Organizational Forms, Corporate Issuer Features, and Ownership provide critical insights into the structure and governance of corporations. This topic explores the various types of organizational forms, such as corporations, partnerships, and sole proprietorships, along with the unique features and obligations of corporate issuers. It also covers ownership structures, including shareholder rights, corporate governance frameworks, and the influence of different types of shareholders. Understanding these concepts is essential for analyzing how organizational structures impact corporate strategy, financial performance, and shareholder value, laying a foundation for effective investment and financial decision-making.

Learning Objectives

In studying “Organizational Forms, Corporate Issuer Features, and Ownership” for the CFA, you should learn to distinguish among various organizational structures, including sole proprietorships, partnerships, limited liability companies, and corporations, analyzing their unique characteristics and implications for investors. Understand the features of corporate issuers, including legal entity status, regulatory requirements, and capital-raising mechanisms. Evaluate different types of ownership structures, such as public vs. private ownership, and their impact on corporate governance and investor rights. Analyze the implications of these organizational forms on financial reporting, taxation, and legal obligations. Additionally, understand how corporate structures influence strategic decisions, risk exposure, and the overall investment appeal to stakeholders.

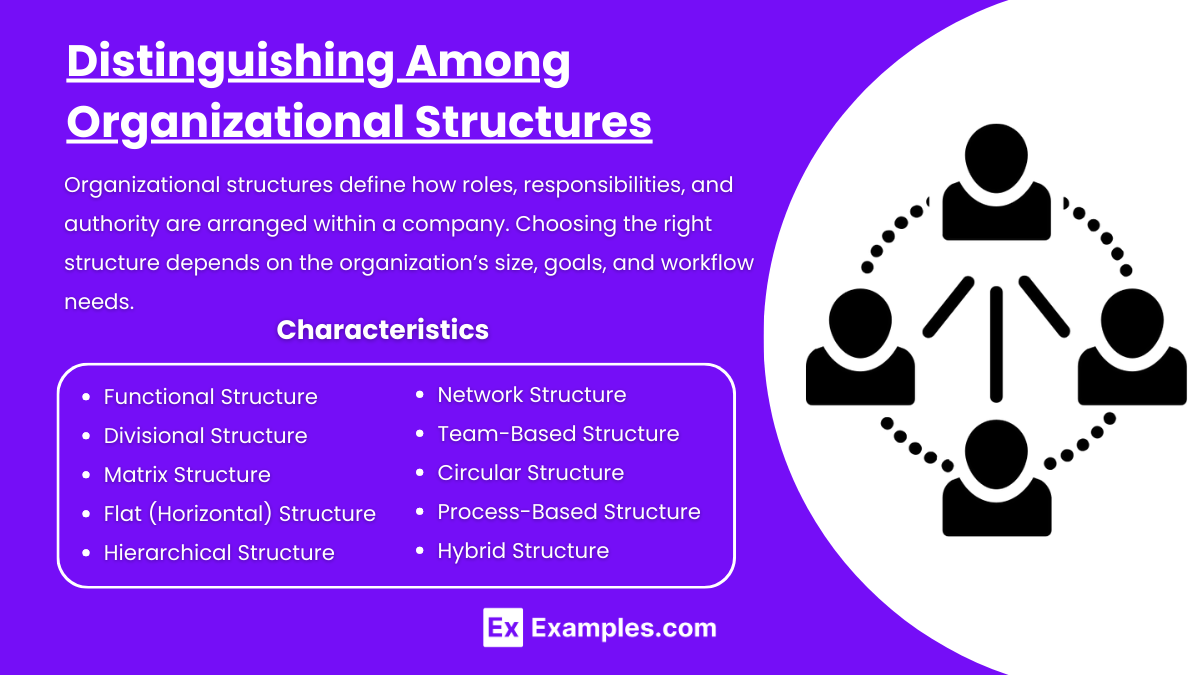

Distinguishing Among Organizational Structures

Organizational structures define how roles, responsibilities, and authority are arranged within a company. Choosing the right structure depends on the organization’s size, goals, and workflow needs. Here are some common organizational structures and their characteristics:

Characteristics

Functional Structure:

- Divides the organization into departments based on specialized functions (e.g., marketing, finance, HR).

