Preparing for the CFA Exam requires a solid grasp of equity securities, a fundamental asset class within finance. Understanding the types, characteristics, and valuation of equity securities is essential for analyzing investment opportunities. This knowledge enables candidates to assess ownership stakes, shareholder rights, and the implications of equity financing on financial markets

Learning Objective

In studying “Overview of Equity Securities” for the CFA Exam, you should aim to understand the fundamentals of equity securities, including their types, characteristics, and valuation methods. Examine common and preferred stock, their rights, and the impact of equity ownership on both companies and shareholders. Develop the ability to assess the advantages and disadvantages of equity financing compared to debt, and evaluate how equity markets influence corporate structure and investor returns. Additionally, focus on the principles of dividends, share buybacks, and the role of equity securities in a diversified investment portfolio, applying this knowledge to real-world financial scenarios.

What is Equity Securities?

Equity Securities are financial instruments that represent ownership in a company, giving shareholders a claim on a portion of the company’s assets and earnings. Common examples include common stock and preferred stock. Equity holders, often called shareholders, are entitled to dividends (if declared), voting rights (in the case of common stock), and the potential for capital gains through stock price appreciation. Unlike debt holders, equity holders do not have a fixed return but instead participate in the company’s profits and losses, making equity securities a key component of investment portfolios due to their potential for growth and income

Types of Equity Securities

1. Common Stock

Definition: Common stock represents a basic ownership stake in a company. Holders of common stock are considered residual owners, meaning they are entitled to the company’s profits and assets after all obligations to debt holders and preferred shareholders are satisfied.

Key Characteristics:

- Voting Rights: Common shareholders typically have voting rights, allowing them to vote on important matters like electing the board of directors and approving major corporate actions.

- Dividends: Dividends on common stock are variable and are paid at the discretion of the company’s board of directors. While they offer the potential for dividend income, dividends are not guaranteed.

- Capital Gains Potential: Common shareholders benefit from potential stock price appreciation, allowing for capital gains if the stock’s market price rises.

- Residual Claim: In the event of liquidation, common shareholders have a claim on assets only after debts and preferred stock claims are settled, making it a riskier investment than debt or preferred shares.

Role in Investment Portfolios: Common stock is often sought for its potential for long-term growth and capital appreciation. It appeals to investors willing to assume higher risk in exchange for potentially higher returns.

2. Preferred Stock

Definition: Preferred stock is a type of equity security that has features of both common stock and debt. Preferred shareholders receive priority over common shareholders in dividend payments and asset distribution, but they typically lack voting rights.

Key Characteristics:

- Fixed Dividends: Preferred stock usually pays a fixed dividend, making it more predictable than common stock dividends. This dividend is often higher than common dividends and is paid before any dividends on common shares.

- Priority in Liquidation: In case of liquidation, preferred shareholders have a claim on the company’s assets before common shareholders, though after debt holders.

- Convertible Features: Some preferred stocks are convertible, allowing holders to convert their shares into a specified number of common shares, providing the potential for capital appreciation if the company’s common stock price rises.

- Cumulative Dividends: Many preferred stocks are cumulative, meaning that if a company skips a dividend payment, it accumulates, and the company must pay the owed amount before any dividends can be paid to common shareholders.

- Callable Option: Certain preferred shares are callable, meaning the company can repurchase the shares at a predetermined price, often used when interest rates fall, and the company can refinance at a lower cost.

Role in Investment Portfolios: Preferred stock appeals to income-focused investors seeking predictable returns with a lower risk level than common stock. It combines equity’s growth potential with some characteristics of fixed-income investments, like bonds.

Equity Ownership and Shareholder Rights

Equity ownership in a company gives shareholders specific rights and privileges, which vary depending on the type of stock they hold. Understanding these rights is essential for investors to assess their control over company decisions, potential financial benefits, and protections as equity holders.

1. Voting Rights and Corporate Control

- Voting Rights of Common Shareholders: Common stockholders usually have voting rights, allowing them to influence the company’s direction by voting on significant corporate matters. This includes electing the board of directors, approving major corporate policies, and deciding on mergers or acquisitions. Voting rights can be structured differently, with some companies offering one vote per share, while others may have different classes of shares with varying voting power.

