Preparing for the CFA Exam requires a strong grasp of Measuring & Managing Market Risk, a key component of risk management. Understanding risk metrics, value at risk (VaR), stress testing, and scenario analysis is essential. This knowledge helps assess and mitigate market risk exposure, supporting effective portfolio management and enhancing investment decision-making skills.

Learning Objective

In studying “Measuring & Managing Market Risk” for the CFA Exam, you should learn to understand and apply techniques to measure market risk, such as Value at Risk (VaR), stress testing, and scenario analysis. Evaluate how risk metrics are used to quantify exposure to changes in market variables like interest rates, currency values, and equity prices. Analyze the principles behind hedging strategies, including derivatives, to mitigate risk and protect portfolio performance. Additionally, explore risk modeling frameworks and regulatory standards, and apply your understanding to case studies, ensuring effective risk assessment, capital allocation, and decision-making in real-world market scenarios.

Risk Measurement Techniques

Risk Measurement Techniques involve assessing and quantifying exposure to market risks to evaluate potential losses and develop effective mitigation strategies. Key methods include Value at Risk (VaR), stress testing, scenario analysis, and sensitivity analysis, which offer different perspectives on market exposure and help improve portfolio risk management.

Value at Risk (VaR): Quantifies the maximum potential loss of a portfolio over a specified time period at a given confidence level. VaR is calculated using historical simulation, parametric methods, or Monte Carlo simulations and helps in assessing market risk exposure.

Historical Simulation: Uses past market data to simulate potential losses based on historical price movements, providing a practical and intuitive way to estimate risk.

Parametric (Variance-Covariance) Method: Assumes a normal distribution of returns and relies on the mean and variance to estimate potential losses, simplifying calculations for portfolios with linear risk profiles.

Monte Carlo Simulation: Generates a range of potential outcomes by running thousands of simulations with random inputs based on statistical distributions, offering a comprehensive view of risk exposure.

Stress Testing and Scenario Analysis: Applies extreme market conditions or specific scenarios (historical or hypothetical) to evaluate the impact on a portfolio, identifying vulnerabilities and preparing for unexpected shocks.

Sensitivity Analysis: Measures the effect of changes in specific market factors, such as interest rates or stock prices, on the value of a portfolio. Tools like duration and convexity (for bonds) and beta coefficients (for equities) help quantify this sensitivity.

Limitations of VaR and Other Techniques: While VaR is widely used, it may not account for extreme market events or tail risks. Stress testing and scenario analysis help address these gaps by providing a broader assessment of potential market shocks.

Market Risk Factors

Market risk factors influence the potential changes in the value of investments or portfolios due to broader market conditions. These factors are typically outside the control of individual investors and require strategic management to mitigate adverse impacts. Key market risk factors include interest rate changes, equity market fluctuations, currency exchange shifts, commodity prices, and credit spreads. A robust understanding of these factors helps optimize investment performance and manage risk exposure effectively.

- Interest Rate Risk: This risk occurs due to changes in interest rates, which impact the value of fixed-income securities. Rising rates typically decrease bond prices, while falling rates have the opposite effect. Duration and convexity are common measures used for evaluating interest rate sensitivity.

- Equity Market Risk: Refers to the potential for losses from fluctuations in stock prices driven by market sentiment, economic shifts, or company-specific news. Beta measures a stock’s sensitivity to overall market movements.

- Currency (Foreign Exchange) Risk: Arises when investments are exposed to different currencies. Exchange rate fluctuations can impact returns for international investors, which can be managed using hedging instruments like forwards and options.

- Commodity Price Risk: This risk involves changes in the prices of commodities such as oil, gold, or agricultural products, affecting producers, consumers, and companies reliant on raw materials. Futures and options are often used to hedge this risk.

- Credit Spread Risk: Relates to changes in the difference (spread) between yields on different credit instruments, which can impact the cost of borrowing or the value of bonds. A widening spread indicates increased risk perception.

Risk Management Tools and Hedging Strategies

Risk management tools and hedging strategies are essential components used by investors and financial institutions to mitigate potential losses and protect the value of portfolios from market volatility and adverse market movements. These tools help manage market, credit, liquidity, and other types of risk through various approaches. Effective use of these tools ensures stability and reduces exposure to potential threats, ultimately enhancing long-term performance and meeting risk management goals.

- Derivatives for Risk Management: Derivatives such as forwards, futures, options, and swaps are used to hedge against market risks by locking in prices or transferring risk to counterparties. This provides flexibility to manage interest rate, currency, and equity risk.