- Promotes expertise within each function but can create silos where departments work independently.

- Suitable for stable environments where specialized skills are important.

Divisional Structure:

- Organizes departments by product, service, or geographical region (e.g., North America division, consumer goods division).

- Each division operates semi-independently and has its own functional departments.

- Works well for large organizations offering multiple products or services.

Matrix Structure:

- Combines functional and divisional structures, creating dual reporting relationships (employees report to both functional and project managers).

- Encourages flexibility and collaboration across departments but can lead to confusion or conflicts with dual authority.

- Ideal for complex projects requiring input from multiple areas.

Flat (Horizontal) Structure:

- Has minimal management layers, promoting open communication and quick decision-making.

- Employees have more responsibility and autonomy, making it suitable for startups and smaller organizations.

- Works best in organizations with highly skilled and self-motivated employees.

Hierarchical Structure:

- Follows a traditional, pyramid-like structure with clear authority levels (e.g., CEO at the top, followed by managers and staff).

- Offers clear chain-of-command and well-defined roles, which can improve accountability.

- Effective for larger, more established organizations with formal, top-down management.

Network Structure:

- Centers around a core organization that outsources major functions to external partners or collaborators.

- Increases flexibility and reduces overhead, suitable for organizations focusing on specific areas.

- Commonly used in industries like technology, where outsourcing specialized tasks is efficient.

Team-Based Structure:

- Organizes employees into cross-functional teams focused on specific projects or goals.

- Encourages collaboration and innovation but may create challenges with role clarity.

- Often used in organizations prioritizing adaptability and a collaborative culture.

Circular Structure:

- Arranges roles in a circular model, with executives in the center and other layers radiating outward.

- Emphasizes communication and equality, aligning everyone toward common goals.

- Typically suited for organizations emphasizing shared values and a unified mission.

Process-Based Structure:

- Focuses on the workflow or processes within the organization, rather than functions or products.

- Promotes efficiency and streamlined operations, ideal for businesses where processes drive outcomes.

- Often seen in manufacturing and logistics sectors.

Hybrid Structure:

- Combines elements of multiple structures, often merging functional, divisional, or team-based models.

- Provides flexibility and can be tailored to specific needs, though complexity may increase.

- Useful for organizations needing both stability in core functions and adaptability in other areas.

Understanding the Features of Corporate Issuers

Corporate issuers refer to companies that issue financial instruments, such as stocks and bonds, to raise capital from investors. These features help investors assess corporate issuers’ potential, risk, and suitability for investment. Below are the key features of corporate issuers:

1. Ownership Structure

The ownership structure of a corporate issuer influences its decision-making, governance, and accountability.

- Public vs. Private Ownership: Publicly traded companies are listed on stock exchanges and must comply with regulations on financial disclosure, while privately held companies have fewer disclosure requirements.1–87, 90–300

- Concentrated vs. Dispersed Ownership: In companies with concentrated ownership, large shareholders or founding families may have significant influence, whereas dispersed ownership means shareholders have more diluted power.

- Voting Rights: Ownership structures can include voting and non-voting shares, affecting shareholder control over corporate decisions.

Example: Facebook (now Meta) has a dual-class share structure, with founder Mark Zuckerberg retaining significant voting control, allowing him to influence major decisions.

2. Capital Structure

A corporate issuer’s capital structure reflects its mix of debt and equity financing, impacting financial risk and return.

- Debt Financing: Companies issue bonds or take loans to raise capital without diluting ownership, but high debt levels increase financial risk and interest obligations.

- Equity Financing: Issuing shares allows a company to raise funds without the need for repayment, but it dilutes ownership and can impact shareholder value.

- Debt-to-Equity Ratio: This ratio reflects the balance between debt and equity. A higher ratio indicates more debt relative to equity, which can amplify returns but also increases risk.

