Preparing for the CFA Exam requires a comprehensive understanding of “Natural Resources,” a key area within alternative investments. Mastery of this asset class, including commodities like oil, gas, metals, and timber, is essential. This knowledge provides insights into portfolio diversification, inflation protection, and resource-driven economic cycles, critical for achieving a high CFA score.

Learning Objective

In studying “Natural Resources” for the CFA Exam, you should aim to understand the characteristics, investment methods, and performance drivers of natural resource assets, including commodities like oil, gas, metals, agriculture, and timber. Analyze how natural resources contribute to portfolio diversification, inflation protection, and potential returns during economic cycles. Evaluate the unique risks associated with natural resources, such as volatility, geopolitical factors, and environmental impacts. Additionally, explore various methods of investing in natural resources, from direct commodity ownership to equities in resource companies and exchange-traded funds (ETFs). Apply this knowledge to assess the role of natural resources in a diversified portfolio for practical use on the CFA Exam.

Overview of Natural Resources as an Investment Class

Natural resources constitute a broad category of investment assets that include physical substances such as minerals, forests, water, and agricultural land. These investments are considered alternative assets and can provide diversification in an investment portfolio due to their unique characteristics and economic fundamentals. Here’s an overview of natural resources as an investment class:

Investment Characteristics:

- Hedging Capabilities: Commodities like gold are known for their ability to hedge against inflation and currency risks.

- Diversification: Due to their low correlation with traditional financial assets like stocks and bonds, natural resources can reduce overall portfolio risk.

- Volatility: Commodity prices can be highly volatile, influenced by changes in weather, political instability, and macroeconomic factors.

- Sustainability Issues: Investments in natural resources are increasingly evaluated for their environmental impact and sustainability, influencing investor choices and regulations.

