Investors and Other Stakeholders are central to financial markets, each with unique interests and influences on corporate strategies and financial decisions. This topic examines the roles of various stakeholders, including institutional and individual investors, regulatory bodies, and corporate management, in shaping financial practices. It delves into the objectives and expectations these parties bring, as well as the mechanisms they use to impact corporate governance, financial performance, and sustainability efforts. A comprehensive understanding of stakeholder dynamics is essential for analyzing investment decisions and ensuring alignment with broader economic and social goals in a financial context.

Learning Objectives

In studying “Investors and Other Stakeholders” for the CFA, you should learn to identify and understand the various stakeholders in a company, including investors, employees, customers, suppliers, and the community. Recognize the roles and objectives of each stakeholder group and how they may influence a company’s operations and strategic decisions. Analyze the potential conflicts and alignment of interests among stakeholders, especially between shareholders and other groups. Evaluate how companies create value for stakeholders and the impact of corporate governance practices on stakeholder relationships. Additionally, develop insights into how companies balance stakeholder needs while pursuing long-term growth and sustainability, as well as how stakeholder considerations can affect risk management and corporate reputation

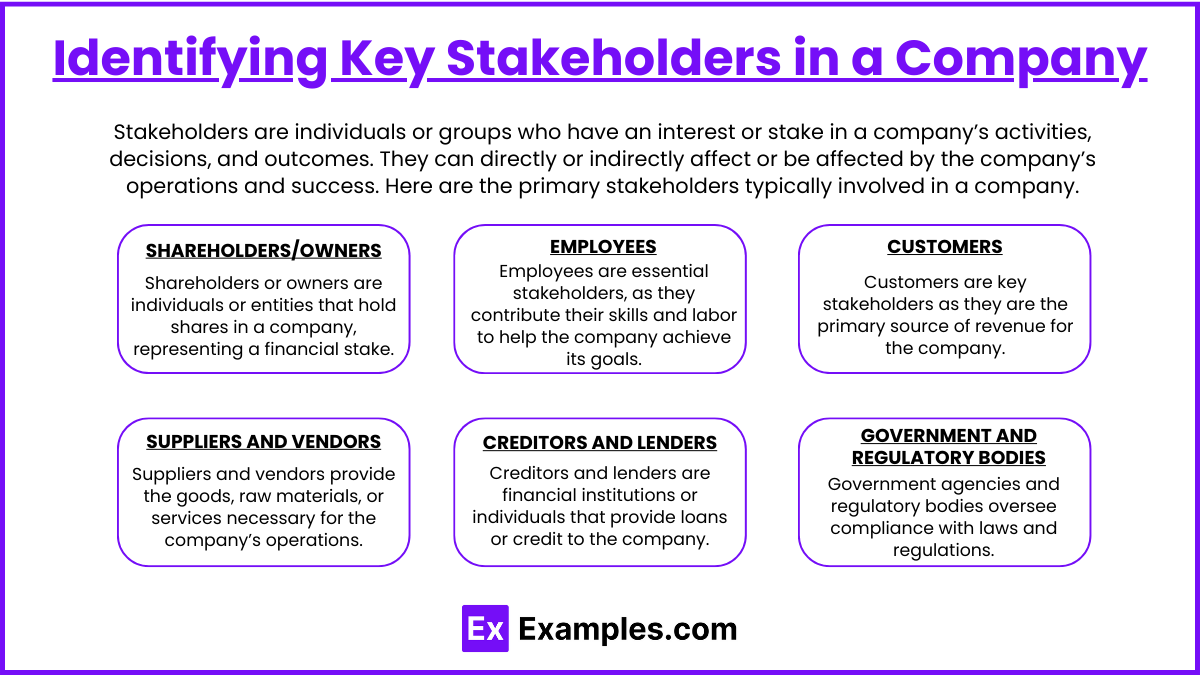

Identifying Key Stakeholders in a Company

Stakeholders are individuals or groups who have an interest or stake in a company’s activities, decisions, and outcomes. They can directly or indirectly affect or be affected by the company’s operations and success. Here are the primary stakeholders typically involved in a company:

1. Shareholders/Owners

Shareholders or owners are individuals or entities that hold shares in a company, representing a financial stake.

