Option Replication Using Put-Call Parity

- Notes

Preparing for the CFA Exam necessitates a clear understanding of “Option Replication Using Put-Call Parity”, a key concept in options trading. This principle explains how combining call and put options with the underlying asset or risk-free bonds can replicate option payoffs and spot arbitrage opportunities. Proficiency in Put-Call Parity helps candidates identify mispricings and structure synthetic positions, essential for informed decision-making and risk management. This foundational knowledge supports the goal of achieving a high CFA score.

Learning Objectives

In studying “Option Replication Using Put-Call Parity” for the CFA, you should learn to understand the fundamental principles behind replicating option payoffs and identifying arbitrage opportunities in financial markets. This involves recognizing the relationship between call and put options, the underlying asset, and risk-free bonds, which allows for constructing synthetic positions that mimic the payoffs of actual options. Mastery of this principle enables you to exploit mispricings and create balanced investment strategies.

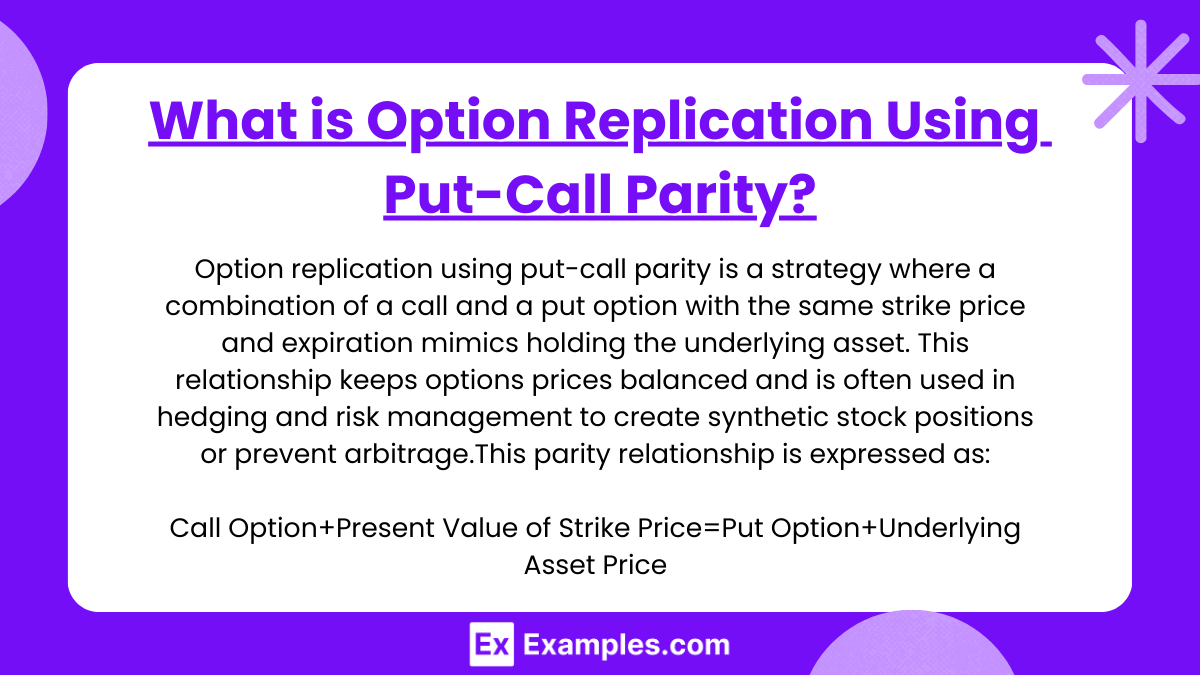

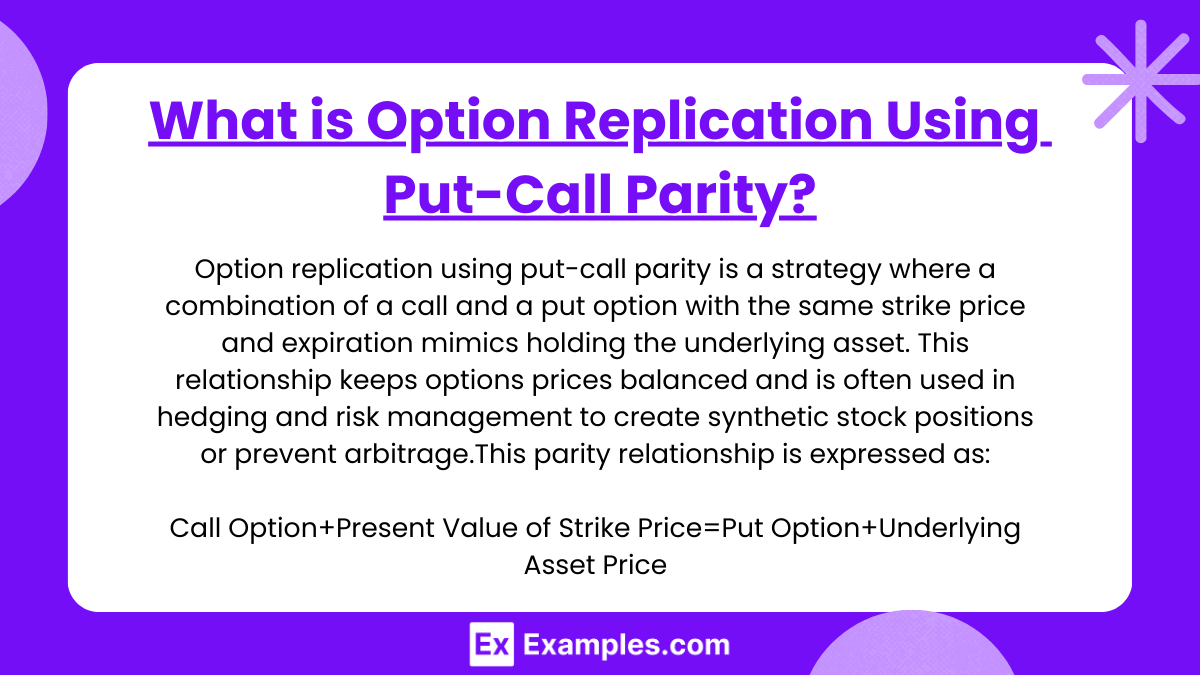

What is Option Replication Using Put-Call Parity?

Option replication with put-call parity is based on the principle that a call option and a put option with the same strike price and expiration can be used with the underlying asset and a bond to replicate each other’s payoffs. This parity relationship is expressed as:

Call Option+Present Value of Strike Price=Put Option+Underlying Asset Price

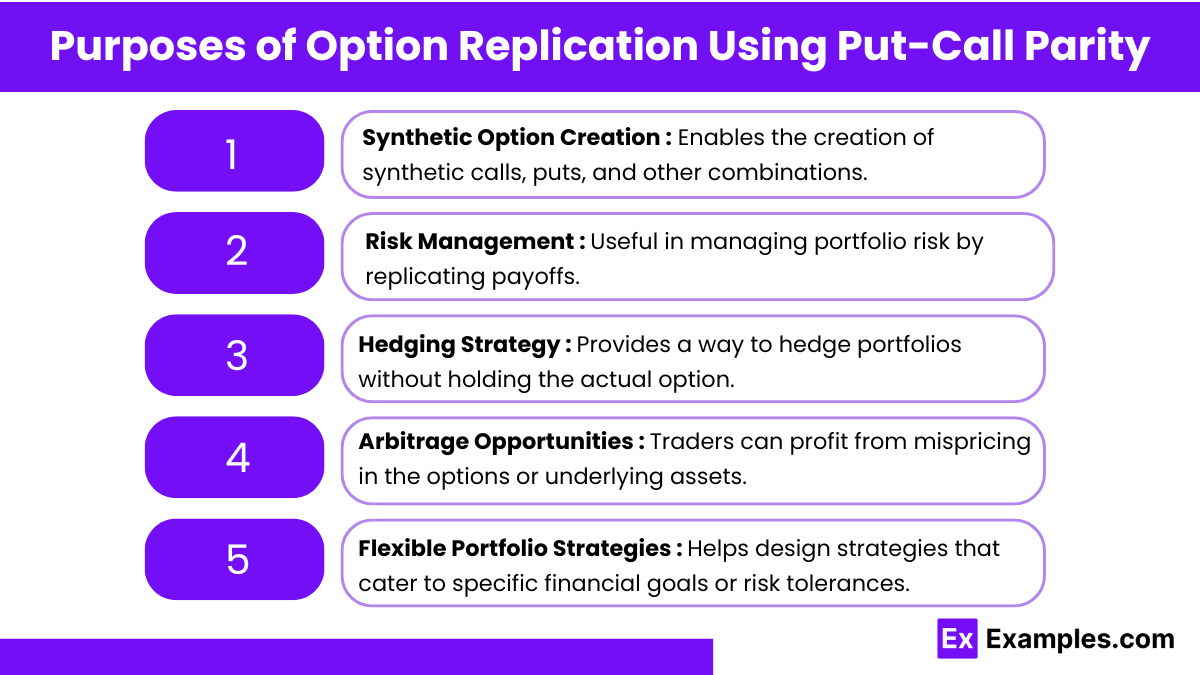

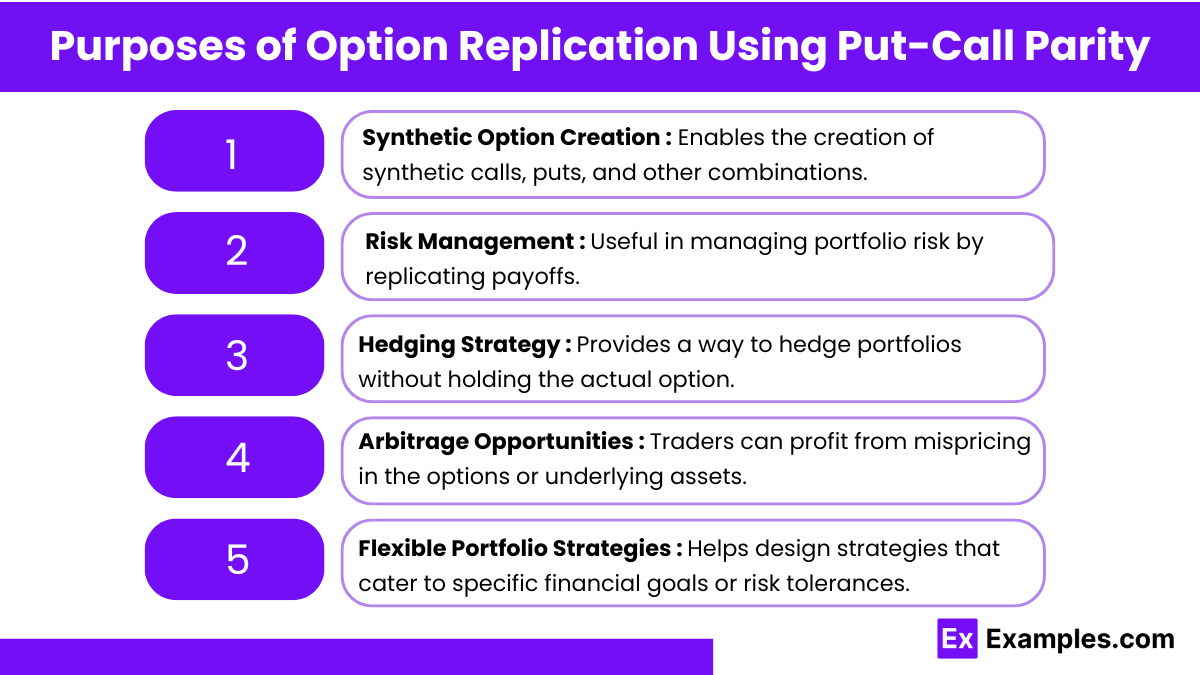

Purposes of Option Replication Using Put-Call Parity

- Synthetic Option Creation: Enables the creation of synthetic calls, puts, and other combinations.

- Risk Management: Useful in managing portfolio risk by replicating payoffs.

- Hedging Strategy: Provides a way to hedge portfolios without holding the actual option.

- Arbitrage Opportunities: Traders can profit from mispricing in the options or underlying assets.

- Flexible Portfolio Strategies: Helps design strategies that cater to specific financial goals or risk tolerances.