Example: Apple’s capital structure includes both significant equity and long-term debt, balancing flexibility with low-interest rates to fund growth initiatives.

3. Financial Stability and Creditworthiness

Financial stability and creditworthiness are key indicators of a corporate issuer’s ability to meet its financial obligations and maintain profitability.

- Credit Ratings: Issuers with higher credit ratings (e.g., AAA) are considered low risk and can borrow at lower interest rates, while lower-rated issuers (e.g., junk-rated) must pay higher rates to attract investors.

- Liquidity: Measures like the current ratio and quick ratio assess a company’s ability to meet short-term liabilities, impacting its financial resilience.

- Profitability: Profit margins, return on assets, and return on equity indicate how efficiently a company generates profits from its assets and equity.

Example: Microsoft holds a AAA credit rating, indicating high creditworthiness, strong liquidity, and low risk for bondholders.

4. Regulatory Compliance and Disclosure

Corporate issuers must adhere to regulatory requirements that ensure transparency and protect investors.

- Financial Reporting: Public companies are required to disclose quarterly and annual financial statements, providing insights into their performance and financial health.

- Corporate Governance: Regulations, such as the Sarbanes-Oxley Act in the U.S., require companies to establish internal controls and ethical standards to ensure responsible management.

- Industry-Specific Regulations: Certain industries, like banking or healthcare, face additional regulations that impact operations and reporting requirements.

Example: Public companies listed on U.S. exchanges must file 10-K (annual) and 10-Q (quarterly) reports with the SEC, ensuring transparency for investors.

5. Dividend and Payout Policies

Corporate issuers often establish dividend policies to distribute profits to shareholders, which can impact investor appeal and stock value.

- Dividend-Paying Stocks: Some companies, especially established ones, pay regular dividends, offering income stability for investors.

- Growth vs. Income: Companies focused on growth typically reinvest earnings rather than pay dividends, while income-focused companies provide regular payouts.

- Payout Ratio: This ratio indicates the percentage of earnings paid as dividends. A high payout ratio might appeal to income-focused investors but limit funds for growth.

Example: Procter & Gamble is known for consistently paying dividends, making it attractive to income-oriented investors.

6. Governance Structure

Corporate governance involves the rules, practices, and processes that direct and control the company, impacting decision-making and shareholder rights.

- Board of Directors: A company’s board oversees management, represents shareholder interests, and ensures that the company is run responsibly.

- Executive Leadership: CEOs and other executives implement strategies and make operational decisions. Leadership quality significantly affects corporate performance.

- Shareholder Rights: Shareholders often have voting rights on key issues, such as electing board members or approving mergers and acquisitions.

Example: Amazon’s board of directors and executive team oversee its diverse operations and growth strategies, balancing shareholder value with innovation and expansion.

Evaluating Ownership Structures and Their Impact on Corporate Governance

Ownership structure significantly impacts corporate governance, influencing decision-making, accountability, and overall strategic direction. Different types of ownership structures create varying degrees of control, responsibility, and alignment with shareholders’ interests, shaping a company’s governance practices and its ability to respond to market challenges and opportunities. Here’s an overview of common ownership structures and how they impact corporate governance.

1. Concentrated Ownership

In concentrated ownership, a small group of shareholders—often founders, family members, or a few large institutional investors—holds a significant portion of a company’s shares. This structure provides more direct control over corporate decisions.

- Influence on Corporate Governance: Concentrated owners have substantial power to shape policies, appoint board members, and guide strategic decisions, often aligning the company’s goals with their long-term vision. This can lead to stability and a clear strategic direction but may also lead to limited accountability if the controlling shareholders prioritize personal or family interests over minority shareholders.

- Risks: Concentrated ownership can limit board diversity and discourage external perspectives, potentially leading to biased decision-making and entrenchment of leadership.

Example: In many family-owned businesses, such as Walmart (Walton family ownership), family members retain significant influence over strategic and operational decisions, aligning the company’s vision with long-term family values.

