Preparing for the CFA Exam demands a strong grasp of Fixed-Income Portfolio Management, a key area within the investment field. Understanding bond portfolio construction, risk management, and yield strategies is essential. This knowledge helps in managing interest rate risk, optimizing returns, and effectively diversifying portfolios, crucial for achieving a high CFA score.

Learning Objective

In studying “Overview of Fixed-Income Portfolio Management” for the CFA Exam, you should aim to understand the core principles and strategies involved in managing fixed-income portfolios, including duration management, immunization strategies, and yield curve positioning. Analyze how these techniques help in controlling interest rate risk, achieving desired income, and meeting portfolio objectives. Evaluate methods like bond laddering, barbell, and bullet strategies to manage cash flow timing and interest rate sensitivity. Additionally, explore how credit analysis, sector rotation, and active versus passive management approaches are applied to optimize fixed-income portfolios, preparing you to analyze and interpret portfolio scenarios in CFA practice cases.

Core Principles of Fixed-Income Portfolio Management

Fixed-income portfolio management focuses on constructing and managing a portfolio of bonds and other debt instruments to meet specific financial goals. Here are the core principles that guide fixed-income portfolio management:

- Risk and Return Balance

Fixed-income investments are typically valued for their predictable returns and lower risk compared to equities. However, managing a fixed-income portfolio still requires a careful balance between risk and return. This involves analyzing credit risk (the risk that an issuer will default) and interest rate risk (the risk that changes in interest rates will impact bond prices) to optimize portfolio performance while maintaining an acceptable risk level. - Income Stability and Predictability

A primary objective for many fixed-income investors is income stability. Bonds provide regular interest payments, making them suitable for investors seeking reliable cash flow. Portfolio managers aim to construct a portfolio that generates consistent income to meet the needs of investors, particularly those with income-focused goals, such as retirees. - Liquidity Management

Fixed-income portfolios must be managed to ensure that sufficient liquidity is available when needed. This means holding a mix of bonds with different maturities and assessing the liquidity of each asset in the portfolio. Liquidity allows managers to meet client withdrawal demands, take advantage of new opportunities, or respond to changing market conditions without significant transaction costs. - Alignment with Investor Objectives

Every fixed-income portfolio should be tailored to the investor’s specific objectives, such as growth, income, capital preservation, or a combination. For instance, a portfolio focused on capital preservation might prioritize investment-grade bonds with low risk, while a growth-oriented portfolio might include higher-yield, lower-credit bonds to boost returns. Proper alignment ensures the portfolio meets the investor’s expectations and remains consistent with their financial goals.

By adhering to these principles, fixed-income portfolio managers aim to create a portfolio that meets performance goals while managing risk, providing stable income, maintaining liquidity, and aligning with the investor’s objectives.

Interest Rate Risk and Duration Management

Interest rate risk and duration management are central concepts in fixed-income portfolio management, as they directly impact the value and stability of bond investments. Here’s a breakdown of these principles:

- Interest Rate Risk

Interest rate risk refers to the potential change in a bond’s price due to fluctuations in interest rates. When interest rates rise, bond prices generally fall, and vice versa. This inverse relationship is crucial for fixed-income investors because it affects the market value of bonds within a portfolio. Interest rate risk is particularly significant for long-term bonds, as they are more sensitive to rate changes than shorter-term bonds. - Duration as a Measure of Interest Rate Sensitivity

Duration is a metric that measures a bond’s sensitivity to interest rate changes. It’s expressed in years, representing the weighted average time an investor can expect to receive cash flows from the bond. Higher-duration bonds are more sensitive to interest rate changes, meaning a small rate increase could cause a significant decrease in the bond’s price. Portfolio managers use duration to gauge and adjust the overall interest rate sensitivity of the portfolio. - Matching Duration to Investment Objectives

By aligning a portfolio’s duration with the investor’s time horizon and objectives, managers can better manage interest rate risk. For instance, if an investor has a short-term horizon, a lower-duration portfolio can reduce price volatility due to rate changes. Conversely, if the investor has a longer-term horizon, a higher duration can be used to seek potentially higher returns, assuming the investor can tolerate the increased sensitivity to interest rate movements. - Duration Management Strategies

Portfolio managers use various strategies to adjust portfolio duration based on interest rate expectations:- Immunization: This strategy aims to match the portfolio’s duration with the investment time horizon to protect against interest rate changes. By doing so, managers aim to secure a specific return over a period regardless of rate fluctuations.