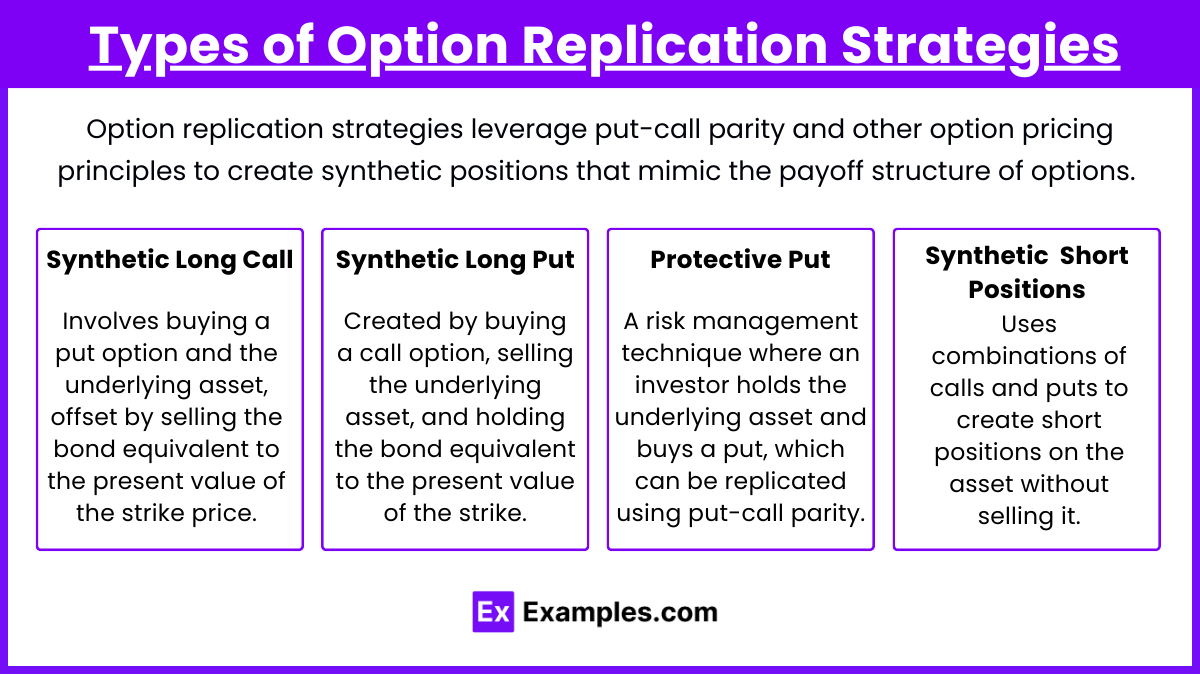

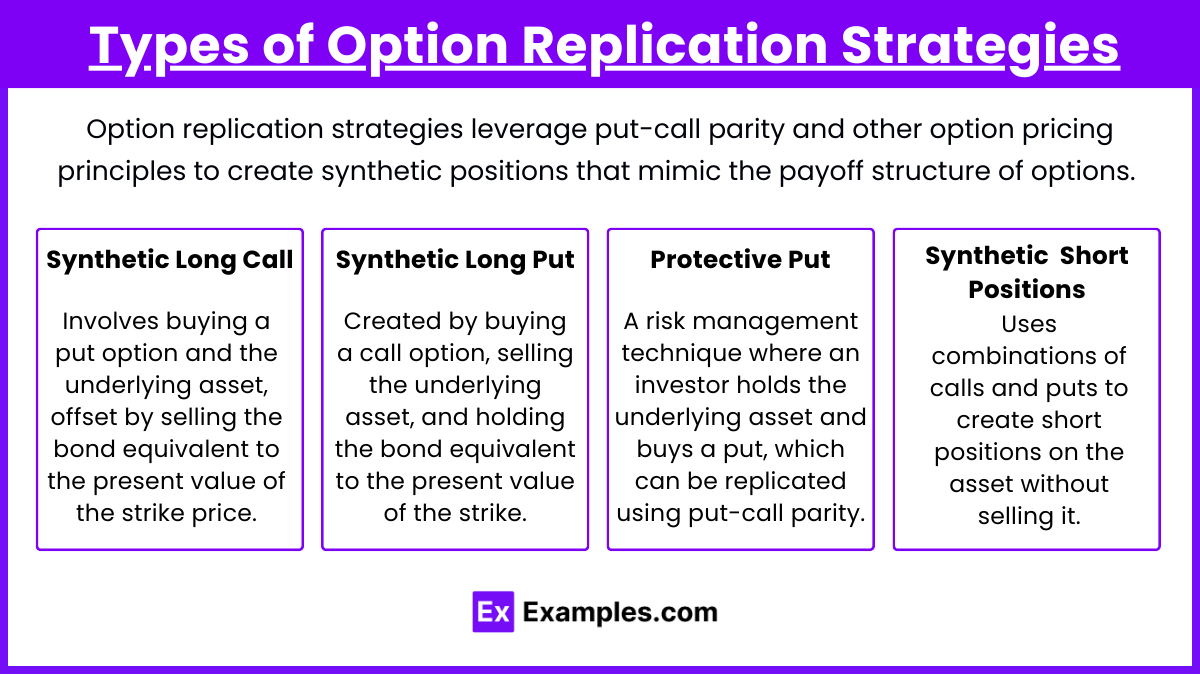

Types of Option Replication Strategies

- Synthetic Long Call: Involves buying a put option and the underlying asset, offset by selling the bond equivalent to the present value of the strike price.

- Synthetic Long Put: Created by buying a call option, selling the underlying asset, and holding the bond equivalent to the present value of the strike.

- Protective Put: A risk management technique where an investor holds the underlying asset and buys a put, which can be replicated using put-call parity.

- Synthetic Positions: Uses combinations of calls and puts to create short positions on the asset without selling it.

Examples

Example 1. Hedging Against Market Downturns

Investors can replicate a synthetic long position in stock by combining a long call option and a short put option at the same strike price and expiration. This allows investors to hedge their positions, especially during volatile market conditions, while also taking advantage of put-call parity to manage risk with less capital than purchasing the underlying asset directly.

Example 2. Constructing Synthetic Short Positions

Through put-call parity, traders can construct a synthetic short position in the underlying stock by purchasing a put option and short-selling a call option with the same strike price and expiration date. This method helps in managing bearish positions without directly shorting the asset, which may be advantageous in regulated or restricted markets.

Example 3. Arbitrage Opportunities in Pricing

Traders utilize put-call parity to identify discrepancies in option prices, allowing for arbitrage opportunities. For instance, if the cost of buying a stock and a put differs significantly from the price of a call option, traders can exploit this by simultaneously buying the underpriced asset and selling the overpriced one to lock in a risk-free profit, adjusting for any market inefficiencies.

Example 4. Creating a Risk-Free Position (Box Spread)

