Monetary Policy plays a critical role in shaping economic conditions by influencing interest rates, inflation, and overall economic growth. This topic explores the tools central banks use, including open market operations, interest rate adjustments, and reserve requirements, to manage money supply and maintain economic stability. A thorough understanding of how monetary policy affects market conditions, investment strategies, and financial decision-making is essential for financial analysis. Mastery of these concepts enables a nuanced approach to assessing the macroeconomic environment and its impact on asset prices and investor behavior.

Learning Objectives

In studying “Monetary Policy” for the CFA, you should learn to understand the objectives of monetary policy, such as controlling inflation, managing employment levels, and ensuring economic stability. Analyze the tools central banks use, including open market operations, interest rate adjustments, and reserve requirements, and their impact on the economy. Understand the role of central banks in influencing short-term interest rates and money supply to achieve economic goals. Evaluate different types of monetary policy stances—expansionary and contractionary—and their effects on financial markets, exchange rates, and business cycles. Additionally, assess the limitations and challenges of monetary policy, including the trade-offs involved and the influence of global economic conditions on domestic policy effectiveness.

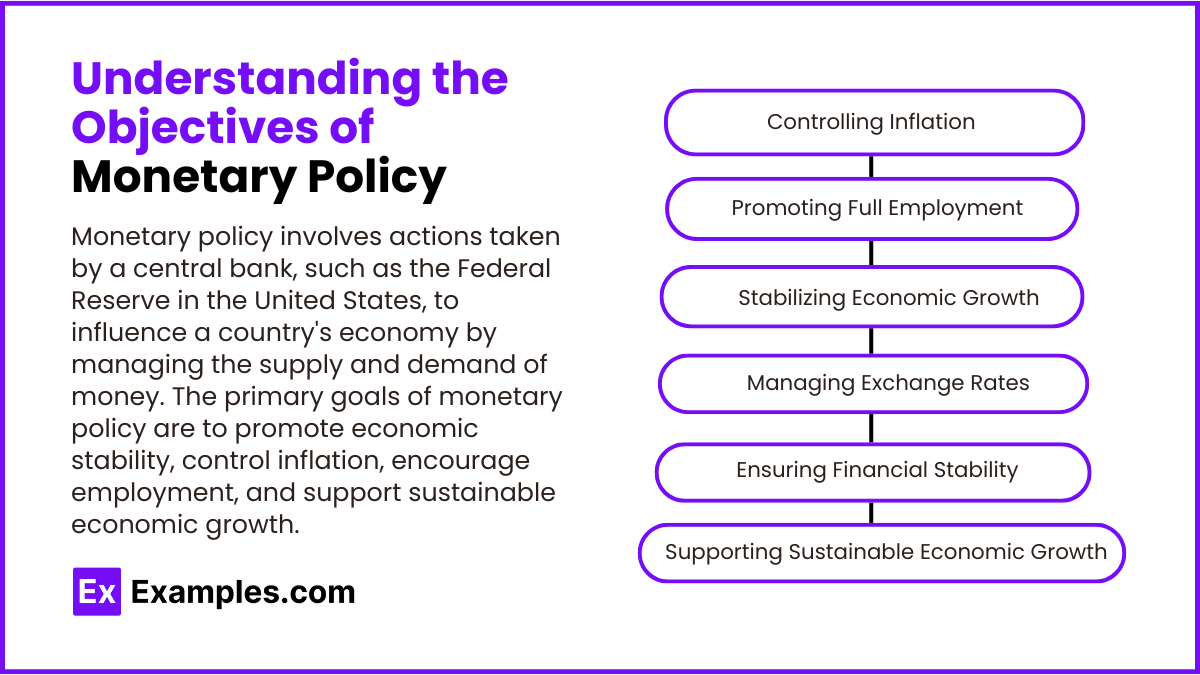

Understanding the Objectives of Monetary Policy

Monetary policy involves actions taken by a central bank, such as the Federal Reserve in the United States, to influence a country’s economy by managing the supply and demand of money. The primary goals of monetary policy are to promote economic stability, control inflation, encourage employment, and support sustainable economic growth. Here’s a breakdown of the key objectives of monetary policy and how they impact the economy.