- Preferred Shareholders: Typically, preferred shareholders do not have voting rights. However, some preferred stock types may allow voting under specific conditions, such as when dividends are in arrears.

2. Right to Dividends

- Common Stock Dividends: Common shareholders are entitled to a portion of the company’s profits in the form of dividends, though these are not guaranteed. Dividend payments depend on the company’s profitability and are decided at the discretion of the board of directors. If the company prioritizes reinvestment, common shareholders may see little to no dividends.

- Preferred Stock Dividends: Preferred shareholders generally receive a fixed dividend that is paid before any dividends are issued to common shareholders. In cases where dividends are skipped, cumulative preferred shares ensure that missed dividends are paid before any common dividends.

3. Residual Claim on Assets

- Priority in Liquidation: Equity holders have a claim on the company’s assets if it is liquidated. However, common shareholders are at the end of the line, meaning they receive any remaining assets only after all debts and obligations (such as loans, bonds, and preferred shareholders’ claims) have been paid.

- Risk and Reward Balance: This residual claim means that common shareholders bear more risk but also have greater potential for high returns if the company succeeds, as they participate fully in the profits after all other claims are satisfied.

4. Right to Information

- Access to Financial Information: Equity holders have a right to access timely and accurate financial information about the company. Public companies must release quarterly and annual financial statements, providing transparency for shareholders to evaluate the company’s financial health.

- Annual Meetings and Reports: Shareholders receive reports on the company’s performance and have the right to attend annual meetings, where they can question management and make informed decisions based on the company’s strategic direction.

5. Preemptive Rights

- Protection from Dilution: Some companies grant preemptive rights to their shareholders, allowing them to purchase additional shares before new shares are offered to the public. This right helps shareholders maintain their proportional ownership in the company, preventing dilution of their voting power and value.

- Importance in Ownership Retention: Preemptive rights are especially valuable for larger shareholders or those with a significant stake in the company, as they can protect their influence and economic interest over time

