Preparing for the CFA Exam requires a solid understanding of liability-driven and index-based strategies, essential for managing assets to meet specific liabilities. Mastery of these strategies involves knowledge of liability matching, index tracking, and risk management. This understanding enhances insights into portfolio construction, optimizing returns while aligning with liabilities for a high CFA score.

Learning Objective

In studying “Liability-Driven and Index-Based Strategies” for the CFA Exam, you should gain an understanding of the methods used to manage investment portfolios with liability-focused and index-tracking approaches. Analyze strategies for liability-driven investing (LDI) that aim to match asset performance with liabilities, such as pension obligations, under varying market conditions. Evaluate the benefits of index-based strategies that aim to mirror benchmark performance, minimizing tracking error and optimizing cost efficiency. Additionally, explore the application of these strategies in managing interest rate, duration, and inflation risk. Apply this knowledge to real-world scenarios in CFA practice questions, enhancing asset-liability management skills.

Introduction to Liability-Driven Investing (LDI)

Liability-Driven Investing (LDI) is a strategic approach to portfolio management focused on aligning assets with specific liabilities, primarily used by pension funds, insurance companies, and other institutions with long-term obligations. The goal of LDI is to ensure that assets grow in a way that can cover liabilities as they come due, regardless of market conditions.

In traditional investing, the primary objective is often to maximize returns or outperform benchmarks. In contrast, LDI prioritizes stability and predictability, seeking to manage and reduce risks related to interest rates, inflation, and funding deficits. This approach often involves matching the duration of assets with the timing of liabilities to mitigate the impact of interest rate fluctuations on both sides of the balance sheet.

An LDI strategy typically relies on fixed-income instruments, such as bonds, which provide predictable cash flows. Additionally, derivatives like swaps and futures may be used to adjust duration and fine-tune interest rate exposure, aligning more precisely with liability cash flows. This approach helps ensure that the portfolio can withstand interest rate shifts and economic cycles, providing stable, reliable funding for future liabilities.

LDI is essential for institutions with fixed future obligations, allowing them to manage funding ratios and avoid significant funding shortfalls. By focusing on liability-matching rather than high returns, LDI enhances the security and sustainability of asset portfolios intended to meet these obligations