1. Controlling Inflation: One of the main objectives of monetary policy is to keep inflation within a target range. Inflation erodes purchasing power, reducing consumer and business confidence. Central banks often set an inflation target, such as 2% annually, as a healthy rate that supports growth without destabilizing the economy.

2. Promoting Full Employment: Another goal of monetary policy is to support maximum employment, aiming for a level of job creation where anyone who wants a job can find one, within reasonable limits. High employment levels contribute to economic growth and improve living standards.

3. Stabilizing Economic Growth: Monetary policy also aims to smooth out economic cycles by preventing extreme booms and busts. Economic stability supports long-term growth, as both rapid expansion and sharp contraction can destabilize the economy.

4. Managing Exchange Rates (in Some Economies): In countries where the exchange rate is a key economic factor, monetary policy may aim to maintain a stable currency value. A stable exchange rate supports trade by reducing uncertainty for exporters and importers.

5. Ensuring Financial Stability: Monetary policy also aims to support a stable financial system by overseeing money supply, interest rates, and lending conditions. Financial stability is crucial for protecting consumer confidence and preventing crises that can lead to severe economic downturns.

6. Supporting Sustainable Economic Growth: Sustainable growth is a long-term objective, as it ensures that economic expansion is steady, resilient, and not driven by unsustainable debt or bubbles. Sustainable growth aligns with the central bank’s goal of fostering a healthy economy.

Tools of Monetary Policy

Central banks use various tools of monetary policy to influence the money supply, interest rates, and overall economic activity. These tools allow central banks to achieve objectives such as controlling inflation, promoting employment, stabilizing economic growth, and maintaining financial stability. Here’s an overview of the main tools of monetary policy and how they work:

1. Open Market Operations (OMOs)

Open market operations are one of the primary tools used by central banks to control the money supply. Through OMOs, central banks buy or sell government securities in the open market to influence the level of bank reserves and interest rates.

- Expansionary OMO: When the central bank buys government securities, it increases bank reserves, allowing banks to lend more. This lowers interest rates and stimulates economic activity.

- Contractionary OMO: When the central bank sells government securities, it reduces bank reserves, leading to higher interest rates and cooling off economic activity.

2. Discount Rate (Interest Rate on Central Bank Loans)

The discount rate is the interest rate charged by central banks on loans to commercial banks. By raising or lowering this rate, central banks can influence the cost of borrowing for banks, which affects overall lending rates in the economy.

- Lowering the Discount Rate: Makes it cheaper for banks to borrow from the central bank, encouraging them to lend more to businesses and consumers. This stimulates economic activity.

- Raising the Discount Rate: Increases the cost of borrowing for banks, making loans more expensive for consumers and businesses, which slows economic activity.

3. Reserve Requirements

Reserve requirements refer to the percentage of deposits that banks must hold in reserve and not lend out. By adjusting this requirement, central banks can control how much money banks can create through lending.

- Lowering Reserve Requirements: Allows banks to lend more of their deposits, increasing the money supply and stimulating the economy.

- Raising Reserve Requirements: Reduces the amount banks can lend, decreasing the money supply and slowing down economic activity.

4. Interest on Reserves

Central banks can pay interest on the reserves that banks hold with them. By changing this interest rate, central banks can influence banks’ incentives to hold reserves or lend money out to the public.

- Higher Interest on Reserves: Encourages banks to hold more reserves with the central bank rather than lending, reducing the money supply and slowing economic activity.

- Lower Interest on Reserves: Encourages banks to lend more, increasing the money supply and stimulating economic activity.

5. Quantitative Easing (QE)

Quantitative easing is an unconventional tool used when interest rates are already near zero, and further rate cuts aren’t possible. Through QE, central banks purchase longer-term securities, such as government bonds or mortgage-backed securities, to inject money directly into the economy.