- Portfolio Diversification: This strategy involves spreading investments across a range of assets to reduce exposure to any single asset or risk. Diversifying a portfolio lowers overall risk by balancing potentially high-risk investments with more stable ones.

- Hedging with Options: Options give investors the right, but not the obligation, to buy or sell an asset at a predetermined price. This flexibility allows for tailored risk mitigation strategies, such as protective puts to limit downside risk.

- Hedging with Futures and Forwards: Futures and forwards contracts allow for locking in the price of an asset, reducing the impact of unfavorable market movements. These contracts are widely used to hedge currency, commodity, and interest rate risks.

- Use of Swaps: Swaps, such as interest rate and currency swaps, enable the exchange of cash flows or currencies between parties. These instruments can help companies and investors manage exposure to fluctuations in interest rates or currency exchange rates.

- Correlation Analysis: Understanding correlations between different asset classes or investments helps in constructing hedges and diversifying portfolios. Low or negatively correlated assets reduce overall portfolio risk, providing better risk-adjusted returns.

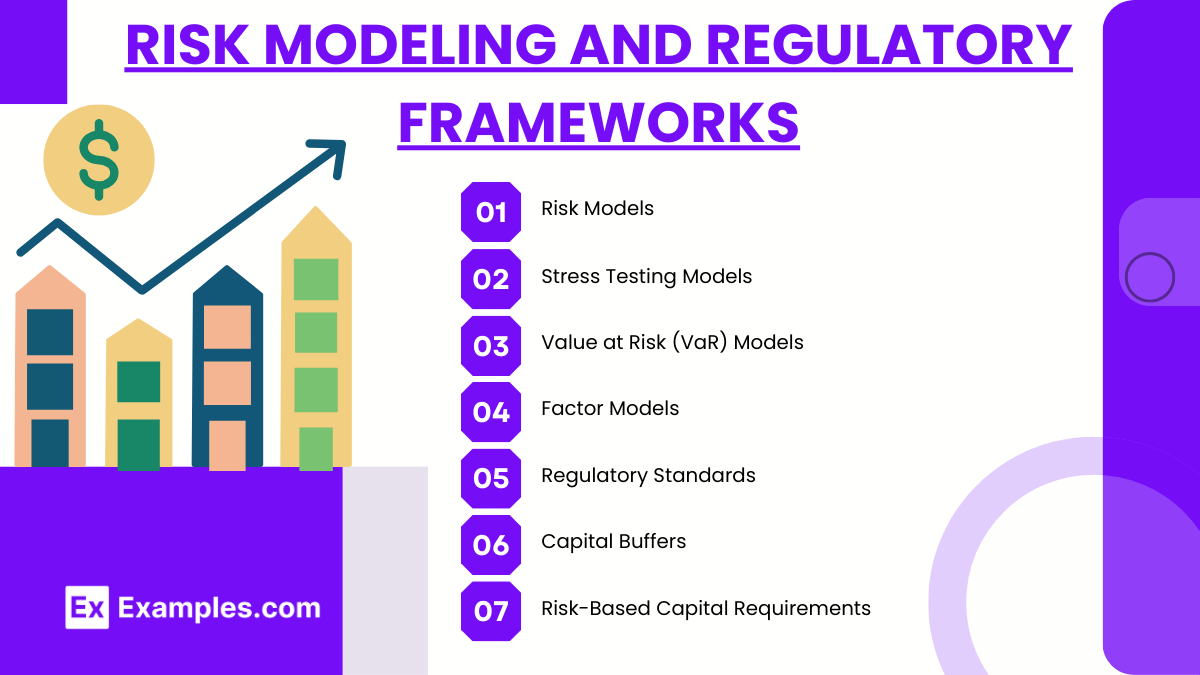

Risk Modeling and Regulatory Frameworks

Risk modeling and regulatory frameworks provide a structured approach to identifying, measuring, managing, and mitigating risk within financial institutions and portfolios. These tools and guidelines ensure that organizations can evaluate their risk exposure and maintain compliance with industry regulations, reducing the likelihood of financial instability. Effective risk models offer critical insights into market behaviors, and regulatory standards set clear expectations for managing risk at both the institutional and systemic levels.

- Risk Models: Models such as single-factor and multi-factor models help quantify market risk exposure by considering various risk drivers. They allow financial institutions to predict potential losses and optimize risk management strategies.