Portfolio Construction for Liability-Driven Strategies

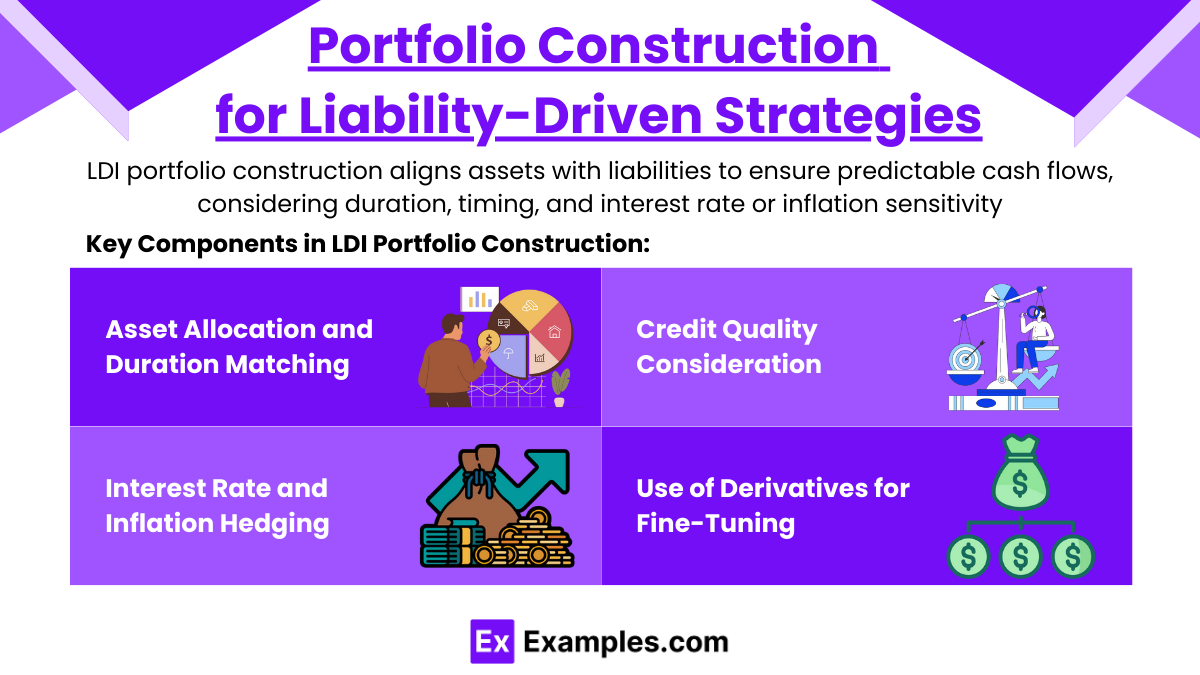

Portfolio construction in Liability-Driven Investing (LDI) focuses on aligning the assets within a portfolio with the specific liabilities an institution must meet over time. This approach requires careful asset selection, allocation, and risk management to ensure predictable cash flows that match the timing and size of liabilities. The process begins with a thorough analysis of the liabilities, including their duration, timing, and sensitivity to interest rates and inflation. By understanding these characteristics, portfolio managers can design a portfolio that mitigates risks associated with mismatches between assets and liabilities.

Key Components in LDI Portfolio Construction:

- Asset Allocation and Duration Matching

- Asset allocation in LDI prioritizes fixed-income securities, especially bonds, since they provide regular and predictable cash flows. Duration matching, a core concept in LDI, involves selecting assets with durations that align with the liability schedule, thereby reducing interest rate risk. For example, long-term bonds may be used to match long-duration liabilities, ensuring that asset values move in tandem with liability changes due to interest rate fluctuations.

- Interest Rate and Inflation Hedging

- Since liabilities are often sensitive to interest rate changes and inflation, LDI portfolios commonly employ hedging strategies. Interest rate swaps or Treasury Inflation-Protected Securities (TIPS) can help align the portfolio with liabilities affected by inflation or shifting interest rates. By using these instruments, portfolio managers can protect against interest rate increases that might otherwise reduce the portfolio’s ability to cover future liabilities.

- Credit Quality Consideration

- The credit quality of assets is crucial in LDI strategies, as higher-quality bonds offer lower risk and greater certainty in meeting liabilities. Institutions managing liabilities aim to hold assets with minimal default risk to ensure that liabilities are met without interruptions in cash flow. Bonds from governments or highly rated corporations are often chosen to provide reliability and stability in portfolio returns.

- Use of Derivatives for Fine-Tuning

- Derivatives such as interest rate swaps, futures, and forwards allow for fine-tuning of the portfolio’s duration and sensitivity to interest rates. These instruments can help extend or reduce portfolio duration, allowing for precise alignment with the liability structure. For example, swaps can adjust the duration without buying or selling bonds, making the strategy more flexible and cost-effective.

Through these approaches, LDI portfolio construction provides a framework that balances risk and return to ensure liabilities are met under varying economic conditions. By focusing on liability-matching rather than return maximization, LDI strategies promote stability and predictability, which are essential for institutions with future obligations