- Goal: QE aims to lower long-term interest rates, increase the money supply, and encourage lending and investment when traditional tools are less effective.

- Impact: It boosts asset prices, reduces yields, and encourages investors to move funds into other investments, such as stocks, to stimulate economic growth.

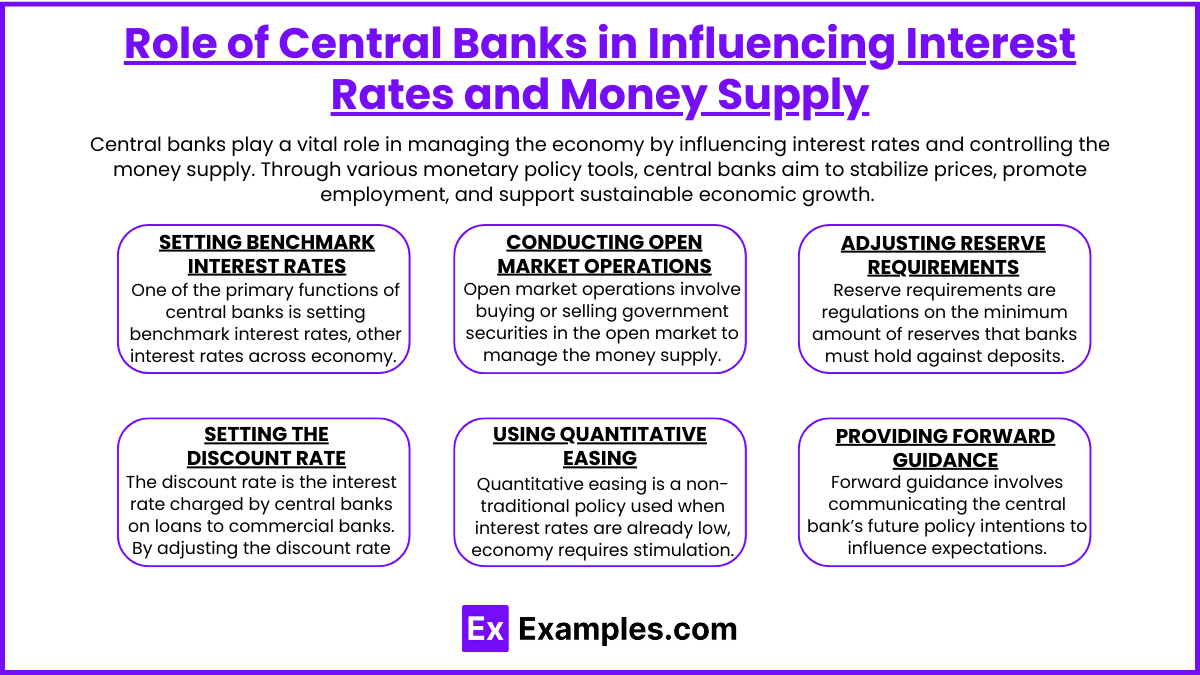

Role of Central Banks in Influencing Interest Rates and Money Supply

Central banks play a vital role in managing the economy by influencing interest rates and controlling the money supply. Through various monetary policy tools, central banks aim to stabilize prices, promote employment, and support sustainable economic growth. Here’s an overview of how central banks influence interest rates and the money supply and the impact of these actions on the broader economy.

1. Setting Benchmark Interest Rates

One of the primary functions of central banks is setting benchmark interest rates, which serve as a base for other interest rates across the economy. The central bank’s policy rate influences borrowing costs for banks, businesses, and consumers.

- Lowering Interest Rates: When the central bank lowers rates, borrowing becomes cheaper for consumers and businesses, encouraging spending, investment, and economic growth.

- Raising Interest Rates: When rates are increased, borrowing costs rise, reducing consumer spending and business investment, which can help cool down an overheated economy.