A box spread strategy combines long and short positions in calls and puts across two strike prices to create a risk-free payoff if put-call parity holds. This strategy is often used when mispricing occurs in the market, allowing traders to leverage put-call parity by locking in a known profit with zero market risk, as long as transaction costs are minimal.

Example 5. Portfolio Management and Position Adjustment

By understanding put-call parity, portfolio managers can efficiently adjust exposures without liquidating the actual stock positions. For instance, if they need to maintain a synthetic exposure to the stock but expect a short-term decline, they can sell a call and buy a put to replicate a synthetic cash position. This method provides flexibility in managing portfolio risk while aligning with specific investment strategies, thanks to the fundamental equivalence of the options under put-call parity.

Practice Questions

Question 1

What does put-call parity imply about the relationship between European call and put options with the same strike price and expiration date?

A) The call option is always more expensive than the put option.

B) The value of a call option plus the present value of the strike price equals the value of the put option plus the stock price.

C) A put option is always more valuable than a call option.

D) The call and put options are always priced equally.

Answer: B) The value of a call option plus the present value of the strike price equals the value of the put option plus the stock price.

Explanation:

Put-call parity is a fundamental principle in options pricing that shows the relationship between the price of European call and put options with the same strike price and expiration. The put-call parity formula is typically written as:C+PV(X)=P+S

where:

- C is the price of the call option.

- P is the price of the put option.

- S is the current stock price.

- PV(X) is the present value of the strike price X, discounted at the risk-free rate.

This relationship means that the value of a call plus the present value of the strike price (i.e., cash equivalent) equals the value of a put plus the stock price, allowing for arbitrage-free pricing of these options. Answer A is incorrect as the value depends on market conditions, and answer D is incorrect because calls and puts are rarely priced equally.