Fundamentals of Index-Based Strategies

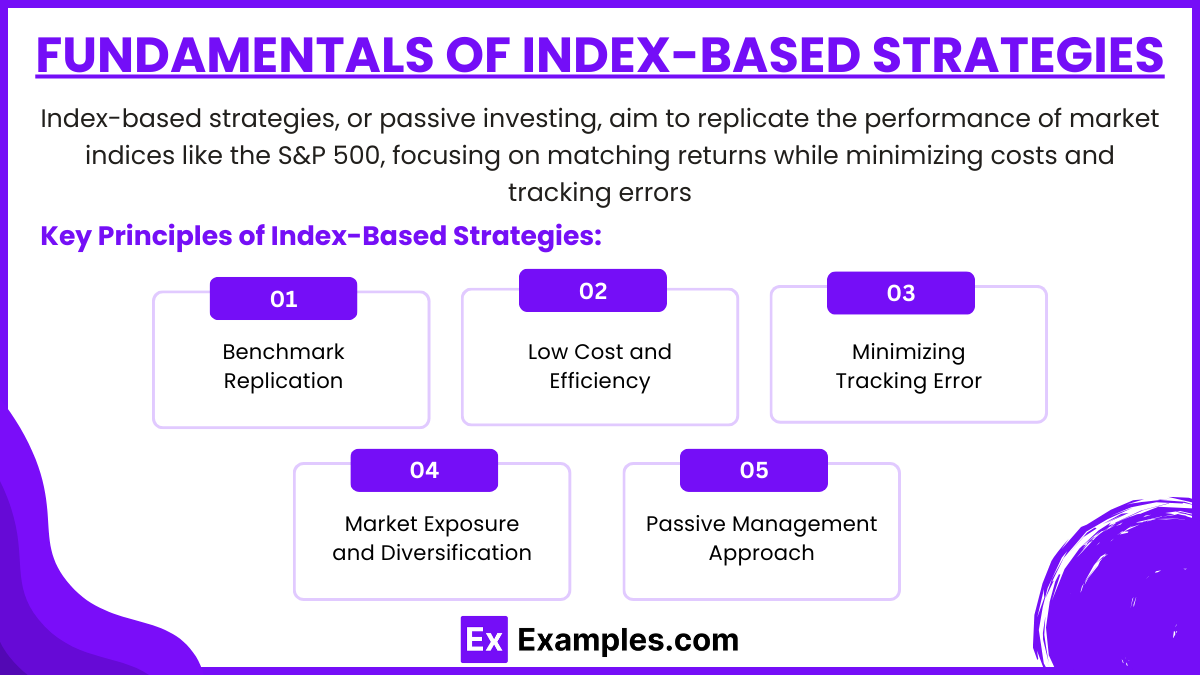

Index-based strategies, commonly known as passive investing, aim to mirror the performance of a specific market index, such as the S&P 500, FTSE 100, or MSCI Emerging Markets Index, rather than seeking to outperform the market. By replicating an index, these strategies focus on achieving returns that closely match the index’s performance while keeping costs and tracking errors low.

Key Principles of Index-Based Strategies:

- Benchmark Replication

- Index-based investing involves creating a portfolio that holds the same or a representative sample of securities as the benchmark index. This can be done through full replication, where every asset in the index is held in the exact proportions, or sampling, where only a subset of securities is selected to approximate the index’s characteristics. Both methods strive to minimize the tracking error, or the deviation between the portfolio’s returns and the index returns.

- Low Cost and Efficiency

- One of the major benefits of index-based strategies is cost-efficiency. Since the strategy does not require active security selection or frequent trading, it incurs lower management fees and transaction costs compared to actively managed funds. This makes index investing appealing for long-term investors looking for efficient exposure to a specific market or asset class without high fees.

- Minimizing Tracking Error

- Tracking error is the degree to which an index-based portfolio’s returns deviate from the index. The goal of index-based strategies is to minimize this tracking error to provide returns that closely match the index. Techniques like optimization algorithms and statistical sampling are used to reduce tracking error, ensuring that the portfolio moves in line with the benchmark’s performance.

- Market Exposure and Diversification

- By following an index, investors gain exposure to a broad range of securities within a market or sector, providing a level of diversification that can reduce individual security risk. For example, a portfolio replicating the S&P 500 gains exposure to 500 large-cap U.S. companies, spreading risk across multiple industries and companies. Diversification within an index helps reduce the impact of poor performance from any single security on the overall portfolio returns.