- Roles and Interests: Shareholders are interested in the company’s profitability, growth, and value creation. They expect dividends, capital appreciation, and sustainable business practices that protect their investment.

- Influence: Shareholders have the right to vote on major company decisions, such as board elections and significant policy changes, and may directly influence corporate governance.

Example: Institutional investors, such as pension funds and mutual funds, are often significant shareholders in publicly traded companies and can influence corporate policies.

2. Employees

Employees are essential stakeholders, as they contribute their skills and labor to help the company achieve its goals.

- Roles and Interests: Employees seek fair compensation, job security, career advancement, a positive work environment, and respect. Their productivity, morale, and loyalty directly impact the company’s operational performance.

- Influence: Employees may influence company culture, productivity levels, and even the public image of the company. Satisfied employees can enhance company reputation, while dissatisfaction can lead to high turnover or negative perceptions.

Example: Tech companies like Google and Apple are known for valuing employee satisfaction, offering benefits and fostering an innovative culture to attract and retain talent.

3. Customers

Customers are key stakeholders as they are the primary source of revenue for the company.

- Roles and Interests: Customers are interested in high-quality products and services, fair pricing, and excellent customer service. Their loyalty and satisfaction are vital to the company’s long-term success.

- Influence: Customer feedback can directly impact a company’s reputation and drive product or service improvements. Loyal customers can also be brand advocates, promoting the company through word-of-mouth.

Example: Companies like Amazon are highly customer-centric, constantly innovating to improve customer satisfaction and retain loyalty.

4. Suppliers and Vendors

Suppliers and vendors provide the goods, raw materials, or services necessary for the company’s operations.

- Roles and Interests: Suppliers seek reliable partnerships, timely payments, and fair treatment in contractual agreements. They rely on the company’s stability for continued business and growth.

- Influence: Strong supplier relationships can ensure quality and cost-efficiency, while disruptions or strained relations can negatively affect the company’s supply chain and production.

Example: Automobile manufacturers like Toyota rely on a network of suppliers for parts and components, making supplier relationships critical to production continuity.

5. Creditors and Lenders

Creditors and lenders are financial institutions or individuals that provide loans or credit to the company.

- Roles and Interests: Creditors are concerned with the company’s financial stability, cash flow, and debt repayment capabilities. They seek timely repayments and a solid credit rating to minimize risk.

- Influence: Creditors can influence a company’s financial policies, particularly if the company is highly leveraged. In cases of financial distress, creditors may also take a more active role in decision-making.

Example: Banks or bondholders that lend money to a company have an interest in ensuring the company remains financially healthy to secure repayment.

6. Government and Regulatory Bodies

Government agencies and regulatory bodies oversee compliance with laws and regulations, including tax policies, labor laws, environmental standards, and consumer protection.

- Roles and Interests: Governments are interested in the company’s adherence to regulations, tax contributions, and commitment to public welfare. They also monitor the impact of business activities on the economy and society.

- Influence: Governments can enforce compliance, impose fines, or restrict operations if a company fails to meet regulatory standards. They may also offer incentives, such as tax breaks, for companies contributing to economic growth.

Example: The U.S. Environmental Protection Agency (EPA) monitors companies for environmental compliance, particularly in industries with high environmental impact.

Roles and Objectives of Stakeholder Groups

Stakeholder groups play distinct roles in a company’s ecosystem, with each group pursuing specific objectives that align with their interests and relationship with the organization. Understanding these roles and objectives helps companies make balanced decisions that support long-term success and address the needs of various groups.

- Shareholders/Investors: Shareholders, or investors, are the owners of a company and have a financial interest in its performance.

- Employees: Employees are individuals hired by the company to perform tasks essential for achieving business objectives.