- Active Duration Management: Here, managers may increase or decrease duration based on their interest rate outlook. For instance, if they expect rates to drop, they might increase duration to capitalize on potential bond price gains. Conversely, if they expect rates to rise, they might reduce duration to limit price declines.

- Bond Laddering: In this strategy, managers build a portfolio with bonds that mature at regular intervals. Laddering helps reduce interest rate risk by spreading investments across short- to long-term bonds, allowing for reinvestment at prevailing rates over time.

By carefully managing duration, fixed-income portfolio managers can navigate interest rate risk, optimize returns, and align portfolio performance with the investor’s financial objectives. Duration management thus becomes an essential tool to balance risk and return in a fluctuating interest rate environment

Yield Curve Positioning and Strategies

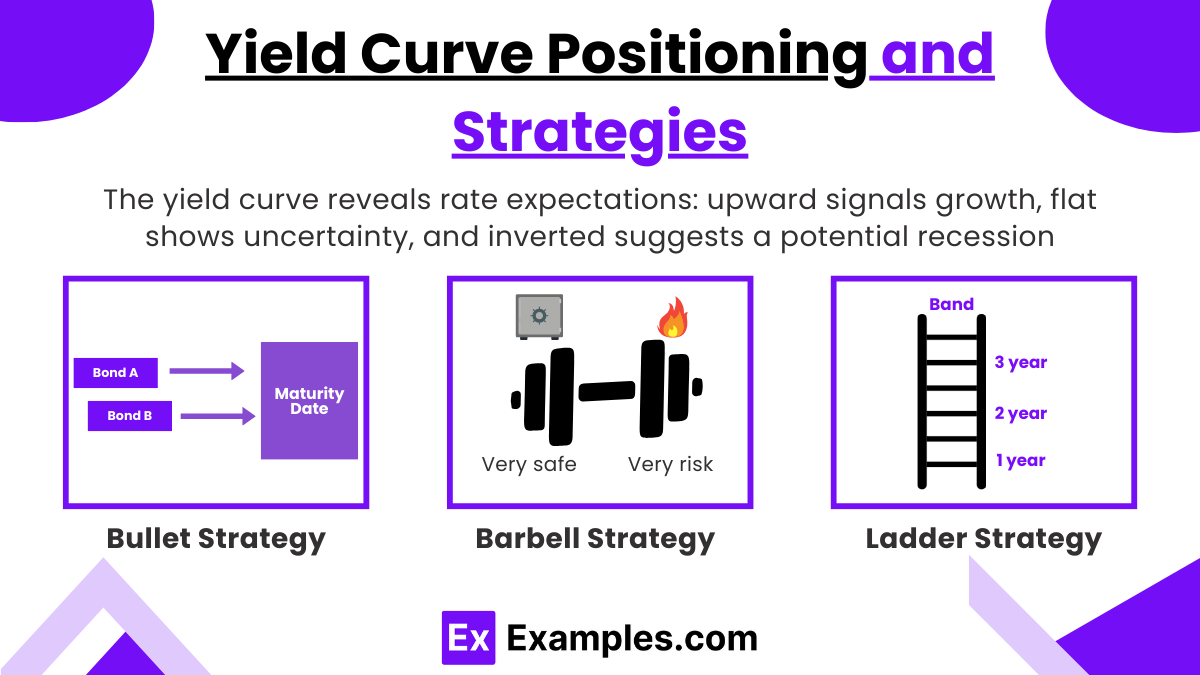

Yield curve positioning involves strategically selecting bonds within a portfolio based on their maturities and the shape of the yield curve. The yield curve, which plots interest rates of bonds with similar credit quality across different maturities, can take various shapes (e.g., upward sloping, flat, or inverted) that reflect market interest rate expectations. By positioning a portfolio along specific points on the yield curve, portfolio managers can optimize income, manage risk, and capitalize on expected rate changes. Here’s a closer look at key yield curve strategies:

- Understanding the Yield Curve

The yield curve reflects market expectations of future interest rates and can indicate economic trends:- Normal Yield Curve: An upward-sloping curve where long-term rates are higher than short-term rates, typically signaling expected economic growth and inflation.