2. Dispersed Ownership

Dispersed ownership structures are common among publicly traded companies, where ownership is spread across a large number of individual and institutional shareholders, each with a relatively small stake.

- Influence on Corporate Governance: With dispersed ownership, no single shareholder group has significant control, leading to greater reliance on the board of directors and executive management to represent shareholder interests. This structure often fosters transparency, accountability, and corporate governance policies aligned with a broad base of shareholder interests.

- Risks: Dispersed ownership may result in less strategic cohesion and challenges in decision-making, as a large number of stakeholders with diverse interests need to be considered. This can lead to “short-termism” if the company prioritizes immediate financial performance over long-term growth.

Example: Apple’s ownership structure is highly dispersed, with ownership split among millions of shareholders worldwide, resulting in strong board oversight and alignment with market-driven governance standards.

3. Dual-Class Share Structures

Dual-class share structures involve two (or more) types of shares, typically one class with enhanced voting rights and another with limited or no voting rights. This structure enables founders or specific shareholders to maintain control while allowing other investors to participate financially.

- Influence on Corporate Governance: Dual-class shares allow founders or key stakeholders to retain control over strategic decisions, even as the company raises capital from public investors. This can provide stability and protection for long-term projects but may limit the influence of minority shareholders.

- Risks: Minority shareholders may have limited say in corporate governance decisions, creating a potential misalignment of interests and reducing the accountability of those in control. This can lead to conflicts, especially if those with controlling shares make decisions that prioritize personal interests over overall shareholder value.

Example: Meta (formerly Facebook) uses a dual-class share structure that grants founder Mark Zuckerberg significant voting power, allowing him to control major decisions while raising funds from public investors.

4. State-Owned Enterprises (SOEs)

In state-owned enterprises, the government holds a majority or significant ownership stake. SOEs are often established to manage strategic industries or provide public goods and services.

- Influence on Corporate Governance: SOEs are usually governed by political objectives and may prioritize social or economic goals over profit maximization. Government-appointed board members and executives often shape corporate strategy, ensuring alignment with national interests.

- Risks: Governance in SOEs may be influenced by political pressures and short-term government goals, leading to inefficient decision-making. Additionally, transparency and accountability may be limited, as SOEs may be less driven by shareholder value and more by national objectives.

Example: In China, major firms like China National Petroleum Corporation (CNPC) are state-owned, with their corporate governance closely aligned with government policy and national economic goals.