- Customers: Customers are the recipients of the company’s products or services, and their satisfaction directly impacts business success.

- Suppliers: Suppliers provide raw materials, goods, or services that a company uses to produce its products or operate effectively.https://www.examples.com/cfa/organizational-forms-corporate-issuer-features-and-ownership

- Creditors: Creditors are institutions or individuals who lend money or extend credit to the company, such as banks, bondholders, or trade creditors.

- Government and Regulatory Bodies: Government and regulatory bodies oversee compliance with laws and regulations, ensuring companies operate within legal frameworks.

- Local Community: The local community includes residents and local organizations near a company’s operations or headquarters. They are often directly impacted by the company’s activities.

- Board of Directors: The board of directors is an elected group responsible for overseeing a company’s strategy and ensuring accountability to shareholders.

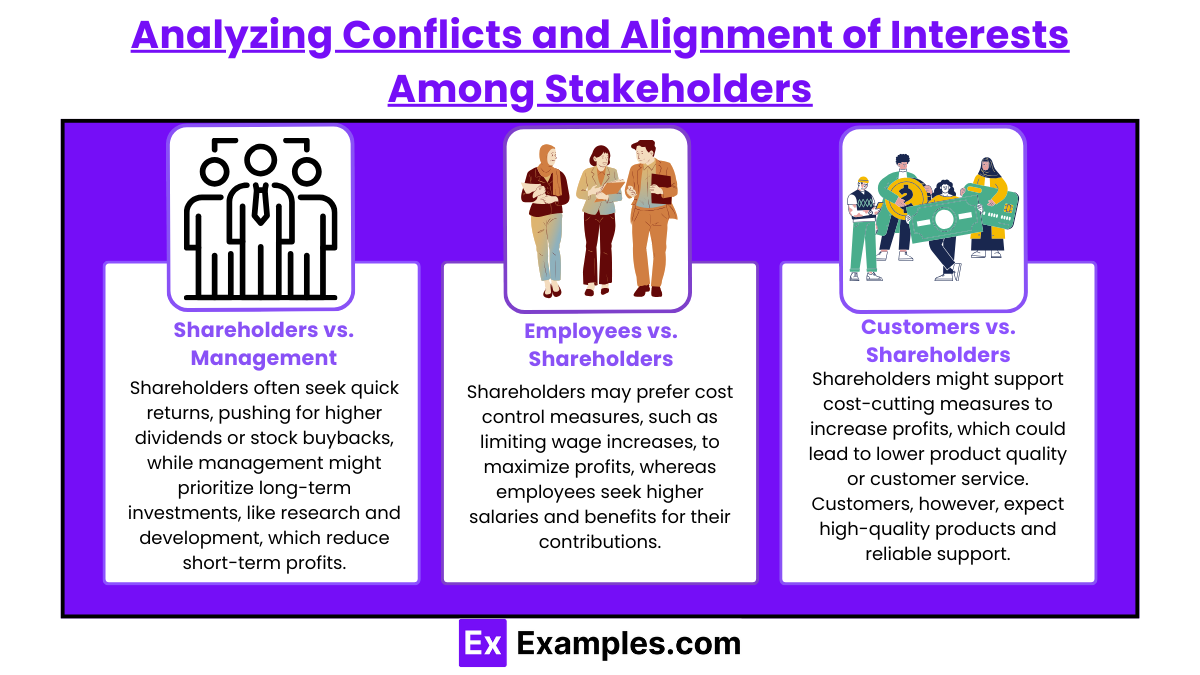

Analyzing Conflicts and Alignment of Interests Among Stakeholders

In any organization, different stakeholders often have varying, sometimes conflicting, interests. Effective management involves understanding these interests and finding ways to align them to support the organization’s long-term goals. Here’s an analysis of typical conflicts and potential alignment of interests among key stakeholder groups.

1. Shareholders vs. Management

- Conflict:

- Short-Term vs. Long-Term Goals: Shareholders often seek quick returns, pushing for higher dividends or stock buybacks, while management might prioritize long-term investments, like research and development, which reduce short-term profits.