2. Conducting Open Market Operations (OMOs)

Open market operations involve buying or selling government securities in the open market to manage the money supply. OMOs are a primary tool for controlling short-term interest rates and influencing liquidity in the banking system.

- Buying Securities (Expansionary): The central bank buys securities, injecting money into the banking system, lowering interest rates, and encouraging lending.

- Selling Securities (Contractionary): By selling securities, the central bank reduces the money supply, raises interest rates, and restrains borrowing and spending.

3. Adjusting Reserve Requirements

Reserve requirements are regulations on the minimum amount of reserves that banks must hold against deposits. By changing reserve requirements, central banks directly influence the amount of money banks can lend.

- Lower Reserve Requirements: This allows banks to lend more, increasing the money supply and stimulating economic activity.

- Higher Reserve Requirements: Limits the amount of money available for lending, reducing the money supply and cooling down the economy.

4. Setting the Discount Rate

The discount rate is the interest rate charged by central banks on loans to commercial banks. By adjusting the discount rate, central banks can control the cost of borrowing for financial institutions, which affects lending rates across the economy.

- Lowering the Discount Rate: Makes it cheaper for banks to borrow, encouraging them to increase lending to consumers and businesses, which boosts economic activity.

- Raising the Discount Rate: Increases borrowing costs for banks, discouraging them from lending and reducing overall economic activity.

5. Using Quantitative Easing (QE)

Quantitative easing is a non-traditional policy used when interest rates are already low, and the economy requires further stimulation. Through QE, central banks purchase long-term securities, such as government bonds and mortgage-backed securities, injecting liquidity into the economy.

- Objective: QE aims to lower long-term interest rates, increase the money supply, and support lending and investment when traditional monetary policy tools are less effective.

- Impact: QE boosts asset prices, lowers yields, and encourages investors to move capital into other areas, such as equities, to stimulate economic growth.

6. Providing Forward Guidance

Forward guidance involves communicating the central bank’s future policy intentions to influence market expectations. By signaling their intentions, central banks can guide expectations about inflation, interest rates, and economic growth.

- Objective: Forward guidance reduces uncertainty, helping consumers and businesses plan their spending and investment decisions with more confidence.

- Impact: It stabilizes financial markets by clarifying the central bank’s policy direction, preventing sudden shifts in economic activity due to unexpected policy changes.