- Passive Management Approach

- Index-based strategies adopt a passive management style, where the goal is not to outperform the market but to track it as closely as possible. This approach is driven by the belief that markets are generally efficient, making it difficult for active managers to consistently outperform. Passive management allows for a set-and-forget approach, providing investors with stable, market-level returns without needing frequent adjustments.

Index-based strategies are popular among investors who value cost efficiency, diversification, and predictable returns that align with a chosen benchmark. They play a crucial role in portfolio management, especially for long-term investors, retirement funds, and those seeking broad market exposure without the complexities and costs associated with active management.

Examples

Example 1: Pension Fund Liability Matching with LDI

A pension fund with long-term liabilities to retirees implements an LDI strategy by investing in long-duration government and corporate bonds. The fund selects assets with maturities and cash flows that match its expected liability payments. By aligning the asset durations with the timing of future liabilities, the pension fund minimizes interest rate risk, ensuring that its assets grow at a rate that covers future obligations.

Example 2: Insurance Company Managing Inflation Risk

An insurance company that has liability obligations sensitive to inflation includes Treasury Inflation-Protected Securities (TIPS) in its LDI portfolio. These securities adjust with inflation, allowing the insurance company to meet future claims while maintaining the real value of its assets. This approach helps the company manage inflation risk and maintain alignment with its liability requirements over time.

Example 3: Tracking the S&P 500 with an Index-Based Strategy

A mutual fund aiming to provide investors with returns that mirror the S&P 500 index uses a full replication strategy. By purchasing all the stocks within the S&P 500 in the exact proportions as the index, the fund minimizes tracking error, closely following the index’s performance. This strategy provides investors with market-level returns at a lower cost than actively managed funds.

Example 4: Using Derivatives to Hedge Duration in an LDI Portfolio

A pension plan’s LDI portfolio includes interest rate swaps to manage duration. To match long-term liabilities, the pension plan extends its duration by entering into swap contracts that allow it to receive fixed payments while paying floating rates. This strategy adjusts the portfolio’s overall duration without altering the underlying assets, enhancing the plan’s ability to meet future liabilities even if interest rates fluctuate.

Example 5: Cost-Effective Index Tracking with Optimization

A fund tracking the MSCI Emerging Markets Index uses an optimization approach rather than full replication to keep costs low. Instead of buying all index constituents, the fund holds a smaller sample of securities selected to closely represent the index’s characteristics. This approach reduces transaction costs while maintaining low tracking error, allowing the fund to approximate index returns efficiently

Practice Questions

Question 1

Which of the following best describes the primary goal of Liability-Driven Investing (LDI)?

A) To maximize returns by selecting high-growth assets

B) To match the asset portfolio with expected liabilities over time

C) To outperform a specific market index

D) To diversify across multiple asset classes regardless of liability alignment

Answer: B

Explanation: The primary goal of LDI is to align the asset portfolio with the timing and size of future liabilities, minimizing risks such as interest rate fluctuations that could impact the ability to meet these liabilities. LDI prioritizes stability over high returns, focusing on predictable cash flows.

Question 2

An insurance company that anticipates inflation-sensitive liabilities would most likely include which type of asset in its LDI portfolio?

A) Long-term corporate bonds

B) Stocks with high dividend yields

C) Treasury Inflation-Protected Securities (TIPS)

D) Foreign currency-denominated bonds

Answer: C

Explanation: Treasury Inflation-Protected Securities (TIPS) adjust with inflation, making them suitable for managing inflation-sensitive liabilities. This feature helps the insurance company ensure that the real value of its assets aligns with its inflation-affected liabilities, thereby protecting purchasing power over time.

Question 3

What is the primary objective of an index-based strategy?

A) To achieve returns exceeding the benchmark

B) To minimize tracking error and closely follow the benchmark

C) To frequently rebalance the portfolio to beat the market

D) To focus on high-growth stocks within the index

Answer: B

Explanation: The main objective of an index-based strategy is to replicate the performance of a specific benchmark index as closely as possible, with minimal tracking error. This strategy does not aim to outperform the index but to provide investors with returns that closely match the index, offering a stable, market-level performance at a lower cost.