Machine Learning

- Notes

For CFA Level 2 candidates, understanding machine learning (ML) is increasingly essential as finance embraces more advanced data analysis techniques. Machine learning offers powerful tools for predictive analytics, risk management, and investment strategy, enhancing the traditional models used in financial analysis, a key aspect of the Quantitative Methods section of the exam.

Learning Objectives

In studying “Machine Learning” for the CFA exam, you should aim to grasp the fundamental concepts and applications of machine learning in finance. This includes learning about different types of machine learning algorithms such as supervised, unsupervised, and reinforcement learning, and their uses in analyzing financial data. You will also explore how these algorithms can be applied to predict market trends, assess risks, and optimize portfolios. Understanding the limitations and ethical considerations of using machine learning in finance will also be covered to ensure well-rounded knowledge.

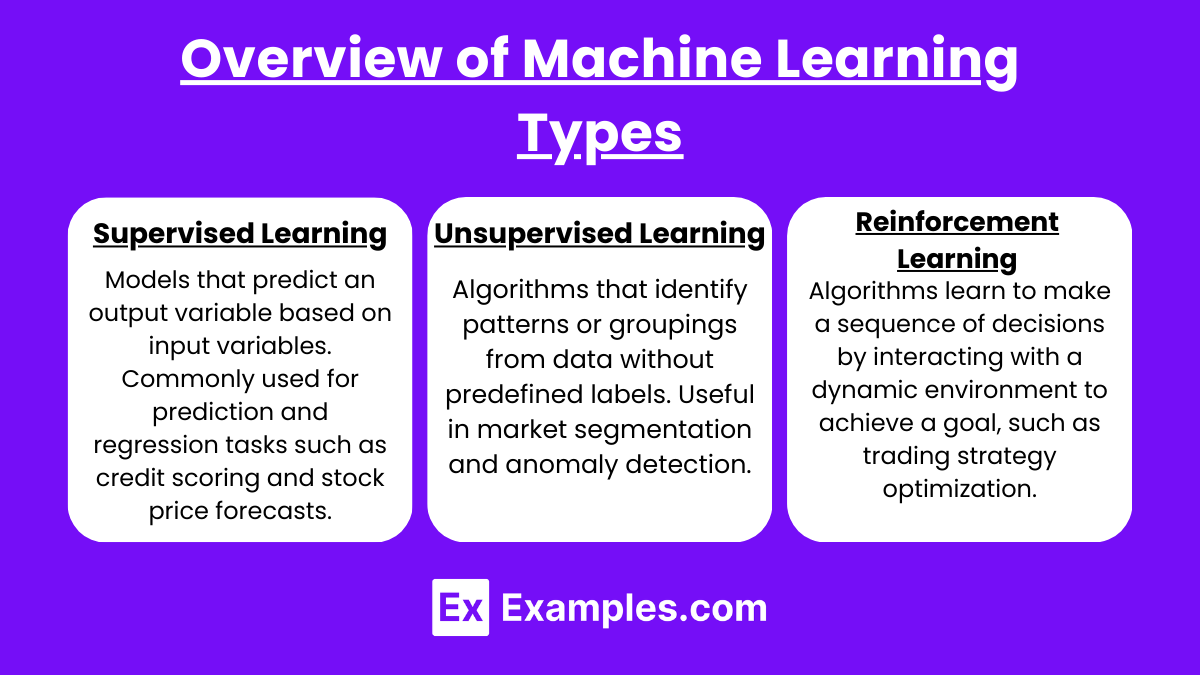

1. Overview of Machine Learning Types

- Supervised Learning: Models that predict an output variable based on input variables. Commonly used for prediction and regression tasks such as credit scoring and stock price forecasts.

- Unsupervised Learning: Algorithms that identify patterns or groupings from data without predefined labels. Useful in market segmentation and anomaly detection.

- Reinforcement Learning: Algorithms learn to make a sequence of decisions by interacting with a dynamic environment to achieve a goal, such as trading strategy optimization.