Equity Financing vs. Debt Financing

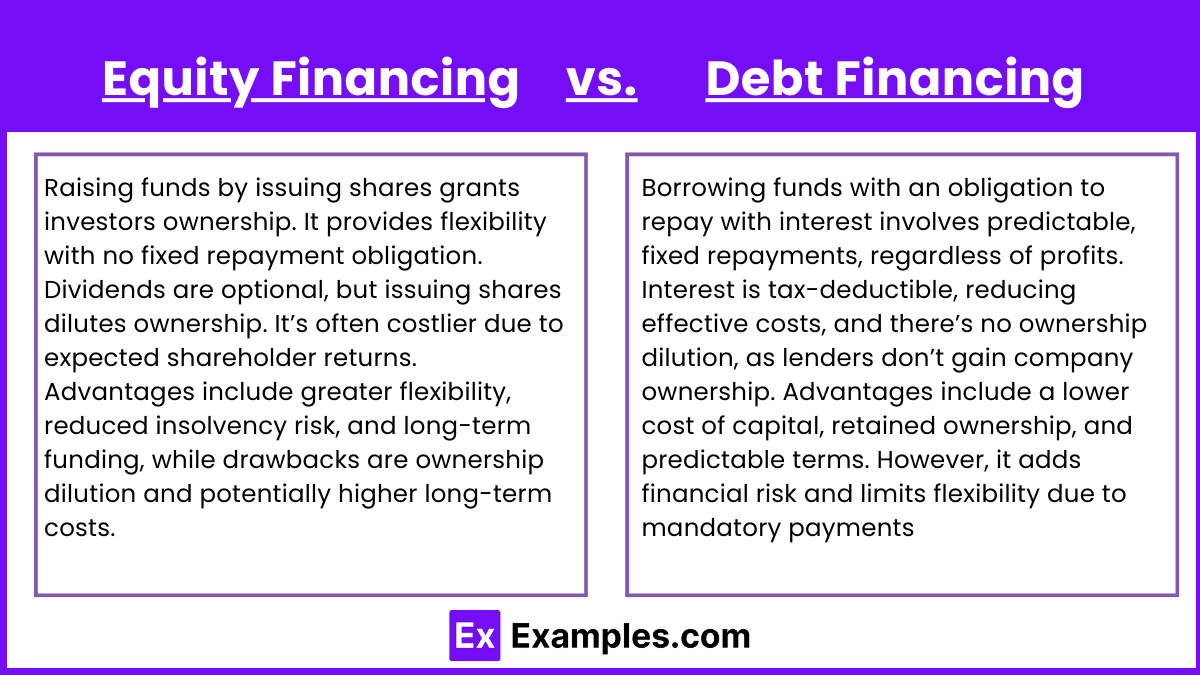

When a company needs capital, it can choose between equity financing and debt financing, each with unique benefits and drawbacks.

Equity Financing

- Definition: Raising funds by issuing shares, giving investors ownership in the company.

- Key Points:

- No Repayment: No fixed obligation to return funds, providing flexibility.

- Dividends and Dilution: Dividends are discretionary, but issuing shares dilutes ownership.

- Higher Cost: Often more expensive due to shareholders’ expectation of returns.

- Pros: Increases flexibility, lowers insolvency risk, and provides long-term funding.

- Cons: Dilutes ownership and may be costlier in the long run.

Debt Financing

- Definition: Borrowing funds with an obligation to repay with interest.

- Key Points:

- Fixed Repayments: Predictable payments that must be made regardless of profits.

- Tax Deductible: Interest is tax-deductible, lowering effective costs.

- No Ownership Dilution: Lenders don’t own part of the company.

- Pros: Lower cost of capital, maintains ownership, predictable terms.

- Cons: Adds financial risk and reduces flexibility due to mandatory payments.

Valuation of Equity Securities

Valuing equity securities is essential for determining a company’s worth and guiding investment decisions. Different models and methods are used to assess the intrinsic and market value of a company’s stock, helping investors decide whether a stock is overvalued, undervalued, or fairly priced.

1. Intrinsic Value of Equity

- Definition: Intrinsic value is the estimated true value of a stock based on its future cash flows, growth potential, and risk, rather than its current market price.

- Importance: Understanding intrinsic value helps investors make informed decisions by comparing a stock’s intrinsic value to its market price.