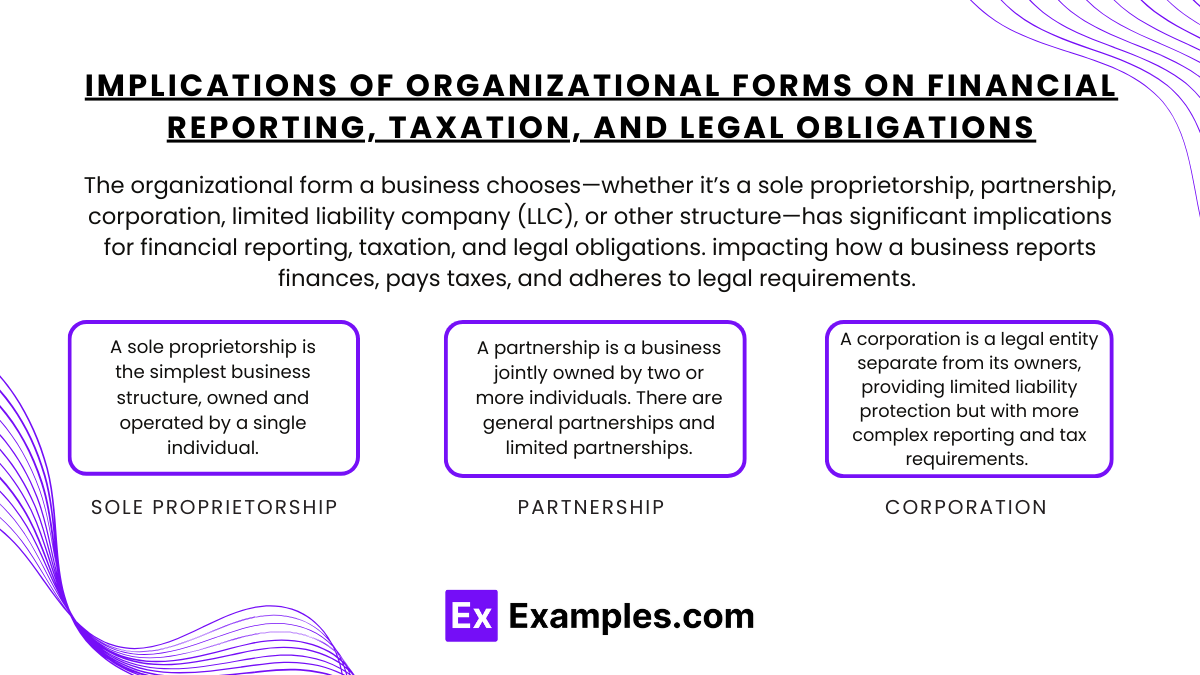

Implications of Organizational Forms on Financial Reporting, Taxation, and Legal Obligations

The organizational form a business chooses—whether it’s a sole proprietorship, partnership, corporation, limited liability company (LLC), or other structure—has significant implications for financial reporting, taxation, and legal obligations. Each structure offers unique advantages and challenges, impacting how a business reports finances, pays taxes, and adheres to legal requirements. Below is an overview of these implications for various organizational forms.

1. Sole Proprietorship

A sole proprietorship is the simplest business structure, owned and operated by a single individual.

- Financial Reporting: Sole proprietorships often have simpler reporting requirements. Financial statements are generally prepared for personal use or small-scale financing and are not required to follow GAAP unless seeking external funding.

- Taxation: Income and expenses are reported on the owner’s personal tax return (Schedule C). Profits are subject to personal income tax rates, and the owner is liable for self-employment tax.

- Legal Obligations: The owner has unlimited liability, meaning personal assets can be used to settle business debts and obligations. Sole proprietorships have fewer legal formalities, though they may need permits and licenses.

Example: A freelancer reports their business income on their personal tax return, with all earnings added to their personal income and subject to individual tax rates.

2. Partnership

A partnership is a business jointly owned by two or more individuals. There are general partnerships (all partners share liability) and limited partnerships (some partners have limited liability).

- Financial Reporting: Partnerships typically prepare financial statements for internal use and tax reporting, though they are generally not required to adhere to GAAP unless seeking substantial external financing.

- Taxation: Partnerships are pass-through entities, meaning profits are passed directly to partners and taxed at individual rates. Each partner reports their share of income or loss on their personal tax returns (using Form 1065 for partnership income reporting and a K-1 for individual shares).

- Legal Obligations: General partners have unlimited liability, while limited partners have liability restricted to their investment. Partnerships are relatively easy to set up but may require a partnership agreement outlining each partner’s role and responsibility.

Example: In a law firm partnership, partners report their respective income shares on personal tax returns, but the firm itself is not taxed separately.

3. Corporation

A corporation is a legal entity separate from its owners, providing limited liability protection but with more complex reporting and tax requirements. Corporations can be either C corporations or S corporations.

- Financial Reporting: Corporations are generally required to follow GAAP and provide detailed financial statements. Publicly traded corporations must file quarterly and annual reports (10-Q and 10-K) with the SEC and adhere to stringent reporting standards.

- Taxation:

- C Corporation: Subject to corporate income tax on profits, leading to potential double taxation if dividends are distributed to shareholders and taxed again at the individual level.

- S Corporation: An S corporation has pass-through taxation, similar to a partnership, where income flows to shareholders and is taxed at individual rates, avoiding corporate taxes.

- Legal Obligations: Corporations provide limited liability for shareholders, meaning personal assets are generally protected. However, corporations must adhere to corporate governance rules, hold annual meetings, keep detailed records, and meet regulatory requirements.