- Flat Yield Curve: Short- and long-term rates are similar, often indicating uncertainty or a transition period in the economy.

- Inverted Yield Curve: Short-term rates are higher than long-term rates, which can signal an economic downturn or recession.

- Bullet Strategy

In a bullet strategy, portfolio managers focus on bonds with similar maturities. For example, they might invest heavily in bonds maturing in 5 to 10 years, avoiding short-term and very long-term maturities. The bullet strategy can reduce reinvestment risk by concentrating maturities around a specific time, making it suitable for investors with a particular future income need. When interest rates are expected to remain stable, this strategy can help achieve a targeted return over a set horizon without frequent reinvestment. - Barbell Strategy

The barbell strategy involves holding both short-term and long-term bonds while avoiding intermediate maturities. For example, a portfolio might have bonds maturing in 1-3 years and others maturing in 10-15 years. This structure allows flexibility: short-term bonds provide liquidity and can be reinvested quickly, while long-term bonds offer higher yields. The barbell strategy is effective in uncertain or fluctuating interest rate environments, as it allows managers to take advantage of both ends of the yield curve, potentially maximizing returns while managing risk. - Ladder Strategy

A ladder strategy involves purchasing bonds that mature at regular intervals (e.g., 1, 3, 5, 7, and 10 years). This approach provides consistent cash flows and enables reinvestment at prevailing interest rates over time. As each bond matures, the funds are reinvested in a new bond at the end of the ladder, ensuring that the portfolio stays balanced across different maturities. Laddering helps reduce interest rate risk and provides liquidity, making it suitable for investors seeking stable income and protection against rate changes.

By using these yield curve positioning strategies, fixed-income managers can align the portfolio with anticipated interest rate trends and economic conditions, helping to achieve optimal balance between income, risk management, and flexibility in changing market environments.

Credit Analysis and Sector Allocation

Credit analysis and sector allocation are critical components of fixed-income portfolio management, allowing portfolio managers to assess the creditworthiness of bond issuers and strategically allocate investments across sectors to enhance returns and manage risk.

- Credit Analysis

Credit analysis involves evaluating the financial health of bond issuers to determine their ability to meet debt obligations. This process is essential for managing credit risk, especially in portfolios that include corporate bonds or bonds from lower-rated issuers. Key elements of credit analysis include:- Issuer’s Financial Strength: Reviewing the issuer’s income statements, balance sheets, and cash flow to assess profitability, liquidity, and leverage.

- Credit Ratings: Considering ratings from agencies like Moody’s, S&P, and Fitch, which provide insight into the default risk of an issuer. Higher-rated bonds (e.g., AAA) are considered safer but offer lower yields, while lower-rated bonds (e.g., BB or below) carry higher risk but offer higher yields.

- Industry and Economic Conditions: Assessing the economic environment and industry trends that may impact the issuer’s performance, such as interest rate changes, inflation, or sector-specific challenges.

- Sector Allocation

Sector allocation refers to the distribution of a fixed-income portfolio across various economic sectors (e.g., government, corporate, municipal, financial, healthcare, or technology sectors). Sector allocation helps achieve diversification, reducing risk by spreading investments across sectors that may respond differently to economic shifts. Key strategies in sector allocation include:- Cyclical vs. Defensive Sectors: Cyclical sectors (like technology and consumer discretionary) are sensitive to economic cycles, while defensive sectors (such as utilities and healthcare) are more stable. Allocating between these sectors can help balance risk depending on economic conditions.

- Industry-Specific Risks: Certain industries have unique risks (e.g., regulatory risks in healthcare or interest rate sensitivity in financials). By diversifying across sectors, managers can mitigate the impact of sector-specific risks on the overall portfolio.

- Strategic Shifts Based on Economic Outlook: For example, if a recession is expected, managers might allocate more to defensive sectors with lower credit risk. Conversely, in times of economic growth, they might increase exposure to corporate bonds in growth-oriented sectors.