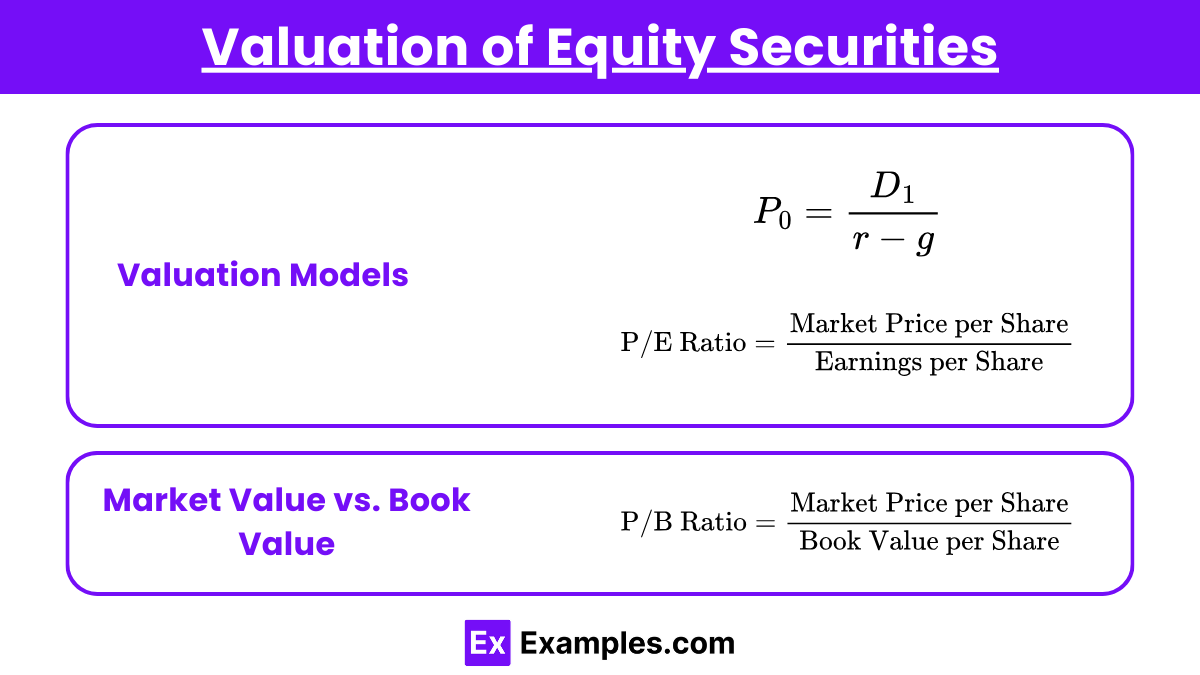

2. Valuation Models

- Dividend Discount Model (DDM): This model values a stock by discounting its future dividends back to the present. It’s ideal for companies with stable, predictable dividend payments.

- Formula:

- Where P0 is the stock price, D1 is the dividend expected next year, r is the required rate of return, and g is the growth rate of dividends.

- Formula:

- Price-to-Earnings (P/E) Ratio: This ratio compares a company’s current stock price to its earnings per share (EPS), providing a relative valuation measure.

- Formula:

- Useful for comparing companies within the same industry to assess if a stock is over or undervalued.

- Formula:

3. Market Value vs. Book Value

- Market Value: The current price of a stock on the open market, reflecting investor sentiment, demand, and overall economic conditions.

- Book Value: The net asset value of a company according to its balance sheet, calculated as total assets minus total liabilities.

- Comparison: The Price-to-Book (P/B) Ratio helps investors compare a company’s market value to its book value.

- Formula:

- Formula:

Dividend Policies and Shareholder Value

Dividend policies dictate how a company distributes profits to its shareholders, directly impacting shareholder value and perceptions of the company’s financial health.

1. Types of Dividend Policies

- Stable Dividend Policy: The company pays a consistent dividend regardless of earnings fluctuations, which appeals to income-focused investors seeking predictable returns.

- Residual Dividend Policy: Dividends are paid only after all profitable investment opportunities are funded, leading to variable payouts based on available residual income.

- Hybrid Dividend Policy: Combines stability with flexibility, providing a regular base dividend with additional payments in profitable years.

2. Impact on Shareholder Value

- Signal of Financial Health: Regular dividends can signal stability and profitability, enhancing investor confidence.

- Share Price Reaction: Dividend announcements often affect stock prices. An increase in dividends may lead to a rise in share price, while a reduction could result in a price drop.

- Share Buybacks: Companies may repurchase shares as an alternative to dividends, reducing the number of outstanding shares and potentially boosting earnings per share (EPS), which can increase share price and shareholder value.

Equity Market Dynamics and Corporate Structure

- Primary Market

- Companies raise capital by issuing new shares directly to investors in the primary market, typically through Initial Public Offerings (IPOs) or secondary offerings.

- This process helps companies secure funding for growth and expansion.

- Secondary Market

- Existing shares are traded among investors in the secondary market, providing liquidity and allowing shareholders to buy or sell ownership without affecting the company’s capital directly.

- Examples include stock exchanges like the NYSE and NASDAQ.

- Market Efficiency

- The Efficient Market Hypothesis (EMH) suggests that stock prices reflect all available information, making it difficult to consistently outperform the market.

- Market efficiency is influenced by investor sentiment, economic indicators, and corporate disclosures.

- Corporate Governance and Board of Directors

- The board of directors oversees company management, ensuring accountability and representing shareholders’ interests.

- Corporate governance policies aim to align the company’s operations with shareholder goals.

- Corporate Actions

- Corporate actions such as stock splits, mergers, acquisitions, and rights issues directly impact share prices, ownership structure, and shareholder value.