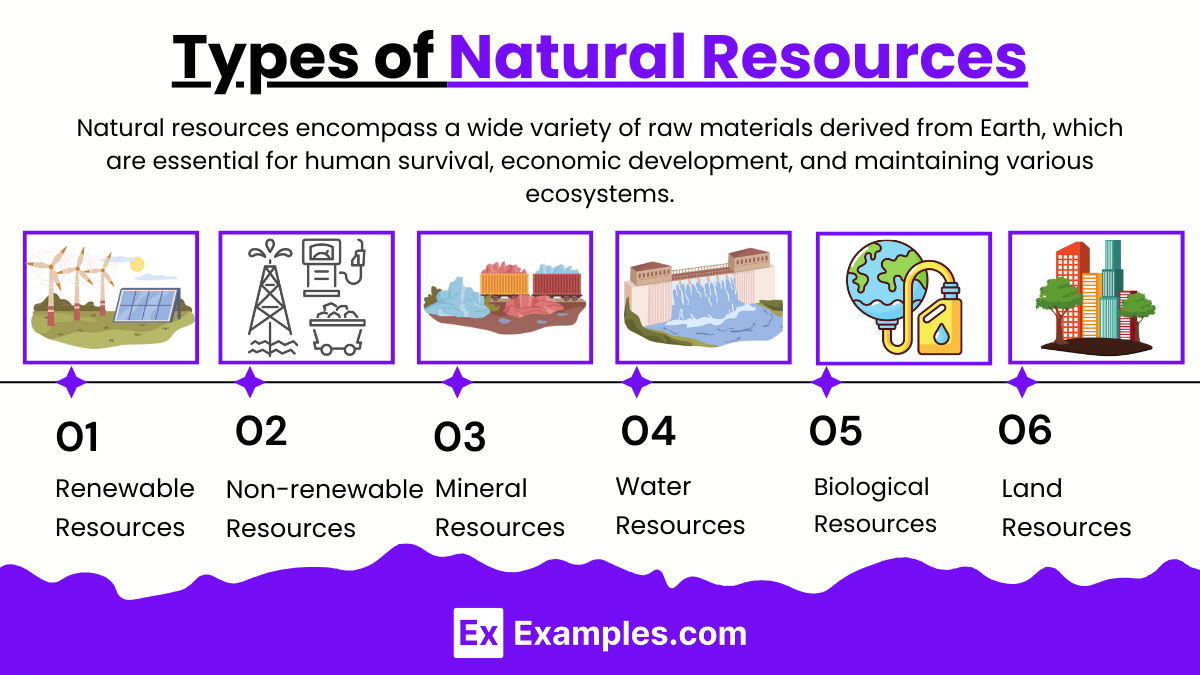

Types of Natural Resources

Natural resources encompass a wide variety of raw materials derived from Earth, which are essential for human survival, economic development, and maintaining various ecosystems. Here’s a closer look at the major types of natural resources, categorized by their characteristics and utility:

1. Renewable Resources

- Key Types: Solar, wind, hydropower, biomass, and geothermal energy.

- Can be replenished naturally over relatively short periods and are sustainable.

2. Non-renewable Resources

- Key Types: Fossil fuels (coal, oil, natural gas) and nuclear fuels (like uranium).

- Limited availability; do not renew on a human timescale and are depleted when used.

3. Mineral Resources

- Key Types: Precious metals (gold, silver, platinum), base metals (iron, copper), and industrial minerals (phosphates, silica).

- Mined from the earth, essential for various industrial and economic applications.

4. Water Resources

- Key Types: Freshwater (lakes, rivers, groundwater) and oceanic water.

- Essential for life, used in drinking, agriculture, sanitation, and industrial processes.

5. Biological Resources

- Key Types: Agricultural crops, forest resources, and fisheries.

- Include flora and fauna used for food, medicine, and industry.

6. Land Resources

- Key Types: Arable land, pasture land, and urban land.

- Used for agriculture, grazing, residential, commercial, and recreational purposes.

Investment Methods in Natural Resources

Investing in natural resources offers diverse opportunities across various sectors, each with its own set of strategies tailored to the characteristics of the resources and the dynamics of their markets. Here are some common investment methods used in natural resources:

1. Direct Ownership

- Investors purchase physical assets directly, such as land with timber, agricultural property, or mining rights.

- Offers tangible asset ownership with potential income through operational returns and appreciation over time.

2. Commodity Futures

- Contracts to buy or sell a specific commodity at a predetermined price at a future date.

- Useful for hedging against price volatility or speculating on price movements without needing to hold the physical commodity.

3. Stocks and Equities

- Investing in shares of companies involved in extraction, production, or management of natural resources, such as oil, mining, or agricultural firms.

- Provides exposure to natural resources with the liquidity and ease of trading stocks.

4. Exchange-Traded Funds (ETFs) and Mutual Funds

- Funds that invest in a diversified portfolio of stocks related to natural resources, across sectors like energy, forestry, or metals.

- Allows for diversified exposure within natural resources without managing individual stock selections.

5. Master Limited Partnerships (MLPs)

- Investment structures focusing on energy infrastructure in the U.S., such as pipelines and storage facilities.

- Offers stable income through distribution yields and tax benefits.

6. Real Estate Investment Trusts (REITs)

- Companies that own, operate, or finance income-generating real estate related to resources, such as timber REITs or farmland REITs.

- Provides regular income from real estate operations linked to natural resources, with the liquidity of traded securities.

7. Royalties and Streaming

- Financing methods where capital is provided to resource producers in exchange for royalty payments or the right to purchase production at a fixed cost.

- Allows for exposure to commodity prices and production without direct operational risks.

8. Private Equity and Venture Capital

- Direct investments in private companies or projects within the natural resources sector, typically focusing on later-stage developments or innovative technologies.

- Suitable for those willing to take on higher risks for potentially higher returns, with a longer investment horizon.

9. Debt Financing

- Investing in the debt of companies in the natural resources sectors, which can offer fixed returns and higher security than equity.

- Provides stable returns and lower risk compared to equity investments.