Types of Monetary Policy Stances: Expansionary vs. Contractionary

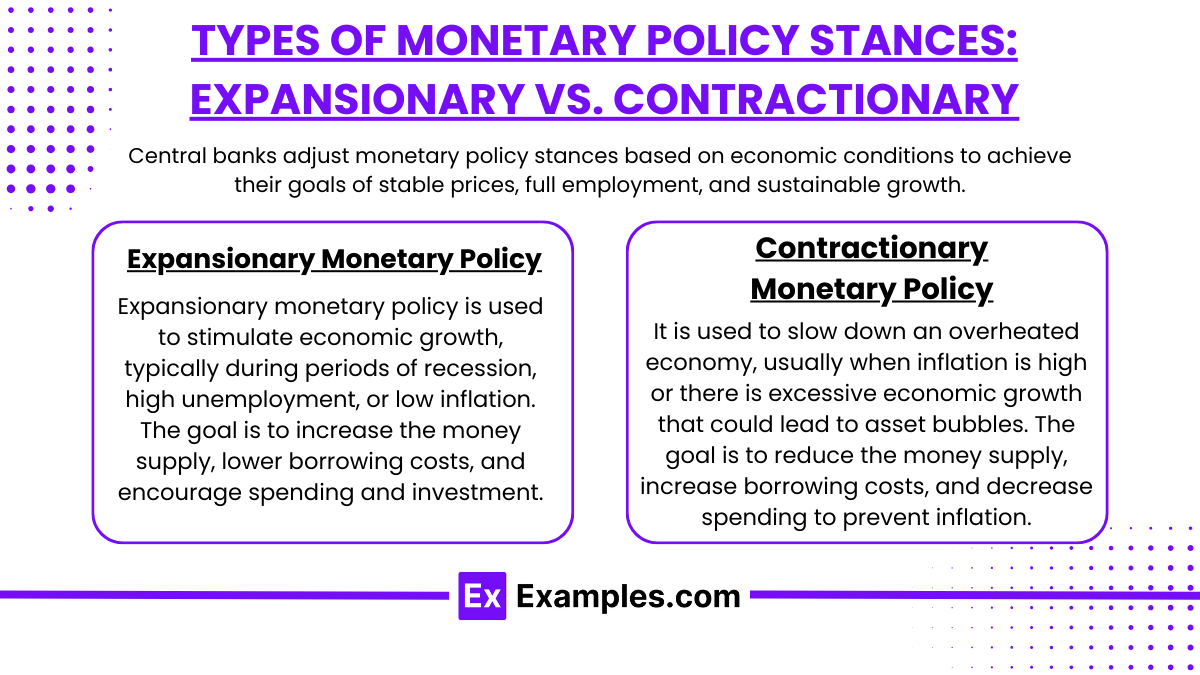

Central banks adjust monetary policy stances based on economic conditions to achieve their goals of stable prices, full employment, and sustainable growth. The two main stances are expansionary and contractionary monetary policy, each with distinct goals and tools. Here’s an overview of both types and their effects on the economy.

1. Expansionary Monetary Policy

Expansionary monetary policy is used to stimulate economic growth, typically during periods of recession, high unemployment, or low inflation. The goal is to increase the money supply, lower borrowing costs, and encourage spending and investment.

- Tools Used:

- Lowering Interest Rates: Central banks reduce benchmark interest rates, making borrowing cheaper for consumers and businesses, which encourages spending and investment.

- Buying Government Securities (Open Market Operations): The central bank buys government bonds to inject money into the banking system, lowering interest rates further and increasing liquidity.

- Reducing Reserve Requirements: Lowering the amount of reserves banks must hold allows them to lend more, boosting the money supply.

- Quantitative Easing (QE): If interest rates are already near zero, central banks may purchase longer-term securities, such as mortgage-backed securities, to provide more liquidity and support economic recovery.

- Expected Effects:

- Increased Spending and Investment: Lower borrowing costs encourage businesses to invest and consumers to spend.

- Higher Employment: With more spending and business investment, demand for labor rises, helping to reduce unemployment.

- Increased Inflation (When Needed): Expansionary policy can raise inflation closer to a central bank’s target, supporting price stability.

Example: During the 2008 financial crisis, the Federal Reserve used an expansionary policy by lowering interest rates and implementing quantitative easing to support economic recovery and prevent a deeper recession.

2. Contractionary Monetary Policy

Contractionary monetary policy is used to slow down an overheated economy, usually when inflation is high or there is excessive economic growth that could lead to asset bubbles. The goal is to reduce the money supply, increase borrowing costs, and decrease spending to prevent inflation from rising uncontrollably.

- Tools Used:

- Raising Interest Rates: Central banks increase benchmark interest rates, making borrowing more expensive for businesses and consumers, which reduces spending and investment.

- Selling Government Securities (Open Market Operations): The central bank sells government bonds, which reduces bank reserves, raises interest rates, and decreases the money supply.

- Increasing Reserve Requirements: Raising the reserve ratio forces banks to hold more reserves and limits their ability to lend, slowing down the economy.

- Increasing Interest on Reserves: Central banks may raise the interest paid on reserves held by banks, encouraging banks to hold more funds rather than lend them out.

- Expected Effects:

- Decreased Spending and Investment: Higher borrowing costs discourage businesses from expanding and consumers from making large purchases, which helps slow economic activity.

- Lower Inflation: With reduced demand, inflationary pressures decrease, helping keep inflation within the target range.

- Controlled Economic Growth: By slowing down spending and investment, contractionary policy aims to prevent the economy from overheating, reducing the risk of asset bubbles and maintaining sustainable growth.