- Risk Tolerance: Shareholders may desire aggressive growth strategies for higher returns, whereas management might prefer cautious growth to maintain stable operations and job security.

- Alignment:

- Performance-Based Incentives: Aligning management’s interests with shareholder objectives through stock options or performance-based bonuses can encourage management to focus on profitability and share price appreciation.

- Transparent Communication: Open communication with shareholders about long-term plans can foster support for sustainable growth strategies.

Example: A CEO may advocate for reinvesting profits into innovation to support long-term growth, while shareholders prefer higher immediate dividends. Performance-based incentives can bridge this gap by linking executive pay to stock performance over time.

2. Employees vs. Shareholders

- Conflict:

- Cost Control vs. Wage Increases: Shareholders may prefer cost control measures, such as limiting wage increases, to maximize profits, whereas employees seek higher salaries and benefits for their contributions.

- Job Security vs. Efficiency: Shareholders might support downsizing or automation to reduce costs, which conflicts with employees’ need for job security and stable income.

- Alignment:

- Productivity and Profit Sharing: Offering profit-sharing plans or stock options to employees can align their interests with those of shareholders by directly linking compensation to company success.

- Training and Development: Investing in employee skills enhances productivity, benefiting both employees and shareholders through improved company performance.

Example: Implementing a profit-sharing plan where employees receive bonuses tied to annual profits encourages employees to work more efficiently, aligning their financial interests with shareholders.

3. Customers vs. Shareholders

- Conflict:

- Quality vs. Cost-Cutting: Shareholders might support cost-cutting measures to increase profits, which could lead to lower product quality or customer service. Customers, however, expect high-quality products and reliable support.

- Pricing: Shareholders may favor price increases to boost revenue, while customers prefer fair prices for value received.

- Alignment:

- Customer Loyalty Programs: Prioritizing customer satisfaction through loyalty programs can build long-term customer relationships, increasing customer lifetime value and supporting sustainable revenue growth for shareholders.

- Brand Reputation and Value: Ensuring product quality and good service enhances brand reputation, attracting loyal customers and boosting profitability, benefiting shareholders in the long term.

Example: A company might implement a quality assurance program to ensure consistent product quality, enhancing brand reputation and satisfying both customers and shareholders by fostering loyalty.

Balancing Stakeholder Needs with Long-Term Growth and Sustainability

Balancing stakeholder needs while pursuing long-term growth and sustainability is essential for creating a resilient business that delivers value to shareholders, employees, customers, and society. By meeting both short-term expectations and long-term objectives, companies can build trust with stakeholders, enhance their competitive edge, and achieve sustainable growth. Here are key strategies to balance these needs effectively:

Prioritizing Stakeholder Engagement and Communication

Engaging stakeholders through transparent communication ensures that their needs and concerns are understood and integrated into the company’s strategy.

- Regular Stakeholder Dialogue: Open channels for feedback with shareholders, employees, customers, and communities help the company gauge expectations and adjust practices accordingly.

- Transparent Reporting: Publishing sustainability reports, financial results, and progress updates builds trust and demonstrates the company’s commitment to balancing short-term and long-term objectives.

- Aligning Expectations: Clearly communicating the company’s mission, vision, and goals aligns stakeholders with its growth and sustainability agenda, fostering shared understanding and collaboration.

Example: Unilever publishes annual sustainability reports, detailing progress on social, environmental, and financial goals, which helps align stakeholder expectations and reinforces trust.

Balancing Short-Term Profits with Long-Term Investments

While stakeholders often focus on short-term financial returns, investing in future-oriented projects, such as R&D, employee training, and technology, supports sustainable growth.

- Reinvesting Profits: Allocating a portion of profits to innovation, infrastructure, and sustainable practices strengthens the company’s long-term competitiveness and resilience.

- Strategic Dividends and Buybacks: While dividends and buybacks provide short-term value for shareholders, a balanced approach ensures that funds are available for growth initiatives.

