REITs (mREITs)?

A) Sector-specific risk

B) Interest rate risk

C) Property market cycle risk

D) Leverage risk

Answer: B) Interest rate risk

Explanation: Mortgage REITs (mREITs) are highly sensitive to interest rate changes, as they earn income from the spread between the interest they receive on mortgage-backed assets and the cost of borrowing funds. When interest rates rise, borrowing costs increase, potentially compressing this spread and reducing profitability. This makes interest rate risk a critical concern for mREIT investors. While sector-specific risk (Option A) and property market cycle risk (Option C) do affect real estate investments generally, mREITs are primarily impacted by fluctuations in interest rates rather than property-specific factors. Leverage risk (Option D) is also relevant, as mREITs often use borrowed funds to invest, but interest rate risk remains the predominant factor due to its direct effect on borrowing costs and income generation.