Question 2

An investor holds a long position in a stock and wants to protect against downside risk. According to put-call parity, which of the following strategies can replicate a protective put?

A) Buying a call option and shorting the stock.

B) Buying a call option and a risk-free bond with a face value equal to the strike price.

C) Selling a call option and buying a risk-free bond.

D) Selling a put option and buying the underlying stock.

Answer: B) Buying a call option and a risk-free bond with a face value equal to the strike price.

Explanation:

To replicate a protective put, the investor wants to create a position that will limit downside losses on the stock, similar to the payoff of holding a stock and buying a put. According to put-call parity, holding a stock plus a put option is equivalent to holding a call option plus a risk-free bond (with face value equal to the strike price). This means that by buying a call option and a bond, the investor can achieve the same payoff structure as holding a stock with a protective put. Answer A describes a short position, answer C describes a covered call (not a protective put), and answer D is incorrect as it does not provide downside protection.

Question 3

If the price of a call option is greater than what is implied by put-call parity, what arbitrage opportunity exists?

A) Buy the call option, short the put option, and sell the stock.

B) Buy the put option, sell the call option, and buy the stock.

C) Short the call option, short the put option, and buy the stock.

D) Buy both the call and put options and sell the stock.

Answer: B) Buy the put option, sell the call option, and buy the stock.

Explanation:

When the call option price is higher than what is implied by put-call parity, there is a pricing imbalance. To capitalize on this arbitrage, the trader can buy the put, sell the call, and buy the stock. This strategy sets up a position that, at expiration, will generate a profit regardless of where the stock price ends up, as long as the call is overpriced relative to the put and stock prices. This setup works because by buying the put and stock, the investor creates a synthetic long call position. Selling the overpriced call against this synthetic position locks in a risk-free profit.

Preparing for the CFA Exam necessitates a clear understanding of "Option Replication Using Put-Call Parity", a key concept in options trading. This principle explains how combining call and put options with the underlying asset or risk-free bonds can replicate option payoffs and spot arbitrage opportunities. Proficiency in Put-Call Parity helps candidates identify mispricings and structure synthetic positions, essential for informed decision-making and risk management. This foundational knowledge supports the goal of achieving a high CFA score.

Learning Objectives

In studying "Option Replication Using Put-Call Parity" for the CFA, you should learn to understand the fundamental principles behind replicating option payoffs and identifying arbitrage opportunities in financial markets. This involves recognizing the relationship between call and put options, the underlying asset, and risk-free bonds, which allows for constructing synthetic positions that mimic the payoffs of actual options. Mastery of this principle enables you to exploit mispricings and create balanced investment strategies.

What is Option Replication Using Put-Call Parity?

Option replication with put-call parity is based on the principle that a call option and a put option with the same strike price and expiration can be used with the underlying asset and a bond to replicate each other’s payoffs. This parity relationship is expressed as:

Call Option+Present Value of Strike Price=Put Option+Underlying Asset Price

Purposes of Option Replication Using Put-Call Parity

Synthetic Option Creation: Enables the creation of synthetic calls, puts, and other combinations.

Risk Management: Useful in managing portfolio risk by replicating payoffs.

Hedging Strategy: Provides a way to hedge portfolios without holding the actual option.

Arbitrage Opportunities: Traders can profit from mispricing in the options or underlying assets.

Flexible Portfolio Strategies: Helps design strategies that cater to specific financial goals or risk tolerances.

Types of Option Replication Strategies

Synthetic Long Call: Involves buying a put option and the underlying asset, offset by selling the bond equivalent to the present value of the strike price.

Synthetic Long Put: Created by buying a call option, selling the underlying asset, and holding the bond equivalent to the present value of the strike.

Protective Put: A risk management technique where an investor holds the underlying asset and buys a put, which can be replicated using put-call parity.

Synthetic Positions: Uses combinations of calls and puts to create short positions on the asset without selling it.

Examples

Example 1. Hedging Against Market Downturns

Investors can replicate a synthetic long position in stock by combining a long call option and a short put option at the same strike price and expiration. This allows investors to hedge their positions, especially during volatile market conditions, while also taking advantage of put-call parity to manage risk with less capital than purchasing the underlying asset directly.