- Encouraging Patient Capital: Engaging investors who prioritize long-term returns over quick gains supports the company’s ability to pursue sustainable growth strategies without sacrificing immediate financial performance.

Example: Amazon’s strategy of reinvesting profits into logistics, R&D, and infrastructure has driven its long-term growth and industry leadership, even when this required foregoing short-term profits.

Examples

Example 1: Individual Investors

Individual investors are private citizens who purchase stocks, bonds, mutual funds, or other financial instruments to grow their personal wealth. For example, an individual might invest in a technology company’s shares, hoping that the company’s growth will increase the value of their investment over time. These investors are key stakeholders, as their decisions can influence market trends and corporate strategies.

Example 2: Institutional Investors

Institutional investors, such as pension funds, insurance companies, and mutual funds, manage large amounts of capital on behalf of clients or policyholders. For instance, a pension fund might invest in a diversified portfolio of stocks and bonds to ensure that it can meet future obligations to retirees. Their substantial investments can significantly affect the financial markets and the companies in which they invest.

Example 3: Company Management

The management team of a company, including executives and board members, are important stakeholders who make strategic decisions affecting the company’s direction. For example, the CEO and the board of directors are responsible for setting corporate policies, making operational decisions, and ensuring the company’s long-term profitability. Their actions directly influence investor confidence and company performance.

Example 4: Employees

Employees are vital stakeholders who contribute to the company’s operations and success. Their engagement and job satisfaction can significantly impact productivity and retention rates. For example, a company that invests in employee training and development may see higher performance levels, which can ultimately lead to increased profits and shareholder value. Employees often also invest their careers and livelihoods into the company.

Example 5: Customers

Customers are key stakeholders who drive demand for a company’s products or services. Their preferences and purchasing decisions significantly influence a company’s profitability and market position. For instance, a company that produces eco-friendly products may attract environmentally conscious consumers, leading to increased sales and brand loyalty. Understanding customer needs is essential for companies to develop products that meet market demands and sustain growth.

Practice Questions

Question 1

Which of the following best describes the primary interest of institutional investors in a company?

A) Short-term speculation for quick profits

B) Long-term growth and stability of their investments

C) Influencing company policies and management decisions

D) Gaining insights into employee satisfaction

Correct Answer: B) Long-term growth and stability of their investments.

Explanation: Institutional investors, such as pension funds, mutual funds, and insurance companies, primarily focus on achieving long-term growth and stability for their investments. They tend to analyze a company’s fundamentals, performance, and market potential to make informed decisions that will yield sustainable returns over time. While they may engage in some short-term strategies, their main objective is to ensure the financial health and growth of their portfolios.

Question 2

How do employees function as stakeholders in a company?

A) They have no direct influence on company performance.

B) They only benefit from profit-sharing plans.

C) Their engagement and job satisfaction can impact productivity and company success.

D) They solely provide customer service.

Correct Answer: C) Their engagement and job satisfaction can impact productivity and company success.

Explanation: Employees are crucial stakeholders whose attitudes and performance directly affect a company’s productivity and overall success. Engaged and satisfied employees are more likely to be productive, contribute positively to the workplace culture, and remain with the company long-term, which reduces turnover costs. Therefore, companies that prioritize employee welfare tend to see improved performance and better outcomes.

Question 3

Which of the following statements is true regarding the role of customers as stakeholders?

A) Customers have no impact on a company’s financial performance.

B) Customers only care about product pricing.

C) Customer preferences and loyalty can significantly influence a company’s success and growth.

D) Customers are primarily interested in corporate governance.

Correct Answer: C) Customer preferences and loyalty can significantly influence a company’s success and growth.

Explanation: Customers play a vital role as stakeholders because their preferences, buying behaviors, and loyalty significantly impact a company’s revenue and market position. Companies that understand and respond to customer needs can develop products and services that enhance customer satisfaction, leading to repeat business and positive word-of-mouth. This, in turn, drives growth and profitability, making customer engagement critical for long-term success.