Example: A C corporation pays taxes on its profits, and shareholders pay taxes again on dividends received, leading to double taxation.

Examples

Example 1: Sole Proprietorship

A sole proprietorship is the simplest form of business organization, owned and operated by a single individual. This structure allows for complete control over the business, making decision-making straightforward. However, the owner faces unlimited liability, meaning personal assets can be at risk if the business incurs debts or legal issues. This form is common among small businesses, freelancers, and consultants.

Example 2: Partnership

A partnership involves two or more individuals who share ownership and management responsibilities. In this structure, partners contribute capital and expertise, sharing profits and losses according to their agreement. Partnerships can be general (where all partners have equal responsibility) or limited (where some partners have restricted liability). This organizational form fosters collaboration but also introduces complexities regarding decision-making and profit sharing.

Example 3: Corporation

A corporation is a legal entity separate from its owners, known as shareholders. This form of organization provides limited liability protection, meaning shareholders are not personally responsible for the corporation’s debts. Corporations can issue stocks to raise capital, and they often have a more complex structure, including a board of directors and formal governance processes. This organizational form is common among larger businesses that seek to scale and attract investment.

Example 4: Limited Liability Company (LLC)

An LLC combines features of both corporations and partnerships, offering limited liability to its owners (members) while allowing flexible management structures. Members can choose to manage the LLC themselves or appoint managers. This form is particularly popular among small to medium-sized businesses because it provides personal liability protection and avoids the double taxation often associated with corporations.

Example 5: Cooperative (Co-op)

A cooperative is an organizational form owned and operated by a group of individuals for their mutual benefit. Members of a co-op may be consumers, producers, or workers who share profits and decision-making responsibilities. This structure emphasizes democratic governance, where each member has a vote in major decisions. Cooperatives are commonly found in sectors like agriculture, retail, and housing, where members seek to achieve common economic, social, or cultural goals.

Practice Questions

Question 1

Which of the following is a key feature of a corporation that distinguishes it from other organizational forms, such as sole proprietorships or partnerships?

A) Unlimited liability for owners

B) Limited liability for shareholders

C) Simplicity in formation and operation

D) Pass-through taxation

Correct Answer: B) Limited liability for shareholders.

Explanation: One of the defining features of a corporation is that it provides limited liability protection to its shareholders, meaning that shareholders are not personally liable for the corporation’s debts and obligations. In contrast, sole proprietorships and partnerships typically involve unlimited liability, where owners can be personally responsible for business debts. This limited liability feature makes corporations an attractive option for raising capital and protecting personal assets.

Question 2

What is the primary advantage of a limited liability company (LLC) compared to a traditional corporation?

A) LLCs have no restrictions on ownership.

B) LLCs are taxed as a separate entity.

C) LLCs offer flexibility in management structure.

D) LLCs must hold annual meetings.

Correct Answer: C) LLCs offer flexibility in management structure.

Explanation: Limited liability companies (LLCs) provide a flexible management structure that can be tailored to the specific needs of the owners, known as members. Unlike corporations, which have a more rigid structure requiring a board of directors and formal meetings, LLCs can be managed by their members or appointed managers. This flexibility makes LLCs appealing for small businesses and startups, allowing them to operate more informally while still enjoying limited liability protection.

Question 3

In the context of corporate ownership, what distinguishes common stock from preferred stock?

A) Common stockholders receive dividends before preferred stockholders.

B) Common stock provides voting rights, while preferred stock typically does not.

C) Preferred stock has a higher risk than common stock.

D) Common stockholders have priority in bankruptcy proceedings over preferred stockholders.

Correct Answer: B) Common stock provides voting rights, while preferred stock typically does not.

Explanation: Common stock and preferred stock are two different classes of equity in a corporation. Common stockholders usually have voting rights that allow them to participate in corporate governance, such as electing the board of directors. In contrast, preferred stockholders typically do not have voting rights but may receive fixed dividends and have a higher claim on assets in the event of liquidation. This distinction highlights the varying levels of ownership rights and financial benefits associated with each type of stock.