Example: In the late 1970s, the Federal Reserve implemented contractionary policy by raising interest rates significantly to combat double-digit inflation, which ultimately helped bring inflation under control.

Examples

Example 1:Open Market Operations

Central banks engage in open market operations by buying or selling government securities in the open market to regulate the money supply. For instance, if a central bank wants to stimulate the economy, it may purchase government bonds, which injects liquidity into the banking system. This action lowers interest rates, encouraging borrowing and spending by consumers and businesses.

Example 2: Adjusting Interest Rates

One of the primary tools of monetary policy is adjusting the benchmark interest rate, such as the federal funds rate in the United States. When a central bank lowers interest rates, it reduces the cost of borrowing, making loans more affordable for consumers and businesses. This encourages investment and consumption, thereby stimulating economic growth. Conversely, raising interest rates can help control inflation by discouraging excessive borrowing.

Example 3: Quantitative Easing

In response to economic downturns, central banks may implement quantitative easing (QE), a non-traditional monetary policy tool. This involves purchasing long-term securities, such as government bonds and mortgage-backed securities, to increase the money supply and lower long-term interest rates. For example, during the financial crisis of 2008, the Federal Reserve initiated QE to stabilize the financial system and promote recovery by encouraging lending and investment.

Example 4: Reserve Requirements

Central banks can influence the amount of money that banks can lend by adjusting reserve requirements. By lowering the reserve requirement ratio, banks are required to hold less capital in reserve, allowing them to lend more of their deposits. This increases the money supply and can stimulate economic activity. Conversely, raising reserve requirements restricts the amount banks can lend, helping to cool off an overheated economy.

Example 5: Forward Guidance

Central banks use forward guidance as a communication tool to influence market expectations about future monetary policy. By signaling their intentions regarding interest rates and other policy measures, central banks aim to shape economic behavior. For example, if a central bank indicates that it plans to keep interest rates low for an extended period, it can encourage consumers and businesses to invest and spend, thereby supporting economic growth. This tool is particularly effective in managing expectations during uncertain economic times.

Practice Questions

Question 1

What is the primary goal of monetary policy?

A) To increase government spending

B) To control inflation and stabilize the economy

C) To regulate foreign trade

D) To set tax rates

Correct Answer: B) To control inflation and stabilize the economy.

Explanation: The primary goal of monetary policy is to manage the economy by controlling inflation and promoting stable economic growth. Central banks, such as the Federal Reserve in the United States, implement monetary policy through tools like interest rates and open market operations to influence money supply and credit availability. While government spending and tax rates are fiscal policy tools, monetary policy focuses specifically on the money supply and its effects on inflation and economic stability.

Question 2

Which of the following is a tool used by central banks to implement monetary policy?

A) Fiscal stimulus

B) Tax incentives

C) Open market operations

D) Import tariffs

Correct Answer: C) Open market operations.

Explanation: Open market operations refer to the buying and selling of government securities by a central bank to influence the money supply and interest rates. When a central bank buys securities, it increases the money supply, which can lower interest rates and stimulate economic activity. Conversely, selling securities reduces the money supply, which can help control inflation. Fiscal stimulus, tax incentives, and import tariffs are not monetary policy tools; they fall under fiscal policy measures.

Question 3

What effect does lowering interest rates typically have on the economy?

A) It reduces consumer spending and investment.

B) It encourages borrowing and stimulates economic growth.

C) It leads to an increase in inflation.

D) It strengthens the national currency.

Correct Answer: B) It encourages borrowing and stimulates economic growth.

Explanation: Lowering interest rates makes borrowing cheaper for consumers and businesses, encouraging them to take out loans for spending and investment. This increase in borrowing can stimulate economic growth by boosting consumer spending and business expansion. While lower interest rates can lead to higher inflation over time, the immediate effect is generally positive for economic activity. Options A, C, and D do not accurately describe the typical impacts of lower interest rates on the economy.