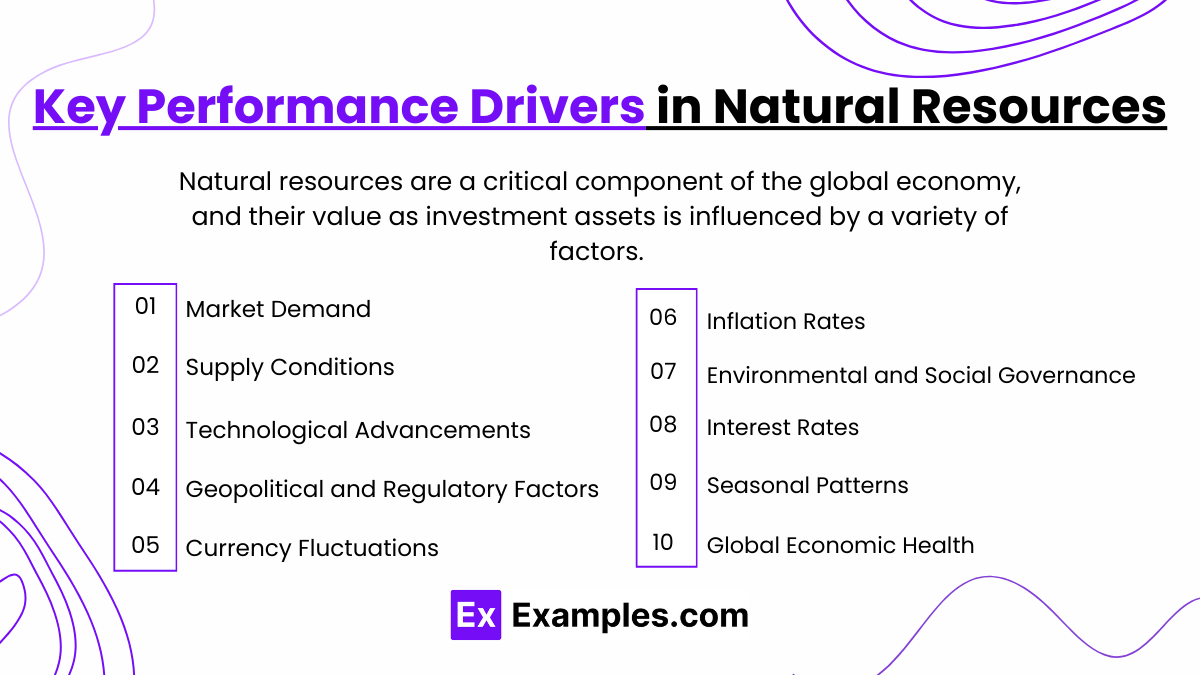

Key Performance Drivers in Natural Resources

Natural resources are a critical component of the global economy, and their value as investment assets is influenced by a variety of factors. Here’s an overview of the key performance drivers in natural resources:

1. Market Demand

- Fluctuations in demand for commodities like oil, metals, and agricultural products can significantly affect prices. Economic growth, technological advancements, and changes in consumer preferences all influence demand levels.

2. Supply Conditions

- Supply can be affected by geopolitical events, production decisions by major suppliers, natural disasters, and regulatory changes. Supply constraints or surpluses can lead to significant price volatility.

3. Technological Advancements

- Improvements in technology can dramatically change the efficiency of production and extraction processes, affecting the cost of mining or drilling. Innovations can also influence demand, as seen in the rise of renewable energy sources impacting fossil fuel markets.

4. Geopolitical and Regulatory Factors

- Changes in government policies, international trade agreements, and political stability in resource-rich regions can alter market dynamics. Regulations related to environmental protection, resource management, and taxation also play crucial roles.

5. Currency Fluctuations

- Since many natural resources are priced in U.S. dollars, changes in currency values can affect investment returns, especially for international investors and companies operating in different countries.