- Stress Testing Models: Used to simulate adverse market conditions and measure their impact on a portfolio or financial institution. Stress testing identifies potential vulnerabilities and prepares organizations for unexpected market shocks.

- Value at Risk (VaR) Models: VaR quantifies the potential maximum loss of a portfolio over a specified period at a given confidence level. VaR models are widely used for regulatory reporting and internal risk management.

- Factor Models: These models assess the sensitivity of an asset or portfolio to multiple risk factors, such as economic indicators or market-specific events, providing a comprehensive view of risk exposure.

- Regulatory Standards: Frameworks such as the Basel Accords establish rules and minimum capital requirements to protect against market, credit, and operational risks. Compliance ensures stability and helps mitigate systemic risk in financial markets.

- Capital Buffers: Regulatory standards often mandate capital buffers that institutions must hold in addition to minimum capital requirements, providing an extra cushion against potential losses during market downturns.

- Risk-Based Capital Requirements: These requirements ensure that institutions allocate sufficient capital to cover their risk exposure, promoting sound risk management practices and reducing potential systemic threats.

Examples

Example 1: Portfolio Hedging with Derivatives

A portfolio manager uses futures contracts to hedge against potential declines in the stock market. By taking a short position in index futures, the manager can offset losses in the equity portion of the portfolio during a market downturn, thus managing market risk exposure effectively.

Example 2: Value at Risk (VaR) Analysis for a Bank

A bank measures its market risk exposure using Value at Risk (VaR) to quantify the potential maximum loss it could incur over a one-day period with a 95% confidence level. This analysis helps the bank establish risk limits, allocate capital, and prepare for potential large losses.

Example 3: Stress Testing a Financial Institution

A major financial institution conducts stress tests to simulate adverse scenarios, such as a sudden rise in interest rates or an economic recession. By assessing the impact on its balance sheet, the institution can identify potential vulnerabilities and develop strategies to mitigate risk during market shocks.

Example 4: Currency Risk Management for a Global Company

A multinational corporation manages currency risk by using currency swaps and forward contracts. By locking in exchange rates, the company can stabilize its cash flows and protect against unfavorable currency movements that could negatively affect profitability.

Example 5: Interest Rate Risk Management with Duration and Convexity

A bond fund manager evaluates the portfolio’s sensitivity to changes in interest rates using duration and convexity. The manager adjusts the portfolio composition, using tools like interest rate swaps or diversifying bond holdings, to manage and reduce interest rate risk exposure.

Practice Questions

Question 1

Which of the following best describes the purpose of Value at Risk (VaR) in risk management?

A. It measures the total amount of profit a portfolio can generate over a specified period.

B. It quantifies the maximum expected loss a portfolio can incur over a specified time at a given confidence level.

C. It calculates the potential return on a risk-free asset.

D. It identifies the maximum possible gains from market fluctuations.

Answer: B. It quantifies the maximum expected loss a portfolio can incur over a specified time at a given confidence level.

Explanation:

Value at Risk (VaR) is a commonly used metric to measure the maximum expected loss of a portfolio over a defined time period at a given confidence level (e.g., 95% or 99%). It provides a clear quantification of potential downside risk and helps financial institutions and portfolio managers set appropriate risk limits. Unlike profit measures or risk-free returns, VaR focuses on potential losses.

Question 2

Stress testing and scenario analysis in market risk management are primarily used to:

A. Identify the best-performing investments in a portfolio.

B. Simulate adverse market conditions to assess potential portfolio impact.

C. Determine the average returns of a portfolio over time.

D. Compare different hedging instruments.

Answer: B. Simulate adverse market conditions to assess potential portfolio impact.

Explanation:

Stress testing and scenario analysis involve applying extreme or hypothetical market conditions to a portfolio to evaluate how it may perform under these scenarios. The primary purpose is to identify potential vulnerabilities, measure the portfolio’s resilience, and develop strategies to mitigate risk during adverse market events. This differs from normal performance analysis or comparisons of hedging tools.

Question 3

Which of the following tools is often used to manage interest rate risk in fixed-income portfolios?

A. Correlation analysis

B. Futures contracts

C. Duration and convexity analysis

D. Option pricing models

Answer: C. Duration and convexity analysis

Explanation:

Duration and convexity are critical tools in measuring the sensitivity of a fixed-income portfolio to changes in interest rates. Duration indicates the percentage change in bond price for a change in interest rates, while convexity provides a more refined measure of this sensitivity by capturing the curvature of the price-yield relationship. Together, they allow portfolio managers to assess and manage interest rate risk effectively.