- These actions can signal changes in corporate strategy or financial health, affecting investor perceptions.

- Shareholder Influence and Rights

- Shareholders, especially those with voting rights, can influence major corporate decisions, including board elections and mergers.

- Equity ownership empowers shareholders to participate in shaping the company’s future.

Examples

Example 1: Common Stock Investment in Apple Inc. (AAPL)

Description: Apple Inc. issues common stock, representing ownership in the company. By purchasing Apple shares, investors gain voting rights and participate in the company’s growth and profits.

Equity Benefits: Shareholders may receive dividends, benefit from stock price appreciation, and have voting power on corporate matters like board elections.

Example 2: Preferred Stock in Bank of America (BAC)

Description: Bank of America issues preferred shares that pay a fixed dividend, prioritized over common stock dividends.

Equity Benefits: Preferred shareholders have no voting rights but receive regular dividends before common shareholders and have a higher claim on assets in liquidation.

Example 3: Initial Public Offering (IPO) of Airbnb (ABNB)

Description: Airbnb went public in 2020 through an IPO, allowing it to raise capital by issuing shares in the primary market. Investors purchased shares, contributing to Airbnb’s funding and growth.

Equity Market Role: The IPO provided Airbnb with access to equity financing, expanding its business, while giving shareholders ownership stakes.

Example 4: Dividend Policy of Johnson & Johnson (JNJ)

Description: Johnson & Johnson maintains a stable dividend policy, consistently paying dividends to shareholders, even during economic downturns.

Impact on Shareholder Value: This stability appeals to income-focused investors and signals financial strength, supporting share price and long-term shareholder value.

Example 5: Stock Buyback Program by Microsoft Corporation (MSFT)

Description: Microsoft regularly repurchases its own shares in a stock buyback program, reducing the number of outstanding shares.

Effect on Shareholders: Share buybacks increase earnings per share (EPS) and may drive up the stock price, benefiting shareholders by enhancing their ownership value without paying out dividends

Practice Questions

Question 1

Which of the following best describes common stock?

A) A type of equity security that provides fixed dividends and no voting rights

B) A type of equity security that grants ownership, voting rights, and potential dividends based on profitability

C) A debt instrument with fixed interest payments and no ownership rights

D) A type of security that has priority over common stockholders in dividends and liquidation

Answer: B. A type of equity security that grants ownership, voting rights, and potential dividends based on profitability

Explanation: Common stock represents an ownership stake in a company and typically grants shareholders voting rights. Common stockholders may receive dividends, but these are based on the company’s profitability and are not guaranteed. Unlike debt, common stock does not have fixed payments, and common shareholders are the last to be paid in the event of liquidation. Option B accurately describes common stock, while options A and D describe preferred stock, and option C refers to debt instruments.

Question 2

Which of the following is a primary characteristic of preferred stock?

A) Voting rights in major corporate decisions

B) Guaranteed dividends that must be paid before common stock dividends

C) The ability to convert the stock into common shares upon shareholder request

D) Priority claim on assets and profits over debt holders

Answer: B. Guaranteed dividends that must be paid before common stock dividends

Explanation: Preferred stockholders receive dividends before common shareholders, and these dividends are often fixed, making them a primary characteristic of preferred stock. However, preferred stockholders generally do not have voting rights (option A). Option C is only true for convertible preferred stock, and option D is incorrect because debt holders have priority over both common and preferred shareholders in asset claims during liquidation.

Question 3

Which of the following scenarios is an example of equity financing?

A) A company issues bonds to raise capital for expansion.

B) A company takes out a loan to buy new equipment.

C) A company issues common stock to raise funds for a new project.

D) A company pays dividends to its shareholders.

Answer: C. A company issues common stock to raise funds for a new project

Explanation: Equity financing involves raising capital by issuing shares of the company’s stock, which provides ownership stakes to investors. Option C is correct as it describes issuing common stock to raise funds, a classic example of equity financing. Options A and B refer to debt financing, where funds are borrowed and must be repaid. Option D is related to dividend distribution and does not represent a method of financing.