- Enhancing Portfolio Performance with Sector Rotation

Sector rotation is a dynamic strategy where portfolio managers adjust sector allocations based on anticipated economic cycles and market conditions. By rotating sectors to capture periods of growth or stability in specific industries, managers aim to enhance returns and manage risk. For example, they might increase exposure to industrials and technology during expansion phases and shift to utilities or government bonds during downturns. - Balancing Yield and Risk

Combining credit analysis with sector allocation allows managers to balance yield and risk effectively. High-yield sectors (such as lower-rated corporates) may enhance income but come with increased credit risk. Conversely, investing in highly rated sectors (like government bonds) provides stability but may reduce yield. By blending sectors with varying risk and return characteristics, managers can create a balanced portfolio that aligns with the investor’s income needs, risk tolerance, and economic expectations.

Credit analysis and sector allocation together form a robust framework that helps fixed-income managers build resilient portfolios, capable of withstanding market volatility and generating stable returns across economic cycles.

Examples

Example 1

A portfolio manager holds a variety of corporate bonds in a fixed-income portfolio. To manage interest rate risk, they use a ladder strategy, purchasing bonds with staggered maturities every two years. As each bond matures, it is reinvested in a new bond at the end of the ladder, allowing the portfolio to adapt to changing interest rates while maintaining a steady income stream.

Example 2

An investor is seeking higher income from their fixed-income portfolio and allocates a portion to high-yield bonds from lower-rated companies. Through credit analysis, the portfolio manager evaluates the financial health and industry outlook of each issuer, selecting bonds with strong fundamentals despite lower credit ratings. This strategy increases income but involves careful monitoring of credit risk.

Example 3

A fixed-income manager anticipates an economic downturn and shifts the portfolio allocation toward government bonds and high-quality corporate bonds. This sector allocation strategy provides greater stability by focusing on bonds that are less sensitive to economic cycles, aiming to reduce credit risk and protect the portfolio’s value during a market downturn.

Example 4

The portfolio manager utilizes a barbell strategy by investing in both short-term and long-term bonds, avoiding intermediate-term maturities. Short-term bonds provide liquidity and flexibility, while long-term bonds offer higher yields. This yield curve positioning helps balance risk and return, especially in uncertain interest rate environments, giving the manager options to adjust quickly.

Example 5

A portfolio manager using an immunization strategy aligns the portfolio’s duration with the investor’s time horizon to protect against interest rate changes. By matching the duration of assets to future cash needs, the manager ensures that interest rate fluctuations will have a limited impact on the portfolio’s ability to meet targeted return goals over the investment period

Practice Questions

Question 1

What is the primary purpose of using a ladder strategy in fixed-income portfolio management?

A) To increase exposure to high-yield bonds

B) To maintain a steady income stream while managing interest rate risk

C) To concentrate on short-term bonds for liquidity

D) To focus on long-term bonds for higher returns

Answer: B

Explanation:

A ladder strategy involves buying bonds with staggered maturities, which allows for reinvestment as each bond matures. This approach helps maintain a steady income stream and manage interest rate risk by spreading investments across different maturity dates, reducing the impact of rate fluctuations.

Question 2

In fixed-income portfolio management, credit analysis is essential because:

A) It helps assess the interest rate sensitivity of bonds

B) It determines the likelihood that the bond issuer will meet their debt obligations

C) It calculates the duration of the portfolio

D) It focuses on aligning bond maturities with economic cycles

Answer: B

Explanation:

Credit analysis evaluates the financial health of bond issuers to assess their ability to meet debt obligations, a key factor in managing credit risk. By understanding the issuer’s credit quality, portfolio managers can select bonds that align with the investor’s risk tolerance.

Question 3

Which of the following best describes a barbell strategy in fixed-income management?

A) Investing only in short-term bonds to enhance liquidity

B) Concentrating on intermediate-term bonds to balance yield and risk

C) Allocating funds to both short-term and long-term bonds, avoiding intermediate-term maturities

D) Focusing on bonds from a single sector for higher returns

Answer: C

Explanation:

A barbell strategy involves investing in both short-term and long-term bonds, while avoiding intermediate-term maturities. This strategy balances the need for liquidity and flexibility (short-term bonds) with the higher yields often available from long-term bonds, providing a strategic response to uncertain interest rate environments.