6. Inflation Rates

- Natural resources often act as a hedge against inflation. During periods of high inflation, tangible assets like gold, oil, and real estate typically maintain or increase their value.

7. Environmental and Social Governance (ESG) Factors

- Increasing awareness and regulation of environmental and social issues are changing the landscape of resource investments. Companies with better ESG practices may have a competitive advantage and are increasingly favored by investors.

8. Interest Rates

- Interest rates affect the cost of financing and can influence the value of income-producing natural resources like timber or agricultural land. Lower rates generally support higher valuations for these assets.

9. Seasonal Patterns

- Agricultural commodities in particular are subject to seasonal influences that can predictably affect supply and prices. Weather conditions and natural cycles also impact forestry products and energy consumption.

10. Global Economic Health

- The overall health of the global economy influences demand for natural resources. Industrial activity, construction, and energy consumption are closely tied to economic conditions.

Examples

Example 1: Oil and Gas Investment During Supply Shocks

Analyze the impact of supply disruptions (e.g., geopolitical conflicts or production cuts by OPEC) on oil and gas prices. Explore how these price shifts affect related investments, such as energy equities and futures contracts, and examine risk mitigation strategies through diversification or hedging.

Example 2: Gold as a Hedge Against Inflation

Study the role of gold as an inflation hedge, using historical data to show how it performs during periods of high inflation. Discuss the advantages of including gold in a portfolio, its low correlation with traditional assets, and its role as a “safe haven” investment during economic uncertainty.

Example 3: Investing in Timberland for Sustainable Returns

Examine timberland as a long-term investment with both capital appreciation and income from timber harvests. Discuss how timberland provides a unique diversification benefit due to its low correlation with other asset classes and its potential as a natural inflation hedge.

Example 4: Agricultural Commodities and Seasonal Price Fluctuations

Explore how seasonal factors, such as planting and harvest cycles, impact the prices of agricultural commodities like wheat and corn. Discuss the role of agricultural commodities in portfolio diversification and how they are affected by weather patterns, global demand, and trade policies.

Example 5: Renewable Energy Investments in a Diversified Portfolio

Analyze the growth of renewable energy investments, such as wind and solar farms, as part of a diversified portfolio. Discuss the potential for steady cash flows through power purchase agreements (PPAs), the impact of government incentives, and how renewable energy aligns with environmental, social, and governance (ESG) goals.

Practice Questions

Question 1

Which of the following is a primary reason investors include commodities like oil and gold in a portfolio?

A. To generate regular dividend income

B. To provide a hedge against inflation

C. To increase portfolio liquidity

D. To lower overall portfolio risk in all economic conditions

Answer:

B. To provide a hedge against inflation

Explanation:

Commodities like oil and gold are often included in portfolios to serve as a hedge against inflation, as their prices tend to rise when inflation increases. Unlike stocks or bonds, commodities do not generate dividend income and may not lower risk in all economic conditions due to their price volatility.

Question 2

Which natural resource investment is known for providing both low correlation with traditional assets and income through sustainable harvests?

A. Oil futures

B. Gold bullion

C. Timberland

D. Agricultural ETFs

Answer:

C. Timberland

Explanation:

Timberland investments provide income through sustainable timber harvests and exhibit low correlation with traditional assets like stocks and bonds, making them a valuable diversification tool. Unlike commodities such as oil and gold, timberland also offers potential for long-term capital appreciation while maintaining steady cash flows.

Question 3

What is a key risk factor for investing in agricultural commodities?

A. Dividend cut risk

B. Low correlation with inflation

C. Exposure to seasonal and weather-related fluctuations

D. High regulatory risk in all countries

Answer:

C. Exposure to seasonal and weather-related fluctuations

Explanation:

Agricultural commodities are particularly sensitive to seasonal cycles and weather patterns, which can lead to price volatility and impact crop yields. While regulatory risks exist, they vary by region, and agricultural commodities are generally included in portfolios for their inflation correlation, not for dividend income.