Example 2. Constructing Synthetic Short Positions

Through put-call parity, traders can construct a synthetic short position in the underlying stock by purchasing a put option and short-selling a call option with the same strike price and expiration date. This method helps in managing bearish positions without directly shorting the asset, which may be advantageous in regulated or restricted markets.

Example 3. Arbitrage Opportunities in Pricing

Traders utilize put-call parity to identify discrepancies in option prices, allowing for arbitrage opportunities. For instance, if the cost of buying a stock and a put differs significantly from the price of a call option, traders can exploit this by simultaneously buying the underpriced asset and selling the overpriced one to lock in a risk-free profit, adjusting for any market inefficiencies.

Example 4. Creating a Risk-Free Position (Box Spread)

A box spread strategy combines long and short positions in calls and puts across two strike prices to create a risk-free payoff if put-call parity holds. This strategy is often used when mispricing occurs in the market, allowing traders to leverage put-call parity by locking in a known profit with zero market risk, as long as transaction costs are minimal.

Example 5. Portfolio Management and Position Adjustment

By understanding put-call parity, portfolio managers can efficiently adjust exposures without liquidating the actual stock positions. For instance, if they need to maintain a synthetic exposure to the stock but expect a short-term decline, they can sell a call and buy a put to replicate a synthetic cash position. This method provides flexibility in managing portfolio risk while aligning with specific investment strategies, thanks to the fundamental equivalence of the options under put-call parity.

Practice Questions

Question 1

What does put-call parity imply about the relationship between European call and put options with the same strike price and expiration date?

A) The call option is always more expensive than the put option.

B) The value of a call option plus the present value of the strike price equals the value of the put option plus the stock price.

C) A put option is always more valuable than a call option.

D) The call and put options are always priced equally.

Answer: B) The value of a call option plus the present value of the strike price equals the value of the put option plus the stock price.

Explanation:

Put-call parity is a fundamental principle in options pricing that shows the relationship between the price of European call and put options with the same strike price and expiration. The put-call parity formula is typically written as:C+PV(X)=P+S

where:

C is the price of the call option.

P is the price of the put option.

S is the current stock price.

PV(X) is the present value of the strike price X, discounted at the risk-free rate.

This relationship means that the value of a call plus the present value of the strike price (i.e., cash equivalent) equals the value of a put plus the stock price, allowing for arbitrage-free pricing of these options. Answer A is incorrect as the value depends on market conditions, and answer D is incorrect because calls and puts are rarely priced equally.

Question 2

An investor holds a long position in a stock and wants to protect against downside risk. According to put-call parity, which of the following strategies can replicate a protective put?

A) Buying a call option and shorting the stock.

B) Buying a call option and a risk-free bond with a face value equal to the strike price.

C) Selling a call option and buying a risk-free bond.

D) Selling a put option and buying the underlying stock.

Answer: B) Buying a call option and a risk-free bond with a face value equal to the strike price.

Explanation:

To replicate a protective put, the investor wants to create a position that will limit downside losses on the stock, similar to the payoff of holding a stock and buying a put. According to put-call parity, holding a stock plus a put option is equivalent to holding a call option plus a risk-free bond (with face value equal to the strike price). This means that by buying a call option and a bond, the investor can achieve the same payoff structure as holding a stock with a protective put. Answer A describes a short position, answer C describes a covered call (not a protective put), and answer D is incorrect as it does not provide downside protection.

Question 3

If the price of a call option is greater than what is implied by put-call parity, what arbitrage opportunity exists?

A) Buy the call option, short the put option, and sell the stock.

B) Buy the put option, sell the call option, and buy the stock.

C) Short the call option, short the put option, and buy the stock.

D) Buy both the call and put options and sell the stock.

Answer: B) Buy the put option, sell the call option, and buy the stock.

Explanation:

When the call option price is higher than what is implied by put-call parity, there is a pricing imbalance. To capitalize on this arbitrage, the trader can buy the put, sell the call, and buy the stock. This strategy sets up a position that, at expiration, will generate a profit regardless of where the stock price ends up, as long as the call is overpriced relative to the put and stock prices. This setup works because by buying the put and stock, the investor creates a synthetic long call position. Selling the overpriced call against this synthetic position locks in a risk-free profit.