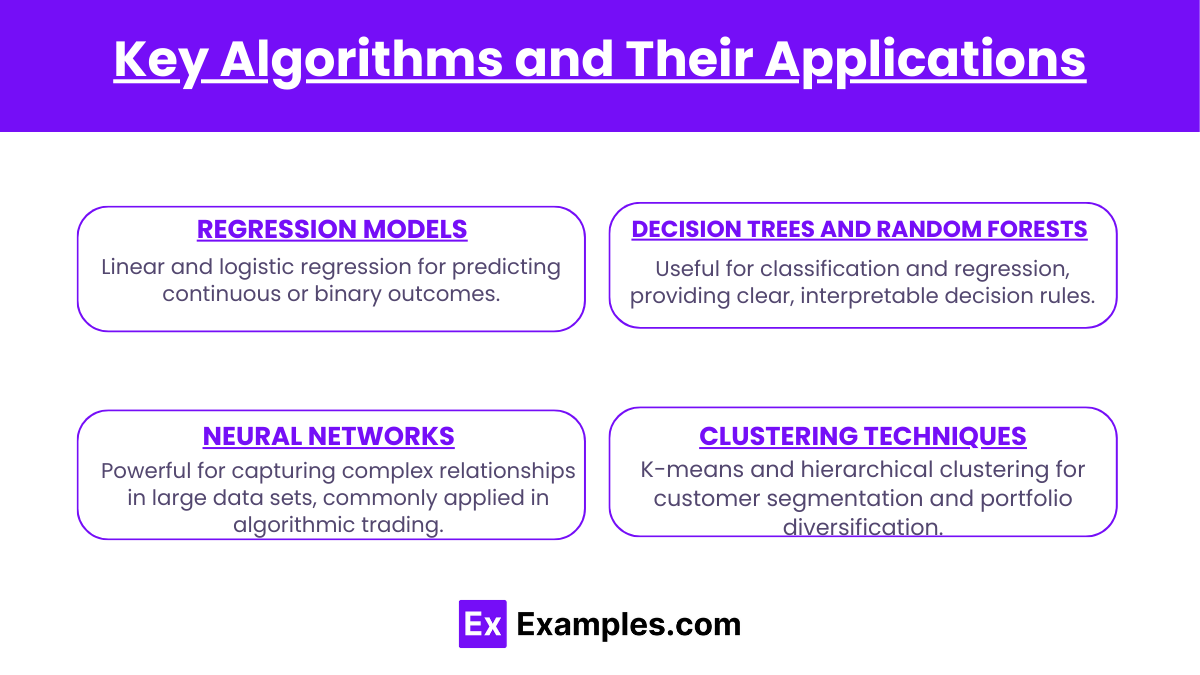

2. Key Algorithms and Their Applications

- Regression Models: Linear and logistic regression for predicting continuous or binary outcomes.

- Decision Trees and Random Forests: Useful for classification and regression, providing clear, interpretable decision rules.

- Neural Networks: Powerful for capturing complex relationships in large data sets, commonly applied in algorithmic trading.

- Clustering Techniques: K-means and hierarchical clustering for customer segmentation and portfolio diversification.

3. Evaluating Model Performance

- Cross-Validation: Technique for assessing how the results of a statistical analysis will generalize to an independent data set.

- Bootstrap Methods: Used to estimate the distribution of a statistic and to enhance model accuracy and stability.

- Performance Metrics: Accuracy, precision, recall, and F1-score for classification models; MSE, RMSE, and MAE for regression models.

4. Challenges and Ethical Considerations

- Overfitting and Underfitting: Balancing model complexity and predictive power to ensure robustness.

- Bias and Fairness: Addressing data and algorithmic biases to avoid unethical outcomes.

- Regulatory Compliance: Ensuring that ML applications comply with financial regulations and privacy standards.

Examples

Example 1: Credit Scoring with Logistic Regression

- A financial institution uses supervised learning to predict the probability of loan defaults based on past transaction data and demographic information, employing logistic regression to classify borrowers as high or low risk.

Example 2: Market Segmentation Using K-means Clustering

- An investment firm applies unsupervised learning to segment the market based on trading behaviors and demographics, using k-means clustering to tailor investment packages to different customer segments.

Example 3: Algorithmic Trading with Neural Networks

- Traders utilize neural networks to predict stock price movements based on historical data, employing deep learning to capture complex patterns and automate trading decisions.

Example 4: Portfolio Optimization Using Reinforcement Learning

- Portfolio managers implement reinforcement learning to optimize asset allocation, teaching algorithms to maximize returns based on real-time market conditions.

Example 5: Anomaly Detection in Transaction Data

- Using unsupervised learning, a security team identifies unusual transactions that could indicate fraudulent activity, employing clustering techniques to detect outliers.

Practice Questions

Question 1:

Which machine learning method is primarily used for finding hidden patterns and groupings without prior labeling?

A) Supervised learning

B) Unsupervised learning

C) Reinforcement learning

D) Regression analysis

Answer: B) Unsupervised learning

Explanation: Unsupervised learning is used to identify patterns or groupings in data without needing predefined labels, making it suitable for tasks like market segmentation or anomaly detection.

Question 2:

What is a common use of reinforcement learning in finance?

A) Credit scoring

B) Customer segmentation

C) Trading strategy optimization

D) Default prediction

Answer: C) Trading strategy optimization

Explanation: Reinforcement learning is effectively used in finance to optimize trading strategies by learning to make a sequence of decisions that maximize a financial objective, adapting strategies based on market dynamics.

Question 3:

Which metric is particularly important when evaluating a machine learning model’s performance in predicting rare events?

A) Accuracy

B) Recall

C) Precision

D) F1-score

Answer: B) Recall

Explanation: Recall is crucial for evaluating models predicting rare events (like fraud detection), as it measures the ability of a model to correctly identify all actual positives, ensuring that few positive cases are missed.